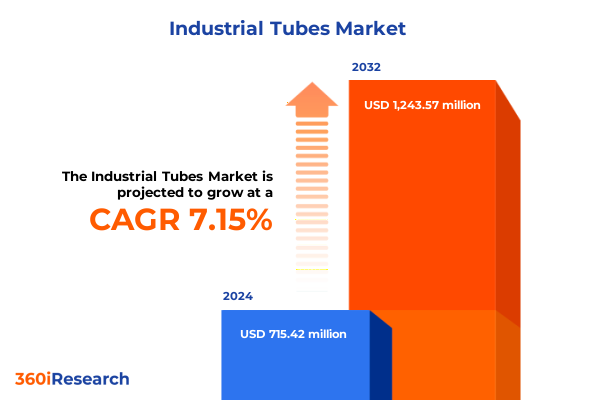

The Industrial Tubes Market size was estimated at USD 765.75 million in 2025 and expected to reach USD 810.61 million in 2026, at a CAGR of 7.17% to reach USD 1,243.57 million by 2032.

Unveiling the Strategic Significance and Versatile Applications of Industrial Tubes Across Global Sectors

The industrial tubes sector serves as a foundational component across a myriad of end-use industries, underpinning critical applications from fluid conveyance to structural reinforcement. These essential conduits facilitate the reliable and efficient transport of gases, liquids, and heat transfer media, enabling operations in power generation, oil and gas, automotive, construction, and beyond. As industries pursue greater operational efficiency, sustainability, and cost optimization, the role of high-performance tubes has never been more pivotal.

Against this backdrop, stakeholders must navigate an increasingly complex environment characterized by fluctuating raw material prices, shifting regulatory frameworks, and rapid technological advancements in manufacturing processes. From alloy selection to precision forming techniques, every aspect of tube production influences downstream performance and life-cycle costs. This executive summary delivers a concise yet comprehensive introduction to the current industrial tubes landscape, highlighting the market’s critical importance, key drivers, and emerging challenges that will define the sector’s trajectory.

Exploring the Emerging Technological Advancements and Digital Transformations Shaping Industrial Tube Production

In recent years, the industrial tubes landscape has undergone remarkable transformations driven by technological breakthroughs and evolving end-user demands. Additive manufacturing methods and advanced welding systems have enabled producers to achieve tighter tolerances, superior material integrity, and complex geometries previously unattainable with conventional processes. These innovations not only enhance product performance but also reduce lead times and waste, aligning with broader sustainability objectives.

Moreover, digitalization initiatives such as predictive maintenance, real-time quality monitoring, and digital twin simulations are reshaping how manufacturers design, produce, and service tubular products. By harnessing data-driven insights, companies can preempt failures, optimize maintenance schedules, and improve overall equipment effectiveness. As the sector embraces Industry 4.0 principles, the integration of sensor-equipped tubing and automated inspection systems promises to further elevate quality standards and operational reliability.

Meanwhile, the accelerating shift toward lightweight and high-strength materials is prompting a recalibration of material selection criteria. The demand for alloyed and pure aluminum tubes, as well as advanced stainless steel grades, reflects the imperative to balance weight reduction with mechanical robustness, particularly in automotive and aerospace applications. These transformative shifts underscore a market in flux, where continuous innovation and agility are essential to capitalizing on emerging opportunities.

Evaluating the Impact of Recent Trade Measures on Industrial Tube Supply Chains and Cost Structures

The imposition of new trade measures in midyear two thousand twenty-five has exerted considerable pressure on global supply chains for industrial tubes. Heightened tariffs on key commodities such as alloyed steel, aluminum, and copper have driven a recalibration of sourcing strategies, compelling many producers to seek alternative suppliers or realign production footprints to mitigate cost escalations. As import duties rose, the pass-through effect to end users translated into higher procurement expenses for sectors heavily reliant on tubular components, notably oil and gas and power generation.

In response to tariff-induced cost volatility, several manufacturers accelerated efforts to localize raw material processing and tube fabrication. This strategic pivot not only reduced exposure to cross-border levies but also fostered closer collaboration with domestic metal producers to ensure consistent quality and supply reliability. Concurrently, some downstream users revisited design specifications to optimize material consumption and simplify tube geometries, thereby offsetting incremental tariff burdens through engineering efficiencies.

Although short-term disruptions emerged-manifested in extended lead times and selective product shortages-the longer-term impact has driven a more resilient value chain. By diversifying supplier networks and enhancing vertical integration, industry participants have fortified their ability to navigate evolving trade policies, underpinning sustainable competitiveness in an era of geopolitical uncertainty.

