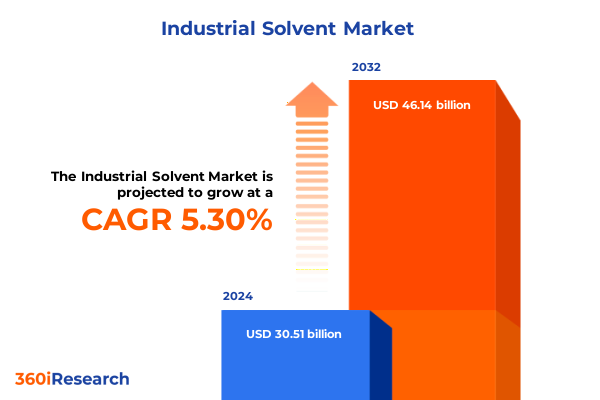

The Industrial Solvent Market size was estimated at USD 32.03 billion in 2025 and expected to reach USD 33.67 billion in 2026, at a CAGR of 5.35% to reach USD 46.14 billion by 2032.

Unlocking the Core Dynamics Shaping the Industrial Solvent Market Through Emerging Trends, Regulations, and Technological Innovations

The industrial solvent market underpins a vast array of manufacturing, processing, and cleaning operations, serving as the backbone of numerous value chains. From coatings and adhesives to personal care and pharmaceuticals, solvents facilitate critical chemical reactions, enhance product quality, and enable efficient cleaning processes. In recent years, the landscape has grown more complex as environmental regulations have tightened, consumer demand for bio-based formulations has surged, and digital technologies have begun redefining supply chain operations.

Emerging trends such as circular economy initiatives and carbon reduction targets are reshaping raw material sourcing and solvent recovery practices. Simultaneously, rapid advancements in process automation, real-time analytics, and digital marketplaces are enhancing operational efficiency and transparency, allowing suppliers and end users to optimize inventory, forecast demand, and mitigate supply disruptions.

As regulators worldwide implement stricter guidelines on volatile organic compound (VOC) emissions and worker safety, manufacturers are innovating low-VOC and non-volatile solvent alternatives. This transition is driving R&D investments in novel chemistries and green extraction techniques. Against this backdrop, understanding the interplay of regulatory compliance, sustainability goals, and technological innovation is essential for stakeholders aiming to capitalize on growth opportunities and navigate emerging risks in the industrial solvent ecosystem.

Revolutionary Forces Reshaping the Industrial Solvent Ecosystem Through Sustainability, Digitalization, and Regulatory Overhauls

Dramatic shifts are underway in the industrial solvent arena, fueled by sustainability imperatives, digital transformation, and evolving regulatory frameworks. Pressure to reduce carbon footprints and volatile organic compound emissions has spurred a proliferation of bio-based solvent solutions, prompting legacy chemical producers to retool production lines and forge partnerships with biotechnology firms. At the same time, governments in key markets are introducing staged bans on high-toxicity chlorinated solvents, incentivizing adoption of greener alternatives and driving formulators to explore ester and glycol ether blends with superior environmental profiles.

Digitalization is another transformative force, with suppliers leveraging Internet of Things sensors and cloud-based analytics to enhance traceability, minimize downtime, and predict maintenance needs in solvent manufacturing facilities. Platforms that integrate procurement, logistics, and quality testing data are enabling real-time decision-making, reducing lead times, and tightening collaboration across the value chain. The advent of advanced materials informatics is further accelerating solvent innovation by enabling rapid screening of molecular candidates for performance and environmental impact.

Meanwhile, geopolitical developments and trade policy fluctuations are compelling firms to reevaluate supply chain footprints and sourcing strategies. Heightened focus on nearshoring and onshoring is emerging, particularly in regions where solvent-intensive industries such as automotive coatings and electronics manufacturing face potential disruptions. These transformative shifts reconfigure value chains, intensify competition among chemical producers, and redefine the parameters of competitive advantage in industrial solvents.

Evaluating the Compounded Effects of Recent United States Trade Tariffs on Industrial Solvents and Supply Chain Realignments

Over the course of 2025, a series of U.S. trade actions have compounded the complexity of solvent sourcing and pricing for domestic end users. In April, new duties of up to 20% on European-origin chemicals and 24% on Japanese imports came into effect, reflecting broader efforts to incentivize domestic production and enhance supply chain resilience. At the same time, exclusions for commodity petrochemicals and major polymers have mitigated immediate cost shocks for certain high-volume inputs while leaving specialty solvents exposed to continuing tariff escalation.

