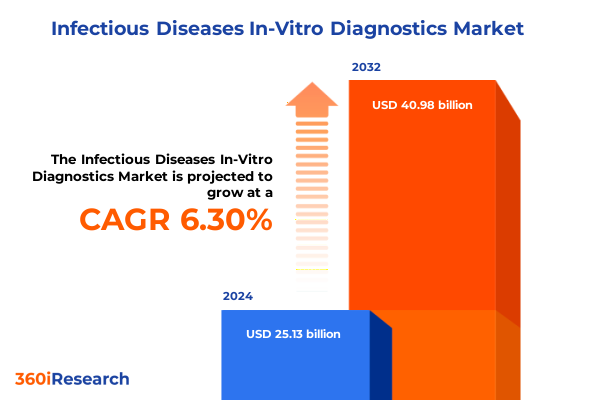

The Infectious Diseases In-Vitro Diagnostics Market size was estimated at USD 26.62 billion in 2025 and expected to reach USD 28.24 billion in 2026, at a CAGR of 6.35% to reach USD 40.98 billion by 2032.

Understanding the Evolution, Challenges, and Critical Role of Infectious Disease In-Vitro Diagnostics in Advancing Public Health and Clinical Decision-Making

Over the past decade, infectious disease in-vitro diagnostics have evolved from specialized laboratory tools into indispensable assets for public health surveillance and clinical decision-making. The demand for rapid, accurate tests has accelerated in response to emerging pathogens, antimicrobial resistance, and the ongoing imperative to manage pandemic threats. These diagnostic platforms now provide critical insights that guide treatment protocols, inform epidemiological models, and support patient outcomes across diverse healthcare settings. Despite this progress, gaps remain in global preparedness: inadequate availability of diagnostics for priority pathogens such as Ebola and cholera continues to pose significant risks of future outbreaks, underscoring the pressing need for sustained investment in research and development to bolster diagnostic capacity worldwide.

Simultaneously, digitalization is reshaping traditional IVD value chains by integrating data analytics, artificial intelligence, and clinical decision support into testing workflows. The cost of molecular technologies, including next-generation sequencing, has declined substantially, driving commoditization and intensifying competition. As diagnostics offerings become increasingly standardized, companies are compelled to seek new growth avenues by embedding digital diagnostics into care pathways, enhancing laboratory efficiency, and enabling real-time surveillance of infectious disease trends. This intersection of technological innovation and public health imperatives sets the stage for a more resilient diagnostic ecosystem tailored to evolving clinical and epidemiological demands.

How Technological Advancements, Regulatory Adaptations, and Pandemic Preparedness Have Reshaped the Infectious Disease In-Vitro Diagnostics Landscape

Recent years have witnessed a profound transformation in the infectious disease in-vitro diagnostics landscape, driven by accelerated regulatory adaptation and an unprecedented imperative for rapid detection of emerging pathogens. The COVID-19 pandemic served as a catalyst for shifting testing paradigms: molecular assays based on reverse-transcription polymerase chain reaction (RT-PCR) became the gold standard globally, spurring a twenty-fold surge in demand across Europe and North America in 2020 and prompting the installation of hundreds of new laboratories in regions previously reliant on immunoassays. This capacity expansion not only addressed pandemic needs but also established a durable infrastructure for future viral and microbial surveillance.

Parallel to molecular testing, decentralized modalities such as point-of-care molecular platforms and immunoassays have gained traction for their rapid turnaround and ease of deployment outside centralized laboratories. Regulatory agencies responded with expedited pathways, including emergency use authorizations, enabling the approval of CRISPR-based and next-generation sequencing diagnostics at an unprecedented pace. As a result, more than 280 SARS-CoV-2 tests secured clearance by October 2020 in the United States, demonstrating the feasibility of agile regulatory frameworks to meet acute public health demands. Looking ahead, digital analytics, remote patient monitoring, and population health management solutions are positioned to outpace core IVD growth, underscoring the critical role of integrated data ecosystems in the next wave of diagnostic innovation.

