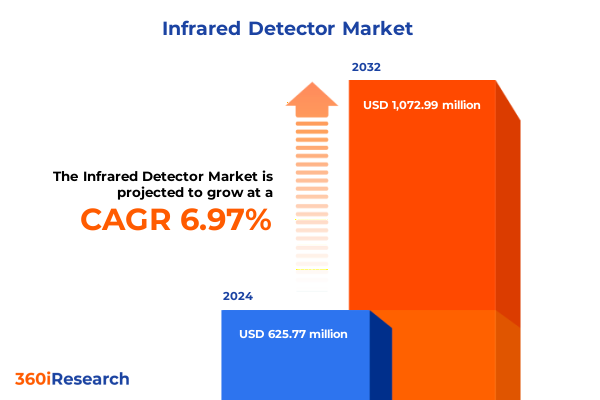

The Infrared Detector Market size was estimated at USD 669.08 million in 2025 and expected to reach USD 720.17 million in 2026, at a CAGR of 6.97% to reach USD 1,072.98 million by 2032.

Infrared Detectors Unveiled: Foundations of Next-Generation Sensing Redefining Precision Monitoring Across Commercial, Industrial, and Defense Sectors

Infrared detectors have become foundational elements in modern sensing systems, enabling unprecedented visibility across wavelengths beyond the spectrum of visible light. At their core, photon detectors rely on quantum well infrared photodetectors or semiconductor materials to convert incoming photons into electrical signals, while thermal detectors leverage changes in temperature to sense infrared radiation. Advances in new materials research-such as graphene and metamaterials-paired with computational imaging and data fusion, are driving these detector systems to new heights of sensitivity, reliability, and miniaturization.

From military night-vision goggles to industrial process monitoring and automotive driver-assist systems, infrared detectors have extended their reach across a wide array of applications. Early reliance on bulky, cooled photon detectors has given way to compact, uncooled microbolometers and hybrid multispectral solutions. Meanwhile, the integration of focal plane arrays with machine learning and artificial intelligence is enhancing real-time image processing capabilities, empowering systems to detect temperature differentials with higher precision and interpret complex thermal scenes dynamically.

Breakthrough Infrared Detector Technologies and System-Level Innovations Reshaping Applications from Defense Surveillance to Industrial Automation

The infrared detector landscape is undergoing transformative shifts, driven by persistent demands for higher resolution, faster response times, and lower size, weight, and power consumption. On the photon detection front, type-II superlattice (T2SL) architectures and strain-compensated superlattices are extending detection capabilities into the extended short-wave infrared (eSWIR) range, offering improved operating temperatures and cost efficiencies compared to legacy II-VI solutions. Simultaneously, thermal detectors are benefiting from advances in nanomaterials and MEMS-based readouts, resulting in microbolometers that achieve superior noise performance and thermal stability without the need for cryogenic cooling.

Moreover, multi-spectral and hyperspectral infrared imaging systems are emerging as critical tools in defense, environmental monitoring, and industrial automation. By fusing data across multiple infrared bands, these systems deliver richer contextual awareness and enable more accurate threat detection or quality inspection. Complementary developments in VR/AR interfaces and simulation-driven design methodologies are ensuring that next-generation EO/IR systems can be optimized for specific operational environments, from battlefield reconnaissance to smart manufacturing floors.

Assessing the Full Spectrum of Section 301 Tariff Increases on Infrared Detector Imports and Their Long-Term Supply Chain Implications

The cumulative impact of U.S. Section 301 tariffs, particularly the January 1, 2025 increase of semiconductor duties from 25% to 50%, is exerting significant pressure on infrared detector supply chains. As many infrared detectors fall under HTS codes 8541 and 8542, importers are now contending with steeper duties on both cooled and uncooled focal plane arrays, amplifying total landed costs and prompting a critical reassessment of sourcing strategies.

In response, leading OEMs are accelerating domestic production investments under the CHIPS and Science Act, while exploring eligible tariff exclusions and foreign trade zone treatments to mitigate duty burdens. Nonetheless, the heightened tariff environment is driving wider supply-chain diversification, encouraging companies to establish manufacturing partnerships in tariff-friendly regions or invest in in-house fabrication capabilities. This shift will have lasting implications for cost structures, delivery lead times, and global competitive dynamics.