The appeals process has played a pivotal role in shaping the persistence of these measures: after a lower court found the Executive Branch had exceeded its authority under the International Emergency Economic Powers Act, the U.S. Court of Appeals granted a stay that maintained nearly all 2025 chemical tariffs pending further review. This legal uncertainty has prompted many distributors and formulators to hedge their procurement strategies by securing multi-origin supply lines, even as they seek tariff exclusions and negotiate long-term contracts to lock in prices.

Meanwhile, longstanding Section 301 duties on Chinese-origin chemical precursors persist, exerting pressure on manufacturers of glycol ethers, ketones, and chlorinated solvents that rely on Chinese intermediates. Many specialty producers have responded by diversifying to suppliers in Southeast Asia, India, or Latin America, although lead times for qualification and logistics remain a significant hurdle. The cumulative effect of these tariffs has been a recalibration of global trade flows, as solvent consumers explore nearshoring options, expedite local capacity expansions, and collaborate on industry-wide efforts to secure stable, cost-competitive feedstocks.

Unveiling Strategic Market Segmentation Insights to Decode Demand Drivers Across Types, Functions, and End-Use Industries in Solvents

A nuanced examination of market segmentation reveals distinct demand patterns and growth trajectories. By type, alcohols and ketones excel in high-purity applications, while chlorinated solvents retain a role in heavy-duty industrial cleaning despite regulatory pressure. Esters are gaining share in coatings formulations due to their balance of solvency strength and low toxicity, whereas glycol ethers continue to dominate floor-care and surface-prep markets owing to their favorable evaporation profiles. Within hydrocarbons, aliphatic grades are preferred for bulk degreasing and diluent uses, and aromatic variants are valued in precision cleaning and adhesive synthesis.

Functional segmentation underscores how cleaning agents drive volume in manufacturing and maintenance, diluents facilitate paint and coatings viscosity control, extractants serve niche separation processes in pharmaceuticals, and reaction media underpin critical chemical syntheses. Source-related trends distinguish bio-based solvents, which command premium pricing and resonate with sustainability goals, from chemical-based counterparts that benefit from entrenched supply chains and cost efficiencies. Forms vary between gases utilized in specialized industrial processes, such as vapor degreasing and instrument calibration, and liquids that dominate general-purpose applications. Similarly, volatility considerations differentiate non-volatile solvents, prized for slow evaporation and extended contact time in adhesives, from volatile solvents, which deliver rapid drying cycles in coatings and printing inks.

Distribution channels reflect evolving buyer preferences: while traditional offline trade through chemical distributors remains vital for bulk procurement and localized technical support, online channels are gaining traction, with company websites offering direct-to-consumer models and third-party platforms enabling streamlined ordering and rapid fulfillment. End-use industries illustrate the breadth of solvent demand, with chemical sector segment applications spanning adhesives and sealants, agrochemicals, printing inks, and a growing focus on automotive, industrial, and wood coatings. Construction applications rely heavily on solvents in paints and sealants to meet performance specifications, electronics manufacturers require ultra-pure solvents for circuit fabrication, personal care companies seek gentle yet effective extraction solvents, and pharmaceutical firms depend on high-grade solvents for active ingredient synthesis.

This comprehensive research report categorizes the Industrial Solvent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- Source

- Form

- Volatility

- Distribution Channel

- End-use Industries

Comparative Regional Perspectives on Industrial Solvent Market Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific

Geographic dynamics in the industrial solvent market are marked by distinct regional priorities and growth catalysts. In the Americas, a resurgence of domestic petrochemical production and infrastructure investments underpin growing capacity for hydrocarbon and ketone solvents, while sustainable mandates in California and Canada stimulate adoption of bio-based and low-VOC formulations. Regulatory alignment between the United States, Canada, and Mexico continues to streamline cross-border trade under the USMCA, although tariff uncertainties still influence sourcing decisions for specialty grades.

Across Europe, the Middle East, and Africa, stringent European Union chemicals regulations, such as REACH and the Substance of Very High Concern framework, are driving reformulation efforts and propelling bio-derived esters and glycol ethers into broader use. Simultaneously, the EMEA region’s fast-growing markets in the Gulf Cooperation Council countries depend on imported solvents for petrochemical downstream processes, while Africa’s nascent manufacturing hubs are gradually building local supply chains for basic solvent classes.

