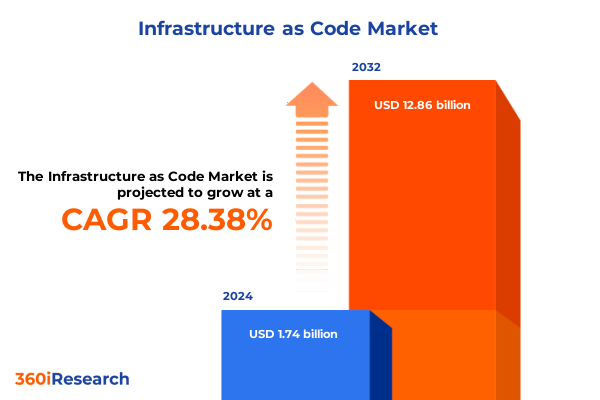

The Infrastructure as Code Market size was estimated at USD 2.20 billion in 2025 and expected to reach USD 2.80 billion in 2026, at a CAGR of 28.62% to reach USD 12.86 billion by 2032.

Unveiling the Fundamentals of Infrastructure as Code to Navigate Modern Digital Transformation and Accelerate IT Efficiency

Infrastructure as code (IaC) has emerged as a transformative approach that replaces manual configuration workflows with programmable, declarative scripts, enabling organizations to treat infrastructure components as versioned, reusable artifacts. This paradigm shift fosters the same principles of code through modular templates, automated provisioning, and continuous integration pipelines, thereby reducing human error while accelerating deployment speed. Across cloud, on-premises, and hybrid environments, infrastructure teams now leverage code repositories to orchestrate network, compute, and storage resources alongside container and serverless functions, embracing the agility demanded by digital-first initiatives.

As business units increasingly demand rapid experimentation, IaC aligns closely with DevOps methodologies by embedding infrastructure changes into continuous delivery cycles. Engineers can apply rigorous testing, peer reviews, and rollbacks for environment configurations just as they do for application code. Security and compliance are likewise programmatically enforced through policy-as-code frameworks, ensuring that guardrails are consistently applied-even as underlying platforms evolve. This alignment between development, operations, and security teams underpins a governance model that is both resilient and auditable.

Examining the Game-Changing Technological Disruptions Redefining Infrastructure Management Paradigms in the Era of Code-Driven Environments

The landscape of infrastructure management has been reshaped by unprecedented technological disruptions, catalyzing a shift from manual orchestration to code-driven governance models. The adoption of containerization and microservices architectures, paired with IaC, empowers teams to define entire application stacks and network topologies with minimal human intervention. GitOps workflows uniquely integrate inbound pull requests from version control systems to trigger platform updates, creating a closed feedback loop that embeds operational maturity directly within code changes.

Moreover, the infusion of artificial intelligence and machine learning into infrastructure operations is augmenting predictive maintenance and auto-remediation capabilities. By analyzing telemetry data, systems can preemptively adjust resource allocations or remediate configuration drift-ensuring optimal performance at scale. Meanwhile, the drive toward edge computing and distributed architectures is extending IaC practices to remote locations and micro data centers, further reinforcing the need for standardized, code-centric provisioning methodologies. As organizations pursue multi-cloud strategies, these transformative shifts will continue to redefine how infrastructure is designed, deployed, and governed.

Analyzing the Aggregate Consequences of 2025 United States Tariffs on Infrastructure as Code Adoption and Global Supply Chain Dynamics

Throughout 2025, new tariff measures imposed by the United States have introduced cascading effects on infrastructure hardware, component sourcing, and cloud service cost structures. Levies targeting advanced semiconductor wafers and specialized networking equipment have driven manufacturers to reevaluate supply chains, often passing increased costs onto service providers and, ultimately, end users. As capital expenditures rise, organizations are reassessing the balance between on-premises clusters and cloud-native deployments to mitigate exposure to fluctuating component pricing.

Simultaneously, the broader technology ecosystem has responded with localized manufacturing and regional alliances to circumvent tariff-related delays and cost premiums. Infrastructure as code practices have offered a degree of insulation, enabling rapid reconfiguration of resource allocations across different cloud regions or vendor platforms. Yet, procurement cycles have lengthened as CFOs demand more scenario planning and cost analysis, prompting DevOps teams to build cost-optimization modules directly into IaC templates. In this manner, tariff volatility has accelerated the adoption of real-time budgeting insights and programmable spend controls-enhancing financial governance within infrastructure orchestration.

Uncovering Actionable Segmentation Perspectives to Guide Strategic Decision-Making in Diverse Infrastructure as Code Market Niches

A nuanced view of the IaC landscape reveals critical segmentation dimensions that inform targeted strategies and investment priorities. When dissecting offerings by type, managed services and professional services coalesce around automation consultancy, implementation, support, and training frameworks that guide enterprises through IaC adoption journeys. These service lines complement an evolving tool ecosystem, which spans open source platforms favored for community-driven extensibility alongside commercial solutions that deliver integrated support and enterprise grade security features.

