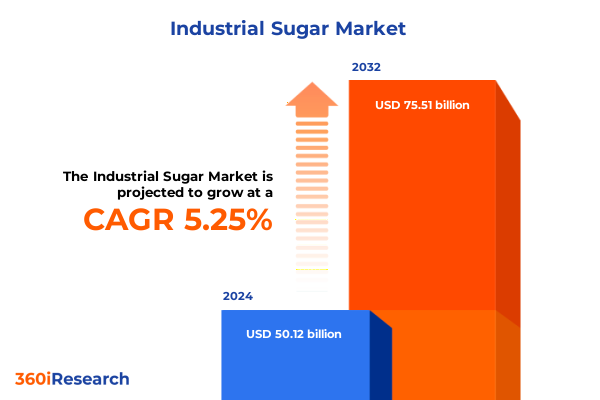

The Industrial Sugar Market size was estimated at USD 52.71 billion in 2025 and expected to reach USD 55.29 billion in 2026, at a CAGR of 5.26% to reach USD 75.51 billion by 2032.

Exploring the Indispensable Role of Industrial Sugar in Modern Production, Supply Chain Dynamics, and its Strategic Importance Across Industries

Industrial sugar serves as a cornerstone input across an array of manufacturing processes, from biofuel production to high-purity pharmaceutical excipients, defining its strategic importance in global industrial ecosystems. Its diverse forms and types enable manufacturers to meet stringent quality and functional requirements, underscoring the critical nature of reliable supply chains. As global demand continues to expand, understanding the foundational role of industrial sugar in value creation is indispensable for stakeholders aiming to optimize operations, manage risks, and uncover new growth avenues.

Beyond its chemical composition, industrial sugar embodies a network of agricultural production, milling operations, and logistics management that collectively shape market dynamics. Raw sugar extraction from cane and beet introduces variability in quality and supply consistency, while subsequent refining processes impact functionality and purity levels. These complexities necessitate a thorough grasp of upstream and downstream linkages, emphasizing the need for integrated strategies that can seamlessly adapt to fluctuations in feedstock availability, energy costs, and regulatory requirements.

Moreover, in an era of increasing emphasis on sustainability and resource efficiency, industrial sugar producers and end users alike are reevaluating traditional practices. From reducing water consumption in milling to adopting greener refining technologies, industry players are embracing innovations that align operational performance with environmental stewardship. This introduction lays the groundwork for a deeper exploration of transformative shifts, tariff impacts, segmentation nuances, and regional specificities that define the current industrial sugar landscape.

Navigating Transformative Shifts in Industrial Sugar Markets Driven by Sustainability Mandates, Technological Advancements, and Changing Consumer Preferences

The industrial sugar market is undergoing profound transformation driven by heightened sustainability mandates and shifting stakeholder expectations. Regulatory bodies worldwide are introducing stricter guidelines on water usage, effluent management, and carbon emissions, compelling producers to invest in cleaner extraction and refining processes. Concurrently, end users are demanding traceability and eco-certifications, propelling the adoption of organic and invert sugar varieties that resonate with sustainability narratives. This shift is redefining supply chain architectures, as companies prioritize partnerships with environmentally compliant suppliers to mitigate reputational and regulatory risks.

Technological advancements are further catalyzing change, as digitalization and automation permeate traditional sugar milling and refining operations. Real-time monitoring platforms enable precise control over crystallization parameters, translating into consistent product quality and reduced energy consumption. Moreover, innovations in membrane filtration and enzymatic processing are unlocking specialty sugar segments with tailored functional properties. These forward-looking technologies are not merely incremental improvements; they represent a paradigm shift in how industrial sugar is produced, characterized, and integrated into complex manufacturing processes.

Consumer preferences and application trends are also reshaping the market landscape. The rise of alternative sweeteners and sugar reduction initiatives in food and beverage manufacturing has prompted industrial sugar stakeholders to focus on high-purity and specialty sugars that offer distinct performance benefits. Simultaneously, the expanding biofuel sector is driving demand for fermentation-grade sugar, creating new opportunities at the intersection of energy and agricultural commodity markets. Taken together, these transformative shifts underscore the dynamic and multifaceted nature of today’s industrial sugar environment.

Assessing the Cumulative Impact of 2025 United States Tariffs on Industrial Sugar Trade Flows, Cost Structures, and Strategic Supply Chain Realignments

In 2025, the implementation of new United States tariffs on industrial sugar imports has precipitated a notable recalibration of trade flows and cost structures across the sector. Historically reliant on cost-competitive origins to fulfill capacity needs, many U.S. processors have confronted increased landed costs and supply chain disruptions. As a direct consequence, importers have explored alternative sourcing strategies, including higher cost domestic cane and beet sugar, while leveraging free trade agreements to secure preferential access from certain export partners.

