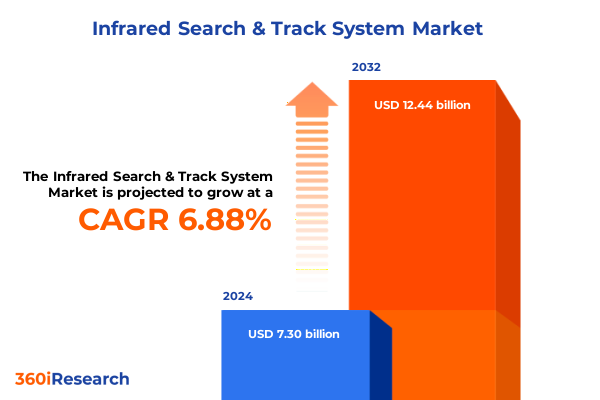

The Infrared Search & Track System Market size was estimated at USD 7.80 billion in 2025 and expected to reach USD 8.32 billion in 2026, at a CAGR of 6.90% to reach USD 12.44 billion by 2032.

Revolutionizing Surveillance Operations Through Infrared Search and Track Systems That Deliver Unmatched Precision Across Critical Domains

Infrared Search and Track systems represent a pivotal advancement in modern surveillance and defense capabilities, harnessing the natural emission of heat energy to detect, identify, and monitor objects across a variety of operational theaters. These systems leverage both cooled and uncooled infrared detector technologies to provide sustained monitoring in conditions where traditional electro-optical sensors might falter. By integrating multi-band infrared sensitivity, contemporary infrared search and track solutions deliver exceptional target discrimination, even under low-contrast and obscured environments, thereby augmenting situational awareness in critical missions.

In recent years, the strategic importance of infrared search and track has surged in response to evolving security threats and the proliferation of unmanned platforms. As geopolitical tensions continue to redefine the nature of surveillance and reconnaissance, the ability to passively detect and track without reliance on active emissions has become a strategic imperative. Consequently, defense and homeland security organizations are accelerating the integration of infrared search and track into airborne, maritime, and ground-based systems to achieve enhanced operational effectiveness.

Moreover, technological innovations in detector materials, signal processing, and sensor fusion are broadening the spectrum of IRST applications. From border control to maritime security, stakeholders are now demanding systems that offer rapid target acquisition, low false alarm rates, and seamless integration with command and control architectures. As the market continues to mature, the imperative for a comprehensive understanding of these systems and their evolving role has never been greater, setting the stage for an in-depth exploration of the transformative shifts reshaping the landscape.

Navigating the Emerging Technological and Operational Paradigm Shifts Reshaping Infrared Search and Track Capabilities in Mission-Critical Applications

The infrared search and track landscape is undergoing a fundamental transformation driven by rapid advancements in sensor fusion, artificial intelligence, and materials science. With the advent of next-generation focal plane arrays and quantum well infrared photodetectors, cooled detector performance has reached new heights in sensitivity and spectral range. Simultaneously, breakthroughs in uncooled microbolometer technology are enabling cost-effective solutions suitable for smaller platforms and budget-constrained programs. Together, these developments are expanding the addressable market for infrared search and track across a broader array of mission profiles.

In addition, the integration of machine learning algorithms for automated target detection and classification is revolutionizing system performance. Advanced on-board analytics now facilitate real-time decision support, allowing operators to focus on critical threats rather than manual cueing. This shift toward cognitive sensing not only enhances the responsiveness of surveillance operations but also reduces operator workload and training requirements.

Furthermore, the growing prevalence of unmanned aerial systems and autonomous surface vessels is creating new deployment scenarios for infrared search and track. Miniaturized, low-power IRST payloads are empowering small drones to conduct persistent surveillance over vast territories, while shipborne and vehicle-mounted configurations are being adapted for rapid threat assessment in contested zones. As interoperability standards continue to evolve, the convergence of multisensor data is establishing a unified operational picture, underscoring the transformative impact of these technological and operational paradigm shifts.

