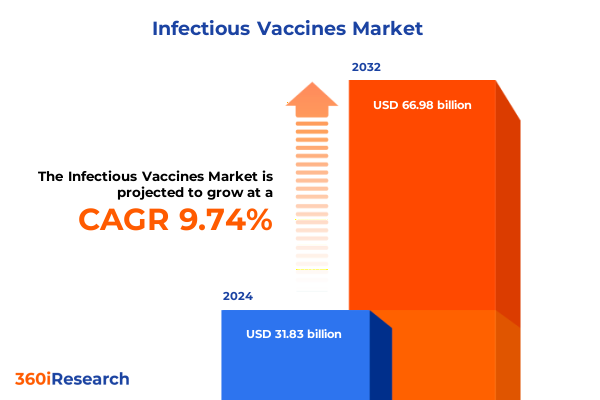

The Infectious Vaccines Market size was estimated at USD 34.88 billion in 2025 and expected to reach USD 38.23 billion in 2026, at a CAGR of 9.76% to reach USD 66.98 billion by 2032.

Exploring the dynamic evolution of infectious vaccine innovations reshaping global health resilience and preparedness strategies for emerging pathogens

Global immunization coverage has experienced significant setbacks in the aftermath of the COVID-19 pandemic, with data from the World Health Organization revealing that in 2024 approximately 85% of infants worldwide received three doses of the diphtheria, tetanus, and pertussis vaccine, marking a modest increase yet still falling short of pre-pandemic levels. Alongside this stagnation, the number of zero-dose children-those who have never received any routine immunizations-remains alarmingly high at 14.3 million, underscoring persistent gaps in health infrastructure and equitable access across regions.

The stalled momentum in routine childhood immunization has tangible public health consequences. Outbreaks of measles surged globally by 20% in 2023, with over 22 million children missing their first measles vaccine dose and more than 277 cases reported in the United States alone, reflecting how coverage shortfalls rapidly translate into preventable disease resurgence.

However, the unprecedented speed and scale of mRNA vaccine development during the COVID-19 pandemic has demonstrated the potential for near real-time response to emerging pathogens. The European Medicines Agency’s recent recommendation to approve Moderna’s updated mRNA COVID-19 vaccine targeting the LP.8.1 variant for the 2025–2026 season highlights a new paradigm of rapid antigenic updates and streamlined regulatory pathways.

Simultaneously, innovations in needle-free delivery platforms are advancing through clinical evaluation, offering logistical advantages and enhanced patient acceptance. Nasal sprays and microneedle patches circumvent traditional syringes, mitigate needle phobia, and promise simplified cold chain management, potentially expanding immunization coverage in underserved communities.

These interwoven challenges and breakthroughs set the stage for a transformative period in which vaccine developers, policy makers, and public health stakeholders must collaborate to translate scientific advances into equitable immunization strategies worldwide.

Unveiling transformative technological and regulatory shifts driving rapid advancements in infectious vaccine development and distribution landscapes

The infectious vaccine landscape has been radically reshaped by a convergence of scientific breakthroughs and evolving regulatory frameworks. Over the past five years, the mRNA platform has transcended its experimental origins to become a cornerstone of pandemic preparedness. Its modular design and rapid formulation capabilities allow developers to pivot swiftly against novel threats-a capability underscored by the European Union’s recent backing of Moderna’s updated Spikevax, tailored to the LP.8.1 variant and poised for deployment in the 2025–2026 vaccination season.

Parallel advances in viral vector technologies are enabling the development of multivalent vaccines with heightened immunogenicity and scalability. Adenoviral, Modified Vaccinia Ankara (MVA), and Vesicular Stomatitis Virus (VSV) vectors are now being harnessed to deliver complex antigens, driving pipelines that span from emerging infectious diseases to therapeutic cancer vaccines. This shift toward vector-based platforms represents a critical expansion beyond conventional live attenuated or inactivated approaches, offering robust immune responses with tailored safety profiles.

Subunit vaccines are also undergoing a renaissance, propelled by advances in antigen design and adjuvant systems. The FDA’s approval of GSK’s AREXVY, an adjuvanted RSV subunit vaccine for adults aged 50–59, exemplifies how recombinant protein antigens combined with proprietary adjuvants can achieve durable protection in high-risk populations. This success cements subunit formulations as vital tools in extending vaccine coverage beyond traditional demographics.