Integrating Technology, Wavelength, Installation, Application, and End-User Perspectives to Reveal Infrared Detector Market Dynamics

Analyzing the market through the lens of technology reveals that photon detectors, encompassing quantum well infrared photodetectors and semiconductor photodiodes, coexist with thermal detectors in both cooled and uncooled configurations, each addressing distinct performance and cost trade-offs. Examining wavelength ranges uncovers a broad spectrum of use cases, from short-wave infrared systems tailored for high-speed imaging to long-wave infrared modules optimized for thermal surveillance. Installation modalities further diversify the market, with fixed installations anchoring critical infrastructure, while handheld and portable units deliver flexibility for field operations and inspection tasks.

Application-based segmentation highlights the extensive reach of infrared detectors: automotive platforms leverage thermal imagers for driver-assist and safety systems, commercial sectors deploy them for fire and gas detection along with perimeter surveillance, and industrial environments utilize them for process monitoring and quality inspection. Military and defense applications demand the highest performance, driving the adoption of cooled focal plane arrays with exceptional sensitivity. Finally, end-user industries such as aerospace, healthcare, manufacturing, and oil and gas each have unique requirements-from satellite payloads and medical diagnostics to factory automation and pipeline leak detection-that shape procurement priorities and development roadmaps.

This comprehensive research report categorizes the Infrared Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Wavelength Range

- Installation

- Application

- End User Industry

Exploring Regional Demand Drivers for Infrared Detectors Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas, robust defense budgets and a thriving space sector continue to fuel demand for advanced infrared detectors, as evidenced by significant allocations for microelectronics and critical sensor development in the Department of Defense’s fiscal 2025 budget request. Concurrently, healthcare institutions are adopting thermal imaging for early fever screening and preventative maintenance in high-risk environments, while automotive OEMs increasingly integrate night-vision and pedestrian-detection systems into next-generation vehicles.

Europe, the Middle East, and Africa exhibit a strong focus on security and infrastructure protection, with border control agencies and urban surveillance networks deploying fixed infrared camera arrays for 24/7 monitoring. Regional research initiatives are fostering collaborations around uncooled IR detector development to lower total cost of ownership, supported by funding from the European Defence Industrial Programme. Meanwhile, the Asia-Pacific region remains the fastest-growing market, driven by China’s leadership in consumer electronics, Japan’s innovation in multispectral imaging, and South Korea’s expansion of autonomous vehicle pilot programs, all of which are integrating infrared sensing for enhanced safety and automation.

This comprehensive research report examines key regions that drive the evolution of the Infrared Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Infrared Detector Innovators and Their Strategic Product and Brand Enhancements

Key players in the infrared detector arena are advancing their portfolios through strategic product launches and brand evolutions. Teledyne FLIR recently introduced its FLIR MIX multispectral imaging kits, combining thermal and visible-light sensors to deliver richer environmental insights for defense testing and battery research. Its subsidiary Teledyne FLIR OEM has also rebranded to streamline OEM access to certified ITAR-free and NDAA-compliant modules, bolstering supply-chain reliability and accelerating innovation cycles.

Hamamatsu Photonics has expanded its semiconductor lineup with the G1719X InGaAs photodiode series, featuring surface-mounted ceramic packaging and high sensitivity across multiple NIR bands, as well as the C17212-011 mid-infrared detector module with integrated preamplifier for portable spectrometry applications. Meanwhile, Lynred (formerly Sofradir) is advancing cooled MCT and dual-band detector technologies, exemplified by its collaboration with CEA-Leti on Janus dual-band sensors and the compact 15-micron-pitch Epsilon MWIR detector for wearable and UAV payloads.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infrared Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bourns, Inc.

- Excelitas Technologies Corp

- FATRI (Xiamen) Technologies Co., Ltd.

- FLIR Systems Inc.

- Global Sensor Technology Co., Ltd.

- Hamamatsu Photonics K.K.

- Heimann Sensor GmbH

- Honeywell International Inc.

- InfraTec GmbH

- KADO Intelligent Technology (Shanghai) Co., Ltd.

