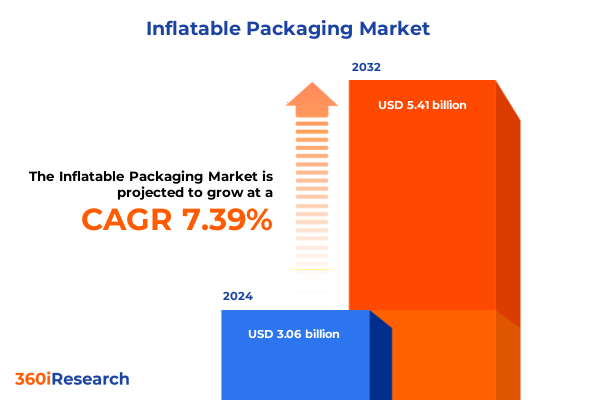

The Inflatable Packaging Market size was estimated at USD 3.28 billion in 2025 and expected to reach USD 3.52 billion in 2026, at a CAGR of 7.41% to reach USD 5.41 billion by 2032.

Understanding How Innovative Inflatable Packaging Solutions Are Shaping Industry Practices and Meeting Demand for Efficiency and Protection

Inflatable packaging has emerged as a cornerstone of modern protective solutions by offering unparalleled cushioning, tailored fit, and lightweight efficiency that collectively reduce overall transit costs and product damage. As global supply chains become increasingly complex, companies across diverse industries are adopting air-inflated materials to streamline fulfillment operations, minimize environmental impact, and elevate customer satisfaction. The tangible benefits of these solutions range from accelerated packing speeds on high-volume lines to significant reductions in waste through reusable and on-demand inflation platforms.

Heightened consumer expectations, stringent regulatory frameworks, and the relentless growth of e-commerce shipments have converged to propel inflatable packaging from a niche offering into a mainstream logistics enabler. Organizations seeking to differentiate themselves on service quality and sustainability performance are investing in advanced film technologies and integrated inflation systems. Consequently, the sector is witnessing rapid innovation cycles, fostering collaboration among material scientists, equipment manufacturers, and sustainability advisors.

Against this backdrop, this executive summary synthesizes critical market dynamics, transformative technological shifts, and strategic segments to equip decision-makers with a clear understanding of the inflatable packaging landscape. By distilling complex trends into actionable insights, the document lays the groundwork for informed choices that balance cost efficiency, environmental stewardship, and operational resilience.

Exploring Major Transformative Shifts Reshaping the Inflatable Packaging Landscape in Response to Sustainability, Technology, and Market Dynamics

The inflatable packaging industry is undergoing major transformations driven by advances in material engineering, automation technologies, and evolving customer requirements. Across the value chain, sustainable formulations and high-strength films are replacing traditional bubble systems, while intelligent inflation units now interface with warehouse management software to optimize gas usage and reduce operational downtime. Moreover, data-driven customization tools enable real-time adaptation of cushion dimensions, ensuring that packages of varying shapes and fragility receive the precise protection needed without material excess.

In parallel, environmental mandates and corporate ESG targets are accelerating the adoption of bio-based polymers and recyclable substrates. Leading innovators are experimenting with closed-loop recovery programs, offering customers incentives to return used inflatable dunnage for reprocessing. As a result, industry partnerships are forming between film producers, packaging integrators, and waste management firms to close the circularity gap.

Furthermore, the rapid proliferation of direct-to-consumer channels has underscored the necessity for on-demand inflation capabilities. Automated foam-in-place dispensers are now coexisting alongside traditional air pillow generators, granting operators the flexibility to select the optimum protective strategy based on pack station constraints and shipment profiles. Consequently, businesses that quickly embrace flexible filling gas technologies and modular inflation platforms are positioned to outperform peers in both cost metrics and sustainability benchmarks.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Raw Materials, Supply Chains, and Competitive Dynamics in Inflatable Packaging

The introduction of increased import tariffs in 2025 by the United States has had a pronounced effect on the cost structure and competitive positioning of inflatable packaging providers. Raw materials such as polyethylene resins and specialized films, previously procured at scale from key overseas suppliers, experienced cost escalations that reverberated throughout supply chains. Small and mid-sized converters encountered margin compression, prompting them to explore alternative domestic sources, local partnerships, and backward integration strategies.

Consequently, many manufacturers accelerated investments in in-house extrusion and lamination capabilities to mitigate exposure to fluctuating duties. This realignment spurred innovation in compound formulations, yielding films with equaled or improved performance at lower base resin costs. At the same time, the increased financial burden of overseas imports incentivized a wave of reshoring initiatives, driven by both economic and political imperatives.

Additionally, the tariffs triggered a strategic repricing of end-user contracts as distributors and fulfillment centers navigated changed freight and procurement expenses. Some market participants sought to pass through cost increases, while others absorbed a portion of the duties to maintain competitive pricing. The net result has been a redefined manufacturer-distributor relationship, characterized by deeper collaboration on inventory management and co-development of cost-efficient packaging solutions.

