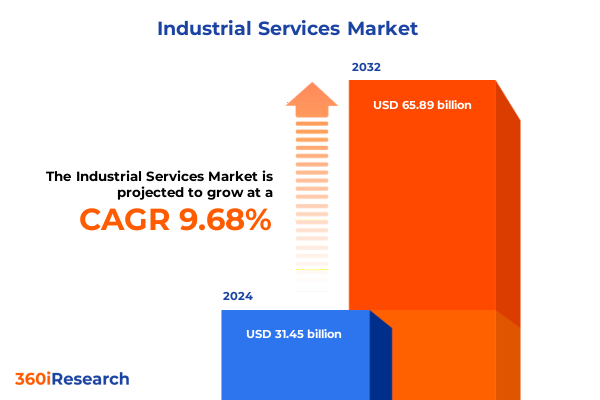

The Industrial Services Market size was estimated at USD 34.26 billion in 2025 and expected to reach USD 37.33 billion in 2026, at a CAGR of 9.78% to reach USD 65.89 billion by 2032.

Unveiling the Dynamics Driving Industrial Services Growth and Innovation in a Rapidly Evolving Global Market Environment

The industrial services sector operates at the intersection of complex infrastructure demands, stringent safety requirements, and rapid technological advancements. As organizations strive to maintain optimal performance of critical assets, the breadth of service offerings-from inspection and maintenance to repair and testing-has expanded and diversified. Aging infrastructure across utilities, manufacturing, and energy industries has underscored the importance of rigorous inspection and non-destructive testing methods, while escalating cost pressures have driven a shift toward predictive and preventive maintenance frameworks. In parallel, digital transformation initiatives have introduced next-generation capabilities such as remote monitoring, AI-driven diagnostics, and augmented reality support, enabling service providers to reduce downtime, enhance safety, and deliver higher levels of transparency to end users.

Meanwhile, macrotrends such as globalization, sustainability mandates, and workforce skill gap challenges continue to reshape competitive dynamics. Regulatory agencies are imposing tighter standards for asset integrity and emissions control, prompting service organizations to invest heavily in compliance technologies and specialized expertise. Moreover, the growing emphasis on environmental, social, and governance principles has elevated the role of industrial services in supporting decarbonization initiatives and circular economy models. Consequently, stakeholders must navigate a multifaceted landscape where operational excellence, technological innovation, and regulatory adherence converge to define market leadership.

Charting the Technological, Regulatory and Sustainability-driven Shifts Reshaping the Industrial Services Landscape Across Key Market Segments

In recent years, the industrial services landscape has undergone transformative shifts driven by rapid technological breakthroughs, evolving regulatory frameworks, and the imperative for sustainable solutions. One of the most significant catalysts is the advancement of digitalization technologies: the integration of Internet of Things sensors, machine learning algorithms, and robotics has redefined how service tasks are executed, shifting from traditional manual processes to automated and data-centric operations. As a result, service providers are increasingly deploying predictive analytics to anticipate equipment failures, optimizing maintenance schedules, and delivering value through condition-based interventions rather than time-based routines.

Concurrently, heightened environmental considerations and climate-related regulations have pressed organizations to adopt greener practices and reduce carbon footprints. This regulatory impetus has spurred demand for energy-efficient diagnostics, emissions monitoring, and life-cycle assessments-driving service firms to develop specialized offerings aligned with sustainability benchmarks. Moreover, the resurgence of onshoring initiatives and supply chain resilience strategies has compelled providers to reassess geographic footprints, invest in localized field service networks, and cultivate partnerships that secure critical equipment availability.

These converging forces underscore a paradigm shift in service delivery models, where agility, digital integration, and sustainability credentials have become non-negotiable. Consequently, market participants must adapt to an environment in which traditional maintenance paradigms give way to fully integrated service ecosystems, characterized by real-time data exchange, outcome-based contracting, and continuous innovation.