Equally, deployment models frame distinct operating paradigms: public, private, and hybrid clouds each present unique governance, compliance, and cost profiles. Hybrid cloud strategies, in particular, leverage seamless IaC abstractions to unify on-premises systems with public cloud elasticity, while private clouds remain a stronghold for regulated industries demanding stringent data sovereignty. Meanwhile, organizational scale stratifies requirements further-large enterprises seek broad tooling interoperability and centralized policy enforcement, whereas small and medium businesses prioritize turnkey templates and low-touch automation that accelerate initial deployments.

Across industry verticals, sector-specific patterns emerge. Financial institutions demand high-assurance IaC constructs with embedded encryption and audit logging. Government and defense agencies emphasize configuration immutability and compliance with rigorous standards. Healthcare and life sciences organizations balance innovation with patient-data privacy regulations. Telecommunications and IT services embrace IaC to manage sprawling network topologies. Retail and consumer goods companies leverage code-based infrastructure to orchestrate intensive e-commerce workloads during peak shopping cycles.

This comprehensive research report categorizes the Infrastructure as Code market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering Type

- Deployment Model

- Organization Size

- Industry Vertical

Illuminating Regional Variances Shaping Infrastructure as Code Strategies Across the Americas Europe Middle East Africa and Asia-Pacific

Regional nuances in IaC adoption underscore the importance of tailored approaches that address differing market maturity, regulatory environments, and digital infrastructure investments. In the Americas, early adopters within technology and financial hubs have driven robust demand for code-centric automation, leveraging public cloud innovations alongside native tool integrations to accelerate continuous delivery pipelines. Enterprises across North and South America are investing heavily in upskilling programs, recognizing that the human capital required to author, review, and secure infrastructure templates is integral to operational resilience.

Meanwhile, Europe, Middle East, and Africa markets exhibit measured growth, guided by data protection regulations and regional cloud sovereignty mandates. Organizations in these regions often favor private cloud deployments and open source toolchains that align with local governance requirements. Collaborative research consortia and government-backed initiatives have bolstered private-public partnerships, funding pilot projects that demonstrate the efficacy of declarative infrastructure models in meeting strict compliance objectives.

In Asia-Pacific, rapid digitalization and aggressive cloud adoption have accelerated IaC uptake across both developed and emerging economies. Hyperscale providers have localized cloud disruptions, and local startups are innovating around edge orchestration and micro data centers. As a result, infrastructure teams are embedding policy-as-code to navigate complex regulatory landscapes, balancing speed with the necessity of region-specific security postures.

This comprehensive research report examines key regions that drive the evolution of the Infrastructure as Code market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Players and Their Pioneering Contributions Driving Evolution and Competitive Advantage in the Infrastructure as Code Ecosystem

Leading organizations have emerged at the forefront of the IaC revolution by continuously refining their product portfolios and strengthening ecosystem alliances. Terraform’s provider plug-in architecture, for example, offers extensive coverage across cloud, network, and third-party services, while its enterprise platform introduces policy enforcement and collaboration layers. Similar patterns are evident with AWS CloudFormation and Azure Resource Manager, which deliver native integration with their respective cloud services alongside their templating frameworks.

Open source projects such as Ansible and Pulumi have also gained traction by offering imperative and polyglot approaches that resonate with developers seeking code flexibility. Commercial vendors like Chef and Puppet have diversified into hybrid and multi-cloud orchestration, embedding machine learning for drift detection and self-healing capabilities. Collectively, these market participants drive innovation through community contributions, strategic partnerships, and vertical-specific solution accelerators-each reinforcing competitive positioning while expanding the scope of IaC use cases.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infrastructure as Code market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Arista Networks, Inc.

- BMC Software, Inc.

- Broadcom Inc.

- Canonical Group Limited

- Cisco Systems, Inc.

- Dell Technologies Inc.

- DigitalOcean Holdings, Inc.

- F5, Inc.

- GitLab Inc.

- Google LLC

- HashiCorp, Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Juniper Networks, Inc.

- Microsoft Corporation

- NetApp, Inc.

- Oracle Corporation

- Progress Software Corporation

- Pulumi Corporation

- Puppet, Inc.

- Rackspace Technology, Inc.

- Rancher Labs, Inc.

- Red Hat, Inc.

- ServiceNow, Inc.

- VMware, Inc.