Examining the Wide-Ranging Financial and Operational Consequences of Newly Imposed United States Tariffs on In-Vitro Diagnostic Devices in 2025

In 2025, newly imposed United States tariffs on imported medical devices have extended to critical IVD instruments, reagents, and consumables, introducing a baseline duty of 10 percent and additional levies up to 20 percent on European products and 125 percent on certain Chinese exports. These measures have directly increased the cost base for test manufacturers that rely on overseas production, prompting a strategic reassessment of sourcing and manufacturing footprints. Companies with significant components of their reagent kits or instrument parts manufactured outside the United States have reported hundreds of millions of dollars in incremental costs, ultimately exerting pressure on pricing, profitability, and supply chain resilience.

In response to these financial headwinds, leading diagnostic firms are reallocating capital toward U.S.-based manufacturing expansions to mitigate tariff exposure. For example, several global players have announced new facilities in Georgia, Illinois, and Texas to localize the production of culture media, immunoassay kits, and PCR reagents, absorbing upfront investment to circumvent ongoing duty burdens. Meanwhile, others are optimizing production flows across existing sites, renegotiating supplier contracts, and prioritizing alternative sourcing from countries with lower tariff implications. Despite these mitigations, the near-term impact includes extended lead times, inventory stockpiling, and selective price adjustments that will reverberate throughout healthcare procurement and reimbursement frameworks.

Unlocking Deep Market Understanding Through Comprehensive Segmentation Insights Across Products Technologies Pathogens Applications and End Users

A nuanced understanding of the in-vitro diagnostics market emerges through a multi-dimensional segmentation lens that highlights distinct value pools and growth drivers. Product segmentation underscores the divergent dynamics between capital-intensive instruments, consumable reagents & kits, and critical software & services. Automated culture systems, immunoassay analyzers, and PCR instruments anchor the instruments segment, whereas immunoassay kits, microbial culture media, and PCR reagents dominate consumable revenues. Meanwhile, consulting services, data management tools, and maintenance & support frameworks underpin the ecosystem of software & services, reflecting a shift toward value-added offerings that enhance laboratory productivity.

Technology segmentation further delineates market trajectories: traditional immunoassays encompass chemiluminescence, enzyme-linked immunosorbent assays, fluorescence assays, and lateral flow formats, while molecular diagnostics span polymerase chain reaction, isothermal amplification, and next-generation sequencing. Microbiology culture remains foundational but is increasingly complemented by rapid automated identification systems. Pathogen segmentation highlights distinct requirements for bacterial targets- including Enterobacteriaceae, Mycobacterium tuberculosis, and Staphylococcus aureus-parasitic and fungal detection platforms, and viral assays for influenza, HIV, and hepatitis viruses. Application segmentation reveals persistent demand for diagnosis, complemented by burgeoning needs in epidemiological surveillance, patient monitoring, and population-level screening. End-user segmentation illustrates that academic research institutes, clinics, hospitals, and independent laboratories each drive specific workflow optimizations and purchasing decisions, underscoring the heterogeneous requirements across the healthcare continuum.

This comprehensive research report categorizes the Infectious Diseases In-Vitro Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Pathogen

- Application

- End User

Revealing Critical Regional Dynamics Shaping Infectious Disease In-Vitro Diagnostics Adoption Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on the adoption and diffusion of infectious disease in-vitro diagnostics, with distinct market characteristics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a robust reimbursement infrastructure and advanced regulatory frameworks support rapid uptake of cutting-edge molecular and point-of-care platforms; the United States leads with significant investments in laboratory capacity and digital health integration, while Latin America presents opportunities fueled by expanding healthcare access and targeted public health initiatives.

In Europe, harmonization efforts under the In Vitro Diagnostic Regulation have phased in stringent clinical evidence requirements and post-market surveillance obligations, including a six-month prior-notice mandate for anticipated supply disruptions. Amendments extending transition periods and a phased implementation of the Eudamed database through 2025 aim to prevent shortages of critical IVD kits, yet compliance burdens remain substantial, particularly for legacy devices and laboratory-developed tests. Across the Middle East and Africa, nascent regulatory structures, growing public health imperatives, and diversified financing models create mixed adoption patterns, with an emphasis on cost-effective immunoassays and culture media.