Understanding the Comprehensive Effects of 2025 United States Tariffs on Infrared Search and Track System Development and Global Supply Chains

In 2025, the United States implemented a series of tariffs affecting imports of critical infrared detector materials and subsystems, creating immediate implications for manufacturers and system integrators. The increased cost of specialized cooling components and advanced semiconductor materials has necessitated a re-evaluation of global sourcing strategies. For many suppliers, this has translated into localized manufacturing initiatives aimed at mitigating tariff exposure and controlling lead times.

Consequently, defense primes and first-tier integrators have accelerated investments in domestic production capabilities, fostering partnerships with specialized foundries and thermal component manufacturers. This realignment has spurred innovation in alternative detector materials that bypass tariffed supply chains, while also raising the threshold for new market entrants who face elevated capital requirements.

However, the ripple effects extend beyond cost increases. Tier-two vendors supplying niche optical assemblies have encountered extended qualification cycles, and pricing adjustments have impacted procurement budgets across defense and homeland security agencies. As a result, contract structures are evolving toward performance-based incentives and flexible pricing models to account for ongoing tariff volatility.

Ultimately, while the 2025 tariff measures have introduced complexity into procurement and supply chain planning, they have also catalyzed strategic investments in supply chain resilience and material innovation. Stakeholders capable of navigating these headwinds are poised to secure long-term competitive advantages through enhanced domestic capabilities and diversified sourcing frameworks.

Unveiling Critical Market Segmentation Dimensions That Illuminate Infrared Search and Track System Adoption Trends Across Detector Types Applications and Users

Market segmentation reveals distinct trends across detector types, each offering trade-offs between sensitivity, size, weight, power, and cost. Cooled detectors operating in long-wave infrared, mid-wave infrared, and short-wave infrared bands continue to lead high-end surveillance applications, benefitting from superior thermal contrast resolution. At the same time, uncooled detectors within the same spectral bands are gaining traction in handheld and vehicle-mounted systems, where rapidly deployable, lower-power sensors are essential for tactical flexibility and reduced logistics support.

System type segmentation highlights the divergent requirements of airborne, handheld, shipborne, and vehicle-mounted platforms. Airborne IRST payloads demand rigorous weight-and-balance optimization alongside high frame-rate imaging, whereas handheld units prioritize robustness and ease of use in dismounted operations. Shipborne installations focus on long-range horizon scanning and integration with naval combat management systems, and vehicle-mounted configurations strike a balance between mobility, power supply constraints, and environmental survivability.

Diverse applications such as border control, search and rescue, surveillance, target acquisition, threat detection, and weather monitoring each impose unique performance criteria. Border control operators require persistent, wide-area coverage with rapid alerting, whereas search and rescue missions emphasize high-sensitivity detection under variable climatic conditions. Surveillance and threat detection roles demand low false alarm rates and seamless data transfer, while weather monitoring applications leverage infrared radiometry to deliver actionable meteorological insights.

End users across civil aviation, defense, homeland security, infrastructure protection, and maritime security illustrate the breadth of market demand. Air forces, armies, and navies seek integrated IRST capabilities to augment existing radar and electro-optical suites. Border patrol agencies, customs authorities, and federal law enforcement agencies within homeland security embrace infrared search and track for perimeter monitoring and critical event response. Infrastructure protection stakeholders deploy these systems to safeguard energy sites and transportation hubs, and maritime security organizations leverage them for vessel identification and port surveillance.

This comprehensive research report categorizes the Infrared Search & Track System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Detector Type

- System Type

- Application

- End User

Analyzing Regional Market Dynamics to Identify Strategic Opportunities for Infrared Search and Track Systems Across Global Economic Zones

Regional analysis underscores how geographic dynamics shape infrared search and track deployments. In the Americas, strong defense budgets and homeland security initiatives drive demand for advanced sensor packages across land, sea, and air domains. Collaborative programs between government agencies and private integrators foster a mature ecosystem where domestic innovation is prioritized to support export controls and interoperability with allied partners.

