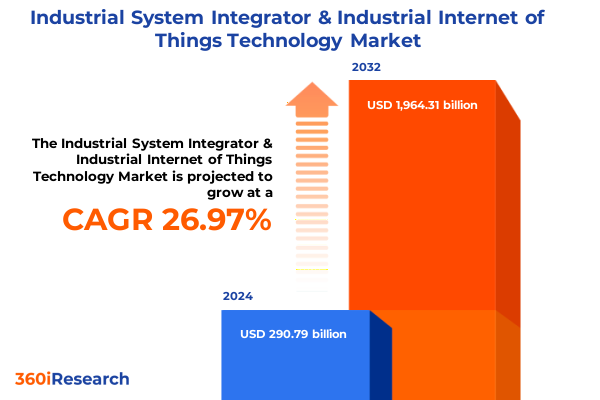

The Industrial System Integrator & Industrial Internet of Things Technology Market size was estimated at USD 370.16 billion in 2025 and expected to reach USD 452.68 billion in 2026, at a CAGR of 26.92% to reach USD 1,964.31 billion by 2032.

Exploring the Convergence of Automation and Data Intelligence Transforming the Industrial Integration Ecosystem

The industrial landscape is undergoing a profound metamorphosis as organizations embrace smart technologies and integrated solutions to drive efficiency and innovation. Traditional automation approaches are converging with data-driven insights, creating a synergy that extends visibility from the plant floor to the enterprise level. This report delves into the pivotal forces reshaping system integration and Industrial Internet of Things (IIoT) technologies, highlighting how leading manufacturers and service providers are architecting agile, resilient operations.

Against a backdrop of global competition and shifting regulatory environments, companies are urged to adopt holistic frameworks that align hardware, software, and services to achieve seamless interoperability. By exploring real-world use cases and strategic market drivers, this introduction sets the stage for a deep dive into the trends, challenges, and opportunities that define today’s industrial integration ecosystem. Stakeholders across engineering, operations, and executive teams will find a comprehensive overview of the transformative potential and key enablers fueling the next wave of productivity gains.

How Decentralized Control, Edge Computing, Cybersecurity and AI Are Revolutionizing Industrial Operations and Resilience

In recent years, five transformative shifts have recalibrated the industrial integration landscape: the decentralization of control architectures, the proliferation of edge computing, the ascendancy of cybersecurity imperatives, the integration of artificial intelligence into operational workflows, and the emergence of open, cloud-based platforms. Decentralized control has empowered localized decision-making at machinery and process levels, reducing latency and optimizing response times. Concomitantly, edge computing devices have emerged as critical nodes for processing high-velocity operational data nearer to its source, enabling real-time analytics and autonomous control loops.

Cybersecurity, once an afterthought in industrial settings, is now a foundational element, driving the adoption of zero-trust frameworks and secure-by-design principles. The infusion of AI into predictive and prescriptive maintenance paradigms has unlocked unprecedented insights, shifting asset management from reactive to proactive models. Finally, open, cloud-centric platforms have dismantled traditional silos, fostering interoperability across vendors and geographies. These shifts collectively pave the way for a new era of operational agility and resilience, setting the context for deeper market segmentation and regional dynamics.

Assessing the Layered Effects of Section 301, Section 232, and Reciprocal IEEPA Tariffs on Industrial Integration Strategies

The United States’ escalating tariff regime in 2025 has introduced significant headwinds for industrial system integrators and IIoT technology providers. Section 301 measures on Chinese imports have imposed levies up to 50 percent on solar wafers and polysilicon, as well as 25 percent on tungsten products effective January 1, 2025, intensifying input costs for critical hardware components such as sensors and edge devices. Section 232 tariffs have escalated duties on steel and aluminum to 50 percent for all countries effective June 4, 2025, with additional 25 percent duties on passenger vehicles and light trucks introduced on April 3, 2025, affecting capital equipment procurement across manufacturing facilities.

Moreover, reciprocal tariffs under IEEPA have extended a flat 10 percent Universal Duty to most trading partners through July 9, 2025, while imposing a 125 percent reciprocal levy on imports from China, Hong Kong, and Macau beginning April 10, 2025. These layers of tariffs have compelled firms to reconfigure supply chains, seek alternative sourcing strategies, and absorb or pass through higher costs. Collectively, these measures have driven companies to reassess supplier portfolios, prioritize onshore manufacturing partnerships, and accelerate digital transformation initiatives aimed at offsetting tariff-related cost pressures through efficiency gains and predictive maintenance.