The tariff regime has also influenced contract negotiations and inventory management practices. Buyers are recalibrating long-term procurement frameworks to incorporate tariff premiums, fostering closer collaboration with producers capable of offering flexible pricing and volume commitments. This realignment has stimulated investments in storage infrastructure and hedging mechanisms designed to buffer against further policy volatility. Moreover, downstream converters are reassessing production footprints, with some shifting partial manufacturing operations to tariff-exempt jurisdictions to preserve competitiveness.

Strategic responses have extended beyond cost mitigation to encompass supply chain resilience enhancements. Companies are diversifying supplier portfolios to reduce dependence on single origins, integrating digital tools for real-time visibility, and forging collaborative partnerships that share logistics and warehousing assets. While these adaptations entail upfront investments, they lay the foundation for a more agile, responsive industrial sugar ecosystem capable of withstanding future trade policy fluctuations and sustaining operational continuity.

Deriving Actionable Insights from Comprehensive Segmentation Analysis of Industrial Sugar Based on Type, Form, Application, Distribution Channel, and Packaging Type

The industrial sugar market exhibits multifaceted characteristics when analyzed through the lens of type segmentation, which encompasses raw, refined, and specialty categories. Raw sugar remains pivotal as a feedstock for large-scale refining operations, whereas refined sugar addresses the rigorous purity requirements of food, beverage, and pharmaceutical applications. Specialty sugar varieties, including invert and organic grades, cater to niche segments where functional attributes such as sweetness profile or sustainability credentials command a premium. Understanding these distinctions enables suppliers to develop targeted product portfolios aligned with end-user specifications and regulatory frameworks.

When considering form segmentation, crystal and liquid configurations dominate supply chain strategies. Crystal sugar, available as granulated and powdered formats, offers advantages in ease of handling and dosing accuracy, making it suited for bakery and confectionery processes. In contrast, liquid sugar, subdivided into concentrate and syrup forms, facilitates seamless integration into continuous mixing and blending operations prevalent in beverage and industrial fermentation applications. This bifurcation underscores the importance of form factor in driving efficiency, reducing processing steps, and minimizing waste generation at customer facilities.

Application segmentation reveals a spectrum of end markets including biofuel, chemical, food and beverage, and pharmaceutical sectors. Within the chemical domain, ethanol production and industrial fermentation stand out as major consumers of high-purity sugar feedstocks. The food and beverage category further fragments into bakery, beverages, confectionery, and dairy subsegments, each demanding unique functional properties such as crystallization behavior or solubility kinetics. In pharmaceuticals, excipients and syrup preparations rely on pharmaceutical-grade sugar for consistency and compliance with stringent quality standards. This depth of application insight empowers market participants to tailor product development and value-added services accordingly.

Distribution channels represent another critical segmentation dimension, spanning direct sales, distributors, and online platforms. Direct sales often align with large-volume contracts and bespoke logistical solutions, whereas distributors, categorized as retail and wholesale intermediaries, extend market reach and provide localized service capabilities. The emergence of online distribution channels has introduced a new paradigm for small-to-mid-scale end users seeking convenience and rapid fulfillment. Each channel presents distinct operational and commercial implications, necessitating differentiated strategies to optimize coverage and customer engagement.

Lastly, packaging type segmentation highlights the dichotomy between bagged and bulk shipments. Bagged sugar, available in 25Kg and 50Kg formats, caters to smaller manufacturing facilities and artisanal producers that require precise lot control and handling convenience. Bulk shipments, in contrast, benefit large-scale operations with silo storage and automated feed systems, enabling economies of scale and reduced packaging overhead. Mastery of packaging strategies allows suppliers to balance logistical costs with service level expectations, thereby enhancing competitive positioning across diverse end-use scenarios.

This comprehensive research report categorizes the Industrial Sugar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- Distribution Channel

- Packaging Type

Uncovering Distinct Regional Trends in Industrial Sugar Demand and Supply Dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

Regionally, the Americas continue to anchor global industrial sugar production and consumption dynamics, underpinned by robust agricultural output in Brazil, the United States, and Mexico. Brazil’s dual role as both a leading cane sugar producer and a major biofuel feedstock supplier drives integrated market behaviors, while U.S. cane and beet refining capabilities support a mature downstream ecosystem. North American end users benefit from established logistics networks and proximity to feedstocks, yet they must navigate evolving trade policies and increasing sustainability scrutiny. In Latin America, emerging economies are ramping up capacity expansions, positioning themselves to capture new opportunities in high-growth application segments such as bio-based chemicals.