Sustainability and supply chain resilience have emerged as key imperatives, with green chemistry principles guiding manufacturing and cold chain logistics optimized for energy efficiency. Renewable energy integration, recyclable packaging, and refurbishment of single-use systems are setting new environmental standards across the vaccine lifecycle, aligning public health goals with global climate commitments.

Yet, this innovation surge is unfolding amid shifting policy landscapes. Recent U.S. administration actions targeting mRNA grant funding and advisory committee structures have injected uncertainty into vaccine development trajectories, emphasizing the need for adaptive strategies that reconcile scientific opportunity with regulatory risk.

Analyzing the cumulative economic and operational impact of United States 2025 tariffs on the global supply chain for infectious vaccine manufacturing

Trade policy changes enacted in early 2025 have introduced a new calculus for vaccine producers, as a 10% global tariff on most imported goods-including active pharmaceutical ingredients and auxiliary supplies-came into effect on April 5, followed by country-specific duties on China and Europe. This sweeping tariff framework, coupled with reciprocal levies of up to 245% on Chinese imports, signals a reorientation of global supply chains toward regional resilience and cost mitigation.

Central to vaccine production, APIs and key intermediates have been hit with 25% duties on Chinese-origin materials and 20% on Indian imports. Sterile packaging components and analytical instruments are subject to 15% tariffs, while specialized machinery for aseptic manufacturing carries a 25% duty. These measures have elevated input costs and prompted pharmaceutical manufacturers to reevaluate sourcing strategies, with ripple effects on R&D timelines and capital expenditure plans.

Vaccines and injectables face acute pressure, as costs for high-purity reagents, prefilled syringes, glass vials, and cold-chain packaging have climbed by 12–18%. To alleviate margin compression, major vaccine producers are accelerating reshoring efforts, establishing or expanding manufacturing hubs in North America and Mexico to bypass tariff exposure and secure uninterrupted supply for critical immunization programs.

The Biotechnology Innovation Organization’s recent survey paints a stark picture: 94% of U.S. biotech firms anticipate significant manufacturing cost surges if imports from the EU, China, and Canada are taxed, while nearly 90% rely on foreign-sourced components for at least half of their FDA-approved products. Companies warn that abrupt tariff impositions could derail regulatory filings and extend product development by upwards of 12 months, threatening timely access to breakthrough vaccines.

In response to the tariff-driven disruption, AstraZeneca has unveiled a $50 billion U.S. investment plan to expand domestic research and manufacturing capacity by 2030. This commitment underscores a broader industry pivot toward onshoring and strategic diversification, as life sciences leaders seek to fortify supply chains against evolving trade headwinds.

Unlocking critical segmentation insights to understand diverse vaccine types, administration routes, end users, and distribution channels shaping market dynamics

The infectious vaccine market spans a spectrum of technological platforms, beginning with classical conjugate vaccines that include Hib, meningococcal, and pneumococcal formulations. Inactivated vaccines address pathogens such as hepatitis A, influenza, polio, and rabies, while live attenuated options cover influenza LAIV, measles, oral polio, rubella, and varicella. Next-generation mRNA vaccines utilize lipid nanoparticle encapsulation and self-amplifying constructs to deliver antigenic instructions with precision and speed. Subunit vaccines leverage protein fragments and virus-like particles, often combined with potent adjuvants, to drive robust immune responses. Toxoid vaccines target bacterial toxins from diphtheria, pertussis, and tetanus, and viral vector platforms employ adenovirus, MVA, and VSV backbones to present antigens safely and effectively.

Routes of administration are equally varied, with intradermal and intramuscular injections remaining predominant, complemented by emerging intranasal sprays, oral capsules, and subcutaneous injections that cater to patient preference and logistical feasibility. The end-user environment extends from general practice and specialty clinics to private and public hospitals, online and brick-and-mortar pharmacies, and rural and urban public health centers dedicated to immunization campaigns.

Distribution channels encompass local and national government agencies, which often coordinate mass vaccination programs, hospital pharmacies serving inpatient and outpatient clinics, and a dual-tier retail system consisting of direct and platform-based online pharmacies alongside chain and independent brick-and-mortar outlets. Understanding the interplay among these segments is critical for stakeholders seeking to align product development, go-to-market strategies, and access initiatives with the unique demands of each market stratum.

