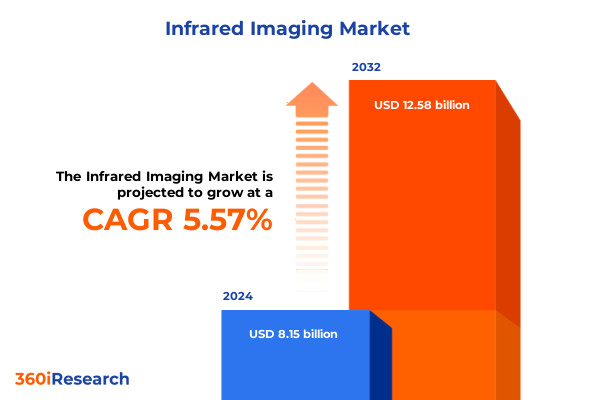

The Infrared Imaging Market size was estimated at USD 8.59 billion in 2025 and expected to reach USD 9.05 billion in 2026, at a CAGR of 5.59% to reach USD 12.58 billion by 2032.

Pioneering the Future of Infrared Imaging Through Unprecedented Precision, Market Dynamics, and Strategic Technological Advances

Infrared imaging has emerged as a cornerstone technology across a multitude of sectors, from advanced security systems to precision-guided medical diagnostics. By capturing thermal signatures invisible to the naked eye, infrared solutions enable organizations to detect anomalies, monitor processes, and enhance situational awareness in real time. This rapidly evolving field draws on advances in sensor design, signal processing, and materials science, creating a confluence of innovation that drives performance gains and cost efficiencies. As organizations pursue greater operational reliability and safety, the ability to harness thermal data effectively has become a strategic imperative rather than a niche capability.

The purpose of this executive summary is to provide decision-makers with a concise yet comprehensive overview of current market dynamics, transformative trends, and strategic challenges shaping the infrared imaging industry. By examining shifts in technology adoption, regulatory influences, and competitive positioning, this report will empower stakeholders to make informed choices about research investments, supply chain configurations, and product development roadmaps. In doing so, it lays the groundwork for organizations to capitalize on emerging applications, optimize their portfolios, and foster partnerships that accelerate their infrared imaging initiatives.

Unveiling the Transformative Shifts Redefining Infrared Imaging with AI Integration, Miniaturization Trends, and Cross Industry Convergence Driving Innovation

The infrared imaging landscape is undergoing profound shifts fueled by miniaturization, artificial intelligence, and convergence with adjacent digital platforms. Tiny, low-power detectors are now enabling thermal functionality in portable devices, opening avenues for consumer-grade analytics and mass-market deployment. Meanwhile, advanced algorithms are transforming raw thermal data into actionable insights, automating threat detection in security applications and facilitating predictive maintenance in industrial settings. This merger of hardware and software is giving rise to smart imaging solutions that can learn from environmental cues and adapt to changing conditions without human intervention.

Simultaneously, cross-industry convergence is redefining traditional roles, as automotive manufacturers partner with sensor suppliers to embed thermal cameras into driver-assistance systems, and healthcare providers integrate infrared imaging into telemedicine platforms. These collaborative ecosystems are dissolving silos, accelerating time to market, and fostering innovation at an unprecedented pace. As data processing migrates to the edge, devices are becoming more autonomous, emphasizing speed, reliability, and real-time decision-making. The result is an infrared imaging sector that is not only expanding in scope but is also becoming more intertwined with the broader digital transformation sweeping global industries.

Examining the Cumulative Impact of United States Tariffs in 2025 on Supply Chains, Cost Structures, and Strategic Positioning in the Infrared Imaging Sector

In 2025, the introduction of enhanced United States tariffs on imported infrared components has reverberated across global supply chains, compelling manufacturers and integrators to reassess procurement strategies. Suddenly, detector modules and thermal sensors sourced from key Asian suppliers have become more expensive, forcing cost structures upward and squeezing margins for both original equipment manufacturers and aftermarket service providers. In response, companies are exploring nearshoring alternatives and strategic inventory builds in lower-tariff jurisdictions to mitigate volatility.

This tariff landscape has also driven a renewed emphasis on domestic production capabilities, with stakeholders investing in localized assembly lines and forging partnerships with regional foundries. Regulatory shifts have spurred government incentives for technology transfer and in-country manufacturing, which in turn have reshaped competitive positioning. Amid these developments, organizations that proactively engaged with cross-border logistics experts and instituted flexible sourcing policies have managed to buffer margin pressures more effectively. Looking ahead, adaptive supply chain architectures and collaborative relationships with diversified suppliers will remain critical to navigating evolving trade policies and maintaining resilience in the infrared imaging sector.

