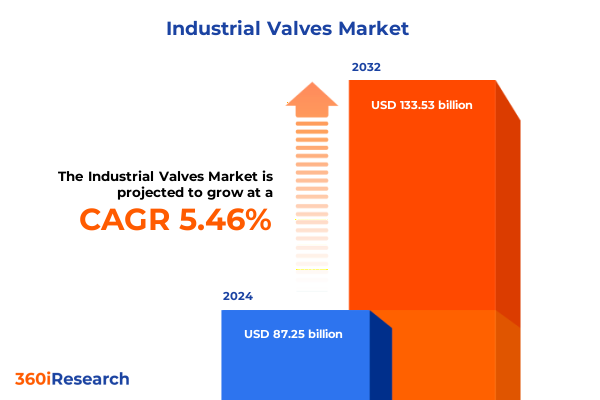

The Industrial Valves Market size was estimated at USD 91.93 billion in 2025 and expected to reach USD 96.90 billion in 2026, at a CAGR of 5.47% to reach USD 133.53 billion by 2032.

Establishing the Critical Role of Industrial Valves in Ensuring Operational Integrity, Efficiency, and Safety Across Diverse Global Industries

Industrial valves serve as indispensable components that regulate the flow of liquids, gases, and slurries in sectors ranging from oil and gas and petrochemicals to water treatment, power generation, and food processing. These mechanical devices encompass a diverse array of designs-such as gate, globe, butterfly, and check configurations-tailored to specific operational requirements including pressure control, leak prevention, and safety isolation. Within complex industrial systems, valve performance directly influences operational efficiency, plant reliability, and regulatory compliance, underscoring the critical role that valve selection, maintenance, and innovation play in sustaining uninterrupted production.

Against a backdrop of accelerating digital transformation, supply chain realignments, and evolving trade policies, industry stakeholders confront the challenge of balancing cost pressures with the demand for higher performance and sustainability. Manufacturers are responding with advancements in materials, actuator technologies, and smart monitoring capabilities, while end users increasingly prioritize predictive maintenance and remote diagnostics to minimize downtime. This executive summary presents a focused examination of the forces reshaping the industrial valve market, offering insights on tariffs, segmentation dynamics, regional trends, key industry participants, and strategic recommendations to guide decision-makers toward resilient growth.

Embracing Digital Transformation and Sustainable Innovation to Redefine Valve Design, Manufacturing, and Operational Paradigms Across Industries

The industrial valve sector is undergoing a profound shift driven by the convergence of digitalization and sustainability imperatives. At its core, the integration of IoT platforms and advanced sensor arrays within valve assemblies has transformed these once-passive components into active nodes in a plant’s information network. Modern smart valves now deliver continuous data on flow rates, pressure differentials, and temperature, enabling centralized control systems to optimize process parameters in real time and significantly reduce operational variability. Moreover, wireless connectivity standards such as LoRaWAN and 5G facilitate deployment in remote and hazardous environments, expanding the reach of digital valve solutions without extensive infrastructure overhauls.

Parallel to digital enhancements, environmental and energy-efficiency goals are catalyzing the development of next-generation actuators and materials. Manufacturers are introducing electric actuator designs that consume up to 40% less power compared to conventional models, aligning with corporate carbon-reduction targets and stringent energy regulations. The rise of additive manufacturing further accelerates innovation by enabling the production of complex internal geometries and custom valve trims on demand, reducing lead times and material waste. A case in point is the Retrofit3D solution deployed by IMI, which replaced internal valve components with 3D-printed substitutes to enhance performance and extend service life at a Chinese power plant. These transformative shifts collectively underscore a new era in valve technology-one defined by data-driven insights, agile production techniques, and heightened sustainability.

