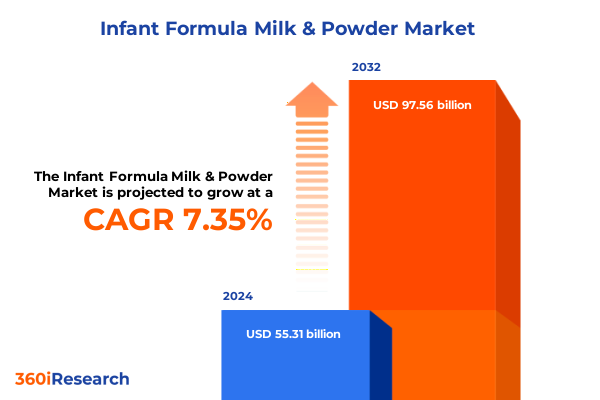

The Infant Formula Milk & Powder Market size was estimated at USD 59.16 billion in 2025 and expected to reach USD 63.35 billion in 2026, at a CAGR of 7.40% to reach USD 97.56 billion by 2032.

Unlocking the Fundamental Forces and Emerging Trends That Define the Infant Formula Milk & Powder Industry’s Competitive and Regulatory Environment

The infant formula milk and powder industry stands at a pivotal juncture defined by shifting demographics, evolving regulatory frameworks, and heightened consumer expectations. Against the backdrop of increasing urbanization and rising birth rates in emerging markets, industry participants are grappling with the challenge of delivering safe, nutritious, and value-added products that align with modern caregivers’ preferences. Moreover, millions of first-time parents worldwide are seeking expert-endorsed solutions that mimic breast milk’s nutritional profile, leading to an unprecedented focus on formulation excellence.

Concurrently, global health authorities have enforced stringent quality and labeling standards to safeguard infant well-being, demanding rigorous compliance from all market players. These regulatory imperatives, while essential for consumer protection, also introduce operational complexities and cost pressures along supply chains. In response, manufacturers are investing in traceability systems, advanced analytics, and strategic supplier partnerships to ensure raw material integrity and maintain customer trust.

In this dynamic environment, industry leaders and emerging challengers alike must navigate a landscape where scientific innovation, sustainability commitments, and digital engagement converge. By understanding the fundamental forces at play-ranging from nutrient science breakthroughs to the rise of e-commerce platforms-stakeholders can craft holistic strategies that drive growth, mitigate risk, and reinforce brand equity among today’s discerning parents.

Charting the Industry’s Shift Through Digitalization, Sustainability Imperatives, and Consumer-Centric Innovation in Infant Nutrition

In recent years, the infant formula market has undergone transformative shifts driven by technological advancements, heightened consumer consciousness, and evolving retail paradigms. The acceleration of e-commerce has unlocked unprecedented direct-to-consumer channels, allowing brands to cultivate personalized experiences through subscription models, tailored nutrition plans, and data-driven loyalty programs. This digital momentum is reshaping traditional distribution hierarchies and enabling nimble players to capture share by engaging caregivers directly.

Parallel to the digital revolution, sustainability has emerged as a non-negotiable pillar of brand differentiation. From carbon-neutral manufacturing facilities to ethically sourced ingredients, companies are embedding environmental and social governance (ESG) principles throughout their operations. This shift reflects a broader consumer demand for transparency, traceability, and responsible stewardship, compelling manufacturers to reconfigure packaging, reduce waste, and support regenerative agriculture initiatives.

Finally, the convergence of nutrition science with biotechnology is redefining product roadmaps. Innovations such as bioengineered human milk oligosaccharides and precision probiotic blends are enhancing formula’s functional benefits, from immune support to cognitive development. As these breakthroughs transition from R&D to commercial launch, the competitive landscape is intensifying, with early movers poised to secure premium positioning in a market where efficacy and safety are paramount.

Assessing How Recent United States Tariff Measures Implemented in 2025 Reshape Supply Chains, Pricing Strategies, and Import Dynamics in Infant Formula

The imposition of new tariff measures by the United States in early 2025 has reverberated across the global infant formula supply chain, compelling manufacturers to reassess sourcing strategies and pricing models. Prior to the tariffs, many producers relied on importation of specialized ingredients and finished goods to balance domestic capacities and fulfill diverse formulation requirements. With elevated duties now applied to select milk powders and barrier packaging materials, profit margins have been squeezed, prompting an urgent search for cost containment levers.