The Europe, Middle East, and Africa region presents a mosaic of regulatory regimes and consumption patterns that influence industrial sugar demand. The European Union’s stringent environmental standards and preference for beet-based sugar shape production incentives, while the Middle East’s dependence on imports fosters strategic stockpiling and distribution hubs. African markets, particularly those with developing agro-industrial infrastructures, are focused on boosting local refining capabilities to capture more value domestically. Across EMEA, logistical complexities and tariff heterogeneity necessitate nuanced market entry strategies and close regulatory monitoring to ensure supply chain reliability and cost-effectiveness.

Asia-Pacific stands out for its rapidly shifting consumption landscape, driven by expanding chemical manufacturing clusters in India, China, and Southeast Asia. Asia’s food and beverage sector, characterized by high-volume beverage and confectionery production, underpins a sizable demand base. Concurrently, the region’s accelerating biofuel mandates in select markets create parallel growth trajectories for industrial sugar. Infrastructure investments in port facilities, inland transport corridors, and storage terminals are enhancing supply chain efficiency, yet capacity constraints and feedstock variability pose ongoing challenges that require strategic collaboration among producers, traders, and end users.

This comprehensive research report examines key regions that drive the evolution of the Industrial Sugar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industrial Sugar Producers and Service Providers Shaping Market Competition through Innovation, Quality Assurance, and Strategic Partnerships

Several key companies have emerged as pivotal drivers of competition and innovation within the industrial sugar sector. Leading global refiners are integrating forward into specialty sugar offerings, leveraging their scale to fund research in functional formulations tailored for fermentation, pharmaceutical excipients, and high-purity chemical applications. These market leaders continue to establish strategic partnerships with technology providers to deploy advanced refining and separation processes, thereby achieving consistent product specifications and improved resource efficiencies.

In parallel, mid-sized and vertically integrated agribusinesses are carving out competitive niches by emphasizing traceability and sustainability credentials. Through direct partnerships with growers and investment in digital traceability platforms, these companies provide end users with verifiable origin data and impact metrics. This emphasis on transparency resonates with stringent regulatory frameworks and end-user demand for responsibly sourced inputs. Such players are also exploring co-investment models for local refinery expansions in emerging markets, aiming to streamline end-to-end supply chains and capture incremental value.

Innovative service providers specializing in logistics, warehousing, and risk management are also exerting significant influence on market dynamics. By offering tailored solutions that combine just-in-time delivery, inventory management, and tariff mitigation consulting, these firms enable sugar processors and converters to navigate complex trade environments efficiently. Their role as enablers of supply chain resilience is increasingly recognized as a differentiator, particularly in light of recent policy shifts and trade uncertainties.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Sugar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bajaj Hindusthan Sugar Limited

- Balrampur Chini Mills Limited

- Dalmia Bharat Sugar and Industries Limited

- DCM Shriram Industries Limited

- Dhampur Sugar Mills Limited

- Dwarikesh Sugar Industries Limited

- E.I.D. - Parry (India) Limited

- Imperial Sugar Company

- KCP Sugar and Industries Corporation Limited

- Mawana Sugars Limited

- Nordzucker AG

- Piccadily Agro Industries Limited

- Rana Sugars Limited

- Raízen S.A.

- Shree Renuka Sugars Ltd.

- Südzucker AG

- Tereos S.A.

- The Ugar Sugar Works Limited

- Triveni Engineering & Industries Limited

- Uttam Sugar Mills Limited

Formulating Forward-Looking Actionable Recommendations for Industrial Sugar Market Leaders to Drive Growth, Efficiency, and Sustainable Competitive Advantage

Industry leaders aiming to capitalize on evolving industrial sugar dynamics should prioritize diversification of raw material sources to mitigate the risks associated with tariff fluctuations and climate-related supply disruptions. Establishing multi-origin agreements and maintaining strategic safety stocks will reinforce supply continuity while preserving negotiating leverage. In tandem, investing in digital supply chain platforms can unlock end-to-end visibility, enabling agile adjustments in response to policy changes or demand shifts.

Given the growing emphasis on sustainability, companies should accelerate adoption of cleaner production technologies and circular economy principles. Collaborations with technology partners to implement energy-efficient crystallization, membrane separation, and wastewater treatment systems can reduce environmental footprints and meet stringent regulatory requirements. Additionally, pursuing certifications for organic and invert sugar products will address demand in high-value specialty segments, reinforcing competitive positioning in markets where traceability and eco-credentials are paramount.