Assessing the Multifaceted Impact of 2025 United States Steel, Aluminum, and Import Tariffs on Industrial Valve Supply Chains and Production Costs

The reimposition and expansion of U.S. tariffs in 2025 have introduced a complex overlay of cost pressures on industrial valve producers and end users. Effective February 10, the administration invoked Section 232 of the Trade Expansion Act to apply a 25% duty on all imported steel and aluminum, with derivative products-including cast iron and stainless steel valve components-subject to the same levy unless fully manufactured from domestic melt or smelt inputs. The inclusion criteria for downstream products remains under clarification, yet early guidance from customs authorities suggests that many valve categories will face escalated import costs, prompting manufacturers to reevaluate sourcing strategies and domestic production incentives.

Further complicating the landscape, a complementary set of Executive Orders under the International Emergency Economic Powers Act introduced additional duties on imports from Canada, Mexico, and China, only to be partially paused and then reinstated under shifting diplomatic arrangements. As of March 12, 2025, Customs and Border Protection commenced enforcement of a uniform 25% tariff on covered entries into foreign trade zones, with no new product exclusions granted and existing exemptions scheduled to expire. The combined effect of these measures has led buyers in sectors such as chemical processing and water treatment to experience sticker shocks in valve pricing, often ranging from 7.5% to 25% increases on alloy-based fittings and components, as reported by leading distributors.

To mitigate the cumulative impact, companies are implementing diversified procurement models, negotiating long-term supplier agreements, and investing in domestic fabrication capabilities. Legal and trade advisory firms recommend exploring tariff classification reviews and temporary workarounds through bonded warehouses, while supply chain teams prioritize inventory optimization to smooth cost fluctuations. Collectively, these responses illustrate the strategic agility required to navigate a highly dynamic tariff environment that directly influences industrial valve supply chains and profitability.

Uncovering Key Segmentation Dynamics Spanning Product Types, Materials, Sizes, Operations, End-Use Industries, and Sales Channels

A nuanced understanding of market segmentation reveals the granular factors shaping demand, competitive positioning, and innovation pathways within the valve landscape. When examined by product type, the market encompasses butterfly valves-spanning concentric, double-eccentric, and triple-eccentric designs-alongside check valves in dual plate, lift, and swing configurations; diaphragm valves in straight-through and weir-type variants; gate valves with rising and non-rising stems; and globe valves in angle and T-pattern formats. Each product class addresses distinct operational requirements, from high-precision control in diaphragm designs to robust shut-off capabilities in gate assemblies.

Material differentiation further delineates performance and cost profiles, with cast iron, stainless steel, and alloy-based constructions offering varied trade-offs in corrosion resistance, pressure ratings, and fabrication methods. Size classifications-from up to six-inch diameters through 6-50 inch and beyond 50 inch-correlate with application scale, influencing selection for compact process skids versus large-bore pipeline systems. Operational modalities also shape buyer preferences: manual actuation remains common in low-frequency settings, whereas electric, pneumatic, and hydraulic actuators dominate automated and high-cycle environments.

End-use segmentation spans chemical and petrochemical applications, food and beverage systems, oil and gas across upstream, midstream, and downstream phases, power generation, and water and wastewater treatments-further subdivided into municipal and industrial wastewater streams. Finally, distribution through offline channels continues to support traditional procurement cycles, while online platforms are gaining traction for specialized custom orders and aftermarket services. These multidimensional segmentation insights inform targeted product development, go-to-market strategies, and tailored service offerings.

This comprehensive research report categorizes the Industrial Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Material

- Size

- Operation

- End Use Industry

- Sales Channel

Highlighting Regional Differentiators in Industrial Valve Adoption, Regulation, and Growth Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics in industrial valve adoption reflect a blend of economic maturity, regulatory frameworks, and infrastructure priorities. In the Americas, established energy and process industries drive steady demand for high-performance valves capable of meeting legacy system requirements and retrofit projects. North American operators increasingly invest in digital and energy-efficient valves, supported by localized manufacturing hubs that cushion the impact of global supply constraints and tariffs.

