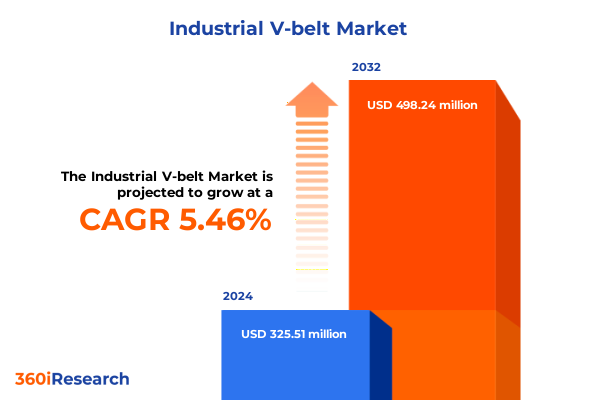

The Industrial V-belt Market size was estimated at USD 343.00 million in 2025 and expected to reach USD 361.52 million in 2026, at a CAGR of 5.47% to reach USD 498.24 million by 2032.

Unveiling the Critical Role of Industrial V-Belts in Enhancing Performance Reliability and Efficiency Across Diverse Machinery Applications

Industrial V-belts serve as the backbone of countless mechanical systems, enabling power transmission solutions that are both reliable and versatile. In heavy industries such as mining and construction, agricultural equipment, and manufacturing plants, these belts are essential components that ensure continuous operation with minimal downtime. Their engineered geometry, including variations like double V-belts for high torque applications and narrow V-belts for compact drive systems, underscores the indispensable role they play across the industrial spectrum.

As global enterprises pursue optimized productivity, V-belt technology has evolved to address rising performance expectations and environmental demands. Manufacturers have introduced raw edge cogged belts that offer superior flexibility, while standard V-belts continue to balance cost-effectiveness with durability. Together, these solutions meet diverse requirements, whether transmitting power in HVAC systems, facilitating material handling operations, or driving heavy-duty power transmission. This introductory overview lays the groundwork for understanding how core product innovations and market dynamics converge to shape the trajectory of the industrial V-belt sector.

Exploring Transformative Shifts Reshaping the Industrial V-Belt Landscape Through Technological Innovations and Emerging Application Demands

The industrial V-belt market is undergoing transformative shifts fueled by rapid digitalization and growing sustainability imperatives. Breakthroughs in sensor integration now enable predictive maintenance capabilities, allowing real-time monitoring of belt tension and wear to preempt unexpected failures. Concurrently, the incorporation of advanced materials derived from thermoplastic polyurethane has delivered belts with enhanced abrasion resistance and extended service lives, reducing both maintenance costs and environmental impact.

Furthermore, the escalating automation of manufacturing and energy sectors demands higher precision and reliability from drive systems. In material handling applications, for instance, narrow V-belts are increasingly favored for compact conveyor setups, while double V-belts are being redeployed in heavy-duty mining machinery where torque requirements have surged. These developments reflect an industry-wide pivot toward solutions that marry mechanical robustness with digital intelligence, setting the stage for next-generation industrial V-belt ecosystems.

Analyzing the Multidimensional Impact of Recent United States Tariffs on Industrial V-Belt Supply Chains and Manufacturer Strategies in 2025

In early 2025, the United States implemented revised tariff measures on certain imported industrial components, directly impacting V-belt supply chains. These duties, targeting raw materials and finished belts from specific regions, have introduced additional cost pressures on domestic manufacturers that rely on global sourcing. As a result, production margins have tightened, compelling suppliers to explore alternative vendor partnerships and localized production strategies to mitigate the financial impact.

Many manufacturers have responded by diversifying their procurement footprints, securing rubber compounds from non-subject countries, and accelerating in-house compounding capabilities. This shift has also influenced the competitive dynamics of the market, as domestic players invest in vertical integration to shield themselves from further tariff volatility. The cumulative effect of these measures underscores the critical need for agile supply chain management and adaptive pricing strategies within the industrial V-belt sector.