In response, leading players are diversifying procurement by forging strategic alliances with local dairy cooperatives and ingredient suppliers, thereby shortening supply lines and reducing exposure to import duties. At the same time, premium brands are passing a portion of these cost increases onto consumers, leveraging the strength of their quality credentials and science-backed claims to justify higher price points. Conversely, value-focused manufacturers are ramping up operational efficiency through lean manufacturing techniques and automation investments, aiming to preserve affordability for price-sensitive segments.

Moreover, the tariffs have catalyzed a broader reconsideration of regional manufacturing footprints. Companies are exploring expansions in free-trade zones and revisiting contract manufacturing partnerships in tariff-exempt jurisdictions. This recalibration not only mitigates immediate duty impacts but also positions players to swiftly adapt to future trade policy shifts, ensuring supply continuity for caregivers and strengthening resilience across the infant formula ecosystem.

Revealing Critical Insights from Segmentation by Product, Formulation, Ingredient, Source, and Distribution Channel to Illuminate Consumer Preferences

A nuanced understanding of segmentation reveals critical pathways to market differentiation and consumer alignment. When products are categorized by product type-ranging from first infant formula designed for newborns to follow-on formula for older infants, and growing-up milk tailored to toddler nutritional needs-distinct innovation and marketing imperatives emerge. Brands targeting the first infant formula segment must emphasize comprehensive nutrient profiles and hypoallergenic attributes, while those focusing on follow-on and growing-up variants often integrate brain-development enhancers and digestive support components.

Examining formulation type segmentation highlights further complexity: concentrated liquid, dry powder, and ready-to-feed formats each address unique user preferences and logistical considerations. Concentrated liquids appeal to time-pressed caregivers seeking minimal preparation steps, whereas powder formulas offer cost efficiencies and extended shelf life. Ready-to-feed products, though premium priced, resonate with on-the-go families prioritizing convenience and consistent dosing accuracy.

Ingredient type segmentation-encompassing cow’s milk, goat’s milk, plant-based alternatives, and soy protein-underscores diverging consumer health motivations and dietary requirements. Organic versus conventional sourcing adds another dimension, with organic variants commanding premium positioning among families prioritizing natural and non-GMO certifications. Finally, distribution channel segmentation divides the market between offline and online channels; within the former, convenience stores, pharmacies and drug stores, specialty baby stores, and supermarkets and hypermarkets cater to varied occasion-based purchases, while brand websites and e-commerce platforms empower consumers with home delivery, subscription flexibility, and detailed product education.

This comprehensive research report categorizes the Infant Formula Milk & Powder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Formulation Type

- Ingredient Type

- Source

- Distribution Channel

Examining Regional Dynamics across the Americas, EMEA, and Asia-Pacific to Uncover Growth Drivers and Market Nuances in Infant Formula Nutrition

Regional dynamics play a pivotal role in shaping the competitive and innovation landscapes of the infant formula market. In the Americas, established markets in North America continue to prioritize research-backed formulations, regulatory compliance, and premiumization, while Latin American markets are experiencing rapid growth driven by rising incomes and increasing urbanization. Consequently, companies tailor their portfolios to balance value-oriented offerings with differentiated, science-enhanced products that meet the diverse nutritional needs across socioeconomic segments.

Meanwhile, Europe, the Middle East & Africa (EMEA) presents a tapestry of regulatory environments and consumer attitudes. Western Europe’s stringent quality and labeling standards necessitate robust clinical substantiation and certified production protocols. Conversely, emerging markets within the EMEA region are witnessing dynamic adoption of innovative formulations, bolstered by expanding retail infrastructure and digital penetration. Manufacturers operating here often adopt tiered strategies, offering both international premium brands and regionally optimized value formulas to capture broad consumer cohorts.