Unlocking Strategic Value Through Deep Segmentation Analysis Across Product Types, Technologies, Wavelength Domains, Applications,and Distribution Channels

Deep segmentation analysis reveals distinct value drivers across product, technology, wavelength, application, and distribution channel categories, each influencing investment priorities and go-to-market tactics. When evaluating product types, detector modules are increasingly leveraged for integration into complex imaging assemblies, whereas standalone infrared sensors continue to serve niche medical and environmental monitoring applications. Thermal imaging cameras, on the other hand, are undergoing rapid innovation in form factor and functional capability to address end-user demands for portability and multi-spectral analytics.

From a technology standpoint, cooled solutions persist in high-precision military and aerospace contexts due to their superior sensitivity, while uncooled detectors gain traction across commercial sectors for their cost-effective performance and simplified maintenance requirements. Wavelength segmentation further refines use cases: long-wave infrared (LWIR) systems excel in night vision and outdoor surveillance scenarios, mid-wave infrared (MWIR) platforms balance sensitivity and thermal contrast for industrial inspection, and short-wave infrared (SWIR) devices enable material characterization and enhanced visibility through obscurants. Application-driven differentiation spans automotive safety systems, where thermal cameras augment pedestrian detection; consumer electronics integrations for gesture recognition; healthcare diagnostics that monitor patient vitals; industrial predictive maintenance programs; military and defense target acquisition; and security and surveillance networks that demand rapid anomaly detection. Finally, distribution channels influence market strategy, as OEM partnerships facilitate embedded solutions within broader product suites, while aftermarket suppliers focus on retrofits, service contracts, and component upgrades that extend equipment lifecycles.

This comprehensive research report categorizes the Infrared Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Wavelength

- Application

- Distribution Channel

Analyzing Regional Dynamics Shaping Demand Patterns and Innovation Trajectories in the Americas, Europe Middle East Africa, and Asia Pacific Market Landscapes

Regional dynamics are reshaping demand trajectories and innovation ecosystems in distinct ways across the Americas, Europe Middle East Africa, and Asia Pacific landscapes. In the Americas, robust defense budgets and rapid adoption of smart infrastructure projects are fueling demand for both military-grade cooled sensors and uncooled surveillance cameras. At the same time, growing investments in autonomous vehicle research are integrating thermal vision into advanced driver-assistance systems, creating new opportunities for domestic suppliers and global partnerships.

Across Europe, the Middle East, and Africa, regulatory frameworks and security imperatives drive heterogeneous adoption patterns. European industries focus on compliance with stringent environmental standards and data privacy regulations, leading to thermal solutions that emphasize energy efficiency and secure connectivity. Middle Eastern nations, seeking to modernize border security and critical infrastructure, are deploying large-scale surveillance networks. In Africa, resource monitoring and public health initiatives leverage portable infrared sensors for agricultural optimization and disease detection.

In the Asia Pacific region, rapid industrialization and smart city initiatives have established a thriving market for thermal inspection systems, while competitive manufacturing ecosystems in China, Japan, and South Korea continue to advance sensor fabrication techniques. Emerging economies are increasingly adopting uncooled technologies for cost-sensitive applications, creating a layered market environment where high-end cooled platforms coexist with mass-market thermal IMG solutions.

This comprehensive research report examines key regions that drive the evolution of the Infrared Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovation Leadership of Pioneering Infrared Imaging Organizations Driving Breakthroughs and Market Differentiation

Key industry players are pursuing differentiated strategies to secure technological leadership and market influence. Pioneering firms are investing heavily in proprietary sensor materials and microbolometer research to enhance sensitivity and reduce power consumption. At the same time, strategic alliances between semiconductor manufacturers and module integrators are accelerating time to market for next-generation detectors. Business models are evolving beyond pure hardware sales; leading organizations are bundling analytics software packages and cloud-enabled services to deliver end-user value while generating recurring revenue streams.

In addition, several enterprises are expanding their geographic footprint by establishing localized production hubs, allowing them to capitalize on favorable trade agreements and reduce lead times. Venture capital infusion has accelerated start-up innovation, with niche entrants specializing in spectral imaging and edge AI solutions challenging traditional incumbents. Mergers and acquisitions have also reshaped the competitive landscape, enabling companies to fill portfolio gaps in wavelength coverage or distribution reach. Collectively, these strategic maneuvers underscore a market environment defined by rapid technological convergence, collaborative ecosystems, and an ever-increasing emphasis on integrated, data-driven offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infrared Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Vision Technologies GmbH

- Axis Communications AB

- BAE Systems Plc

- Episensors

- Fluke Corporation

- General Dynamics Mission Systems, Inc.

- GMS Instruments BV

- IRay Technology Co., Ltd.

- L3Harris Technologies, Inc.

- Leonardo DRS, Inc.

