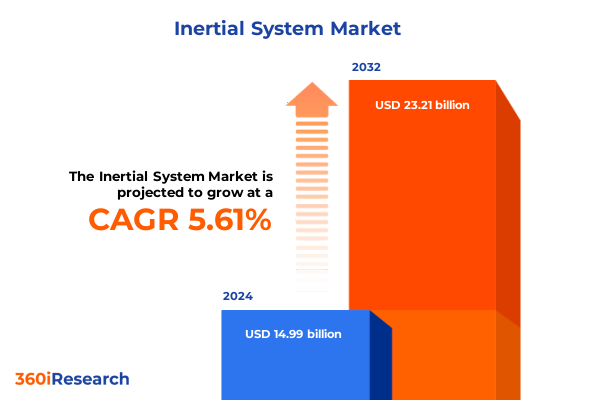

The Inertial System Market size was estimated at USD 15.79 billion in 2025 and expected to reach USD 16.65 billion in 2026, at a CAGR of 5.65% to reach USD 23.21 billion by 2032.

Comprehensive orientation to the evolving inertial systems ecosystem, structural drivers, and strategic uncertainties shaping near-term market transformations

The inertial systems space is at an inflection point driven by converging advances in sensor design, manufacturing sophistication, and cross-industry demand that together are redefining where inertial technologies create the most strategic value. This introduction will orient readers to the scope of the analysis, the structural drivers shaping product and application trajectories, and the principal uncertainties that decision-makers must manage as they plan for near-term operational shifts. We begin by framing the ecosystem: components such as accelerometers, gyroscopes, integrated measurement units, navigation platforms, and magnetometers are no longer discrete commodities but elements in vertically integrated solutions that span hardware, embedded firmware, and system-level calibration.

As commercial and defense stakeholders pursue higher accuracy, lower power, and reduced cost, innovation is migrating from purely component-level improvements to system-level integration and software-enabled performance enhancement. This has implications for procurement, certification, and supplier relationships; organizations that once sourced discrete accelerometers or gyroscopes now evaluate suppliers on their ability to deliver calibrated inertial measurement units and navigation stacks that reduce development time. Concurrently, regulatory and trade shifts are raising the cost of cross-border sourcing and prompting localized supply chain strategies that will influence where R&D and manufacturing investments are placed.

The remainder of the report unpacks the technical, commercial, and geopolitical vectors that are accelerating adoption while also creating new failure modes. By the end of this study, readers will have a clearer understanding of where competitive advantage is being forged, which risk levers matter most for capital allocation, and how to align product roadmaps to emergent demand signals across aerospace, automotive, consumer, healthcare, industrial, marine, and textile sectors.

How converging sensor innovation, embedded AI, and supply-chain resilience are rewriting competitive dynamics and product architectures in inertial systems

The landscape for inertial systems is being transformed by a set of rapid, reinforcing shifts that change the rules of competition, procurement, and product architecture. Advances in microelectromechanical systems and optical sensing are compressing the performance gap between traditional navigation-grade instruments and lower-cost MEMS alternatives, enabling new architectures where software compensation and sensor fusion deliver classification-grade accuracy without the historical cost penalty. At the same time, the proliferation of edge compute and lightweight AI models permits distributed filtering and calibration that extend the operational envelope of compact inertial measurement units, making them viable for a broader set of mobile and wearable use cases.

Concurrently, systems customers are demanding shorter time-to-integration and predictable lifecycle roadmaps, which is increasing the value of suppliers that provide pre-qualified IMUs and end-to-end navigation stacks rather than standalone components. This shift is influencing product roadmaps such that accelerometers and gyroscopes are evaluated for their compatibility with firmware updates and diagnostic telemetry rather than solely on raw sensor metrics. Supply-chain dynamics are also evolving: manufacturers are prioritizing diversification of fabrication and assembly footprints to reduce single-country dependencies and to respond faster to tariff or customs shifts.

Finally, regulatory and standards activity around safety-critical applications-most notably in automotive Advanced Driver Assistance Systems and in certified avionics-are accelerating certification timelines and elevating the importance of traceable component provenance and lifecycle support. Taken together, these transformative shifts favor players that can combine compact hardware, robust embedded software, and resilient supply-chain design to deliver predictable outcomes across industries where reliability and regulatory compliance are non-negotiable.

Assessment of how the recent United States tariff actions and de minimis policy changes are reshaping sourcing, inventory, and product strategies across inertial systems supply chains

United States tariff actions in 2024 and 2025 have introduced material cost and procedural shocks that ripple through the inertial systems supply chain, forcing manufacturers, integrators, and buyers to reassess sourcing, inventory, and qualification strategies. Policy changes have targeted categories relevant to sensors and their upstream materials, and different administrative moves-ranging from increases in Section 301 duties to adjustments in de minimis treatment-have together created new operational frictions for cross-border shipments. Those frictions have increased landed costs, elongated lead times for small-volume imports, and raised the transaction costs of relying on globalized microelectronics manufacturing.