Uncovering Critical Segmentation Insights Revealing How Material, Filling Gas, Application, Industry, and Distribution Channels Drive Market Trends

A close examination of market segmentation reveals that material type remains a primary driver of protective performance and cost efficiency. Air pillows, available in both perforated film and standard film, offer rapid deployment and minimal waste when integrated with automated dispensing systems. Bubble wrap, with options ranging from anti-static and bio-based compositions to traditional standard variants, continues to serve niche applications requiring specific electrostatic or environmental attributes. Foam-in-place systems, differentiated by one-component and two-component formulations, provide tailored on-site cushioning, particularly when irregularly shaped or oversized items demand bespoke protection. Likewise, inflatable dunnage solutions, whether corner protectors or void-fill bags, enable flexible void management across various carton sizes.

In terms of filling gas, ambient air dominates due to its universal availability and low operational complexity, while nitrogen fills play a vital role where moisture and oxidation concerns must be minimized, particularly in electronics and pharmaceutical shipments. Application trends highlight that the automotive sector uses robust inflatable solutions to safeguard heavy parts and assemblies, whereas e-commerce shipments demand lightweight, low-profile packaging that balances protection with carrier weight limits. Electronics and healthcare segments increasingly specify anti-static and sterile-grade inflatable components, and food & beverage shippers prioritize FDA-compliant films to preserve product integrity.

Finally, the distribution channel framework underscores the importance of direct sales relationships for large industrial customers alongside offline retail and wholesale networks that support small-batch and regionally sourced needs. Online channels are rapidly gaining share by enabling end users to order custom packaging kits with short lead times and automated reorder triggers based on inventory thresholds.

This comprehensive research report categorizes the Inflatable Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Filling Gas Type

- Application

- End Use Industry

- Distribution Channel

Evaluating Key Regional Insights Highlighting Growth Patterns and Strategic Considerations across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the Americas reflect a mature market where e-commerce proliferation and corporate sustainability commitments shape demand patterns. The United States, as a leading adopter, leverages advanced inflation technologies at major fulfillment centers, while Canada’s stringent packaging waste regulations have prompted manufacturers to expand recycling partnerships and bio-based product lines. Across Latin America, infrastructural challenges emphasize the need for lightweight, impact-resistant packaging that reduces transportation risks over long haul distances.

Moving to Europe, Middle East & Africa, regulatory harmonization under the European Union’s circular economy directives has catalyzed material innovation and standardized labeling practices. Germany and France lead in adopting recycled films, and the United Kingdom has seen rapid growth in nitrogen-based inflatable dunnage for high-value aerospace components. In the Middle East, nascent industrial zones are building local manufacturing capacity to serve energy sector clients, while South Africa’s logistics hubs drive demand for modular corner protectors and void fill solutions.

In the Asia-Pacific region, robust manufacturing ecosystems in China, India, and Southeast Asia provide economies of scale for raw polymer production, enabling competitive pricing for mass market applications. At the same time, accelerating domestic consumption and cross-border e-commerce flows are prompting companies to deploy on-demand inflation machines that can handle multiple film formats. Japan and South Korea remain at the forefront of integrating digital control systems, ensuring precise gas delivery and seamless interfacing with automated packaging lines.

This comprehensive research report examines key regions that drive the evolution of the Inflatable Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Companies Driving Innovation, Partnerships, and Competitive Positioning in the Global Inflatable Packaging Sector

A review of leading industry players underscores a competitive landscape defined by continuous innovation and strategic partnerships. Established film producers have forged alliances with inflation equipment manufacturers to deliver turnkey solutions that blend high-strength materials with intelligent dispensing. Selective acquisitions of niche bio-based polymer developers illustrate a concerted push toward lower-carbon offerings, while joint ventures with logistics service providers facilitate co-designed packaging systems tailored to specific warehousing footprints.

Simultaneously, emerging specialists in cleanroom-grade and anti-static inflatables are differentiating through rigorous quality certifications and targeted sales channels. These agile firms leverage digital marketing and direct online platforms to reach end users seeking small-batch or rapid-prototype runs. At the same time, incremental improvements in machinery uptime and changeover speed afford major players the ability to upsell maintenance agreements and predictive service contracts.

Overall, the competitive field is characterized by a dual focus on operational excellence and sustainable product portfolios. Leaders that balance investment in next-generation film chemistries with scalable automation platforms are solidifying their market positions, even as cost pressures and regulatory shifts continue to reshape competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inflatable Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A E Sutton Limited

- Advanced Protective Packaging Ltd.

- Aeris Protective Packaging Inc.

- AirPack Systems Ltd.

- Automated Packaging Systems, Inc.

- Berry Global, Inc.

- BUBL Bags Ltd.

- Easypack Limited

- Green Light Packaging Ltd.

- International Paper Company

- Intertape Polymer Group, Inc.

