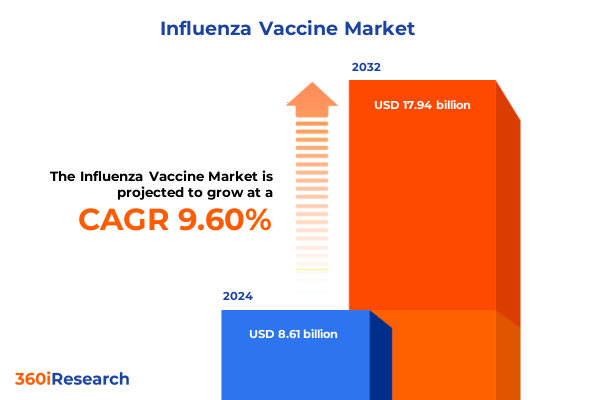

The Influenza Vaccine Market size was estimated at USD 9.41 billion in 2025 and expected to reach USD 10.28 billion in 2026, at a CAGR of 9.65% to reach USD 17.94 billion by 2032.

Modern Influenza Vaccine Evolution: Unveiling Critical Advances in Development, Distribution, and Public Health Impact Across Diverse Populations

Modern influenza vaccines have undergone a profound evolution over the last two decades, driven by advances in molecular biology, supply chain optimization, and data-driven decision making. What once relied primarily on egg-based manufacturing has expanded to embrace recombinant platforms, cell-culture technologies, and emerging nucleic acid modalities. This transformation has enabled faster strain selection, improved antigen matching, and increasingly scalable production capacity, reinforcing vaccines as the first line of defense against seasonal and pandemic flu outbreaks.

As public health authorities and private stakeholders collaborate to enhance immunization strategies, the role of real-time surveillance and predictive analytics has become paramount. Near-universal digital surveillance networks now inform strain forecasting with greater precision, while adaptive regulatory frameworks streamline the review of novel vaccine constructs. In tandem, distribution innovations-from modular fill-finish facilities to smart cold-chain monitoring-have reduced bottlenecks in last-mile delivery. These collective strides across research, regulation, and logistics underscore the critical importance of influenza vaccine innovation in safeguarding global health.

Transformative Forces Redefining Influenza Vaccine Research and Distribution: Innovations, Regulatory Milestones, and Emerging Market Dynamics

The landscape of influenza immunization has been reshaped by a confluence of technological breakthroughs and shifting stakeholder expectations. Leading vaccine developers have embraced mRNA and viral-vector technologies originally proven in other therapeutic areas, testing their adaptability to influenza antigens. Concurrently, investment in universal flu vaccine candidates is gaining momentum, aiming to target conserved viral epitopes and reduce the need for annual reformulation. As a result, research collaboration networks have expanded beyond traditional biopharma alliances to include academic centers, government agencies, and specialized biotech firms.

Regulatory agencies have responded to these trends by establishing accelerated pathways that balance rigorous safety assessment with expedited review timelines, particularly for pandemic preparedness stockpiles. Meanwhile, payers and procurement bodies are increasingly tying reimbursement to demonstrable health and economic outcomes, incentivizing manufacturers to demonstrate improved vaccine effectiveness and real-world performance. With digital health tools facilitating patient engagement and adherence tracking, the convergence of innovation in science, regulation, and market access is redefining the future potential of seasonal and pandemic influenza control.

Assessing the Broad Economic Implications of 2025 United States Tariff Adjustments on Influenza Vaccine Supply Chains and Manufacturing Costs

In 2025, the United States enacted targeted tariff modifications that have introduced new duties on imported vaccine components including glass vials, syringe assemblies, and certain bioreactor consumables. Although these adjustments aim to bolster domestic manufacturing resilience, they have also led to incremental cost pressures across the supply chain. Manufacturers are navigating higher input expenses that, in turn, have influenced procurement contracts and inventory management strategies.

To mitigate these impacts, several vaccine producers have accelerated efforts to onshore critical production steps, from fill-finish operations to primary antigen expression. Co-investment in domestic glass and plastic syringe manufacturing facilities is underway, supported by public-private partnerships. Meanwhile, procurement teams are renegotiating long-term agreements with international suppliers to secure preferential duty treatment under free trade arrangements and minimize the pass-through of tariff-related costs. As these dynamics continue to evolve, industry players must monitor policy shifts closely and adapt supply chain strategies to preserve affordability and access.