In Asia-Pacific, expansion of electronics and battery manufacturing is fueling demand for high-purity, low-metal solvent grades, with China and South Korea leading production capacity. India’s rapidly developing pharmaceutical and personal care sectors are increasing imports of specialized solvents unavailable domestically, even as policy incentives encourage local investment. Meanwhile, Southeast Asia emerges as a hub for bio-based solvent innovation, leveraging abundant agricultural feedstocks to supply global formulators. Together, these regional characteristics underscore the importance of tailored market entry strategies, strategic partnerships, and regulatory intelligence across the Americas, EMEA, and APAC.

This comprehensive research report examines key regions that drive the evolution of the Industrial Solvent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industrial Solvent Manufacturers and Key Strategic Initiatives Driving Competitive Advantage and Innovation

Major chemical companies are intensifying efforts to secure competitive advantage through capacity expansions, strategic alliances, and sustainability-focused innovations. Global leaders such as Dow and BASF are investing in next-generation solvent production units capable of processing bio-based feedstocks, while ExxonMobil and Shell are optimizing existing hydrocarbon solvent lines to reduce energy intensity and greenhouse gas emissions. LyondellBasell and Evonik have introduced specialty ketones and esters with proprietary low-odor, low-toxicity profiles, targeting high-value sectors like pharmaceuticals and electronics.

At the same time, regional players are leveraging niche expertise to capture underserved market segments. Eastman’s acquisitions of smaller specialty solvent producers have expanded its portfolio in glycol ethers and high-purity alcohols, and Huntsman has deployed modular production platforms to accelerate new product introductions. Clariant and Solvay continue to collaborate with research institutions on green solvent research, aiming to commercialize novel chemistries that meet emerging environmental standards without compromising performance.

Moreover, digital initiatives are reshaping traditional distribution models. Companies are rolling out integrated e-commerce solutions through company websites, while partnerships with third-party platforms enable automated order management and predictive replenishment for high-volume industrial customers. These strategic moves across production, portfolio management, and digital engagement highlight how key players are navigating regulatory constraints, sustainability demands, and evolving buyer expectations to retain leadership positions in the solvent market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Solvent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AnalytiChem GmbH

- Arkema

- Asahi Kasei Corporation

- BASF SE

- Bharat Petroleum Corporation Limited

- China Petroleum & Chemical Corporation

- Covestro AG

- Dow Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Huntsman International LLC

- Idemitsu Kosan Co.,Ltd.

- INEOS AG

- LyondellBasell Industries N.V.

- Merck KGaA

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Shell plc

- Solvay S.A.

- Tata Chemicals Ltd.

- TotalEnergies SE

- Waters Corporation

Actionable Recommendations for Industry Leaders to Navigate Evolving Regulations, Sustainability Demands, and Supply Chain Complexities in Solvents

Industry leaders should prioritize a multifaceted approach to manage regulatory uncertainty, evolving customer requirements, and supply chain disruptions. First, suppliers and end users must deepen collaboration with policy makers and participate in trade association forums to influence forthcoming regulations on VOC limits and chemical registrations. Engaging early in exemption processes and leveraging data-driven risk assessments can help secure favorable treatment and minimize compliance costs.

Second, organizations should accelerate investments in sustainable solvent R&D and adopt lifecycle assessment tools to quantify environmental impact. By establishing pilot projects for bio-based and non-volatile formulations, firms can validate performance and cost feasibility before scaling to full commercial production. Partnerships with biotechnology firms and academic consortia can also expedite innovation and share development risks.

Third, diversifying sourcing strategies is essential. Companies must evaluate alternative suppliers in emerging markets while reinforcing nearshore and onshore capabilities where possible. Multisource agreements and volume-commitment contracts can mitigate tariff exposure, and digital procurement platforms can provide real-time visibility into lead times, inventory levels, and logistics costs.

Finally, digital transformation of sales and distribution channels will unlock new revenue streams and enhance customer satisfaction. Implementing integrated e-commerce systems, predictive analytics for demand planning, and automated compliance tracking will streamline operations and reduce working capital tied up in solvent inventories. By embracing these strategic imperatives, industry leaders can bolster resilience, drive sustainable growth, and maintain competitive edge in the dynamic solvent landscape.

