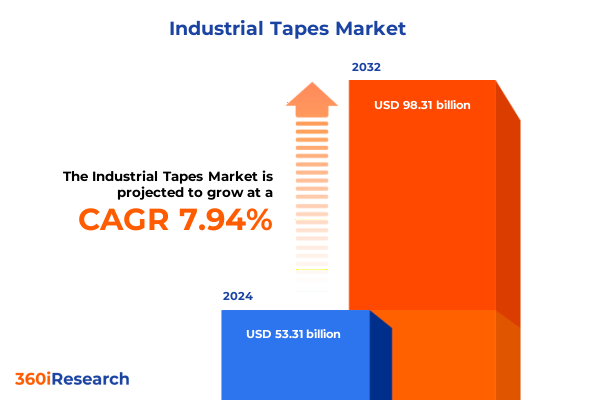

The Industrial Tapes Market size was estimated at USD 57.56 billion in 2025 and expected to reach USD 61.81 billion in 2026, at a CAGR of 7.94% to reach USD 98.31 billion by 2032.

Cutting-edge adhesive technologies in industrial tapes are transforming manufacturing ecosystems by offering robust, precision bonding, insulation, and sealing capabilities

Industrial tapes have become foundational solutions that span a multitude of manufacturing and assembly processes, delivering critical capabilities in bonding, insulation, masking, mounting, and sealing. From the complex tolerances required in automotive assembly to the stringent biocompatibility standards in medical device manufacturing, these products enable engineers to push the boundaries of design and functionality. In recent years, end users have demanded ever-greater performance characteristics-resistance to extreme temperatures, chemical exposure, and mechanical stress-placing new demands on both adhesive chemistries and backing substrates.

Moreover, the drive for sustainability and lightweighting has elevated the role of industrial tapes in reducing overall system weight and facilitating end-of-life recyclability. As industries adopt electric mobility, smart infrastructure, and digital manufacturing techniques, tape suppliers are responding with formulations that incorporate renewable components, offer low-VOC profiles, and simplify assembly workflows. This convergence of high-performance requirements and environmental stewardship is setting the stage for an era of unprecedented innovation within the tape industry, where material science advances and application-driven design collaborate to unlock enhanced manufacturing efficiencies and product reliability.

Advancements in adhesive chemistries and backing materials are reshaping industrial tape performance and unlocking new applications in high-demand sectors

The industrial tapes landscape is undergoing a transformative shift driven by the integration of advanced adhesive systems, innovative backing materials, and digital manufacturing techniques. Newly formulated acrylic and silicone adhesives deliver stronger initial tack and long-term durability, answering the market’s need for reliable performance under fluctuating temperatures and severe chemical exposures. Concurrently, backing materials such as polyester film and aluminum foil have been engineered at micro-thicknesses, enabling thinner, lighter tapes that maintain tensile strength and barrier properties. These material innovations are elevating tape applications in sectors ranging from consumer electronics, where ultra-thin form factors are critical, to healthcare, where precise fluid management and sterility cannot be compromised.

At the same time, manufacturers are embracing Industry 4.0 principles, incorporating automated dispensing systems and digital quality-control mechanisms to ensure batch-to-batch consistency. Artificial intelligence and machine learning algorithms are being piloted to optimize adhesive cure profiles, reducing trial iterations and accelerating time to market. As these capabilities mature, tape producers are poised to offer customized solutions tailored to each customer’s process parameters, from roll-to-roll lamination to robotic pick-and-place assembly. In this rapidly evolving environment, companies that harness the convergence of material science breakthroughs and digital production methodologies will emerge as leaders in the next generation of industrial tape solutions.

Recent U.S. tariff adjustments on imported raw materials and finished components have substantially altered cost structures and supply chain strategies in the industrial tape sector

The introduction and adjustment of United States tariffs in 2025 have generated significant ripple effects across the industrial tapes value chain. Raw materials such as PVC foam and aluminum foil backings, which are often sourced from tariff-exposed regions, have seen cost increases of up to 25 percent as global duties were realigned under Section 301 and Section 232 provisions. Tape converters and formulators have responded by diversifying supplier portfolios, shifting production closer to end markets, and renegotiating long-term contracts to mitigate exposure to sudden rate changes.

These strategic responses have reshaped supply chain dynamics, driving nearshoring initiatives and incentivizing investments in domestic capacity expansions. While the cumulative tariff burden has elevated landed costs, it has also accelerated innovation in low-volume, high-value product segments where unique adhesive-back combinations justify premium pricing. As companies refine cost modeling and implement duty-optimization strategies-such as tariff engineering to adjust harmonized system codes-they are gaining newfound agility to adapt to shifting trade policies. Ultimately, the 2025 tariff environment has not only introduced cost pressures but has also catalyzed supply chain resilience and fostered a more localized production footprint for industrial tape manufacturers.