Delving into Key Segmentation Dynamics Revealing Opportunities Through Belt Type, Industry End-Use, Application, Material and Distribution Channels

A nuanced look at market segmentation reveals the multifaceted nature of demand drivers across belt type, end-use industry, application, material composition, and distribution channels. Belt types ranging from double V-belts optimized for heavy torque to raw edge cogged belts designed for enhanced flexibility shape procurement decisions based on mechanical requirements. Meanwhile, diverse end-use industries such as agricultural machinery and automotive assembly each demand specialized belt configurations that balance load-bearing capacity with operational longevity.

In terms of application, HVAC systems often call for standard V-belts that prioritize quiet operation, whereas power transmission systems necessitate belts capable of sustaining elevated load cycles. Material choices further refine this picture: thermoplastic polyurethane variants deliver exceptional resistance to oil and abrasion, while rubber formulations like EPDM, neoprene, and nitrile cater to specialized temperature and chemical exposure profiles. Lastly, distribution channels-whether secured through direct sales agreements, established distributors, or emerging online platforms-play a pivotal role in ensuring timely product availability and aftermarket support. Collectively, these segmentation insights illuminate the strategic pathways for product development and customer engagement within the V-belt marketplace.

This comprehensive research report categorizes the Industrial V-belt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Belt Type

- Fabric Material

- Distribution Channel

- Application

- End-Use Industry

Examining Regional Market Nuances Highlighting Growth Drivers and Challenges Across Americas, Europe Middle East Africa and Asia Pacific Sectors

Regional market dynamics exhibit pronounced variations in growth trajectory and competitive intensity. In the Americas, robust infrastructure spending and the resurgence of manufacturing hubs have elevated demand for durable power transmission solutions. Companies in North and South America face the dual challenge of catering to aging industrial assets while integrating next-generation belt technologies that support energy efficiency targets.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing equipment emissions and energy consumption are reshaping procurement practices. End users in these regions increasingly seek belts manufactured from sustainable materials and backed by comprehensive maintenance services. Conversely, the Asia-Pacific landscape is marked by rapid urbanization and industrial expansion in nations such as India and Southeast Asian economies, driving a surge in demand across sectors from construction to renewable energy. These regional insights serve as a guide for tailoring market entry strategies and aligning product portfolios with localized requirements.

This comprehensive research report examines key regions that drive the evolution of the Industrial V-belt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industrial V-Belt Manufacturers and Vendors Spotlighting Their Strategic Initiatives Competitive Edge and Collaborative Partnerships

Leading manufacturers and vendors in the industrial V-belt domain have distinguished themselves through targeted innovation, strategic alliances, and focused geographic outreach. Several top firms have unveiled proprietary belt compounds that deliver breakthrough resistance to heat, chemicals, and mechanical fatigue, setting new benchmarks for performance reliability. Concurrently, partnerships with automation providers have enabled integrated drive solutions that combine belt technologies with sensor-enabled monitoring platforms.

Collaborative ventures between component suppliers and major equipment OEMs have further solidified the market position of key players, facilitating co-development of belt systems tailored to specific machinery specifications. Some companies have also expanded their global footprints through selective acquisitions of regional distributors, enhancing logistics capabilities and aftersales support. These concerted efforts underscore the competitive landscape and highlight the strategic initiatives that are defining tomorrow’s leaders in the industrial V-belt market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial V-belt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB SKF

- Ammega Group BV

- Bando Chemical Industries, Ltd.

- Bridgestone Corporation

- Carlisle Companies, Inc.

- Chiorino S.p.A.

- Continental AG

- Dayco Products, LLC

- Fenner PLC

- Gates Corporation

- Hangzhou Grand Transmission Tech co., Ltd.

- Hutchinson SA

- Mitsuboshi Belting Ltd.

- Navyug (India) Limited

- OPTIBELT GmbH

- Pix Transmissions Ltd.

- ProTorque

- Rubena, s.r.o.

- Sanlux Co., Ltd

- SIT S.p.A.

- Supreme Rubber Industries

- The Goodyear Tire & Rubber Company

- The Timken Company

- Toyopower Global Pte. Ltd.