- LASER COMPONENTS GmbH

- Lynred USA

- Mahlo GmbH + Co. KG

- MELEXIS group

- Monarch Instrument

- Ningbo VEZE Automatic Door Co., Ltd.

- Nippon Ceramic Co., Ltd.

- Omron Corporation

- Pantron Automation, Inc.

- Raytheon Technologies Corporation

- Takex Europe Ltd.

- TE Connectivity Ltd.

- Teledyne Technologies Incorporated

- Texas Instruments Inc.

- VIGO Photonics S.A.

- WoMaster

Strategic Initiatives and Partnerships to Foster Innovation, Supply Chain Resilience, and ESG-Driven Growth in Infrared Sensing

Industry leaders should prioritize the development of uncooled microbolometer platforms to capture emerging commercial and industrial use-cases, while simultaneously advancing next-generation photon detector materials such as type-II superlattices to maintain performance leadership in defense markets. Collaborative partnerships, including university consortia and government-supported research initiatives, can accelerate breakthroughs in metamaterials and AI-driven signal processing. Meanwhile, diversifying manufacturing footprints across tariff-friendly jurisdictions will help mitigate the impact of Section 301 duties and ensure resilience in global supply chains.

To align with customer requirements, OEMs must offer modular detector solutions with flexible wavelength sensitivity options and integrated analytics tools. Investing in end-to-end system demonstrations-spanning sensor development, camera integration, and software validation-will strengthen value propositions and reduce time to market. Finally, embedding sustainability considerations in manufacturing processes, such as lower-power cooling and recyclable packaging, can unlock new procurement incentives and support corporate ESG objectives.

Comprehensive Mixed-Method Research Framework Integrating Expert Interviews, Patent Analysis, and Technical Literature

This analysis leverages a mixed-method research approach combining primary interviews with semiconductor foundries, sensor integrators, and defense end users, alongside secondary data sourced from technical conference proceedings, government budget releases, and industry press. Patent landscape mapping and academic journal reviews provided insights into emerging material technologies and focal plane array architectures.

Triangulating qualitative perspectives from expert interviews with quantitative cost and tariff data enabled a holistic view of the market’s supply-chain dynamics and regional demand trends. Case studies of recent product launches and procurement programs offered practical illustrations of innovation drivers. The methodology ensures a balanced assessment of technological potential, regulatory influences, and competitive positioning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infrared Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infrared Detector Market, by Technology

- Infrared Detector Market, by Wavelength Range

- Infrared Detector Market, by Installation

- Infrared Detector Market, by Application

- Infrared Detector Market, by End User Industry

- Infrared Detector Market, by Region

- Infrared Detector Market, by Group

- Infrared Detector Market, by Country

- United States Infrared Detector Market

- China Infrared Detector Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspective on Technological, Regulatory, and Regional Forces Shaping the Future of Infrared Sensing Technologies

Infrared detectors are at the nexus of innovation across defense, commercial, and industrial sectors, driven by material science breakthroughs and system-level integration of AI and data fusion. While Section 301 tariffs have introduced cost challenges, they have simultaneously catalyzed domestic manufacturing investments and supply-chain diversification. Market segmentation underscores the breadth of applications-from handheld gas detection to satellite-borne missile warning arrays-and regional insights reveal a mosaic of demand drivers shaped by security, mobility, and sustainability imperatives.

As leading manufacturers expand their portfolios with advanced superlattice architectures, uncooled microbolometers, and multispectral imaging kits, the industry is poised to deliver more capable, compact, and cost-effective sensing solutions. Going forward, strategic collaborations, modular design philosophies, and ESG-aligned manufacturing will define the competitive landscape for infrared detection.

Connect with Ketan Rohom Today to Unlock Comprehensive Infrared Detector Market Research and Strategic Insights

To explore the full scope of infrared detector innovations, emerging market drivers, and strategic insights, connect with Ketan Rohom, our Associate Director for Sales & Marketing, to secure your comprehensive market research report. His expertise will guide you through tailored solutions and ensure you gain the actionable intelligence needed to stay ahead of industry developments and capitalize on new opportunities.

- How big is the Infrared Detector Market?

- What is the Infrared Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?