In the Asia-Pacific region, demographic momentum and strong cultural emphasis on early childhood nutrition fuel sustained demand. China and Southeast Asian nations lead in volume consumption, while markets such as Japan and Australia focus on premium, specialty nutrition segments. To excel, companies forge localized partnerships, invest in domestic R&D centers, and leverage e-commerce giants for omnichannel distribution, ensuring they resonate with tech-savvy consumers and adapt swiftly to shifting regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Infant Formula Milk & Powder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting Competitive Strategies and Innovation Pipelines of Leading Players to Gauge Market Positioning and Strategic Direction in Infant Formula

A close examination of leading market participants reveals diverse strategic pathways that have defined competitive hierarchies. Some established global brands have leveraged their extensive R&D infrastructures to introduce fortified formulations featuring novel nutritional compounds such as human milk oligosaccharides and targeted probiotic blends. These innovation-led players reinforce their brand authority by publishing clinical trial outcomes and collaborating with pediatric associations to validate health claims.

Emerging challengers, by contrast, have differentiated through agile supply chain configurations and digital-first marketing approaches. They often capitalize on direct-to-consumer channels, deploying social media influencers, personalized content, and interactive education tools to engage new parent communities. Meanwhile, regional producers in high-growth markets are forging co-branded ventures with international specialists to localize premium technology while maintaining competitive pricing.

Furthermore, industry consolidation continues to influence market structure, with strategic acquisitions enabling major players to absorb niche innovators and expand their ingredient portfolios. This pattern not only accelerates access to specialty nutrition capabilities but also enhances bargaining power with suppliers and distributors. As competitive intensity rises, companies that adeptly balance scale economies with targeted innovation stand to solidify their market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infant Formula Milk & Powder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arla Foods amba

- Ausnutria B.V.

- Bellamy’s Australia Pty Ltd

- Biostime

- Bobbie Baby, Inc.

- Bubs Australia Limited

- Dana Dairy Group

- Danone S.A.

- Ezaki Glico Co., Ltd.

- FrieslandCampina

- Heilongjiang Feihe Dairy Co., Ltd.

- Hero Group

- Holle baby food AG

- Isigny Sainte-Mère

- Kendal Nutricare Ltd.

- Lactalis Nutrition Santé

- Maeil Co., Ltd.

- Mead Johnson & Company, LLC

- Meiji Holdings Co., Ltd.

- Morinaga Milk Industry Co., Ltd.

- Namyang Dairy Products Co., Ltd.

- Nestlé S.A.

- Synutra International, Inc.

- The a2 Milk Company Limited

- The Hain Celestial Group, Inc.

Proposing Data-Driven Strategic Imperatives and Partnership Models to Enhance Market Share, Operational Efficiency, and Brand Equity in Infant Nutrition

In light of evolving market dynamics, industry leaders and new entrants alike can benefit from a set of targeted strategic recommendations. First, investing in advanced manufacturing capabilities that support modular production will allow for rapid SKU customization and agile capacity scaling. By embracing flexible equipment and digital plant controls, companies can reduce time-to-market for specialized formulations and respond proactively to shifting demand signals.

Second, forging value-added partnerships across the value chain-such as co-development agreements with biotechnology firms for next-generation prebiotic blends or joint ventures with logistics specialists for cold-chain optimization-will enhance product differentiation and operational resilience. These collaborations can unlock proprietary ingredient access and streamline distribution pathways, delivering measurable cost efficiencies and quality assurances.

Third, reinforcing direct-to-consumer engagement through integrated digital ecosystems that combine mobile apps, telehealth nutrition consultations, and subscription-based fulfillment will deepen consumer relationships and foster loyalty. Leveraging data analytics to personalize recommendations and anticipate replenishment needs further solidifies the brand as a trusted advisor.

Finally, embedding sustainability metrics into core performance indicators-ranging from carbon footprint reduction to ethical sourcing of dairy and plant-based ingredients-will resonate with environmentally conscious parents and strengthen long-term brand equity. By pursuing these imperatives, market participants can align growth ambitions with operational excellence and social responsibility.