- LightPath Technologies

- Lynred

- Nippon Avionics Co.,Ltd.

- Opgal Optronics Industries Ltd.

- Ophir Optronics Solutions Ltd.

- Spectron IR

- Teledyne FLIR LLC

- Trinity Electronics Systems Ltd.

- Viper Imaging LLC

- Zhejiang Dali Technology Co., Ltd.

Empowering Industry Leaders with Actionable Strategies to Accelerate Innovation, Optimize Supply Chains, and Capitalize on Emerging Opportunities

Industry leaders should prioritize strategic investments in uncooled detector technology to harness cost efficiencies and simplify system maintenance, while simultaneously advancing research into next-generation materials for enhanced sensitivity in cooled platforms. Diversifying supply chains through a combination of regional manufacturing partnerships and adaptive procurement frameworks will reduce exposure to evolving trade policies and logistical disruptions. Strengthening collaboration with software developers to integrate artificial intelligence and machine learning algorithms at the edge will add value by enabling real-time analytics and autonomous decision-making capabilities.

It is also critical to adopt flexible go-to-market models that encompass both embedded original equipment manufacturer partnerships and aftermarket service offerings, ensuring access to a broad customer base while fostering long-term relationships. Investing in modular product architectures can accelerate customization cycles and facilitate rapid entry into emerging application segments, such as smart city surveillance, automotive sensing suites, and healthcare monitoring devices. Finally, cultivating cross-industry alliances and participating in standardization forums will accelerate interoperability, reduce barriers to adoption, and unlock new market sectors for infrared imaging technologies.

Detailing Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Advanced Analytical Frameworks for Market Clarity

The research methodology underpinning this analysis relied on a rigorous blend of primary and secondary data collection. Primary insights were obtained through in-depth interviews with senior executives, R&D leaders, and procurement specialists across the infrared imaging value chain. These conversations provided firsthand perspectives on technology roadmaps, procurement challenges, and end-user expectations. Secondary research included a comprehensive review of technical white papers, peer-reviewed journal articles, patent filings, and regulatory documents, ensuring a robust foundation for evaluating material innovations and performance metrics.

Quantitative analysis employed both top-down and bottom-up approaches, cross-referencing macroeconomic indicators with company financial disclosures and trade flow data to identify demand drivers and supply constraints. Advanced analytical frameworks, such as scenario modeling and sensitivity analysis, were used to assess the impact of regulatory shifts, tariff changes, and technology adoption rates. The findings were further validated through expert panel workshops, where key assumptions and interpretations were stress-tested against diverse market scenarios to enhance accuracy and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infrared Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infrared Imaging Market, by Product

- Infrared Imaging Market, by Technology

- Infrared Imaging Market, by Wavelength

- Infrared Imaging Market, by Application

- Infrared Imaging Market, by Distribution Channel

- Infrared Imaging Market, by Region

- Infrared Imaging Market, by Group

- Infrared Imaging Market, by Country

- United States Infrared Imaging Market

- China Infrared Imaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Findings and Strategic Imperatives to Harness the Full Potential of Infrared Imaging Technologies in an Evolving Global Landscape

This executive summary has highlighted the shifting terrain of the infrared imaging industry, underscoring the critical interplay between technological innovation, trade policy, and market segmentation. Organizations that embrace advanced detector materials, integrate smart analytics, and diversify their supply chains will be best positioned to capture emerging opportunities. Regional nuances-from the Americas’ defense-driven demand to the Asia Pacific’s rapid industrial growth-underscore the importance of tailored go-to-market strategies and localized partnerships. The competitive landscape continues to evolve through strategic alliances, mergers, and the expansion of service-based business models.

As the sector moves forward, agility and collaboration will be the hallmarks of successful market participants. Stakeholders must proactively monitor regulatory developments, invest in scalable architectures, and foster cross-industry alliances to drive adoption and secure leadership positions. By aligning strategic initiatives with the insights presented here, decision-makers can navigate complexities, mitigate risks, and accelerate the deployment of transformative infrared imaging solutions.

Drive Business Growth and Inform Strategic Decisions by Securing Your Customized Infrared Imaging Market Report with Insightful Expertise from Ketan Rohom

To gain a competitive edge and actionable intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure a customized infrared imaging market report tailored to your strategic needs. By engaging with an industry expert who understands both technical nuances and market dynamics, you will equip your organization with the insights necessary to navigate evolving regulatory environments, maximize technology investments, and prioritize growth opportunities in an increasingly complex global landscape. Take the next step toward informed decision-making and sustained business growth by partnering with a seasoned professional who can deliver a detailed analysis aligned with your corporate objectives and address any bespoke requirements your team may have.

- How big is the Infrared Imaging Market?

- What is the Infrared Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?