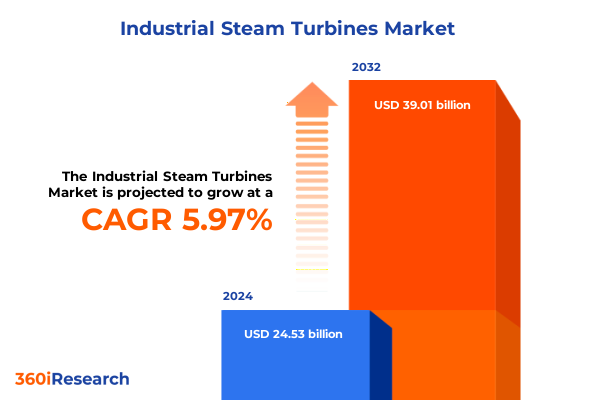

The Industrial Steam Turbines Market size was estimated at USD 25.91 billion in 2025 and expected to reach USD 27.38 billion in 2026, at a CAGR of 6.01% to reach USD 39.01 billion by 2032.

Industrial Steam Turbines Driving Energy Efficiency and Reliability Across Diverse Sectors Amid Evolving Operational Demands

Industrial steam turbines occupy a central role in the global energy and process industries, serving as the engine for diverse applications ranging from power generation to chemical manufacturing. Renowned for their durability and operational flexibility, these machines convert thermal energy into mechanical work with high efficiency, enabling industries to meet stringent performance and reliability standards. As energy consumption patterns evolve, steam turbines are increasingly recognized for their ability to integrate with renewable heat sources and support grid stability through flexible load management.

In today’s environment, decarbonization imperatives and digital transformation agendas drive renewed interest in steam turbine technology. Stringent emissions regulations prompt operators to pursue advanced combustion controls and emission-reduction measures, while digital monitoring systems enhance predictive maintenance capabilities, minimizing downtime and extending equipment lifespan. Simultaneously, supply chain resilience and tariff uncertainties underscore the need for robust strategic planning in component procurement and global manufacturing footprints.

This executive summary distills the most salient insights from our in-depth market research on industrial steam turbines, highlighting the factors reshaping demand, the influence of 2025 United States tariffs, and the segmentation dynamics that inform product positioning and investment decisions. By contextualizing technological innovations, regulatory trends, and regional variations, this section lays the foundation for a nuanced understanding of the market’s trajectory and prepares decision-makers to navigate the complexities of a rapidly evolving landscape.

Transformative Technological and Regulatory Shifts Reshaping the Industrial Steam Turbine Landscape with Sustainability and Performance at Forefront

The industrial steam turbine landscape is experiencing a wave of transformative shifts fueled by breakthroughs in materials science, digitalization, and sustainability mandates. Emerging blade alloys and coatings extend service intervals and enable operation at higher temperatures, unlocking performance gains while driving down lifecycle costs. Concurrently, the proliferation of sensors and edge computing technologies empowers operators with real-time insights into vibration, thermal conditions, and performance efficiency, facilitating predictive maintenance that mitigates unplanned outages and optimizes asset utilization.

Furthermore, sustainability objectives are reshaping design philosophies, with manufacturers integrating carbon-capture readiness and hydrogen-blending capabilities into next-generation turbine models. This evolution aligns with global decarbonization roadmaps and positions steam turbines as a bridge technology in the transition to cleaner energy systems. Regulatory developments, including regional emissions caps and incentives for low-carbon equipment, reinforce these trends and catalyze investment in advanced turbine architectures that balance performance with environmental stewardship.

In parallel, additive manufacturing and modular design approaches are gaining traction, offering the promise of reduced lead times, lower inventory requirements, and greater customization for site-specific applications. This convergence of technological, regulatory, and operational shifts underscores the critical need for stakeholders to adapt procurement strategies, foster innovation partnerships, and realign maintenance protocols. As a result, industry participants that embrace these transformative forces will secure a competitive advantage by delivering higher reliability, lower emissions, and enhanced cost efficiency.