Outlining Robust Qualitative and Quantitative Research Approaches Ensuring Accuracy, Reliability, and Depth of Insight in Infant Formula Market Assessment

This research synthesis is grounded in a rigorous methodology that combines both qualitative and quantitative approaches to ensure depth, reliability, and comprehensive coverage. Primary data collection involved structured interviews with senior executives, supply chain managers, and pediatric nutrition experts to capture firsthand perspectives on innovation priorities, regulatory challenges, and consumer engagement strategies. In addition, extensive surveys of caregivers provided nuanced insights into purchase drivers, brand perceptions, and usage occasions.

Secondary research encompassed an exhaustive review of scientific publications, health authority guidelines, trade association reports, and patent filings to map the evolution of nutrient science and regulatory landscapes. Data triangulation techniques were employed to reconcile discrepancies, verify supplier claims, and validate clinical efficacy statements. Furthermore, proprietary databases tracking distribution channel performance, e-commerce traffic, and regional trade flows underpinned the contextual analysis of market dynamics.

To maintain methodological rigor, all collected information was subjected to multiple layers of quality control, including peer reviews by industry veterans and cross-sectional reconciliation with publicly available disclosures. Ethical considerations, such as informed consent and data anonymization, were strictly adhered to, ensuring that insights reflect authentic market conditions without compromising confidentiality or integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infant Formula Milk & Powder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infant Formula Milk & Powder Market, by Product Type

- Infant Formula Milk & Powder Market, by Formulation Type

- Infant Formula Milk & Powder Market, by Ingredient Type

- Infant Formula Milk & Powder Market, by Source

- Infant Formula Milk & Powder Market, by Distribution Channel

- Infant Formula Milk & Powder Market, by Region

- Infant Formula Milk & Powder Market, by Group

- Infant Formula Milk & Powder Market, by Country

- United States Infant Formula Milk & Powder Market

- China Infant Formula Milk & Powder Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Strategic Implications to Guide Stakeholders Toward Informed Decision-Making in a Rapidly Evolving Infant Formula Landscape

The infant formula milk and powder industry is experiencing a confluence of transformative forces, from tariff-induced supply chain realignments to the rise of sustainability-driven product innovation. Companies that embrace digital distribution channels and invest in advanced formulation science will be best positioned to meet the complex nutritional and convenience demands of modern caregivers. Moreover, firms that proactively integrate local sourcing strategies and optimized manufacturing footprints can mitigate trade-policy risks and fortify resilience against future disruptions.

Segmentation insights underscore the importance of tailoring approaches across product types, formulation formats, ingredient bases, sourcing models, and distribution channels. Regional analyses further highlight that localized strategies-whether navigating North America’s premiumization trends, EMEA’s regulatory sophistication, or Asia-Pacific’s demographic momentum-are essential for capturing nuanced consumer preferences and sustaining market leadership.

Looking ahead, the competitive landscape will favor players who harmonize scale with agility, embedding sustainability and scientific credibility at the core of their value propositions. By implementing the actionable recommendations outlined herein and leveraging the robust research framework that underpins this analysis, stakeholders can navigate uncertainty and unlock new pathways for growth and differentiation.

Engage with Ketan Rohom for Tailored Access to the Full Infant Formula Milk & Powder Market Research Report and Strategic Insights

If you are poised to elevate your strategic positioning in the infant nutrition market, engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, will provide you with seamless access to the complete market research report. His expertise in translating deep industry insights into actionable business plans ensures you receive tailored guidance on product innovation, channel optimization, and regulatory navigation. By partnering with him, you secure a comprehensive understanding of emerging trends, competitive moves, and regional dynamics that can inform your next strategic move.

Ketan’s consultative approach extends beyond report delivery; he will work with your leadership team to identify priority growth opportunities, align internal capabilities with market demand, and establish a roadmap for sustained success. Whether your focus is on expanding into new formulation types, capitalizing on digital retail channels, or mitigating tariff-related cost pressures, his insights will empower you to make data-driven decisions with confidence.

Reach out today to arrange a personalized briefing session. Discover how this meticulously crafted analysis can accelerate your product development pipeline, optimize your distribution network, and strengthen brand loyalty among today’s discerning caregivers. Seize the opportunity to transform market intelligence into measurable competitive advantage by connecting with Ketan now.

- How big is the Infant Formula Milk & Powder Market?

- What is the Infant Formula Milk & Powder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?