Delivering Strategic Roadmaps and Actionable Guidance to Empower Industry Leaders in Harnessing the Transformative Potential of Infrastructure as Code

To capitalize on IaC’s transformative potential, industry leaders should prioritize a phased implementation roadmap that begins with establishing a shared code repository and governance framework. This foundation enables consistent versioning, automated testing, and audit trails for all infrastructure changes. Concurrently, organizations must invest in upskilling programs that cultivate a unified skill set across development, operations, and security teams-bridging traditional silos and fostering cross-functional collaboration.

Next, leaders should evaluate tool compatibility against their existing tech stacks, selecting solutions that complement cloud providers and network fabric designs. Incorporating policy-as-code libraries early ensures compliance is embedded within provisioning workflows, reducing remediation costs over time. In parallel, engineering teams can deploy cost-optimization modules that dynamically adjust resource allocations based on utilization metrics, mitigating the financial impact of hardware tariffs or on-premises capital investments.

Finally, embracing a culture of continuous improvement-through regular IaC retrospectives, peer reviews, and community engagement-will sustain momentum and cultivate innovation. By integrating feedback loops from production telemetry, teams can refine templates, identify bottlenecks, and validate best practices. This disciplined approach not only accelerates time-to-value but also solidifies IaC as a strategic enabler for digital transformation and long-term competitive advantage.

Outlining Rigorous Research Frameworks Employing Comprehensive Qualitative and Quantitative Approaches to Ensure Reliability and Validity

Our research methodology combines a robust secondary analysis of publicly available technical whitepapers, vendor documentation, and regulatory filings with primary data collection from expert interviews, surveys, and advisory board consultations. We conducted in-depth discussions with C-level executives, DevOps architects, and platform engineers representing a cross-section of industries, ensuring a balanced perspective on emerging IaC trends and adoption barriers.

Quantitative insights were derived from structured online surveys targeting infrastructure managers and software engineers, focusing on tool preferences, deployment challenges, and strategic priorities. These were supplemented by real-time telemetry data aggregated from leading cloud and automation platforms-providing empirical validation of anecdotal findings. We also leveraged a series of vendor briefings and proof-of-concept implementations to test best-practice frameworks under diverse environmental constraints.

Data triangulation and rigorous cross-validation were employed throughout the analysis to mitigate bias and enhance reliability. All findings were subjected to peer review by our internal expert panel, ensuring that interpretations align with observed market dynamics and technological advancements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infrastructure as Code market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infrastructure as Code Market, by Offering Type

- Infrastructure as Code Market, by Deployment Model

- Infrastructure as Code Market, by Organization Size

- Infrastructure as Code Market, by Industry Vertical

- Infrastructure as Code Market, by Region

- Infrastructure as Code Market, by Group

- Infrastructure as Code Market, by Country

- United States Infrastructure as Code Market

- China Infrastructure as Code Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Critical Learnings and Key Takeaways to Reinforce Strategic Imperatives and Foster Continued Adoption of Infrastructure as Code

The evolution of infrastructure as code underscores a fundamental shift toward programmable, policy-driven infrastructure management that transcends traditional operational silos. Key learnings reveal that embedding security and compliance into code reduces manual bottlenecks, while investing in upskilling fosters resilient, cross-functional teams capable of iterative innovation. Furthermore, tariff-induced cost pressures have reinforced the strategic value of IaC in delivering financial transparency and agile resource reallocation across geopolitical boundaries.

Segmentation analysis highlights the importance of tailoring offerings to organizational scale, industry regulations, and preferred deployment models, while vendor insights demonstrate a competitive landscape defined by open source extensibility and enterprise-grade governance controls. Regional observations affirm that while mature markets emphasize private cloud sovereignty, emerging economies prioritize rapid deployment and edge orchestration, driving diverse strategic imperatives.

Looking ahead, infrastructure as code will remain a cornerstone of digital transformation initiatives, underpinning next-generation architectures that leverage containers, serverless functions, and AI-driven operations. Organizations that adopt disciplined, code-centric approaches will be best positioned to navigate evolving technological landscapes, regulatory complexities, and economic headwinds-ultimately achieving greater speed, security, and cost efficiency.

Encouraging Engaging Dialogue With Ketan Rohom to Unlock Exclusive Insights and Propel Your Infrastructure as Code Strategy Forward

We welcome you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this infrastructure as code market research report can serve as the cornerstone of your strategic planning and operational excellence. Ketan brings a deep understanding of emerging market dynamics and can tailor insights to address your organization’s unique challenges and objectives. By scheduling a personalized consultation, you will gain access to exclusive data analysis, scenario modeling, and priority previews that empower you to optimize cost structures, accelerate deployment timelines, and reinforce governance frameworks. Connect with Ketan today to unlock early-bird pricing, customized deliverables, and ongoing advisory support designed to drive sustained growth and competitive differentiation within an increasingly code-centric infrastructure landscape

- How big is the Infrastructure as Code Market?

- What is the Infrastructure as Code Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?