Assessing the Cumulative Impact of 2025 United States Tariffs on Industrial Steam Turbine Supply Chains, Pricing Dynamics, and Competitive Strategies

The introduction of new United States tariffs in 2025 has markedly altered the cost structure and strategic calculus for industrial steam turbine manufacturers and end-users. By imposing additional duties on imported components such as high-precision blades, casings, and control systems, these measures have prompted a reexamination of global supply chain configurations. Manufacturers that once relied heavily on low-cost offshore suppliers are now evaluating near-shoring and vertical integration strategies to mitigate exposure to duty fluctuations and delivery delays.

Pricing dynamics have also shifted, as increased import costs cascade through OEM pricing models and aftermarket service rates. Turbine operators face higher capital expenditure projections, spurring interest in refurbishment and life-extension programs to preserve return on investment. Moreover, the cost pressures have stimulated competitive strategies such as forming strategic alliances with domestic content suppliers, exploring tariff exemption processes, and investing in alternative component manufacturing capabilities that align with national content requirements.

Finally, the tariff landscape has instigated strategic recalibrations in product portfolios and market positioning. Equipment vendors are differentiating through service excellence, digital upgrades, and performance warranties that offset cost premiums. At the same time, cross-border partnerships and joint ventures are emerging as vehicles to share risk and access local markets more effectively. These adjustments underscore the importance of proactive tariff mitigation planning and agile supply chain management in sustaining profitability and competitiveness amid evolving trade policies.

Key Segmentation Insights Reveal How Fuel Types, Configurations, and Operational Modes Influence Turbine Performance and Application Suitability

A nuanced understanding of market segments reveals how fuel type, configuration, operational mode, and application context collectively inform strategic decisions. When evaluated by fuel type-ranging from biomass and coal through gas, nuclear, and oil-the analysis demonstrates that gas-fired turbines lead in flexibility and efficiency, while nuclear and biomass units command attention for their low-emission profiles. This spectrum of fuel options underscores the necessity for technology roadmaps that accommodate evolving regulatory mandates and sustainability objectives without sacrificing performance.

Similarly, configuration choices such as backpressure, condensing, and extraction models shape operational outcomes by aligning turbine output with specific process requirements. Combined cycle and simple cycle operation modes further delineate applications where rapid ramp-up capability or heat recovery potential predominates. Together, these parameters frame the technical trade-offs that influence procurement criteria, maintenance regimes, and total energy output.

In addition, application environments ranging from chemical and petrochemical complexes to food and beverage processing, pulp and paper mills, and multifaceted oil and gas operations-including upstream, midstream, and downstream segments-create distinct demand profiles. Power generation installations stand apart for their scale and grid integration needs, driving specifications for control responsiveness and thermal efficiency. Understanding these interdependent segmentation layers enables stakeholders to tailor offerings, optimize lifecycle support services, and prioritize R&D investments to meet the precise performance benchmarks of each end-use scenario.

This comprehensive research report categorizes the Industrial Steam Turbines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Configuration

- Operation Mode

- Application

Regional Analysis Uncovers Growth Catalysts and Adoption Patterns for Industrial Steam Turbines in Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics exert a profound influence on the adoption and evolution of industrial steam turbine technologies, underscoring the importance of geographic nuances in strategic planning. In the Americas, aging power and process infrastructure drives refurbishment projects and aftermarket service growth, while an abundant natural gas supply continues to favor combined cycle deployments. Market participants in this region emphasize flexible operations and emissions compliance to navigate tightening environmental regulations and shifting grid requirements.

Within Europe, the Middle East, and Africa, energy diversification and decarbonization agendas accelerate investments in low-carbon turbine solutions. Established markets in Western Europe focus on retrofitting existing assets with advanced controls, while Gulf Cooperation Council countries leverage paired cycle installations to optimize gas-fired capacity. Meanwhile, industrializing economies across Africa seek scalable turbine packages that accommodate gas availability fluctuations and economic expansion.