This comprehensive research report categorizes the Infectious Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Route Of Administration

- End User

- Distribution Channel

Examining key regional drivers and challenges across the Americas, EMEA, and Asia-Pacific shaping the infectious vaccine landscape and access equity

In the Americas, the United States maintains its position as a global leader in vaccine innovation, driven by robust funding for mRNA and viral vector research, streamlined regulatory processes, and substantial onshoring investments. The CDC’s updated guidance for RSV vaccination of adults 50 and older underscores the region’s agility in adopting new immunization protocols, with three approved RSV vaccines-including GSK’s Arexvy, Moderna’s mResvia, and Pfizer’s Abrysvo-positioned for routine seasonal administration.

Europe, the Middle East, and Africa (EMEA) present a heterogeneous landscape, with the European Medicines Agency facilitating rapid approvals such as Moderna’s 2025–2026 Spikevax update, while public health agencies across the region coordinate large-scale immunization campaigns for influenza, pneumococcal, and meningococcal diseases. In contrast, resource constraints and conflict-driven disruptions in parts of the Middle East and Africa contribute to immunization gaps, highlighting the need for targeted partnerships and infrastructure investments to bolster vaccine access and logistics.

This comprehensive research report examines key regions that drive the evolution of the Infectious Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic moves and innovation pipelines of leading pharmaceutical and biotech companies transforming the infectious vaccine market

Moderna continues to expand its mRNA franchise beyond COVID-19, with portfolios spanning RSV, influenza, and combination shots. The company’s ability to achieve near real-time antigenic updates-demonstrated by its LP.8.1–targeted COVID-19 vaccine and advancing mRESVIA for RSV-positions it as a vanguard of platform scalability and regulatory collaboration.

GSK has emerged as a powerhouse in subunit vaccines following the FDA’s approval of Arexvy for adults aged 50–59, built on a recombinant glycoprotein F antigen and proprietary AS01 adjuvant. The expansion of Arexvy’s indication to younger adults underscores GSK’s commitment to broadening disease prevention across demographically diverse populations.

Pfizer, leveraging its success with Abrysvo for RSV and Comirnaty for COVID-19, holds a strategic edge in commercialization and supply chain integration. The recent resolution of a patent dispute with GSK over RSV vaccine technology reflects an industry-wide drive to consolidate intellectual property while preparing for fierce market competition.

AstraZeneca’s $50 billion U.S. investment program signals a broader industry trend toward onshoring critical manufacturing capabilities and strengthening long-term supply chain resilience. Concurrently, mid-sized biotechs and contract development and manufacturing organizations (CDMOs) are carving out niches in specialized process development, adjuvant expertise, and regional fill-finish services to support major players and emergent innovators alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infectious Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adimmune Corporation

- AstraZeneca plc

- Bavarian Nordic

- Bharat Biotech

- Biological E Limited

- BioNTech SE

- CanSino Biologics

- China National Biotechnology Group

- CSL Limited

- Dynavax Technologies

- Emergent BioSolutions, Inc.

- Genocea Biosciences

- GlaxoSmithKline plc

- Haffkine Bio-Pharmaceutical Corporation

- Inovio Pharmaceuticals

- Johnson & Johnson

- Merck & Co., Inc.

- Microgen

- Mitsubishi Tanabe Pharma

- Moderna, Inc.

- Novavax, Inc.

- Pfizer Inc.

- Sanofi S.A.

- Serum Institute of India

- Sinovac Biotech Ltd.

- Valneva SE

- Vaxcyte, Inc.

- VBI Vaccines, Inc.

Presenting actionable strategic recommendations for industry leaders to navigate market complexities and capitalize on infectious vaccine opportunities

Industry leaders must prioritize platform versatility by investing in adaptable manufacturing infrastructure that can pivot between conjugate, subunit, viral vector, and mRNA production lines. Establishing modular facilities will reduce lead times for product launch and enable swift responses to emerging threats. Diversifying raw material sourcing, including secondary supplier qualification and regional API production partnerships, will mitigate tariff-driven cost pressures and safeguard supply continuity.