- Zhejiang Sanwei Rubber Item

Formulating Actionable Strategic Recommendations to Propel Industrial V-Belt Leaders Toward Sustainable Growth and Competitive Differentiation in a Rapidly Evolving Market

To navigate the complexities of today’s industrial V-belt market, industry leaders must adopt proactive strategies that align operational resilience with technological advancement. Prioritizing investments in material science and in-house compounding capabilities can reduce dependency on volatile raw material markets and shield against tariff fluctuations. Simultaneously, forging deeper collaborations with automation technology partners will enable the development of predictive maintenance ecosystems, thereby minimizing unplanned downtime.

Leaders should also refine their go-to-market approaches by leveraging direct sales channels for strategic accounts while expanding digital platforms to capture broader aftermarket demand. Pursuing sustainability certifications for belt materials and manufacturing processes will not only meet tightening regulatory requirements but also appeal to environmentally conscious end users. By integrating these actionable recommendations, companies can build more agile supply chains, differentiate their product portfolios, and secure long-term competitive advantage.

Outlining Rigorous Research Methodology Incorporating Comprehensive Secondary and Primary Data Collection Techniques for Industrial V-Belt Market Analysis

This research study was conducted through a rigorous methodology designed to ensure comprehensive and reliable insights. Secondary research included analysis of industrial engineering journals, technical certifications, and regulatory filings to map the technological evolution of belt compounds and performance standards. Primary research comprised in-depth interviews with industry executives, product engineers, and end-user maintenance managers, providing firsthand perspectives on emerging challenges and unmet needs.

Quantitative data were further refined through structured surveys targeting procurement specialists across key end-use sectors, enabling our analysts to validate trends identified during the qualitative phase. Data triangulation techniques were employed to cross-verify findings and reduce bias, while detailed competitor profiling leveraged public financial disclosures and patent analysis to uncover strategic positioning. This robust combination of research approaches underpins the credibility of the analysis and ensures its relevance for stakeholders seeking actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial V-belt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial V-belt Market, by Belt Type

- Industrial V-belt Market, by Fabric Material

- Industrial V-belt Market, by Distribution Channel

- Industrial V-belt Market, by Application

- Industrial V-belt Market, by End-Use Industry

- Industrial V-belt Market, by Region

- Industrial V-belt Market, by Group

- Industrial V-belt Market, by Country

- United States Industrial V-belt Market

- China Industrial V-belt Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights Into Industrial V-Belt Market Trends Strategic Implications and Future Outlook for Stakeholders Across the Value Chain

In synthesizing the critical insights from this study, several core themes emerge: the accelerating integration of digital monitoring solutions, the strategic imperative of material innovation, and the rising influence of regional dynamics shaped by regulatory and infrastructural drivers. Stakeholders must remain vigilant to tariff developments and supply chain disruptions while pursuing more sustainable material platforms that meet both performance and environmental benchmarks.

Looking ahead, the convergence of automation, advanced materials, and data-driven maintenance strategies promises to redefine operational reliability across industrial sectors. Companies that adapt swiftly to these evolving dynamics-while fostering collaborative ecosystems with technology partners and end users-will secure the resilience and competitive edge required to thrive. This conclusion offers a consolidated perspective on the market’s trajectory and serves as a strategic compass for decision-makers charting the future of industrial V-belt solutions.

Engaging Directly With Our Associate Director of Sales and Marketing to Secure Customized Industrial V-Belt Market Research Insights and Drive Informed Decisions

To explore the full depth of insights, detailed analyses, and bespoke strategic recommendations, we invite you to connect with Ketan Rohom, our Associate Director of Sales & Marketing at 360iResearch. By partnering directly with Ketan Rohom, you secure not only access to the comprehensive market research report but also personalized support to tailor its findings to your organization’s objectives. Engage with Ketan to arrange a customized briefing, obtain additional annexes, or discuss implementation strategies that align with your operational and growth goals. Embark on the next phase of your industrial V-belt strategy by leveraging specialized analyses and actionable guidance that can only be found in this in-depth research resource. Reach out today to ensure timely acquisition of the report and to position your company at the forefront of industry evolution.

- How big is the Industrial V-belt Market?

- What is the Industrial V-belt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?