Assessing the Far-reaching Cumulative Effects of 2025 United States Tariff Measures on Industrial Services Procurement and Supply Chain Structures

The introduction of new tariff measures by the United States in 2025 has exerted a substantial cumulative impact on the procurement strategies and supply chain configurations of industrial services providers and their end users. Tariffs on imported steel, aluminum, and selected manufactured components have elevated input costs, forcing service organizations to re-evaluate sourcing decisions and negotiate more strategically with domestic suppliers to contain expenses. As cost pressures mount, some providers have absorbed incremental duties, while others have transferred part of the burden to clients, reshaping contract negotiations and price structures.

Beyond material costs, these tariff measures have influenced the geographic distribution of maintenance and repair workflows. Companies that previously relied on offshore repair centers have repatriated certain operations to U.S.-based facilities to avoid additional duties and logistical complexities. This repatriation has prompted investments in local tooling, training programs, and expanded workshop capacities. At the same time, the unpredictability of trade policies has underscored the need for robust scenario planning; firms are actively developing contingency playbooks that anticipate further tariff escalations or policy reversals.

In response to these dynamics, many industrial services providers are strengthening vertical integration efforts, forging alliances with equipment manufacturers and distributors to secure favorable supply agreements. This collaborative approach not only mitigates tariff exposure but also fosters deeper value creation through co-developed maintenance protocols and joint product support initiatives. As a result, the 2025 tariff landscape has catalyzed a shift toward more resilient, localized, and collaborative service models.

Illuminating In-depth Segmentation Perspectives Revealing Service Type, End User, Delivery Mode and Contract Type Dynamics in Industrial Services

Examining the market through the lens of service type segmentation reveals distinct value drivers across inspection, maintenance, repair, and testing offerings. Within inspection services, non-destructive testing methods such as eddy current, magnetic particle, radiography, and ultrasonic play pivotal roles in preserving asset integrity without disrupting operations, while visual inspections provide rapid diagnostics for identifying visible defects. Meanwhile, corrective, predictive, and preventive maintenance protocols each deliver unique benefits: corrective interventions address failures post-event, predictive maintenance leverages data analytics to forecast potential breakdowns, and preventive schedules follow manufacturer guidelines to maintain baseline reliability.

End user segmentation highlights how demand patterns vary significantly across sectors. The construction industry prioritizes rapid turnaround and safety inspections, while energy and power stakeholders focus on high-voltage equipment health and regulatory compliance. Manufacturing end users, encompassing aerospace, automotive, food and beverage, and pharmaceuticals, depend on stringent quality controls and uptime guarantees; within automotive, the division between commercial and passenger vehicle segments further nuances service requirements. Mining and oil and gas sectors demand robust testing and emergency repair capabilities due to the high-risk nature of their operating environments.

Delivery mode differentiation between offsite and onsite models shapes service execution strategies. Offsite testing and repair facilities often achieve economies of scale and controlled environments, whereas onsite interventions deliver swift response times and minimal asset transport. Finally, contract type segmentation-fixed price, performance based, and time and material-determines risk-sharing dynamics. Availability-based and reliability-based contracts under the performance-based category align provider incentives with asset uptime, fostering collaborative partnerships between service firms and their clients.

This comprehensive research report categorizes the Industrial Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Delivery Mode

- Contract Type

- End User

- Pricing Model

- Contract Duration

Decoding the Unique Regional Dynamics and Growth Enablers Driving Industrial Services Adoption Across Americas, EMEA and Asia-Pacific Markets

Regional dynamics exert a powerful influence on industrial services demand and delivery approaches. In the Americas, the maturation of digital infrastructure and growing emphasis on maintenance excellence in oil and gas, utilities, and manufacturing have driven a surge in predictive maintenance and remote monitoring offerings. The drive for operational sustainability and the enforcement of safety regulations further bolster demand for specialized inspection and testing services. North American providers are increasingly integrating digital twins and advanced analytics to differentiate service portfolios and support near-real-time decision-making.