In-Depth Patient, Presentation, and Distribution Segmentation Revealing Distinct Influenza Vaccine Adoption Patterns Across Critical Market Cohorts

Distinct adoption patterns in the influenza vaccine market emerge when examining vaccine types, age groups, dosage regimens, presentation formats, distribution channels, and end-user profiles. Inactivated formulations, long established as the backbone of seasonal programs, maintain strong uptake among older demographics, whereas live attenuated vaccines are favored for pediatric cohorts due to their administration routes and immune response characteristics. Recombinant constructs are rapidly gaining acceptance across all age segments, especially among adults seeking enhanced efficacy during seasonally variable years.

The choice between multi-dose and single-dose presentations often hinges on clinic workflows and patient convenience. Multi-dose offerings remain prevalent in high-throughput settings, while single-dose formats support targeted vaccination campaigns and reduce wastage in specialty clinics. Prefilled syringes, whether glass or emerging plastic designs, are becoming the preferred option for outpatient settings due to their simplicity and reduced preparation time. Conversely, vials-available in multi-dose and single-dose formats-remain integral to hospital pharmacies, where centralized preparation is standard practice.

Distribution channels play a critical role in ensuring vaccine availability. Direct sales models foster closer collaboration between manufacturers and institutional buyers, while hospital pharmacies serve as central hubs for inventory management and patient administration. Within end-user segments, outpatient and specialty clinics account for much of the preventive vaccination volume, whereas private and public hospitals focus on inpatient and high-risk group immunizations. Recognizing these nuanced distinctions across multiple segmentation dimensions can guide tailored marketing strategies, inventory planning, and collaborative partnerships to optimize reach and impact.

This comprehensive research report categorizes the Influenza Vaccine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Age Group

- Dosage

- Presentation

- Distribution Channel

- End User

Analyzing Regional Variations in Influenza Vaccine Uptake and Infrastructure Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional differences in influenza vaccine uptake and infrastructure reflect diverse public health priorities, regulatory environments, and logistical capacities. In the Americas, robust national immunization programs are supported by well-established cold-chain networks and direct procurement agreements between governments and leading manufacturers. Public awareness campaigns and employer-sponsored vaccination initiatives contribute to high adult and geriatric vaccination coverage, while pediatric uptake benefits from school-linked programs and decentralized clinic networks.

Across Europe, the Middle East, and Africa, vaccination strategies vary widely. High-income European nations leverage centralized tender systems and dynamic forecasting tools to align supply with seasonal demand, whereas emerging markets in sub-Saharan Africa and parts of the Middle East face challenges related to storage infrastructure and healthcare access. Collaborative efforts with international organizations are expanding regional fill-finish capacity and training initiatives to strengthen distribution resilience. In contrast, Asia-Pacific exhibits a dynamic blend of mature markets and rapidly growing immunization ecosystems. Japan leads in recombinant vaccine adoption, China continues to scale both antigen production and packaging facilities, and Southeast Asian countries are investing in supply chain digitization to enhance program efficiency and reach remote populations.

This comprehensive research report examines key regions that drive the evolution of the Influenza Vaccine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharma and Vaccine Developers Driving Innovation, Partnerships, and Competitive Strategies in the Global Influenza Immunization Arena

Leading immunization stakeholders are pursuing a range of strategies to maintain market leadership and accelerate innovation. Global biopharma incumbents have expanded capacity through alliances with specialty manufacturers, while next-generation biotech firms are exploring modular, flexible manufacturing platforms that can pivot rapidly between seasonal and pandemic production. Cross-sector collaborations-linking vaccine developers with diagnostic companies and digital health providers-are reshaping value propositions and enabling integrated prevention solutions.

Establishing strategic assets in key geographies has become a priority, with several organizations investing in local fill-finish facilities to shorten lead times and comply with regional regulatory requirements. Mergers and acquisitions continue to drive consolidation, particularly among smaller vaccine developers seeking scale and broader commercial networks. At the same time, partnerships with contract development and manufacturing organizations (CDMOs) are allowing for capacity surges during peak demand periods without burdening core balance sheets. This evolving competitive landscape underscores the importance of agility, collaboration, and technological differentiation for companies vying for a foothold in the global influenza vaccine arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Influenza Vaccine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AstraZeneca plc

- Changchun BCH Bioengineering Co., Ltd.

- China National Pharmaceutical Group Co., Ltd.