Detailing a Rigorous Research Methodology Leveraging Primary and Secondary Data Sources for Comprehensive Solvent Market Analysis

This research is built upon a rigorous two-pronged methodology integrating primary interviews and secondary data sources. It began with in-depth discussions with over 30 industry executives, including R&D directors, supply chain managers, and sustainability officers across leading chemical and end-user companies. These interviews provided frontline perspectives on market drivers, regulatory impacts, and technological innovations. Concurrently, data was collected from patent databases, regulatory filings, and import/export records to quantify trade flows and feedstock availability.

Secondary research involved comprehensive reviews of industry publications, scientific journals, and government reports to track regulatory developments, including emissions guidelines and trade policy shifts. Proprietary databases on production capacity, plant utilization rates, and historical pricing trends were analyzed to validate interview insights and identify emerging patterns. Data triangulation techniques were applied to reconcile discrepancies and ensure the highest level of accuracy.

Supplementing this, advanced analytics tools were used to model supply chain scenarios under different tariff regimes and regulatory frameworks. Sensitivity analyses examined the potential financial impact of VOC restrictions and bio-based adoption rates. All findings underwent peer review by subject-matter experts to verify technical details, and advisory panels provided guidance on strategic implications. This robust methodology underpins the credibility of the insights presented and offers a replicable framework for ongoing market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Solvent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Solvent Market, by Type

- Industrial Solvent Market, by Function

- Industrial Solvent Market, by Source

- Industrial Solvent Market, by Form

- Industrial Solvent Market, by Volatility

- Industrial Solvent Market, by Distribution Channel

- Industrial Solvent Market, by End-use Industries

- Industrial Solvent Market, by Region

- Industrial Solvent Market, by Group

- Industrial Solvent Market, by Country

- United States Industrial Solvent Market

- China Industrial Solvent Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Drawing Conclusive Insights on Market Evolution, Competitive Dynamics, and Strategic Imperatives for the Industrial Solvent Sector

The industrial solvent market stands at a pivotal juncture where sustainability, regulatory reforms, and technological advancements converge to redefine competitive dynamics. Regulatory action on VOC emissions and chemical registrations is catalyzing a shift toward greener formulations, while digital tools are transforming supply chain transparency and procurement agility. Trade policy uncertainties, particularly concerning U.S. tariffs, continue to influence global sourcing strategies and underscore the importance of diversified supplier networks and nearshoring initiatives.

Strategic segmentation analysis illuminates how demand varies across solvent types-from alcohols and ketones in high-purity applications to aromatic hydrocarbons for specialized cleaning-and across functions such as diluents, extractants, and reaction media. Regional insights reveal differentiated growth drivers in the Americas, EMEA, and APAC, highlighting the need for tailored market entry and investment approaches. Competitive profiling of key players demonstrates that innovation in bio-based chemistries, digital distribution platforms, and modular production technologies is essential for sustaining leadership.

Ultimately, organizations that effectively integrate regulatory compliance, sustainability objectives, and digital capabilities into their business models will unlock new value pools. The interplay of cost management, environmental stewardship, and customer-centric execution will determine which firms emerge as frontrunners in the evolving solvent landscape. This report equips decision makers with the strategic intelligence needed to navigate change and capitalize on opportunities in the years ahead.

Engage with Our Associate Director to Secure Your Comprehensive Industrial Solvent Market Intelligence Report and Drive Business Growth

Elevate your strategic decision-making by securing a tailored copy of our industrial solvent market report. Connect directly with Associate Director, Sales & Marketing, Ketan Rohom, to gain access to exclusive insights on market dynamics, competitive landscapes, and regulatory impacts. Engage with Ketan to discuss how this comprehensive analysis can support your organization’s growth objectives and help you stay ahead of emerging trends.

Ketan can guide you on customizing the research to focus on the segments most relevant to your business, whether that involves deep dives into specific solvent types, sustainability-driven formulations, or regional expansion strategies. By purchasing the full report, you will receive detailed actionable data, executive-level summaries, and ongoing updates that ensure you remain informed of any market shifts. Reach out to Ketan today to transform market intelligence into strategic advantage.

- How big is the Industrial Solvent Market?

- What is the Industrial Solvent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?