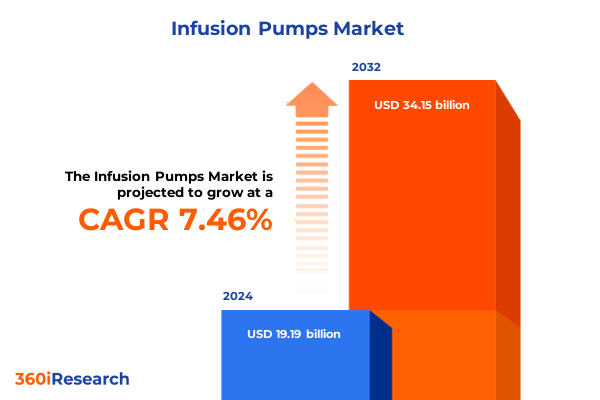

The Infusion Pumps Market size was estimated at USD 20.55 billion in 2025 and expected to reach USD 22.03 billion in 2026, at a CAGR of 7.52% to reach USD 34.15 billion by 2032.

Setting the Stage for Infusion Pump Market Evolution with Key Drivers, Unmet Needs, and Strategic Imperatives Shaping Healthcare Delivery

As healthcare delivery systems evolve under mounting cost pressures and patient expectations, infusion pumps stand at the forefront of therapeutic innovation. These critical devices, which enable precise administration of fluids and medications-from pain management to oncology therapy-play an indispensable role in achieving optimal clinical outcomes. Recent advancements in pump design, connectivity, and battery life have revolutionized point-of-care capabilities, allowing clinicians to personalize treatment regimens and reduce medication errors. Consequently, understanding the multifaceted drivers shaping this technology becomes essential for stakeholders seeking to navigate a competitive landscape marked by rapid technological convergence and stringent regulatory demands.

In addition to technological progress, demographic shifts such as an aging population and the growing prevalence of chronic diseases have intensified demand for outpatient and homecare infusion solutions. This trend challenges manufacturers to balance portability with sophisticated delivery features, while payers and providers strive to maintain cost efficiencies. Moreover, the integration of smart pumping systems with electronic health records and remote monitoring platforms underscores the industry’s shift toward data-driven care models. Together, these elements establish a dynamic environment in which innovation, compliance, and patient safety converge, setting the stage for transformative market developments.

Uncovering Fundamental Transformations Redefining Infusion Pump Technology, Clinical Practices, and Patient-Centric Care Models Globally

The infusion pump sector is experiencing transformative shifts driven by the convergence of digital health ecosystems and next-generation device architectures. Intelligent connectivity now empowers real-time monitoring of infusion parameters, enabling proactive intervention and ensuring treatment adherence. Beyond mere data logging, closed-loop systems are emerging to adjust flow rates automatically based on patient responses, marking a paradigm shift from manual titration to autonomous therapy management. This capability not only enhances clinical precision but also reduces nursing workload, fostering operational efficiencies across acute and non-acute settings.

Concurrently, the rise of personalized medicine has propelled the adoption of modular and multi-drug infusion platforms. These systems allow seamless switching among anesthetics, chemotherapeutics, and nutritional feeds without extensive reprogramming, addressing the growing complexity of polypharmacy regimens. Additionally, patient safety features such as barcode verification and dose-error reduction software have become table stakes, reflecting an industry-wide commitment to mitigating adverse events. As cybersecurity threats intensify, pump manufacturers are also investing in robust encryption and authentication protocols, reinforcing the integrity of data and device operations. Altogether, these shifts underscore a move toward smarter, safer, and more versatile infusion solutions capable of meeting diverse clinical demands.

Evaluating How 2025 United States Medical Device Tariff Measures Are Reshaping Supply Chains, Pricing Models, and Competitive Dynamics

The implementation of new United States tariffs on medical devices in early 2025 has introduced far-reaching implications for infusion pump manufacturers and healthcare providers alike. By imposing additional duties on imported components and finished devices, cost structures across supply chains have shifted significantly. Manufacturers sourcing syringe pump mechanisms or specialized tubing from overseas suppliers have faced immediate raw material price hikes, necessitating strategic adjustments in procurement and production planning. In response, some organizations have accelerated domestic sourcing initiatives and renegotiated supplier agreements to mitigate escalating expenditures.

Meanwhile, the downstream impact on healthcare facilities is undeniable. Hospitals and clinics, already contending with constrained budgets, now face higher acquisition costs for volumetric infusion pumps equipped with advanced safety features. This scenario has spurred renewed interest in elastomeric pump alternatives for low-acuity applications, as these disposable, mechanically driven devices remain exempt from certain tariff classifications. Additionally, tariff-induced pricing pressures have compelled manufacturers to reevaluate global manufacturing footprints, exploring assembly expansions in tariff-free regions to preserve competitiveness. As the market continues to balance cost containment with the imperative for high-performance equipment, strategic responses to these tariffs will shape the competitive hierarchy among pump producers.