Unraveling Adoption Patterns Across Components Services Software Deployments and Industry Use Cases Driving Market Diversification

A nuanced understanding of the industrial integration and IIoT market requires segment-level insights that reveal varied adoption patterns and value drivers. Component adoption trends indicate that while hardware continues to command foundational investment-spanning communication modules, programmable logic controllers, edge computing devices, and an array of sensors-service offerings in consulting, system integration, and support & maintenance are becoming equally critical as enterprises seek end-to-end deployment and lifecycle management. Software solutions for analytics, application development, platforms, security, and visualization underpin these deployments, with advanced descriptive, predictive, and prescriptive analytics unlocking deeper process optimization.

Deployment preferences further illuminate strategic priorities: cloud-based architectures, both public and private, facilitate scalable data aggregation and remote monitoring, whereas hybrid deployments balance on-premise control with cloud elasticity. End users within automotive, energy & utilities, healthcare, manufacturing-including both discrete and process subsectors-and oil & gas exhibit distinct requirements for performance, reliability, and regulatory compliance. Application use cases such as asset tracking, energy management, predictive maintenance-spanning acoustic, thermal, and vibration modalities-quality management, and remote monitoring highlight the versatility of IIoT solutions. Organization size also influences decision-making, as large enterprises typically pursue comprehensive digital transformation programs while small and medium enterprises often adopt phased implementations to align with resource constraints and growth trajectories.

This comprehensive research report categorizes the Industrial System Integrator & Industrial Internet of Things Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Organization Size

- End User

- Application

Mapping Regional Drivers of Digital Transformation and IIoT Deployment Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics in the industrial integration and IIoT landscape reveal differentiated growth drivers and technology adopters. In the Americas, a robust push toward digital equity and domestic manufacturing has heightened demand for integrated solutions that enhance operational visibility and sustainability. Meanwhile, Europe, Middle East & Africa (EMEA) regions prioritize regulatory compliance and energy efficiency, with initiatives such as the European Green Deal catalyzing investments in smart grid and asset performance management applications.

Across Asia-Pacific, rapid industrialization combined with government-backed Industry 4.0 programs in countries like China, Japan, and South Korea is fostering large-scale deployments of edge computing and AI-driven analytics. These regional distinctions underscore the importance of tailoring platform architectures, data governance frameworks, and service models to local market conditions. Moreover, supply chain realignment in response to tariff pressures has reinforced the strategic significance of nearshoring in the Americas and diversifying partnerships in EMEA and Asia-Pacific to maintain resilience and agility.

This comprehensive research report examines key regions that drive the evolution of the Industrial System Integrator & Industrial Internet of Things Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Partnerships Product Innovations and Ecosystem Expansion Among Leading IIoT and Integration Providers

Key players within the industrial integration and IIoT ecosystem are advancing their competitive positioning through strategic partnerships, innovation initiatives, and targeted acquisitions. Global automation legacy firms are investing heavily in cloud-native platforms and edge-to-cloud orchestration capabilities, while software specialists are deepening analytics and visualization toolkits to capture nuanced production insights. Technology giants are integrating cybersecurity and AI functionalities directly into their IIoT portfolios to offer end-to-end, secure operational solutions. At the same time, nimble startups are focusing on vertical-specific applications-from acoustic predictive maintenance to immersive digital twin environments-to carve out niche market footholds.

Collaboration between system integrators, component manufacturers, and cloud service providers is increasingly prevalent, facilitating contiguous value chains that streamline deployment complexity. Additionally, companies are expanding professional services capabilities through consulting and managed services offerings, addressing talent gaps and accelerating time-to-value for end users. This evolving competitive landscape underscores the imperative for continuous innovation and ecosystem orchestration to meet the complex requirements of modern industrial operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial System Integrator & Industrial Internet of Things Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Accenture plc

- Altizon Systems Private Limited

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- General Electric Company

- HCL Technologies Limited

- Hitachi Vantara LLC

- Honeywell International Inc.

- Infosys Limited

- International Business Machines Corporation

- Microsoft Corporation

- PTC Inc.