Analyzing market segmentation by end-user industry, adhesive type, backing material, application, distribution channel, and thickness reveals nuanced demand patterns and strategic opportunities

A nuanced exploration of market segmentation reveals differentiated demand patterns driven by end-user industries, adhesive types, backing materials, application modes, distribution channels, and product thicknesses. In the automotive sector, original equipment manufacturers prioritize robust bonding solutions with high shear strength, while the aftermarket emphasizes cost-effective tapes that deliver quick assembly and repair capabilities. Within construction, commercial projects often require heavy-duty mounting and sealing tapes with foam backings, whereas residential applications favor thinner, aesthetically discreet film tapes. Consumer electronics demand ultra-thin polyester or PVC tape for precision masking and insulation, contrasted with industrial electronics where flame-retardant cloth tapes hold sway. Healthcare’s dual focus on hospital consumables and medical devices underscores the need for silicone-based adhesive tapes that ensure biocompatibility and fluid management.

Simultaneously, the choice of adhesive-whether acrylic for general-purpose durability, rubber for high initial tack, or silicone for extreme temperature resilience-weaves through each application segment. Aluminum foil and polyester film backings excel in insulation and barrier uses, while cloth and polyethylene foam support heavier bonding and vibration damping. Distribution channels bifurcate into traditional offline routes that leverage established distributor networks and emerging online platforms that cater to rapid replenishment demands. Thickness variations-from sub-0.05 mm tapes engineered for microelectronics to tapes exceeding 0.1 mm for heavy sealing-further tailor product performance to precise use-case requirements.

This comprehensive research report categorizes the Industrial Tapes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Adhesive Type

- Backing Material

- Thickness

- Application

- End User Industry

- Distribution Channel

Regional dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific are driving differentiated growth trajectories and influencing competitive positioning in the industrial tape market

Regional market dynamics continue to diverge across the Americas, Europe Middle East & Africa, and Asia-Pacific, each shaped by local regulatory frameworks, end-user preferences, and supply chain infrastructure. In the Americas, nearshoring trends and supportive policy measures are bolstering domestic tape manufacturing, with reshored capacity investments mitigating lead times and reducing tariff vulnerability. Growth in electric vehicle production and renewable energy installations is fueling demand for specialized tapes in battery assembly and photovoltaic module lamination. Transitioning southward, Latin American markets are embracing more value-added applications such as flexible packaging tapes, driven by expanding e-commerce networks.

Europe Middle East & Africa presents a landscape characterized by stringent environmental and safety regulations. This has prompted tape suppliers to develop solvent-free and low-VOC formulations to comply with EU directives and regional sustainability targets. Meanwhile, the Middle East’s infrastructure development projects are elevating requirements for heavy-duty construction tapes. In Asia-Pacific, a robust electronics manufacturing ecosystem is catalyzing adoption of ultra-thin masking and bonding tapes, while rapid urbanization across India and Southeast Asia is amplifying demand for versatile packaging solutions. These regional nuances underscore the imperative for tape manufacturers to align product portfolios and supply chain models with localized market imperatives.

This comprehensive research report examines key regions that drive the evolution of the Industrial Tapes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading industry players are leveraging innovation, strategic partnerships, and targeted expansion to strengthen market presence and sustain competitive advantage in industrial tapes

Industry incumbents and emerging players alike are intensifying their efforts to capture market share through technological innovation, strategic partnerships, and capacity expansions. Leading manufacturers have accelerated R&D investments to develop next-generation adhesive systems that deliver multi-functional performance-combining high shear strength, low outgassing, and removability in a single tape solution. Collaboration agreements with specialty polymer producers have unlocked access to novel base resins, enabling companies to tailor tape formulations for specific thermal and chemical resistance profiles.

Simultaneously, several key players have announced capacity expansion projects in North America and Asia to address rising local demand and reduce tariff exposures. These facilities incorporate Industry 4.0-enabled production lines, offering real-time process monitoring and adaptive control systems. On the distribution front, companies are forging alliances with digital platforms to enhance direct-to-end-user engagement, leveraging online configurators that allow customers to specify tape dimensions, adhesives, and backing options with unprecedented precision. Collectively, these initiatives underscore a competitive landscape in which agility, technical leadership, and supply chain resilience define success drivers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Tapes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ACHEM Technology Corp.

- Adhesive Applications Inc.

- Advance Tapes International

- AIRTECH International Ltd.

- Avery Dennison Corporation

- Berry Global Group, Inc.

- Can-Do National Tape

- Folienwerk Wolfen GmbH & Co. KG

- Intertape Polymer Group Inc.