Uncovering How Material, Industry, Manufacturing Technique, Application, and Shape Drive Tubular Market Dynamics

When examining the industrial tubes sector by material, the landscape encompasses a spectrum of options including aluminum, copper, plastic, stainless steel, and various steel grades. Within the aluminum category, alloyed and pure forms cater to distinct performance requirements, with alloyed variants delivering enhanced strength and corrosion resistance, while pure aluminum tubes offer exceptional formability and lightweight characteristics. Copper tubes maintain indispensable roles in applications demanding superior thermal conductivity and antimicrobial properties. Meanwhile, plastic tubes serve as cost-effective alternatives for non-pressurized or chemically inert environments. In the stainless steel domain, austenitic and ferritic grades provide tailored solutions for corrosion-intensive and high-temperature settings, whereas steel tubes split between alloy steel, prized for its mechanical strength in high-stress applications, and carbon steel, valued for its cost efficiency and widespread availability.

Segmentation by end use industry reveals a diversified demand base, spanning automotive, chemical and petrochemical, construction, oil and gas, and power generation. In automotive manufacturing, tubes deliver critical functions in exhaust systems, chassis components, and fluid conveyance, driving the uptake of lightweight aluminum and high-strength steels. The chemical and petrochemical sectors require tubes capable of withstanding corrosive media and extreme thermal cycles. Within construction, commercial, infrastructure, and residential subsegments each impose unique performance criteria, from building services piping to structural reinforcement. Oil and gas subdivisions-upstream exploration, midstream transport, and downstream refining-demand seamless tubes with impeccable integrity to ensure safe and efficient hydrocarbon handling.

From a manufacturing perspective, seamless production via extrusion and rotary piercing offers unmatched uniformity and mechanical properties, while welded techniques such as electric fusion and resistance welding provide cost-effective fabrication for larger diameters and thinner walls. Application-based segmentation underscores the versatility of industrial tubes, whether in conveying gases or liquids, facilitating heat exchange operations, powering hydraulic and pneumatic systems, or providing structural support. Finally, shape-based analysis differentiates among rectangular, round, and square profiles, each contributing to distinct design and installation efficiencies across diverse projects.

This comprehensive research report categorizes the Industrial Tubes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Manufacturing Technique

- Shape

- End Use Industry

- Application

Mapping Regional Demand Trends and Growth Dynamics in the Americas, EMEA, and Asia-Pacific Industrial Tube Markets

In the Americas region, robust end-user demand stems from extensive infrastructure investment and the ongoing modernization of oil and gas facilities. The resurgence of shale extraction in North America has fueled significant consumption of seamless high-strength tubes, while infrastructure renewal initiatives across highways and rail corridors have driven demand for structural profiles. Latin American markets, meanwhile, are evolving as local refining and petrochemical projects gain traction, presenting growth opportunities for corrosion-resistant stainless and alloy steel tubes.

Europe, Middle East, and Africa collectively exhibit a highly diversified landscape. Western Europe emphasizes sustainability compliance, elevating the role of lightweight aluminum tubes in automotive and renewable energy applications. In the Middle East, large-scale petrochemical complexes and offshore developments underpin a strong requirement for premium seamless and corrosion-resistant tube grades. African emerging markets, driven by infrastructure and urbanization needs, are increasingly integrating industrial tubes into public works, although cost sensitivity remains a critical factor.

Asia-Pacific stands out as a major consumption hub, fueled by rapid industrialization, urban expansion, and maritime trade growth. China continues to spearhead demand across power generation and construction, leveraging domestic steel production capabilities. India’s infrastructure push, including smart cities and new refineries, is driving uptake of seamless and welded tubes alike. Meanwhile, Southeast Asian economies are diversifying end-use industries, from automotive assembly to chemical processing, creating a sustained appetite for specialized tube solutions.

This comprehensive research report examines key regions that drive the evolution of the Industrial Tubes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Top Manufacturers Are Leveraging Innovation, Partnerships, and Digital Solutions for Market Leadership

Industry leaders are refining strategic portfolios through targeted investments in advanced manufacturing assets and collaborative R&D partnerships. Several prominent tube producers have inaugurated next-generation facilities equipped with high-capacity extrusion presses and automated welding lines to expand their ability to deliver complex geometries at scale. Technology ventures are also forging alliances between material scientists and process engineers to develop novel alloys and coatings that enhance durability in corrosive and high-pressure environments.

Market participants are prioritizing digital transformation initiatives to streamline production workflows and augment quality assurance processes. The adoption of machine vision for weld seam inspection and the integration of inline ultrasonic testing have significantly improved defect detection rates, reducing scrap and rework costs. At the same time, logistics providers specializing in tubular shipments are leveraging advanced tracking solutions to ensure just-in-time delivery and minimize inventory holding.

Through these multifaceted efforts, leading companies are solidifying competitive moats based on technological differentiation, operational excellence, and supply chain resilience. By aligning product development with emerging end-user requirements-such as enhanced heat transfer efficiency and reduced carbon footprints-these organizations are well-positioned to capture premium segments and drive long-term profitable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Tubes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ArcelorMittal S.A.

- Borusan Mannesmann Boru Sanayi ve Ticaret A.S.

- Chelpipe Group

- Hyundai Steel Company

- ISMT Limited

- JFE Steel Corporation

- Jindal SAW Ltd.

- Nippon Steel Corporation

- Sandvik AB

- Severstal PAO

- Tata Steel Limited

- Techint Group

- Tenaris S.A.