The Asia-Pacific region stands out for its rapid capacity expansion, driven by both government-led laboratory installations and private sector innovation. India’s RT-PCR infrastructure scaled up a thousand-fold within months of the COVID-19 onset, setting a precedent for broader molecular diagnostic deployment. Simultaneously, China’s domestic platform development is supported by strategic initiatives to reduce import dependence, while Southeast Asian and Oceania markets exhibit growing demand for decentralised testing as part of broader pandemic preparedness strategies.

This comprehensive research report examines key regions that drive the evolution of the Infectious Diseases In-Vitro Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves Innovation Pipelines and Manufacturing Realignments Driving Competitive Advantage of Leading Infectious Disease In-Vitro Diagnostics Companies

Leading companies in the infectious disease IVD sector are deploying strategic portfolios, innovation pipelines, and manufacturing realignments to secure competitive advantage. Abbott, for instance, has absorbed hundreds of millions of dollars in tariff impacts by investing in new manufacturing sites across Georgia, Illinois, and Texas, thereby localizing reagent and instrument production and mitigating crossed-border duty exposures. Roche Diagnostics has similarly committed over half a billion dollars to expand continuous glucose monitoring and molecular diagnostics capacity at a new facility in Indianapolis, demonstrating the value of expansive capital deployments to ensure supply continuity and regulatory compliance.

Other key players are advancing differentiated strategies. Qiagen’s recent CE-mark under the EU IVDR for its QIAstat-Dx syndromic platforms underscores the importance of proactive regulatory alignment, with over 80 percent of its portfolio now IVDR-compliant, enabling uninterrupted market access in Europe. Hologic’s U.S.-based manufacturing of its Aptima assays has rendered its chlamydia and gonorrhea tests largely impervious to recent tariffs, capturing market share at the expense of partially OUS-produced alternatives. Thermo Fisher Scientific, Danaher, and bioMérieux continue to expand their infectious disease test menus, emphasizing point-of-care molecular assays and integrated data solutions, reinforcing the trend toward decentralized, digitally augmented diagnostic ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infectious Diseases In-Vitro Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- DiaSorin S.p.A

- Epitope Diagnostics, Inc.

- F. Hoffmann La-Roche Ltd.

- Grifols, S.A.

- Hologic, Inc.

- Illumina, Inc.

- InBios International, Inc.

- Koninklijke Philips N.V.

- Merck KGaA

- Meril Life Sciences Pvt. Ltd.

- OraSure Technologies, Inc.

- Qiagen N.V.

- Quest Diagnostics

- Quidel Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Trinity Biotech PLC

- Vela Diagnostics

Implementable Strategies for Industry Stakeholders to Strengthen Resilience and Foster Innovation in the Infectious Disease In-Vitro Diagnostics Sector

Industry leaders must adopt agile strategies that fortify supply chains, accelerate digital transformation, and optimize regulatory pathways to thrive amid evolving market pressures. First, diversifying supply bases across low-tariff regions while expanding domestic manufacturing capacity can mitigate exposure to future trade disruptions and ensure continuous test availability, a crucial step validated by recent shifts toward U.S. facility investments and near-shoring initiatives.

Second, embedding digital diagnostics-such as cloud-based data analytics, machine learning-driven decision support, and remote monitoring platforms-can enhance test utility, create new service-based revenue streams, and improve laboratory throughput. Collaborative partnerships with health tech firms and academic centers can expedite platform development and facilitate rapid integration into clinical workflows.

Third, proactive engagement with regulatory authorities on best-practice submissions, supply disruption notifications, and performance evidence generation will streamline compliance under IVDR and FDA pre-submission programs. Companies should invest in modular quality management systems and robust post-market surveillance frameworks to satisfy stringent evidence requirements and minimize time-to-market for new assays.