Moving to the Europe, Middle East, and Africa region, stringent environmental regulations and ambitious renewable energy targets have created robust demand for compliance-driven inspection and certification services. European markets, led by industrial powerhouses in Germany, France, and the UK, prioritize precision diagnostics and zero-failure warranties. Concurrently, the Middle East’s large-scale infrastructure and energy projects require extensive non-destructive testing and heavy asset maintenance capabilities. African markets, while still developing core industrial frameworks, are beginning to adopt advanced service modalities to support mining and power generation expansion.

In Asia-Pacific, rapid urbanization, manufacturing capacity expansion, and infrastructure modernization underpin sustained growth in industrial services. Countries such as China and India are emphasizing domestic content requirements and regulatory oversight, prompting service firms to localize operations and pursue joint ventures. Regional cost optimization priorities coexist with an eagerness to adopt automation and robotics in service delivery, positioning Asia-Pacific as both a cost-efficient execution hub and a testing ground for new operational models.

This comprehensive research report examines key regions that drive the evolution of the Industrial Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives, Partnerships and Innovative Solutions Deployed by Leading Industrial Services Companies Shaping Market Trajectories

A focused review of industry leaders highlights how top-tier providers are charting strategic pathways to capture evolving service requirements. Several global certification and testing firms have accelerated acquisitions of niche specialists to broaden their technical capabilities in high-growth verticals such as renewable energy infrastructure and aerospace component maintenance. Complementing these inorganic moves, investments in digital platforms have become central to competitive differentiation, enabling seamless scheduling, real-time reporting, and outcome-based billing.

Strategic alliances between service companies and original equipment manufacturers (OEMs) are also reshaping market dynamics. Co-branded service agreements allow for deeper integration of diagnostic algorithms into equipment design, facilitating condition monitoring from the point of installation. Meanwhile, some leading firms are piloting robotics and drone-enabled inspections to access hard-to-reach assets, reducing safety risks and increasing throughput. To reinforce their market positions, several of the most influential providers are also expanding training academies and certification programs, ensuring a pipeline of skilled technicians capable of supporting advanced service offerings.

Through these combined strategies-M&A, digital innovation, OEM collaboration, and workforce development-leading companies are laying the foundation for sustained leadership in a landscape characterized by intensifying technological, regulatory, and environmental pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Technology Services, Inc.

- AECOM

- Baker Hughes Company

- EMCOR Group, Inc.

- Emerson Electric Co.

- Equans SAS

- Fluor Corporation

- General Electric Company

- Halliburton Company

- Honeywell International Inc.

- HPC Industrial by Clean Harbors

- Jacobs Solutions Inc.

- KBR, Inc.

- Quanta Services, Inc.

- Rockwell Automation Inc.

- Schlumberger Limited

- Siemens SE

- SKF AB

- SUEZ S.A.

- TechnipFMC plc

- Veolia Environnement S.A.

- Yokogawa Electric Corporation

Overarching Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks and Accelerate Value Creation in Industrial Services

Industry leaders seeking to thrive amid shifting market dynamics should prioritize the adoption of advanced digital tools that enable predictive and prescriptive service models. By integrating IoT sensors and analytics platforms, organizations can transition from reactive maintenance schedules to real-time condition monitoring, thereby reducing unplanned downtime and optimizing resource allocation. Furthermore, establishing strategic partnerships with technology providers and equipment manufacturers can secure access to proprietary data streams, deepening diagnostic accuracy and service differentiation.

Concurrently, investing in workforce development is critical to addressing the growing skills gap. Developing in-house training programs that emphasize digital literacy, advanced testing methodologies, and safety protocols will ensure that service teams remain equipped to manage increasingly complex asset ecosystems. Alongside talent initiatives, diversifying contract portfolios through performance-based agreements-such as availability or reliability models-can align incentives with client outcomes, fostering collaborative relationships and stable revenue streams.