Decoding Complex Infusion Pump Market Segmentation Dynamics through Product Types, Administration Modes, Categories, Applications, End Users, and Distribution Channels

A nuanced understanding of infusion pump segmentation reveals critical avenues for market differentiation and growth. When examining product types, elastomeric infusion pumps offer simplicity and portability for short-term therapies, whereas syringe infusion pumps cater to precise, low-volume dosing needs. Volumetric infusion pumps, by contrast, excel in high-volume, continuous administration scenarios, particularly in intensive care units. Mode of administration further refines clinical use cases: continuous infusion models support steady drug delivery for pain management and nutrition, while intermittent infusion devices enable tailored dosing schedules in oncology and anesthesia.

Category distinctions shed light on deployment settings, with portable infusion pumps empowering homecare and ambulatory clinics through compact design and battery backup capabilities, while stationary infusion systems anchor hospital wards with advanced programmability and integration features. Application-based segmentation highlights therapeutic domains such as anesthesia delivery during surgical procedures, targeted chemotherapy regimens in oncology therapy, patient-controlled analgesia for pain management, and nutrient infusion within parenteral nutrition programs. Insights into end-user adoption patterns demonstrate that ambulatory care centers and clinics prioritize ease of use and mobility, homecare settings demand intuitive interfaces for non-clinical caregivers, and hospitals focus on interoperability with electronic health record systems. Lastly, distribution channels ranging from hospital pharmacies to online and retail pharmacy networks influence device accessibility and purchasing dynamics, underscoring the importance of channel-specific marketing and service support strategies.

This comprehensive research report categorizes the Infusion Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Mode of Administration

- Category

- Application

- End User

- Distribution Channel

Analyzing Distinct Regional Market Characteristics across the Americas, Europe Middle East Africa, and Asia-Pacific Driving Infusion Pump Innovation and Adoption

Regional market characteristics exert profound influence over infusion pump adoption and innovation trajectories. In the Americas, robust healthcare infrastructure and government initiatives promoting home infusion therapy have driven widespread utilization of portable pump systems. The United States, in particular, benefits from extensive reimbursement frameworks and a strong emphasis on patient safety protocols, which accelerate the integration of smart infusion devices within acute and ambulatory care settings.

In Europe, Middle East, and Africa, divergent regulatory landscapes and varying healthcare spending levels shape market growth. Western European nations lead in adopting high-end volumetric and syringe pump solutions, spurred by stringent clinical guidelines and well-established hospital networks. Conversely, emerging markets in the Middle East and Africa increasingly rely on cost-effective elastomeric pumps and contract manufacturing partnerships to expand access to infusion therapies. Across this region, harmonization efforts led by regulatory bodies aim to streamline device approvals, fostering a more predictable environment for multinational manufacturers.

Asia-Pacific presents a mosaic of growth opportunities fueled by expanding healthcare access and rising chronic disease prevalence. Nations such as China and India invest heavily in hospital modernization and homecare programs, incentivizing local production and technology transfer agreements. Japan, renowned for its precision engineering prowess, continues to push the envelope in device miniaturization and connectivity. Collectively, these regional dynamics illustrate how localized drivers and policy frameworks inform strategic priorities for infusion pump stakeholders worldwide.

This comprehensive research report examines key regions that drive the evolution of the Infusion Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positioning Competitive Advantages Product Portfolios and Innovation Pathways of Leading Infusion Pump Manufacturers

Industry leaders are forging competitive advantages through targeted investments and strategic partnerships. One major device manufacturer has expanded its research and development portfolio by integrating artificial intelligence-driven dosing algorithms, thereby differentiating its volumetric pump lineup with predictive infusion adjustments. Another prominent supplier has pursued a multi-tier product strategy, offering a spectrum of syringe pump configurations that span basic functionality to advanced network integration, capturing both emerging and mature market segments.

Collaboration between technology firms and medical device companies is also accelerating. For instance, partnerships focused on embedding Internet of Medical Things platforms into portable pumps enable real-time telemetry, remote troubleshooting, and firmware updates, enhancing overall device uptime. Concurrently, leading regional players in Asia-Pacific are leveraging localized manufacturing expertise to optimize cost structures while customizing pump features to meet regional clinical protocols. Meanwhile, select contract manufacturing organizations are securing long-term agreements to produce elastomeric pumps at scale, highlighting a shift toward flexible production models that respond to tariff and logistical challenges. These initiatives demonstrate how innovation, collaboration, and operational agility define the competitive landscape for infusion pump manufacturers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Infusion Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abbott Laboratories

- Avanos Medical, Inc.

- B. Braun SE

- Baxter International Inc.

- Bayer AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Canadian Hospital Specialties Limited

- Chemyx Inc.

- Epic Medical Pty Ltd.

- Fresenius Se & Co. KGaA

- FUJIFILM Corporation

- GE HealthCare Technologies Inc.