- Kite Packaging Ltd.

- Macfarlane Group plc

- Omniverse Foster Packaging Group

- Pregis LLC

- Ranpak Holdings Corp

- Sealed Air Corporation

- Shorr Packaging Corp.

- Smurfit Kappa Group plc

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- TPC Packaging Solutions, Inc.

- Uniqbag Packaging Systems Ltd.

Strategic Actionable Recommendations for Industry Leaders to Enhance Sustainability, Supply Chain Resilience, and Market Differentiation in Packaging

Industry leaders aiming to capitalize on the inflatable packaging opportunity should prioritize strategic investments in sustainable material R&D to meet growing regulatory and consumer expectations. By accelerating collaboration with bio-polymer innovators, organizations can introduce eco-friendly film options that maintain protective performance while aligning with circular economy goals. At the same time, diversifying supply chains through regional resin partnerships and in-house compounding facilities will mitigate exposure to tariff volatility and ensure continuity of supply.

Moreover, implementing automated inflation systems that integrate with warehouse execution software will optimize gas usage and reduce manual intervention, driving both cost savings and throughput improvements. Investing in Internet of Things-enabled sensors and predictive maintenance platforms can further enhance equipment reliability and unlock valuable operational data. Companies should also explore bespoke nitrogen-inert solutions for specialized applications in electronics and healthcare, thereby commanding premium pricing and reinforcing their industry leadership.

Finally, forging ecosystem partnerships with logistics providers, retailers, and reverse-logistics specialists will facilitate the adoption of closed-loop recovery programs, enhancing end-of-life material capture and reinforcing brand sustainability narratives. By executing these recommendations in concert, manufacturers and distributors can secure a resilient, differentiated market presence.

Detailing the Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Analysis, and Expert Validation Processes

The insights presented in this executive summary derive from a robust mixed-method research approach designed to ensure both depth and reliability. Primary research included structured interviews and roundtable discussions with senior executives at packaging manufacturers, fulfillment center operators, and material science experts. These engagements provided direct perspectives on emerging challenges, technology adoption timelines, and evolving customer requirements.

Secondary research incorporated a comprehensive review of industry reports, technical white papers, patent filings, and regulatory publications to validate market trends and competitive positioning. Data triangulation methods were applied to reconcile differing viewpoints, while expert validation workshops were convened to test preliminary findings and refine key themes. Quantitative inputs such as resin pricing indices, machine shipment statistics, and sustainability metrics supplemented qualitative assessments.

Throughout the research process, stringent quality controls were enforced, including peer reviews and consistency checks, to eliminate bias and ensure analytical rigor. As a result, the conclusions and recommendations within this summary offer a trustworthy foundation for strategic planning and investment decision-making in the inflatable packaging sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inflatable Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inflatable Packaging Market, by Material Type

- Inflatable Packaging Market, by Filling Gas Type

- Inflatable Packaging Market, by Application

- Inflatable Packaging Market, by End Use Industry

- Inflatable Packaging Market, by Distribution Channel

- Inflatable Packaging Market, by Region

- Inflatable Packaging Market, by Group

- Inflatable Packaging Market, by Country

- United States Inflatable Packaging Market

- China Inflatable Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Drawing Conclusive Perspectives on the Future of Inflatable Packaging and Its Critical Role in Supporting Evolving Market Demands and Operational Excellence

The inflatable packaging sector stands at a pivotal juncture, where technological innovation and sustainability mandates converge to redefine protection standards and supply chain resilience. Advancements in film formulations, inflation machinery, and digital integration are empowering organizations to deliver enhanced performance while addressing environmental imperatives. Simultaneously, the ripple effects of tariff policies and regional dynamics underscore the importance of supply chain agility and strategic sourcing.

Segment-level insights illuminate how diverse material types, filling gases, end-use applications, and distribution channels are reshaping value propositions across industries. Regional variations further emphasize the need for localized strategies, whether in the Americas’ e-commerce hubs, Europe’s regulatory harmonization initiatives, or the Asia-Pacific’s manufacturing prowess. By aligning capabilities with these multifaceted drivers, industry participants can seize growth opportunities and reinforce competitive differentiation.

Looking ahead, those who prioritize sustainable innovations, embrace automation, and cultivate collaborative ecosystems will be best positioned to navigate evolving market demands. This summary offers a distilled framework for understanding critical trends and making informed choices in an increasingly dynamic inflatable packaging landscape.

Unlock Comprehensive Insights with Ketan Rohom to Navigate Inflatable Packaging Trends and Drive Strategic Growth by Securing the Full Market Research Report

To obtain the full breadth of in-depth analysis, strategic imperatives, and proprietary insights presented in this executive summary, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Secure your comprehensive report today to gain a competitive edge by exploring tailored data, expert guidance, and actionable road maps designed for your success in the evolving inflatable packaging market.

- How big is the Inflatable Packaging Market?

- What is the Inflatable Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?