Meanwhile, Europe, the Middle East, and Africa exhibit a tapestry of opportunity and complexity. European nations invest in next-generation airborne IRST for fighter and unmanned platforms, often through multinational consortia. In the Middle East, high-value border security projects and maritime domain awareness requirements stimulate rapid procurement cycles. African markets, though heterogeneous, show growing interest in infrared search and track for anti-poaching and critical infrastructure protection, supported by international aid programs that catalyze technology transfers.

In the Asia-Pacific, the strategic imperative of maritime surveillance and air defense expansion fuels significant acquisitions of shipborne and airborne infrared search and track systems. Regional powers prioritize indigenization strategies and joint ventures to bolster local industrial bases. Cross-border tensions and contested maritime zones compel nations to integrate IRST with broader sensor networks, enabling persistent domain awareness and early warning capabilities.

Across all three regions, regulatory environments, export controls, and local content mandates play pivotal roles in shaping procurement strategies and partnership models. Understanding these nuanced regional drivers is essential for stakeholders seeking to align product roadmaps with evolving end user requirements and geopolitical realities.

This comprehensive research report examines key regions that drive the evolution of the Infrared Search & Track System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Investigating Leading Industry Players Driving Innovation and Competitive Strategies in the Infrared Search and Track System Market Landscape

Leading market participants are advancing their portfolios through strategic R&D investments, technology partnerships, and targeted M&A activity. Established defense primes have augmented their infrared search and track offerings by integrating higher resolution cooled detectors, collaborating with sensor specialists to embed AI-driven analytics directly into the sensor chain. Simultaneously, specialized technology providers are expanding their footprint by developing turnkey IRST modules that can be seamlessly integrated into existing platforms, addressing the growing call for modular and scalable solutions.

Collaborative ventures between aerospace firms and optics manufacturers are driving breakthroughs in lightweight thermal assemblies, reducing overall system size and power consumption without sacrificing performance. Additionally, several companies have pioneered hybrid sensor approaches that combine infrared search and track with electro-optical, low-light, and radar data, delivering a unified target picture and elevating detection probabilities in complex environments.

Competitive differentiation is increasingly linked to software capabilities, with companies offering advanced user interfaces, cloud connectivity for remote monitoring, and cybersecurity-hardened data links. Vendors that provide robust lifecycle support, including predictive maintenance analytics and training simulators, are securing long-term contracts and enhancing customer retention.

As the market evolves, firms that can balance innovation with cost competitiveness and regulatory compliance will maintain leadership positions. Those that anticipate end user demands, invest in emerging detector materials, and cultivate global partnerships are best positioned to capture growth opportunities across defense, homeland security, and civilian markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infrared Search & Track System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Curtiss-Wright Corporation

- Diehl Defence GmbH & Co. KG

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hensoldt AG

- HGH Systèmes Infrarouges SAS

- Honeywell International Inc.

- Indra Sistemas S.A.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Lynred

- MBDA UK Limited

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

- Teledyne FLIR LLC

- Thales S.A.

- Thermoteknix Systems Ltd

- Tonbo Imaging Private Limited

Empowering Decision-Makers with Tactical Recommendations to Enhance Adoption and Performance of Infrared Search and Track Solutions in Strategic Operations

To capitalize on the evolving infrared search and track ecosystem, industry leaders should prioritize integrated sensor fusion strategies that combine infrared data with complementary modalities such as radar and electro-optical feeds. This holistic approach enhances detection accuracy and supports cross-domain interoperability. Furthermore, investing in artificial intelligence and machine learning algorithms for adaptive target recognition will streamline processing workflows and deliver actionable intelligence in real time.

In parallel, organizations must diversify supply chains by cultivating relationships with multiple detector foundries and optical component manufacturers. By securing alternative sources for critical materials, stakeholders can insulate themselves from tariff-related disruptions and geopolitical instabilities. Additionally, pursuing vertical integration for key subsystems fosters tighter quality control and accelerates product development cycles.

Engaging with standards bodies and cross-industry working groups is also imperative. Active participation in the development of interoperability protocols and data exchange frameworks will ensure that infrared search and track systems can be seamlessly integrated into coalition networks and joint operations. In tandem, providing comprehensive training programs and simulation environments will accelerate operator proficiency and system adoption.