Strategic alliances between pharmaceutical companies, government agencies, and academic institutions can streamline clinical development through shared data platforms and harmonized regulatory strategies. Co-development agreements should incorporate flexible milestone structures to accelerate proof-of-concept studies and optimize resource allocation.

To address persistent inequities in vaccine access, organizations should deploy targeted delivery innovations such as microneedle patches and thermostable formulations tailored for low- and middle-income markets. Embedding digital tracking and blockchain-enabled traceability solutions will enhance cold chain governance and support real-time distribution analytics.

Finally, proactive engagement with policy makers to shape sustainable trade and reimbursement frameworks is essential. Advocacy for risk-sharing reimbursement models and advanced purchase commitments can de-risk capital investment and expand immunization uptake across diverse population segments.

Outlining a robust mixed-method research methodology integrating qualitative and quantitative analysis for comprehensive infectious vaccine market insights

This analysis integrates a mixed-method research approach combining primary and secondary data collection. Primary research involved structured interviews with vaccine developers, regulatory authorities, and supply chain experts across key regions, yielding qualitative insights into production challenges and strategic priorities.

Secondary research encompassed an exhaustive review of peer-reviewed journals, international health agency reports, and government trade publications. Regulatory databases provided timelines for vaccine approvals and policy shifts, while company press releases and financial disclosures informed the competitive landscape.

Quantitative analysis employed statistical modeling of immunization coverage data from the World Health Organization and UNICEF, tariff schedules from U.S. trade authorities, and patent filings to project supply chain impact scenarios. Scenario planning techniques were used to simulate cost and timeline variances under multiple trade and regulatory contingency frameworks.

Data triangulation ensured validity by cross-referencing stakeholder perspectives with published metrics. Geographic and segment-level benchmarks were established to contextualize findings within the broader infectious vaccine market, enabling robust comparative analysis across platforms, regions, and end-user channels.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infectious Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infectious Vaccines Market, by Vaccine Type

- Infectious Vaccines Market, by Route Of Administration

- Infectious Vaccines Market, by End User

- Infectious Vaccines Market, by Distribution Channel

- Infectious Vaccines Market, by Region

- Infectious Vaccines Market, by Group

- Infectious Vaccines Market, by Country

- United States Infectious Vaccines Market

- China Infectious Vaccines Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Summarizing core insights and reinforcing strategic priorities to advance infectious vaccine innovation, accessibility, and public health preparedness

The confluence of stalled immunization coverage and rapid technological progress has created an inflection point for infectious vaccines. Platforms such as mRNA and viral vectors are poised to revolutionize outbreak response, while subunit and conjugate formulations remain indispensable for established disease prevention programs.

Trade policies in 2025 have underscored the fragility of global supply chains, prompting a multisector pivot toward onshoring and regional diversification. This realignment, coupled with sustainability imperatives, is reshaping manufacturing paradigms and commercial strategies.

Through targeted segmentation analysis, it is clear that success in the infectious vaccine market will hinge on aligning platform capabilities with end-user requirements, whether in clinics, hospitals, pharmacies, or public health centers. Regional dynamics-from North American policy incentives to EMEA regulatory harmonization and Asia-Pacific immunization challenges-demand customized market entry and access initiatives.

Leading companies are leveraging strategic investments, intellectual property resolution, and partnership ecosystems to secure competitive advantage. Yet, agility in supply chain design, regulatory navigation, and stakeholder collaboration will determine which organizations deliver on the promise of equitable, sustainable vaccine delivery in the years ahead.

Partner with Ketan Rohom to secure comprehensive infectious vaccine market research and drive informed strategic decision-making

To gain unparalleled clarity on the evolving infectious vaccine landscape and inform your strategic roadmap with data-driven insights, reach out to Ketan Rohom (Associate Director, Sales & Marketing) today to secure your copy of the full market research report. Engage directly with our expert team to discuss customized deliverables aligned to your specific needs and empower your decision-making with rigorous analysis, comprehensive segmentation, and actionable recommendations. Don’t miss this opportunity to stay ahead in a rapidly transforming market-connect now to unlock the critical intelligence you need for sustained growth and competitive advantage.

- How big is the Infectious Vaccines Market?

- What is the Infectious Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?