- LINTEC Corporation

- Mactac

- MBK Tape Solutions

- Nitto Denko Corporation

- PPM Industries SpA

- Saint-Gobain Performance Plastics Corporation

- Scapa Group Ltd. (part of SWM International)

- Shurtape Technologies, LLC

- Tesa SE

- tesa tape Inc.

Strategic initiatives focused on supply chain optimization, product innovation, and market diversification can equip industrial tape manufacturers to navigate evolving market complexities

To thrive amid evolving market dynamics, industry leaders should prioritize strategic imperatives that drive both operational resilience and product differentiation. A focus on supply chain optimization-incorporating dual-sourcing strategies, tariff engineering, and regional production footprints-will mitigate cost volatility and enhance responsiveness to trade policy shifts. Concurrently, amplifying R&D efforts toward sustainable adhesive chemistries and recyclable backing materials can align product offerings with increasingly stringent environmental regulations and corporate sustainability goals.

Market diversification should extend across end-use industries and geographic markets, targeting high-growth segments such as electric vehicle manufacturing, renewable energy infrastructure, and medical device assembly. Leveraging digital sales and service platforms will enable more efficient customer interactions and rapid custom tape development cycles. Furthermore, establishing collaborative innovation partnerships with end users can generate co-developed solutions that deepen customer loyalty and command premium pricing. By integrating these actionable measures into corporate strategy, tape manufacturers can secure competitive advantage while navigating the complexities of an ever-changing global trade environment.

Comprehensive research methodology integrating primary interviews, secondary data analysis, and validation processes ensures robust insights and accurate market intelligence for industrial tapes

This research employed a rigorous methodology that balanced qualitative insights and quantitative validation to deliver actionable intelligence on the industrial tapes market. Primary data collection involved in-depth interviews with senior executives and technical experts across tape manufacturing, formulation chemistry, and end-use application sectors. These conversations illuminated emerging technology trends, supply chain strategies, and customer requirements.

In parallel, extensive secondary research synthesized information from industry publications, trade associations, regulatory filings, and customs data to map global trade flows and tariff landscapes. Data triangulation ensured consistency across sources, while analytical frameworks such as competitive benchmarking and Porter’s Five Forces provided structured assessments of market dynamics. To validate findings, the research team conducted peer-review sessions with select industry stakeholders, incorporating feedback on key assumptions and model outputs. This comprehensive approach underpins the credibility and robustness of all insights presented within the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Tapes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Tapes Market, by Adhesive Type

- Industrial Tapes Market, by Backing Material

- Industrial Tapes Market, by Thickness

- Industrial Tapes Market, by Application

- Industrial Tapes Market, by End User Industry

- Industrial Tapes Market, by Distribution Channel

- Industrial Tapes Market, by Region

- Industrial Tapes Market, by Group

- Industrial Tapes Market, by Country

- United States Industrial Tapes Market

- China Industrial Tapes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing critical findings and strategic implications underscores the transformative opportunities and challenges shaping the industrial tape sector’s future growth trajectory

The industrial tapes market stands at a pivotal juncture, propelled by material science breakthroughs, digital production technologies, and evolving regulatory landscapes. As end users demand more specialized performance-whether in electric vehicle assembly, medical device fabrication, or high-speed electronics manufacturing-tape producers must continue innovating adhesives and backing substrates to satisfy these exacting requirements. Concurrently, the ramifications of U.S. tariff policies have underscored the importance of supply chain flexibility, nearshoring strategies, and tariff optimization to preserve margins in a cost-pressured environment.

Regionally, differentiated growth patterns call for tailored market approaches, from sustainability-driven product portfolios in Europe to capacity expansions in North America and Asia-Pacific. Leading companies are already forging paths through strategic collaborations, digital engagement platforms, and Industry 4.0‐enabled manufacturing. By embracing the actionable recommendations outlined in this report-centering on supply chain resilience, product innovation, and market diversification-industry stakeholders can seize emerging opportunities and navigate future challenges with confidence. The collective momentum toward higher performance, sustainability, and agile operations marks an exciting evolution for the entire industrial tape ecosystem.

Engage with Associate Director of Sales & Marketing for tailored insights and secure access to the full industrial tapes market research report to inform strategic decision-making

Unlock unparalleled strategic insights and gain a competitive edge by securing the comprehensive industrial tapes market research report. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to discuss your specific business objectives and receive tailored guidance on leveraging the report’s findings. Collaboration with Ketan will ensure you access exclusive analyses on tariff impacts, segmentation trends, and regional dynamics, empowering your leadership team to make informed decisions that drive growth and resilience. Reach out today to explore pricing, licensing options, and customization possibilities that align with your organizational goals. By partnering directly with Ketan Rohom, you’ll streamline the acquisition process and unlock actionable intelligence that fuels innovation in your tape product portfolio and supply chain strategies

- How big is the Industrial Tapes Market?

- What is the Industrial Tapes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?