Finally, exploring emerging markets in Latin America, Southeast Asia, and the Middle East through tailored product portfolios and flexible financing models can diversify revenue streams and counterbalance volatility in traditional geographies, ensuring a resilient growth trajectory for the infectious disease IVD sector.

Holistic Research Methodology Integrating Expert Interviews Data Triangulation and Secondary Analysis for Rigorous In-Vitro Diagnostics Landscape Insights

Our research methodology integrates multiple layers of qualitative and quantitative analysis to deliver reliable and actionable insights. We conducted in-depth interviews with key opinion leaders, procurement executives, laboratory directors, and regulatory specialists to capture diverse perspectives on diagnostic workflows, purchasing criteria, and future technology needs. These primary engagements were complemented by expert validation sessions to refine themes, stress-test hypotheses, and prioritize growth drivers.

On the secondary research front, comprehensive reviews of regulatory filings, published scientific literature, industry white papers, and proprietary databases enabled a robust mapping of technology trends, regional policies, and competitive landscapes. Data triangulation techniques were applied to reconcile potential discrepancies across sources, ensuring consistency and accuracy. Finally, analytical frameworks- including Porter’s five forces, SWOT analysis, and scenario planning- were employed to synthesize findings and formulate strategic recommendations underpinned by empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infectious Diseases In-Vitro Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infectious Diseases In-Vitro Diagnostics Market, by Product

- Infectious Diseases In-Vitro Diagnostics Market, by Technology

- Infectious Diseases In-Vitro Diagnostics Market, by Pathogen

- Infectious Diseases In-Vitro Diagnostics Market, by Application

- Infectious Diseases In-Vitro Diagnostics Market, by End User

- Infectious Diseases In-Vitro Diagnostics Market, by Region

- Infectious Diseases In-Vitro Diagnostics Market, by Group

- Infectious Diseases In-Vitro Diagnostics Market, by Country

- United States Infectious Diseases In-Vitro Diagnostics Market

- China Infectious Diseases In-Vitro Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Unifying Key Findings to Highlight Imperatives for Advancement in Infectious Disease In-Vitro Diagnostics for Enhanced Patient Outcomes and Sector Resilience

In synthesizing these findings, it is evident that the infectious disease in-vitro diagnostics market stands at a strategic inflection point. Technological maturation, exemplified by integrated molecular and digital platforms, converges with shifting regulatory frameworks and trade dynamics to reshape the competitive field. Companies that effectively localize manufacturing, invest in digital enhancements, and navigate complex compliance landscapes will outpace peers and capture emerging opportunities.

Looking forward, the imperative to strengthen diagnostic preparedness for future public health threats will continue to drive demand for decentralized testing, agile supply models, and data-driven decision support. By aligning product innovation with evolving clinical needs and regulatory exigencies, organizations can secure enhanced patient outcomes, reinforce market resilience, and ensure a leadership position in the dynamic infectious disease IVD domain.

Secure In-Depth Industry Intelligence and Propel Your Infectious Disease In-Vitro Diagnostics Growth by Connecting with Ketan Rohom for Exclusive Report Access

If you’re ready to transform your strategic approach to infectious disease in-vitro diagnostics and gain unparalleled visibility into the forces shaping this critical market, connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings a deep understanding of diagnostic market dynamics and can guide you through the nuances of our comprehensive market research report. Engaging directly will ensure you receive tailored insights that align with your organization’s priorities and unlock actionable intelligence to drive your next wave of growth.

Reach out today to learn how our detailed analysis can help you navigate evolving regulations, innovate your product portfolio, and optimize supply chain strategies. Secure your access to exclusive data on tariff impacts, segmentation performance, regional trends, and competitive benchmarks, and position your company at the forefront of the infectious disease in-vitro diagnostics landscape.

- How big is the Infectious Diseases In-Vitro Diagnostics Market?

- What is the Infectious Diseases In-Vitro Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?