- ICU Medical, Inc.

- Insulet Corporation

- Intera Oncology, Inc.

- Intuvie Holdings LLC

- Ivenix, Inc.

- JMS Co., Ltd.

- Longer Precision Pump Co. Ltd. by Halma PLC

- Medline Industries, LP

- Medtronic PLC

- Merck KGaA

- Micrel Medical Devices SA

- Moog Inc.

- Narang Medical Limited

- Nipro Corporation

- Shenzhen MedRena Biotech Co., Ltd.

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- Siemens AG

- SOOIL Developments Co., Ltd.

- Tandem Diabetes Care, Inc.

- Teleflex Incorporated

- Terumo Corporation

- Thermo Fisher Scientific Inc.

- Ypsomed AG

Providing Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Market Trends Overcome Regulatory Challenges and Accelerate Growth

Industry leaders seeking to capitalize on emerging opportunities must adopt a multifaceted strategy. First, prioritizing integration of smart monitoring and closed-loop control features will differentiate high-end device offerings and address escalating demands for patient safety. By incorporating advanced analytics into pump software, manufacturers can deliver actionable clinical insights and facilitate preventive maintenance programs that reduce device downtime.

Second, diversifying supply chains through dual-source strategies and regional assembly operations will mitigate tariff risks and enhance resilience. Establishing satellite manufacturing hubs in key market regions ensures faster time-to-market and compliance with local regulatory requirements. Third, cultivating strong partnerships with healthcare providers and payers can unlock value-based purchasing models, wherein device performance and patient outcomes are jointly measured. Finally, focusing on user-centric design improvements-such as intuitive interfaces for homecare caregivers and modular add-ons for clinic workflows-will expand device adoption across varied care settings. By executing these recommendations, companies can position themselves at the vanguard of infusion therapy innovation.

Outlining Comprehensive Research Methodology Integrating Primary Interviews Secondary Data Analysis and Rigorous Validation Processes to Ensure Report Accuracy and Reliability

This report’s findings are grounded in a rigorous research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with hospital procurement directors, biomedical engineers, and clinician end users to capture frontline perspectives on device performance and unmet needs. Supplementing these insights, secondary research encompassed analysis of regulatory filings, patent databases, and peer-reviewed clinical studies to trace technological evolution and compliance landscapes.

Quantitative data collection included examination of import-export records, tariff schedules, and supplier contracts to assess pricing shifts and supply chain disruptions. Researchers applied triangulation techniques to cross-validate information from disparate sources, ensuring reliability and minimizing biases. Throughout the analysis, a multi-stakeholder validation process-comprising advisory panels of infusion therapy experts and quality assurance professionals-provided critical feedback and endorsed key conclusions. This methodological rigor underpins the credibility of the strategic insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Infusion Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Infusion Pumps Market, by Product Type

- Infusion Pumps Market, by Mode of Administration

- Infusion Pumps Market, by Category

- Infusion Pumps Market, by Application

- Infusion Pumps Market, by End User

- Infusion Pumps Market, by Distribution Channel

- Infusion Pumps Market, by Region

- Infusion Pumps Market, by Group

- Infusion Pumps Market, by Country

- United States Infusion Pumps Market

- China Infusion Pumps Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Insights to Guide Decision-Makers Toward Effective Deployment of Infusion Pump Solutions in Evolving Healthcare Environments

The infusion pump market is poised at a critical juncture, where innovation and regulation intersect to redefine therapeutic delivery standards. Advanced connectivity features, combined with automated infusion controls, promise to elevate patient safety metrics and streamline clinical workflows. Yet, external factors such as tariff-induced cost pressures and regional regulatory divergences demand agile strategic responses to maintain market resilience.

Understanding segmentation nuances-ranging from product types like elastomeric versus volumetric pumps to varied applications in anesthesia, oncology, and parenteral nutrition-enables stakeholders to tailor offerings that address specific clinical scenarios. Regional insights reveal that localized manufacturing and policy alignment can unlock growth in high-potential markets. Moreover, leading companies are demonstrating the value of strategic partnerships and differentiated product portfolios in capturing market share.

Ultimately, decision-makers equipped with these insights will be better positioned to navigate complexities, seize emerging opportunities, and drive sustainable growth across the infusion pump landscape.

Connect with Associate Director Ketan Rohom to Unlock Exclusive Market Research Insights and Propel Your Infusion Pump Strategy Forward

Ready to transform your strategic planning with unparalleled market intelligence, you can engage directly with Associate Director Ketan Rohom to secure comprehensive insights and gain a competitive edge. By connecting with this expert, you will unlock in-depth analyses of tariff impacts, segmentation dynamics, regional outlooks, and leading company strategies, empowering you to make informed decisions that drive growth and profitability. Reach out now to access the full research report and elevate your infusion pump initiatives to new heights, leveraging actionable data and expert guidance for decisive advantage

- How big is the Infusion Pumps Market?

- What is the Infusion Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?