- CSL Limited

- GlaxoSmithKline plc

- Pfizer Inc.

- Sanofi S.A.

- Serum Institute of India Private Limited

- Sinovac Biotech Ltd.

- Zhejiang Tianyuan Bio-Pharmaceutical Co., Ltd.

Strategic Guidance for Leaders to Optimize Influenza Vaccine Deployment, Ensure Regulatory Compliance, and Foster Collaborative Innovation for Public Health

Industry leaders can fortify their market position by adopting a multifaceted strategy that prioritizes supply chain resilience, technological agility, and stakeholder engagement. Investing in diversified manufacturing networks-spanning onshore facilities, regional partnerships, and flexible modular platforms-will mitigate the risks associated with policy shifts and demand volatility. Coupling this infrastructure with advanced analytics for real-time inventory monitoring ensures optimal allocation and minimizes waste.

Furthermore, strengthening relationships with regulatory authorities and public health agencies can facilitate early alignment on novel vaccine modalities and expedite review pathways. Companies should also seek to collaborate with digital health innovators to enhance patient outreach, streamline vaccination scheduling, and gather post-market safety and efficacy data. Finally, tailoring approaches to distinct market segments-be it pediatric clinics, specialty care centers, or large hospital systems-will maximize coverage and drive measurable public health outcomes. By embracing these strategic imperatives, organizations can deliver superior value to patients, payers, and providers alike.

Rigorous Hybrid Methodological Framework Combining Qualitative and Quantitative Techniques to Ensure Comprehensive Influenza Vaccine Market Insights

This research leverages a hybrid methodological design that integrates qualitative insights with quantitative validation. Primary data were collected through structured interviews with sovereign health agencies, vaccine manufacturers, CDMO executives, and distribution specialists, enabling a comprehensive understanding of current practices, challenges, and emerging opportunities. These engagements were supplemented by in-depth case studies of recent vaccine rollouts and tariff policy implementations.

Secondary research encompassed a review of peer-reviewed journals, regulatory filings, and industry white papers to contextualize technology trends and policy developments. To ensure accuracy, findings were triangulated through cross-reference with supply chain performance metrics and market intelligence databases. Segmentation categories were tested via thematic analysis, while regional profiles were refined through localized expert validation. The resulting framework provides a robust foundation for strategic decision making, balancing rigorous data analysis with real-world industry perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Influenza Vaccine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Influenza Vaccine Market, by Vaccine Type

- Influenza Vaccine Market, by Age Group

- Influenza Vaccine Market, by Dosage

- Influenza Vaccine Market, by Presentation

- Influenza Vaccine Market, by Distribution Channel

- Influenza Vaccine Market, by End User

- Influenza Vaccine Market, by Region

- Influenza Vaccine Market, by Group

- Influenza Vaccine Market, by Country

- United States Influenza Vaccine Market

- China Influenza Vaccine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Conclusive Perspectives on Evolving Influenza Vaccine Challenges and Opportunities Shaping Future Immunization Strategies and Public Health Preparedness

The influenza vaccine landscape is marked by rapid innovation, shifting policy landscapes, and evolving stakeholder expectations. Manufacturers are challenged to balance the pursuit of next-generation modalities with the imperatives of supply chain resilience and cost management, particularly in light of recent tariff adjustments. Meanwhile, segmented adoption patterns across age groups, presentation formats, and distribution channels highlight the necessity for tailored market approaches.

Regional disparities underscore the importance of localized strategies, from the mature procurement systems of the Americas to the infrastructural development priorities in EMEA and the digitization drive in Asia-Pacific. For industry leaders, success will hinge on forging strategic partnerships, embracing technological agility, and maintaining close engagement with regulators and public health bodies. By synthesizing these insights, stakeholders can chart a path toward more effective and sustainable influenza immunization programs that protect vulnerable populations and bolster global health security.

Unlock Comprehensive Influenza Vaccine Market Intelligence and Drive Strategic Growth with Expert Insights Curated by Ketan Rohom

To obtain the complete market research report and gain unrestricted access to comprehensive data, expert analysis, and strategic insights, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through the tailored solutions available to address your specific intelligence needs, facilitate report customization, and ensure that your organization capitalizes on the most current developments in the influenza vaccine landscape. Secure your competitive advantage today by engaging with Ketan to acquire this indispensable resource and empower your decision-making with unparalleled market clarity.

- How big is the Influenza Vaccine Market?

- What is the Influenza Vaccine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?