A critical policy lever has been the U.S. government's four-year review of Section 301 tariffs that resulted in higher duty rates for several strategic product groups, including semiconductor-related items and certain battery and critical mineral inputs, which are core to many modern inertial sensing platforms; this has raised import exposure for companies that source finished or semi-finished sensors from constrained geographies. At the same time, the elimination or modification of the long-standing de minimis exemption for low-value shipments has altered the economics of small-batch parts, rapid prototyping imports, and aftermarket spare provisioning, making small shipments subject to duty assessments or carrier-specific surcharges that previously did not apply. The removal of the de minimis exemption for shipments from China and Hong Kong took effect in early May 2025 and has forced firms to consolidate imports or absorb additional handling and duty costs.

Operationally, these tariff-driven effects have led to three observable impacts for the inertial systems value chain. First, procurement teams are increasing inventory buffers for critical components where qualification timelines are long, trading carrying cost for supply assurance. Second, firms are accelerating supplier qualification in alternative locations and considering onshoring or nearshoring more stages of assembly to reduce tariff exposure. Third, there is greater emphasis on redesigning product architecture to reduce reliance on tariff-exposed subassemblies; engineers are prioritizing components and materials that offer equivalent performance with simpler or domestically available supply lines. Together, these responses are reshaping cost structures and capital planning for the next 12 to 36 months, and they underscore the importance of scenario-based planning to manage tariff volatility and maintain program timelines.

In-depth segmentation analysis showing how component technologies and application requirements are driving distinct procurement, validation, and product roadmaps across the inertial systems ecosystem

Segment-level dynamics within the inertial systems domain reveal differentiated growth vectors and procurement priorities depending on component type and end application. Component-level differentiation is significant: accelerometers, which include analog, digital, and piezoelectric variants, remain central for motion detection in compact consumer devices but face growing competition from integrated accelerometer arrays and sensor-fusion IMUs that can provide superior drift characteristics when paired with adaptive filters. Gyroscopes, ranging from MEMS forms to optical and vibrating structure technologies, are being selected on a trade-off between cost, bias stability, and environmental robustness; optical gyroscopes retain advantages for navigation-grade applications, while MEMS gyroscopes are increasingly viable for automotive and consumer deployments because of their cost and integration flexibility.

Inertial Measurement Units and inertial navigation systems are becoming the commercial battleground for suppliers who can combine calibrated multi-axis sensors, onboard processing, and firmware that simplifies system-level integration for customers in aerospace and automotive markets. Magnetometers continue to play a complementary role in heading reference and magnetic compensation in environments where GNSS signals are degraded. On the application side, aerospace and defense demand unmatched reliability and certification support, driving adoption of higher-grade gyroscopes and navigation systems for aircraft stability, guidance, missile control, and platform control uses. Automotive adoption emphasizes ADAS, navigation, stability control, and vehicle safety systems where integration with cameras and radar is mandatory and where failure modes must be comprehensively mitigated through both component redundancy and software fusion.

Consumer electronics, encompassing gaming consoles, personal devices, virtual and augmented reality equipment, and wearable technology, emphasizes low-power, small-form-factor accelerometers and gyroscopes with consistent production volumes and aggressive price targets. Healthcare applications leverage inertial sensing for medical imaging stabilization, patient monitoring, and surgical equipment, where artifact reduction and proven calibration are essential. Industrial customers adopt inertial technologies for machinery monitoring, manufacturing automation, and robotic control, prioritizing ruggedization and predictable lifecycle support. Taken together, these segmented pressures mean that suppliers cannot rely on a single capability; success requires concurrently managing component performance, integrability of IMUs and navigation stacks, and application-specific validation regimes.

This comprehensive research report categorizes the Inertial System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Sales Channel

Regional dynamics and strategic responses revealing how Americas, EMEA, and Asia-Pacific demand patterns and policies are reshaping manufacturing footprints and procurement choices

Regional dynamics are driving differentiated strategic choices for manufacturers and systems integrators as geopolitical risk, industrial policy, and customer demand create region-specific constraints and opportunities. In the Americas, demand is heavily weighted toward aerospace, defense, and automotive programs that require traceable supply chains and strong after-sales support; procurement teams in this region are increasingly focused on supplier localization and certification history to meet program assurance requirements. Capital investment trends show a preference for establishing final assembly and testing capabilities within the region to reduce tariff exposure and to meet government sourcing requirements, while partnerships with domestic component suppliers are being pursued to shorten qualification cycles.