To navigate geopolitical and trade uncertainties, companies should reinforce supply chain resilience by cultivating multiple qualified suppliers and onshoring critical repair capabilities where feasible. Emphasizing sustainability metrics-through green maintenance practices, emissions tracking, and life-cycle assessments-will meet tightening regulatory standards and position firms as trusted partners in decarbonization efforts. Finally, adopting a phased approach to regional expansion allows for nimble responses to local regulatory nuances and market maturity levels, ensuring that growth strategies remain both ambitious and sustainable.

Detailing the Rigorous Research Methodology Integrating Primary and Secondary Data Collection, Expert Consultations and Robust Analytical Techniques

The research underpinning this report combined rigorous primary and secondary methods to ensure comprehensive coverage of the industrial services sector. Primary inputs included in-depth interviews with senior executives from leading service companies, equipment manufacturers, and end-user organizations across target industries. These interviews provided qualitative context on operational challenges, technology adoption curves, and regulatory impacts. Supporting these insights, expert consultations with regulatory authorities and industry associations offered validation of emerging compliance requirements and regional policy trends.

Secondary research encompassed analysis of technical journals, white papers, and publicly available financial disclosures to track service innovation, partnership announcements, and M&A activity. Data triangulation techniques were employed to reconcile findings and ensure accuracy, with quantitative inputs cross-verified against aggregated industry performance indicators. Further, a series of workshops was conducted with domain specialists to stress-test hypotheses and refine segmentation frameworks, emphasizing service type, end-user verticals, delivery modes, and contract typologies.

Analytical tools such as SWOT assessments, scenario modeling, and trend extrapolation were used to synthesize the collected data into actionable insights. Throughout the process, strict data governance protocols were observed to maintain methodological transparency and reproducibility, providing stakeholders with a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Services Market, by Service Type

- Industrial Services Market, by Delivery Mode

- Industrial Services Market, by Contract Type

- Industrial Services Market, by End User

- Industrial Services Market, by Pricing Model

- Industrial Services Market, by Contract Duration

- Industrial Services Market, by Region

- Industrial Services Market, by Group

- Industrial Services Market, by Country

- United States Industrial Services Market

- China Industrial Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Critical Insights and Strategic Considerations to Illuminate the Path Forward for Stakeholders in the Evolving Industrial Services Sector

As the industrial services sector continues to evolve, stakeholders must recognize that agility, technological acumen, and regulatory foresight are paramount to success. Service providers that embrace digital transformation, cultivate strategic partnerships, and refine contractual alignments will be best positioned to deliver differentiated value propositions. Meanwhile, understanding the nuanced impacts of trade policies and regional dynamics will enable companies to navigate risks while capitalizing on localized growth opportunities.

Ultimately, the ability to integrate sustainable practices into service operations-whether through emissions monitoring, green inspection techniques, or lifecycle assessments-will serve as a critical differentiator in an era of heightened environmental accountability. By synthesizing insights across segmentation categories, companies can tailor their approaches to end-user requirements, optimize delivery models, and evolve contract structures that reinforce long-term partnerships. These foundational strategies will guide industry participants toward resilient, innovation-led growth pathways as market complexities intensify.

Secure Your Industrial Services Market Research Report with Associate Director of Sales & Marketing Ketan Rohom to Empower Data-driven Strategic Choices

To gain unparalleled clarity on the strategic imperatives, operational imperatives, and emerging opportunities shaping the industrial services sector, reach out to the Associate Director of Sales & Marketing, Ketan Rohom. By securing the full market research report, you will equip your enterprise with the data-driven insights necessary to anticipate market shifts, optimize service portfolios, and pursue sustainable growth. Engage directly with Ketan to explore how tailored analyses and bespoke advisory can accelerate decision-making, mitigate risk factors introduced by evolving regulations and tariffs, and unlock competitive advantages across end-use industries. Don’t settle for generic overviews when you can commission a comprehensive study designed to inform every major strategic initiative within your organization. Contact Ketan Rohom to transform intelligence into action and lead with confidence in the dynamic industrial services landscape

- How big is the Industrial Services Market?

- What is the Industrial Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?