To harness segmentation-driven opportunities, stakeholders should align product development and marketing efforts with the nuanced needs of applications such as fermentation-grade feedstocks for biofuel, customized excipient grades for pharmaceuticals, and versatile crystal and liquid formats for food and beverage processes. Engaging with customers through joint innovation programs will facilitate co-creation of solutions that enhance processing efficiencies and end-use performance. Finally, exploring strategic partnerships or joint ventures in high-growth regions can accelerate market entry, optimize capital deployment, and leverage local expertise for sustained expansion.

Detailing Rigorous Research Methodology Employed to Deliver Comprehensive Insights into Industrial Sugar Market Dynamics and Growth Drivers

The research methodology underpinning this analysis integrates a blend of secondary and primary data collection techniques to ensure comprehensive market insights. Secondary research involved extensive review of industry publications, regulatory filings, and trade association reports to map supply chain structures, tariff frameworks, and technological advancements. This foundational knowledge established the contextual framework necessary for in-depth segmentation and regional analysis.

Primary research incorporated structured interviews and surveys with key stakeholders across the industrial sugar value chain, including producers, refiners, logistics providers, and end users in biofuel, chemical, food and beverage, and pharmaceutical sectors. These engagements yielded nuanced perspectives on operational challenges, investment priorities, and strategic initiatives. Data triangulation was achieved by cross-referencing primary findings with quantitative trade and production datasets, ensuring that qualitative insights were grounded in empirical evidence.

Analytical tools such as SWOT assessments and scenario modeling were employed to evaluate competitive dynamics and policy impact pathways. Geographic Information System (GIS) mapping provided spatial analysis of production clusters, distribution networks, and infrastructure assets. Quality control measures, including peer review by industry experts and validation against publicly available benchmarks, were implemented to uphold the rigor and reliability of the research outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Sugar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Sugar Market, by Type

- Industrial Sugar Market, by Form

- Industrial Sugar Market, by Application

- Industrial Sugar Market, by Distribution Channel

- Industrial Sugar Market, by Packaging Type

- Industrial Sugar Market, by Region

- Industrial Sugar Market, by Group

- Industrial Sugar Market, by Country

- United States Industrial Sugar Market

- China Industrial Sugar Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Synthesis Highlighting Key Takeaways on Emerging Trends, Strategic Imperatives, and Market Evolution in the Industrial Sugar Landscape

This analysis synthesizes critical perspectives on the evolving industrial sugar landscape, underscoring the interplay of sustainability imperatives, technological innovation, and policy-driven trade dynamics. The emergence of specialty sugar categories and advanced processing techniques reflects a broader industry trajectory toward value-added differentiation, while the 2025 U.S. tariffs illustrate the importance of supply chain resilience and strategic sourcing in an increasingly fluid regulatory environment.

Going forward, market participants must remain vigilant to regional variations in demand and regulatory landscapes, leveraging segmentation insights to tailor offerings for diverse application sectors. Collaboration across the value chain-encompassing growers, refiners, logistics specialists, and end users-will be instrumental in driving operational efficiencies and unlocking new growth avenues. Ultimately, the convergence of sustainability practices, digital tools, and targeted innovation will define competitive success in the industrial sugar market of the coming years.

Partner with Associate Director Sales and Marketing Ketan Rohom to Secure Your Customized Industrial Sugar Market Research Report Today and Accelerate Strategic Decisions

Engaging directly with Associate Director, Sales & Marketing, Ketan Rohom, enables you to secure a tailored industrial sugar market research report designed to meet your organization’s strategic objectives. By partnering with Ketan Rohom, you gain access to bespoke insights that delve deep into supply chain dynamics, tariff implications, and segmentation-driven growth opportunities essential for informed decision-making. His expertise ensures that the report is customized to focus on the areas most critical to your operations, whether that involves refining product portfolios, optimizing regional strategies, or identifying high-impact application sectors.

Contacting Ketan Rohom offers more than just report acquisition; it provides a strategic collaboration that extends beyond static data. Leveraging his guidance, your team can interpret nuanced market shifts, anticipate regulatory changes, and implement best practices for sustainability and operational efficiency. This partnership approach empowers you to translate research findings into actionable plans that drive competitive advantage.

To accelerate your strategic initiatives and stay ahead of market shifts, reach out to Ketan Rohom today and secure your comprehensive industrial sugar market research report. Make the critical investment in tailored intelligence that will underpin robust growth strategies and enhance your organization’s resilience in an evolving global landscape.

- How big is the Industrial Sugar Market?

- What is the Industrial Sugar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?