Europe, the Middle East & Africa presents a mosaic of regulatory regimes and defense procurement programs that favor suppliers with demonstrated compliance to regional standards and the ability to provide long-term sustainment. European automotive programs are significant buyers of high-reliability sensors for ADAS and stability control, and defense customers demand navigation systems that integrate into legacy platforms; as a result, suppliers that offer modular, backwards-compatible IMU solutions see stronger traction. Policy incentives in some EMEA countries also encourage localized manufacturing of critical electronics, driving selective investment inflows and localized partnerships.

Asia-Pacific remains a dual-force region: it is both a major production hub for MEMS fabrication and a rapidly growing market for consumer electronics, automotive, and industrial automation demand. Manufacturers with fabrication footprints or trusted contract manufacturers in Asia-Pacific benefit from proximity to component ecosystems, but they must manage rising labor costs, regional export controls, and shifting tariff rules that affect cross-border shipment economics. Across regions, companies are pursuing a combination of geographic diversification, conditional on regulatory compliance, and targeted onshoring for the most tariff-sensitive stages of production to balance cost, lead time, and risk exposure.

This comprehensive research report examines key regions that drive the evolution of the Inertial System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How top-tier companies are reshaping competitive advantage through vertical integration, partnerships, and resilient production strategies to dominate system-level offerings

Competitive positioning among key companies in the inertial systems space is increasingly defined by three strategic moves: vertical integration across component and system layers, strategic partnerships that accelerate access to embedded software and reference stacks, and investments in production resilience that mitigate tariff and logistic shocks. Leading component manufacturers are expanding offerings from discrete accelerometers or gyroscopes into calibrated IMUs and system-level navigation solutions, recognizing that customers prefer pre-validated subsystems that reduce integration time and regulatory risk.

Some firms are deepening relationships with automotive and aerospace OEMs through co-development agreements and long-term supply contracts that include joint roadmaps for sensor performance and lifecycle support. Others are pursuing targeted acquisitions to bring firmware expertise, machine learning-based sensor fusion, or specialized calibration labs in-house, thereby shortening the path from prototype to certified product. Across the competitive set, there is a clear premium placed on stable supply arrangements, test and calibration capabilities, and global after-sales service networks that can support mission-critical deployments.

Financial and operational commitments are being channeled into establishing distributed manufacturing, test, and repair capabilities to reduce single-point dependencies. Where semiconductor exposure is material, companies are negotiating capacity reservations with foundries and qualifying alternate packaging and assembly partners to preserve continuity. The combination of product breadth, software-enabled differentiation, and supply-chain robustness is emerging as the decisive axis of competition; firms that cannot demonstrate competence across these dimensions are increasingly relegated to niche roles or specialist sub-supply positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inertial System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeron Systems Private Limited

- ASC GmbH

- Bharat Electronics Limited

- Bosch Sensortec GmbH

- General Electric Company

- Gladiator Technologies, Inc.

- Honeywell International Inc.

- Hottinger Brüel & Kjær A/S

- KVH Industries, Inc

- L3Harris Technologies, Inc.

- Northrop Grumman Systems Corporation

- Omni Instruments Ltd

- RTX Corporation

- Safran Group

- SBG Systems

- Silicon Designs, Inc

- Silicon Sensing Systems Limited

- STMicroelectronics International N.V.

- TDK Corporation

- TE Connectivity Corporation

- Teledyne Marine Technologies Incorporated

- Tersus GNSS Inc.

- Thales Group

- Trimble Inc.

- VIAVI Solutions Inc.

Concrete actions for executives to align engineering roadmaps, procurement scenarios, and production investments to reduce tariff risk and speed time-to-market

Industry leaders can act now to convert uncertainty into competitive advantage by aligning product roadmaps, procurement strategies, and investment plans with clear, prioritized objectives that reduce tariff exposure, shorten development cycles, and improve system reliability. First, embedding supply-chain scenario planning into engineering roadmaps enables cross-functional teams to model trade-offs between component cost, qualification lead time, and tariff risk; by linking these scenarios to procurement levers, organizations can make faster, risk-informed sourcing decisions that protect program schedules. Second, accelerating the adoption of modular IMU and navigation stacks with well-documented integration interfaces reduces customer integration time and creates a recurring revenue pathway through firmware updates and calibration services.