Shifting focus to Europe, the Middle East, and Africa reveals a landscape influenced by stringent environmental regulations, decarbonization mandates, and large-scale infrastructure initiatives. European directives on emissions and water quality have propelled the adoption of smart, low-leakage valve solutions in municipal and industrial water networks, while Middle Eastern investments in petrochemical complexes sustain demand for robust valves engineered for high-temperature and high-corrosion service. Across Africa, growth opportunities emerge in mining and power sectors, where modular valve designs offer simplified maintenance in remote locations.

Asia-Pacific stands as the preeminent region for valve manufacturing and consumption, accounting for over 50% of global valve production capacity. Rapid industrialization, urban water infrastructure expansion, and burgeoning renewable energy projects have fueled extensive valve installations, with regional hubs in China, India, South Korea, and Japan leading technological advancement and cost-effective manufacturing strategies.

This comprehensive research report examines key regions that drive the evolution of the Industrial Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Valve Manufacturers and Innovators Shaping the Market through Technology, Scale, and Strategic Positioning

Market leadership in the industrial valve arena is defined by a combination of technological prowess, global scale, and comprehensive product portfolios. Emerson Electric Co. continues to set benchmarks with its Fisher brand, offering a wide spectrum of control valves and automation solutions recognized for precision and reliability. Flowserve Corporation, headquartered in Irving, Texas, distinguishes itself through an extensive valve and actuator lineup supported by a robust aftermarket services network, bolstered by its heritage spanning over two centuries.

Other prominent players include KSB, whose German-engineered pump and valve systems are synonymous with high efficiency and longevity, and IMI, whose specialised control valves address severe service conditions in energy and process industries. Velan Inc., with Canadian origins, excels in high-performance valves for nuclear and petrochemical applications, while Bray International has garnered recognition for its innovative butterfly valve and actuation technologies tailored to HVAC and industrial flow control. Collectively, these global manufacturers leverage broad R&D investments, strategic acquisitions, and expansive distribution frameworks to meet diverse end-use demands and reinforce barrier-to-entry advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Limited

- Amco Industrial Valves

- American Valve, Inc.

- Astech Valve Co., Ltd.

- AVK Holding A/S

- Bray International, Inc.

- Crane Co.

- Crane Co.

- Curtiss-Wright Corporation

- Emerson Electric Co.

- Emerson Electric Co.

- Flowjet Valves Pvt. Ltd.

- Flowserve Corporation

- Forbes Marshall Pvt. Ltd.

- Hambaker Limited

- Hawa Valves & Tubes Pvt. Ltd.

- HYPERR VALVES PVT LTD

- IMI PLC

- Industrial Valves & Equipments

- Kirloskar Brothers Limited

- KITZ Corporation

- KSB SE & Co. KGaA

- L&T Valves Limited

- LESER GmbH & Co. KG

- Novel Valves India Pvt. Ltd.

- Okano Valve Mfg. Co. Ltd.

- Pentair PLC

- RITAG Ritterhuder Armaturen GmbH & Co.

- Rohre Valves GmbH

- Rotork plc

- SAMSON AG

- Sap Industries Limited

- Schneider Electric SE

- SLB Limited

- Spirax Sarco Limited

- Spraytech Automation India Pvt. Ltd.

- Strahman Group

- The Weir Group PLC

- Valmet Corporation

- Valtorc International

- Velan Inc.

- Wajax Limited

- Zhejiang Xinhai Valve Manufacturing Co., Ltd.

Implementing Strategic Initiatives to Enhance Supply Resilience, Accelerate Innovation, and Drive Operational Excellence in Valve Manufacturing and Deployment

To strengthen resilience against tariff-driven cost pressures and supply chain volatility, industry leaders should diversify sourcing strategies by engaging a mix of domestic fabricators and qualified international partners. Establishing multi-tier supplier relationships and leveraging free trade zone capabilities can create flexibility to shift volume amid evolving duty structures. Furthermore, prioritizing investments in additive manufacturing centers of excellence will enable rapid prototyping and localized production of critical valve components, reducing lead times and obsolescence risks.