Asia Pacific exemplifies a dual approach: rapid expansion of power generation capacity, particularly in China and India, coexists with pilot projects integrating biomass and hydrogen blends. Manufacturers operating in the region balance volume-driven production with regional customization to address diverse grid stability concerns and local content requirements. Collectively, these regional footprints highlight the imperative for agile supply chain networks and targeted service models that reflect local policy landscapes and operational priorities.

This comprehensive research report examines key regions that drive the evolution of the Industrial Steam Turbines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Assessment Spotlighting Leading Industrial Steam Turbine Manufacturers, Strategic Positioning, and Innovation Roadmaps

Leading industrial steam turbine manufacturers continue to refine their competitive positioning through strategic investments in research and development, targeted partnerships, and value-added service offerings. Established multinationals leverage expansive service networks to deliver turnkey solutions-spanning installation, condition monitoring, and aftermarket refurbishment-that differentiate them in mature markets. Conversely, emerging regional players capitalize on localized engineering expertise and cost advantages to penetrate segments where rapid deployment and tailored support are paramount.

Innovation roadmaps emphasize digital integration, with incumbents embedding predictive analytics platforms to monitor performance metrics and preempt maintenance issues. At the same time, new entrants explore modular turbine architectures that reduce lead times and simplify maintenance procedures for remote or resource-constrained sites. Collaborative ventures between OEMs, technology providers, and research institutions drive platform standardization, enabling scalable upgrades across multi-unit installations.

Moreover, market consolidation through acquisitions and joint ventures remains a key trend as companies seek to broaden geographic reach and expand product portfolios. This consolidation has accelerated cross-pollination of expertise in advanced materials, control systems, and hybrid energy applications. By mapping these competitive dynamics, stakeholders can benchmark best practices, identify alliance opportunities, and anticipate shifts in market share driven by technological differentiation and service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Steam Turbines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansaldo Energia S.p.A.

- Bharat Heavy Electricals Limited

- Doosan Heavy Industries & Construction Co., Ltd.

- Fuji Electric Co., Ltd.

- General Electric Company

- Harbin Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- MAN Energy Solutions SE

- Mitsubishi Power, Inc.

- Shanghai Electric Group Co., Ltd.

- Siemens Energy AG

- Solar Turbines Incorporated

- Toshiba Energy Systems & Solutions Corporation

Actionable Strategic Recommendations to Empower Industry Leaders in Streamlining Operations, Integrating Technology, and Capturing Market Opportunities

To navigate the complexities of supply chain volatility and tariff pressures, industry leaders should adopt a multi-pronged procurement approach that blends near-shoring with strategic supplier diversification. Establishing regional manufacturing hubs and forming bilateral agreements with component specialists can reduce lead times, bolster domestic content ratios, and enable rapid response to policy changes. Embedding risk-sharing clauses in supplier contracts further ensures continuity under fluctuating trade conditions.

In parallel, prioritizing the integration of digital twin technologies and advanced analytics will unlock operational excellence. By creating virtual replicas of turbine assets, operators can simulate performance under varying load profiles, optimize maintenance schedules, and identify efficiency improvement opportunities before in-field anomalies arise. This proactive stance on data-driven decision-making enhances uptime and lowers lifecycle costs.

Finally, embracing sustainability imperatives through research collaborations on hydrogen blending and carbon capture readiness will position companies at the forefront of the low-carbon transition. Aligning R&D roadmaps with emerging regulatory incentives and cross-sector decarbonization projects enables stakeholders to secure long-term contracts and strengthen their green credentials. Together, these actionable strategies empower industry leaders to convert market insights into measurable competitive advantages.