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Samsara Inc.

- Schneider Electric SE

- Siemens AG

- Tata Consultancy Services Limited

- True Value Infosoft Private Limited

Implementing Edge Analytics Cybersecurity Reskilling and Strategic Partnerships to Accelerate Digital Transformation Initiatives

Industry leaders must adopt a multifaceted strategy to harness the full potential of integrated systems and IIoT platforms. First, prioritizing investment in edge analytics and AI-driven maintenance frameworks will deliver immediate operational benefits by reducing downtime and optimizing asset performance. Second, establishing robust cybersecurity protocols, grounded in zero-trust architectures and continuous monitoring, is essential to protect mission-critical environments from escalating threats. Third, forging strategic alliances with cloud service providers and technology vendors will enable scalable deployments and access to evolving digital capabilities.

Additionally, reskilling workforces to manage data-centric operations and fostering cross-functional collaboration between IT and OT teams will underpin successful digital transformations. Lastly, developing flexible sourcing strategies and localizing critical component manufacturing can mitigate tariff exposure and supply chain disruptions. By executing these initiatives in concert, organizations can accelerate their journey toward connected, intelligent operations while safeguarding resilience and compliance.

Combining Expert Interviews Surveys and Regulatory Analysis to Deliver Robust Insights on Industrial Integration and IIoT Trends

This report’s insights derive from a rigorous, hybrid research methodology combining primary and secondary data collection. Primary research encompassed expert interviews with senior executives, system integrators, and technology providers to capture first-hand perspectives on deployment challenges and innovation priorities. Quantitative surveys of end users across automotive, energy, healthcare, manufacturing, and oil & gas sectors provided empirical validation of adoption trends and feature preferences.

Secondary research involved a comprehensive review of regulatory documents, trade announcements, and industry publications to track tariff developments, regional policies, and emerging standards. Platforms and solution provider websites were analyzed to assess product roadmaps and partner ecosystems. Data triangulation techniques ensured consistency and reliability of findings, while periodic validation workshops with domain experts refined interpretation and scenario planning. This mixed-method approach ensures that our conclusions are both actionable and grounded in real-world industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial System Integrator & Industrial Internet of Things Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Component

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Deployment

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Organization Size

- Industrial System Integrator & Industrial Internet of Things Technology Market, by End User

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Application

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Region

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Group

- Industrial System Integrator & Industrial Internet of Things Technology Market, by Country

- United States Industrial System Integrator & Industrial Internet of Things Technology Market

- China Industrial System Integrator & Industrial Internet of Things Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Positioning Connected Assets and Predictive Analytics as the Cornerstone of Next Generation Industrial Competitiveness

The industrial integration and IIoT technology arena stands at a transformative crossroads, where the convergence of digital and physical systems promises unparalleled gains in efficiency, reliability, and competitiveness. Organizations equipped with intelligent, connected assets are positioned to respond swiftly to market demands, optimize resource utilization, and innovate continuously. Yet, achieving these outcomes requires a strategic blend of advanced analytics, secure architectures, and collaborative ecosystems capable of navigating evolving tariff landscapes and regional nuances.

As the acceleration of Industry 4.0 reshapes operational models, the insights presented in this executive summary offer a comprehensive blueprint for decision-makers. By understanding the underlying shifts, segment-specific drivers, and regional imperatives, stakeholders can craft targeted strategies that unlock the full value of system integration and IIoT investments. The future of industrial competitiveness will be determined by those who not only adopt cutting-edge technologies but also integrate them seamlessly into their operational fabric.

Engage With Ketan Rohom to Access Tailored Industrial Integration and IoT Insights for Strategic Growth and Operational Excellence

As the industrial sector accelerates its digital transformation, the stakes have never been higher: harnessing the power of integrated systems and industrial IoT will define the next era of operational excellence and competitive leadership. To secure your organization’s advantage and obtain the detailed insights driving this report’s analysis, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage with an expert to customize research access, explore tailored data, and initiate strategic planning that aligns with your business objectives. Our team stands ready to guide you through the actionable intelligence contained herein and ensure you capitalize on emerging growth opportunities. Connect today to transform insight into impact and lead your industry with confidence

- How big is the Industrial System Integrator & Industrial Internet of Things Technology Market?

- What is the Industrial System Integrator & Industrial Internet of Things Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?