- Thyssenkrupp AG

- TMK Group

- United States Steel Corporation

- Vallourec S.A.

- Voestalpine AG

- Wheatland Tube Company

- Zekelman Industries

Actionable Strategies for Building Operational Agility, Supply Chain Resilience, and Technological Differentiation in Tubular Manufacturing

To navigate the evolving industrial tubes landscape, companies should prioritize investment in flexible manufacturing platforms that accommodate a diverse range of materials and dimensions. By deploying modular extrusion and welding systems, manufacturers can swiftly pivot production to meet shifting customer specifications while maintaining cost efficiencies. Furthermore, strengthening supplier relationships through long-term agreements and joint innovation programs will ensure consistent access to strategic raw materials under variable trade conditions.

Organizations must also advance their digitalization roadmaps by embedding predictive analytics into maintenance regimes and quality control processes. Leveraging real-time process data to anticipate equipment failures can significantly reduce downtime, while digital quality inspection systems will bolster first-pass yield rates. Concurrently, exploring opportunities in advanced alloys and composite tube designs can unlock new applications in emerging sectors like green hydrogen and advanced mobility.

Finally, industry players should adopt a proactive regulatory engagement strategy to shape standards that govern tube performance and sustainability reporting. By contributing technical expertise to standards bodies and participating in cross-industry working groups, companies can anticipate compliance trends, influence policy development, and differentiate their offerings through verified environmental and safety credentials.

Detailing the Integrated Framework of Primary Research, Secondary Analysis, and Expert Review That Ensured Study Rigor

The research methodology underpinning this analysis integrates a blend of primary interviews, secondary data aggregation, and expert validation. Detailed discussions with manufacturing executives, material scientists, and procurement managers provided firsthand insights into production challenges, material preferences, and emerging application needs. Secondary sources include industry white papers, technical journals, trade association reports, and regulatory filings, all rigorously reviewed to ensure data veracity and relevance.

Quantitative data on production capacities, material availability, and supply chain structures were synthesized through cross-referencing multiple industry databases and proprietary intelligence platforms. Qualitative inputs were systematically coded to identify recurring themes around innovation priorities, tariff impacts, and digital transformation initiatives. The resulting dataset underwent peer review by a panel of subject matter experts to validate assumptions and refine analytical frameworks.

By combining these research components, the study delivers a balanced perspective grounded in empirical evidence and industry best practices. The methodology emphasizes transparency, repeatability, and robustness to support stakeholders in making informed decisions about product development, market entry, and strategic investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Tubes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Tubes Market, by Material

- Industrial Tubes Market, by Manufacturing Technique

- Industrial Tubes Market, by Shape

- Industrial Tubes Market, by End Use Industry

- Industrial Tubes Market, by Application

- Industrial Tubes Market, by Region

- Industrial Tubes Market, by Group

- Industrial Tubes Market, by Country

- United States Industrial Tubes Market

- China Industrial Tubes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing How Innovation, Supply Chain Evolution, and Market Segmentation Define the Future of Industrial Tubes

The industrial tubes market stands at the intersection of innovation, regulation, and evolving end-user expectations. With advancements in material science and manufacturing technology, the sector is poised to deliver enhanced performance while addressing critical sustainability imperatives. Tariff-driven realignments have catalyzed supply chain diversification, fostering greater resilience and closer collaboration among raw material suppliers and tube fabricators. Meanwhile, segmentation insights underscore the importance of tailoring offerings across material types, end-use industries, production techniques, applications, and shapes to capture specialized niches.

Regional disparities reflect a mosaic of demand drivers, from infrastructure modernization in the Americas to large-scale energy and construction projects in EMEA and Asia-Pacific. Leading companies are leveraging digital tools, strategic partnerships, and advanced processing capabilities to secure competitive advantages and meet stringent quality expectations. As market participants chart the path forward, success will hinge on harmonizing technological innovation with agile supply chain management and proactive regulatory engagement.

In sum, the evolving industrial tubes landscape presents both challenges and opportunities for stakeholders willing to invest in flexibility, data-driven decision-making, and continuous product enhancement. Organizations that embrace these imperatives will be ideally positioned to thrive in a dynamic environment and unlock new avenues for growth.

Engage Directly with Our Senior Sales Lead to Access Exclusive Industrial Tubes Market Intelligence

We invite you to secure your competitive edge in the rapidly evolving industrial tubes market by obtaining the comprehensive research insights directly from Ketan Rohom, the Associate Director of Sales & Marketing. With an in-depth understanding of market dynamics, emerging trends, and strategic growth opportunities, our report provides actionable intelligence to inform your investment decisions and operational planning. Reach out to Ketan Rohom to explore customized data packages, detailed segment analyses, and expert guidance tailored to your unique business objectives. Don’t miss the opportunity to leverage the latest industry intelligence and position your organization for sustained success-contact Ketan Rohom to purchase the full market research report and gain the critical insights you need to stay ahead.

- How big is the Industrial Tubes Market?

- What is the Industrial Tubes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?