Third, investing in in-region assembly, final test, and calibration capabilities for the most tariff-sensitive stages of production reduces landed cost volatility and supports customer requirements for local content and certification. Concurrently, leaders should prioritize partnerships with foundries and packaging specialists to secure prioritized capacity and to enable alternative BOMs that preserve performance while reducing exposure to constrained inputs. Finally, institutions should formalize a product de-risking protocol that incorporates accelerated prototype import strategies, extended warranty and spare-parts planning, and a certification playbook that shortens time-to-market for safety-critical sectors. Taken together, these measures reduce the operational friction introduced by trade and regulatory changes while creating tighter alignment between product performance, market access, and commercial outcomes.

Rigorous, multi-layered research methodology combining primary interviews, regulatory review, shipment data triangulation, and scenario stress testing to ensure decision-ready insights

The research methodology underpinning this analysis combined a layered approach to ensure robustness, triangulation, and relevance to decision-makers operating in engineering, procurement, and strategy roles. Primary research consisted of structured interviews with executives across component manufacturers, systems integrators, and end-users in aerospace, automotive, consumer, healthcare, industrial, marine, and textile sectors, supplemented by technical interviews with firmware and calibration engineers responsible for IMU development. These conversations provided ground-truth on qualification timelines, failure-mode priorities, and the practical implications of tariff-driven sourcing changes.

Secondary research involved a comprehensive review of regulatory and trade documentation, customs determinations, and public policy developments that affect tariff classifications and de minimis treatments, cross-referenced with industry statements and trade association guidance to validate procedural impacts on small-batch shipments and certified component flows. Quantitative data inputs were cleaned and triangulated across multiple vendor-supplied shipment datasets, customs lead-time reports, and manufacturing capacity disclosures to identify recurring bottlenecks and lead indicators. The analysis also incorporated scenario-based stress testing, modeling alternative tariff and supply-disruption outcomes to assess procurement and inventory responses under plausible futures.

Quality controls included peer review of technical assumptions by independent engineers, reconciliation of contradictory source claims through follow-up interviews, and a sensitivity analysis on inventory and cost impacts to ensure that recommended actions remain robust under reasonable variance in key inputs. The methodology emphasizes transparency and traceability so that readers may reproduce assumptions, apply alternate parameters relevant to their specific programs, or request a bespoke variant of the analysis tailored to unique operational constraints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inertial System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inertial System Market, by Component

- Inertial System Market, by Application

- Inertial System Market, by Sales Channel

- Inertial System Market, by Region

- Inertial System Market, by Group

- Inertial System Market, by Country

- United States Inertial System Market

- China Inertial System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesis of technical convergence, policy-driven supply-chain shifts, and strategic imperatives that will determine winners in the inertial systems landscape

In conclusion, inertial systems are undergoing a rapid reconfiguration driven by technical convergence, evolving application demands, and policy-driven supply-chain frictions. Component advances continue to blur the line between low-cost MEMS solutions and more traditional navigation-grade instruments, while system-level software and sensor fusion are becoming primary differentiators that determine integration cost and field performance. Simultaneously, tariff actions and de minimis policy changes have introduced tangible procurement and logistical challenges that require proactive scenario planning, supplier diversification, and strategic investments in localized assembly and testing to preserve program timelines.

Organizations that respond by aligning engineering, procurement, and commercial strategies will not only mitigate short-term cost and timing pressures but will also position themselves to capture the most attractive long-term opportunities across aerospace, automotive, consumer, healthcare, industrial, and marine domains. Success will favor firms that combine proven technical capability with flexible manufacturing footprints and robust supplier relationships, and that can deliver pre-validated, software-enabled solutions that simplify customer integration and certification. For decision-makers, the imperative is clear: convert reactive measures into structured strategic programs that embed resilience into product roadmaps rather than treating tariff and logistics shocks as episodic problems.

Secure expert advisory and tailored purchase options to acquire the complete inertial systems market report with prioritized briefing and bespoke data access

To acquire the full market research report and gain prioritized access to proprietary datasets, scenario models, and an extended advisory briefing tailored to your organization’s needs, please contact Ketan Rohom (Associate Director, Sales & Marketing) who will coordinate your purchase, confirm available licensing options, and arrange a personalized walkthrough of the findings. The report purchase enables direct engagement for a custom scope addition, expedited delivery of supplemental data tables, and an opportunity for a strategic Q&A session with the research team to translate insights into immediate commercial actions.

Engaging directly secures priority scheduling for a recorded brief that highlights high-impact opportunities and risks by component, application, and region, and provides the documentation necessary for procurement, strategic planning, and board-level presentations. For enterprise buyers, a tailored package can be arranged that includes bespoke competitive benchmarking, supplier vulnerability mapping, and an implementation roadmap aligned to your timeline and risk tolerance. Reach out to initiate the purchase process and schedule the briefing to convert insight into measurable outcomes.

- How big is the Inertial System Market?

- What is the Inertial System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?