Comprehensive Research Methodology Integrates In-Depth Expert Interviews, Extensive Secondary Data Analysis, and Rigorous Validation Procedures

Our research methodology encompasses a rigorous blend of qualitative and quantitative approaches to ensure comprehensive and reliable insights. Initially, secondary data sources-including industry journals, regulatory filings, and technical white papers-were systematically analyzed to establish foundational sector trends and historical benchmarks. This desk research was augmented by extensive primary engagement, featuring in-depth interviews with C-level executives, plant engineers, and procurement specialists across key regions.

To validate and enrich these findings, we conducted targeted surveys of end-users to capture real-world operational challenges and emerging priorities. Data triangulation techniques were employed to reconcile discrepancies between varied information sources, while statistical analysis tools provided deeper understanding of correlation patterns among segmentation variables. Subject matter experts reviewed intermediate outputs to ensure technical accuracy and relevance.

Finally, an iterative validation process involving cross-functional workshops helped refine strategic imperatives and scenario analyses. These collaborative sessions enabled stakeholders to stress-test assumptions, align on critical risk factors, and prioritize actionable initiatives. This robust methodology delivers an authoritative perspective on the industrial steam turbine market, equipping decision-makers with high-confidence intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Steam Turbines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Steam Turbines Market, by Fuel Type

- Industrial Steam Turbines Market, by Configuration

- Industrial Steam Turbines Market, by Operation Mode

- Industrial Steam Turbines Market, by Application

- Industrial Steam Turbines Market, by Region

- Industrial Steam Turbines Market, by Group

- Industrial Steam Turbines Market, by Country

- United States Industrial Steam Turbines Market

- China Industrial Steam Turbines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Conclusion Synthesizes Critical Insights, Strategic Imperatives, and Future Directions for Navigating the Dynamic Industrial Steam Turbine Market Ecosystem

In conclusion, the industrial steam turbine market stands at a pivotal juncture, shaped by technological innovations, regulatory evolution, and geopolitical dynamics. The synergistic impact of advanced materials, digitalization, and sustainability mandates is redefining performance benchmarks, while 2025 United States tariffs have underscored the importance of adaptable supply chains and agile procurement strategies. Segmentation analysis reveals the critical interplay of fuel type, configuration, operational mode, and application context in guiding product development and aftermarket services.

Regional insights highlight divergent growth trajectories, with refurbishment trends dominating in the Americas, decarbonization driving investment in Europe, Middle East, and Africa, and capacity expansion coupled with low-carbon pilots in Asia Pacific. Competitive dynamics are characterized by strategic alliances, digital service offerings, and modular design innovations, as companies vie for differentiation in a landscape of evolving customer expectations and policy pressures.

As industry participants chart their next steps, the imperative to integrate digital twins, diversify supplier networks, and pursue green technology collaborations cannot be overstated. By leveraging these strategic imperatives, organizations will be well-positioned to address cost volatility, meet sustainability targets, and capture emerging market opportunities. The insights presented herein offer a blueprint for navigating the dynamic terrain of the industrial steam turbine ecosystem and driving long-term value creation.

Engage with Ketan Rohom to Acquire the Complete Industrial Steam Turbines Market Research Report and Uncover Strategic Growth Opportunities

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive industrial steam turbines market research report that equips your organization with the critical intelligence needed to stay ahead of industry shifts, optimize decision-making, and uncover strategic growth avenues. By partnering with Ketan, you gain direct access to tailored insights, expert consultation, and a roadmap for leveraging the latest technologies and regulatory developments to your advantage. Act now to ensure that your enterprise capitalizes on emerging opportunities, mitigates supply chain risks associated with tariff fluctuations, and refines operational strategies for enhanced efficiency and sustainability. Reach out to Ketan Rohom to transform data into action and position your company for long-term success in the dynamic industrial steam turbine landscape.

- How big is the Industrial Steam Turbines Market?

- What is the Industrial Steam Turbines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?