Finally, targeting emerging markets with tailored solutions-such as compact, uncooled payloads optimized for small unmanned platforms-can open new revenue streams. By aligning product roadmaps with specific regional security priorities and environmental conditions, companies can establish early footprints and cultivate enduring partnerships.

Detailing the Rigorous Research Methodology Employed to Analyze Infrared Search and Track System Market Dynamics and Data Integrity Processes

This analysis is founded upon a rigorous research methodology combining primary and secondary sources to ensure data integrity and comprehensive market coverage. Primary research involved in-depth interviews with sensor manufacturers, system integrators, defense officials, and end users across civil aviation, homeland security, and maritime security domains. These discussions yielded qualitative insights into procurement drivers, performance challenges, and future technology roadmaps.

Secondary research encompassed a thorough review of industry publications, government procurement records, technical white papers, and patent filings to validate market trends and technological advancements. Trade journals and regulatory filings provided context on tariff measures and regional policy shifts impacting the supply chain.

Quantitative analysis was conducted by triangulating data from vendor disclosures, trade association statistics, and publicly available budget allocations. Metrics such as sensor deployment volumes, platform retrofit cycles, and R&D expenditure patterns were synthesized to identify growth trajectories and investment priorities.

Finally, the findings underwent multiple layers of validation, including peer reviews by domain experts and cross-verification against independent market data sets. This multi-faceted methodology ensures that the conclusions and recommendations presented herein reflect a balanced, accurate, and actionable understanding of the infrared search and track system landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infrared Search & Track System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infrared Search & Track System Market, by Detector Type

- Infrared Search & Track System Market, by System Type

- Infrared Search & Track System Market, by Application

- Infrared Search & Track System Market, by End User

- Infrared Search & Track System Market, by Region

- Infrared Search & Track System Market, by Group

- Infrared Search & Track System Market, by Country

- United States Infrared Search & Track System Market

- China Infrared Search & Track System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Strategic Implications from Infrared Search and Track System Market Analysis to Inform Executive Decisions

This report has synthesized critical insights into the technological innovations, market drivers, and competitive dynamics that define the infrared search and track system sector. By evaluating the impact of the 2025 United States tariffs, delineating key segmentation dimensions, and assessing regional nuances, stakeholders are equipped with a nuanced perspective on where value creation and adoption momentum converge.

Strategic implications emerge for both incumbent defense primes and emerging technology providers seeking to navigate supply chain complexities and differentiated performance requirements. The convergence of cooled and uncooled detector advancements, the integration of AI-driven analytics, and the expansion of deployment scenarios across manned and unmanned platforms underscore the transformative trajectory of IRST capabilities.

Moving forward, aligning procurement strategies with evolving regulatory frameworks, fostering collaborative R&D partnerships, and embracing modular, scalable system architectures will be essential. By internalizing the recommendations presented herein, decision-makers can mitigate risk, optimize resource allocation, and accelerate time to operational readiness.

Ultimately, the insights contained in this analysis provide the foundation for informed executive decisions, guiding investment roadmaps and ensuring that infrared search and track systems continue to deliver unparalleled situational awareness in an increasingly contested global environment.

Contact Director of Sales and Marketing Ketan Rohom to Acquire an In-Depth Infrared Search and Track System Market Research Report Meeting Strategic Objectives

To explore this in-depth analysis and gain a competitive edge in the evolving infrared search and track system market, reach out to Director of Sales and Marketing Ketan Rohom. He will guide you through the report’s comprehensive findings, tailored to your strategic objectives and operational requirements. By engaging directly with Ketan Rohom, your organization can secure actionable intelligence and expert consultation that aligns with your mission priorities and enhances your investment decisions. Contact him today to arrange a briefing and acquire the full market research report that will empower your team with the insights needed to capitalize on emerging opportunities and maintain technological leadership.

- How big is the Infrared Search & Track System Market?

- What is the Infrared Search & Track System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?