Accelerating the deployment of smart valves equipped with predictive maintenance analytics can yield significant reductions in unplanned downtime and maintenance expenses. By integrating AI-driven diagnostics into valve performance reviews, operators can transition from schedule-based maintenance to condition-based strategies, optimizing operational availability and asset lifecycle costs. Concurrently, enhancing digital twin frameworks for valve networks offers a platform for scenario testing and performance modeling without interrupting live operations.

Finally, embedding sustainability metrics into product development-such as lifecycle carbon assessments and material recyclability targets-will align valve manufacturers with ESG imperatives and end-user decarbonization targets. Collaborating with regulatory bodies to shape standards for low-leakage and energy-efficient valves can drive wider market adoption and reinforce a competitive edge.

Outlining Rigorous Research Methodologies Employing Primary Interviews, Secondary Data Sources, and Triangulation to Ensure Comprehensive Market Insights

This research leverages a dual-axis methodology combining primary and secondary data collection to ensure depth and accuracy. Primary insights stem from in-depth interviews with executive leaders in valve manufacturing, procurement specialists in end user organizations, and technical experts from engineering consultancies. These discussions provided firsthand perspectives on operational challenges, technology adoption cycles, and strategic responses to trade policy shifts.

Secondary research encompassed the systematic review of industry reports, regulatory filings, patent disclosures, and trade association advisories. Key sources included government tariff notices, customs guidance on derivative product classification, and specialized publications on smart valve innovations. Data triangulation was achieved by cross-referencing quantitative findings with expert interviews, validating assumptions around pricing impacts, adoption rates, and regional capacity distributions.

Analytical frameworks such as Porter’s Five Forces and SWOT analyses were applied to contextualize competitive dynamics, while segmentation and regional models were developed to map demand drivers and supplier capabilities. Quality checks included iterative feedback loops with subject matter experts to refine interpretations and ensure the robustness of conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Valves Market, by Product

- Industrial Valves Market, by Material

- Industrial Valves Market, by Size

- Industrial Valves Market, by Operation

- Industrial Valves Market, by End Use Industry

- Industrial Valves Market, by Sales Channel

- Industrial Valves Market, by Region

- Industrial Valves Market, by Group

- Industrial Valves Market, by Country

- United States Industrial Valves Market

- China Industrial Valves Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Perspectives on Market Evolution, Technological Advancements, and Strategic Imperatives for Industrial Valve Stakeholders

The industrial valve sector stands at a pivotal juncture, where technology-driven efficiencies and evolving trade landscapes converge to redefine competitive parameters. Smart valve systems are becoming mainstream, delivering unprecedented operational visibility and maintenance optimization. Meanwhile, tariff pressures are prompting a recalibration of supply chains, with a renewed emphasis on localized production and diversified sourcing.

As regional markets mature at different paces-driven by regulatory mandates, infrastructure investments, and sustainability goals-manufacturers must adopt a flexible, data-informed approach to product development and market entry. Aligning innovation roadmaps with end-user priorities, such as decarbonization and digitalization, will be critical for capturing growth opportunities. Ultimately, the ability to integrate advanced manufacturing techniques, predictive analytics, and strategic partnerships will define which organizations lead the next wave of industrial valve evolution.

Take the Next Step toward Informed Decision-Making by Securing Your Customized Industrial Valve Market Research Report with Expert Guidance

Elevate your strategic planning and competitive positioning by obtaining a tailored market research report that delves deeply into product innovations, regulatory shifts, supply chain dynamics, and regional developments influencing the industrial valve landscape. Collaborate directly with Ketan Rohom, Associate Director of Sales & Marketing, who brings extensive expertise in translating comprehensive data and actionable insights into solutions that support critical decision-making and growth initiatives. Secure your competitive advantage today by initiating a personalized consultation and accessing the full breadth of our in-depth analysis, ensuring your organization is equipped to navigate emerging challenges and capitalize on future opportunities.

- How big is the Industrial Valves Market?

- What is the Industrial Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?