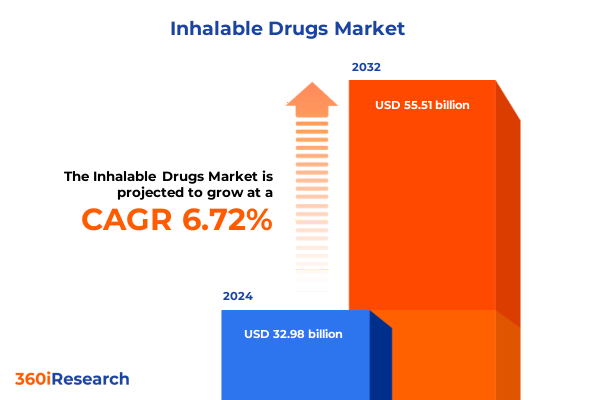

The Inhalable Drugs Market size was estimated at USD 34.59 billion in 2025 and expected to reach USD 36.28 billion in 2026, at a CAGR of 6.99% to reach USD 55.51 billion by 2032.

Laying the Groundwork for Inhalable Drug Delivery: Contextualizing the Rise of Respiratory Therapeutics and Emerging Trends Redefining Patient Outcomes Worldwide

Inhalable drug delivery has emerged as a cornerstone of modern respiratory therapy, offering a direct route to the lungs that enhances therapeutic efficacy while minimizing systemic side effects. Over recent years, the field has experienced significant momentum driven by a convergence of technological innovation and escalating chronic respiratory disease prevalence. As healthcare systems worldwide grapple with increasing instances of asthma, chronic obstructive pulmonary disease, cystic fibrosis, and respiratory allergies, inhalable therapeutics provide a noninvasive and patient-friendly solution that aligns with evolving treatment paradigms.

At the heart of this shift is the recognition that effective lungs–targeted delivery not only improves drug bioavailability but also accelerates onset of action, which is critical for acute respiratory events. Moreover, pandemic-related disruptions underscored the need for scalable delivery platforms that can adapt rapidly to emerging pathogens and patient needs. In response, industry stakeholders accelerated investment in novel formulations, digital monitoring integration, and device innovations aimed at boosting adherence and outcomes.

This executive summary presents a concise yet thorough exploration of the inhalable drug delivery landscape. Starting with an overview of core technological drivers and emerging trends, the report proceeds to analyze transformative shifts, regulatory and tariff-induced pressures, segmentation dynamics, regional footprints, competitive positioning, and strategic imperatives. By synthesizing these insights, decision-makers are equipped to navigate a rapidly evolving market and capitalize on the next wave of respiratory therapeutic advancements.

Uncovering Fundamental Shifts in Respiratory Drug Delivery: From Smart Inhalers to Personalized Therapies Reshaping the Industry Landscape for Better Patient Engagement

The inhalable drug delivery arena is undergoing a profound evolution as digital health convergence and personalized medicine realign the traditional boundaries of respiratory care. Digital smart inhalers equipped with sensors, connected via Bluetooth to mobile applications and cloud-based platforms, are enabling unprecedented levels of patient engagement. These devices not only capture usage patterns in real time but also offer adherence nudges and remote monitoring for healthcare providers. Consequently, the feedback loop between patient behavior and clinical decision-making has tightened, ushering in a new era of data-driven care.

Simultaneously, the industry is witnessing a surge in customized formulation strategies tailored to individual phenotypes and disease endotypes. Advances in particle engineering and excipient selection are facilitating precise drug deposition within targeted regions of the lung, which in turn maximizes therapeutic impact and minimizes off-target exposure. Alongside these formulation breakthroughs, regulatory bodies are increasingly receptive to adaptive trial designs and real-world evidence, encouraging manufacturers to innovate without compromising on safety standards.

These combined forces are reshaping competitive dynamics, prompting established pharmaceutical players and nimble biotech startups alike to invest in integrated digital–device–drug solutions. As a result, the inhalable drug delivery landscape is evolving into a patient-centric ecosystem where technology convergence and regulatory flexibility coalesce to unlock a new generation of respiratory therapies.

Examining the Ripple Effects of 2025 United States Tariff Measures on the Respiratory Inhalable Drug Supply Chain and Manufacturer Cost Structures

In 2025, the United States implemented a series of targeted tariffs affecting components and active pharmaceutical ingredients utilized in inhalable drug delivery. These measures were introduced as part of broader trade initiatives aimed at protecting domestic manufacturing, yet they have generated ripple effects throughout the respiratory therapeutics supply chain. Manufacturers reliant on imported excipients, propellants, and precision-engineered device components have encountered higher input costs, prompting a reevaluation of sourcing strategies.

Consequently, many organizations have accelerated nearshoring efforts, forging partnerships with domestic suppliers to mitigate exposure to tariff-related price volatility. This realignment has not only introduced resilience into the procurement pipeline but also led to incremental investments in local production capacity. At the same time, some entities have opted to absorb a portion of the cost increases to preserve price competitiveness and maintain end-user affordability.

Looking ahead, the cumulative impact of these tariff measures is likely to incentivize vertical integration within the inhalable drug manufacturing ecosystem. By consolidating formulation, device production, and assembly under unified operational structures, manufacturers can achieve greater control over cost levers and ensure continuity of supply. In sum, the 2025 tariff landscape is catalyzing a strategic shift towards more agile, localized manufacturing models that promise to redefine competitive advantage in the inhalable therapeutics sector.

Extracting Nuanced Segmentation Insights: Device Variants, Clinical Indications, Channels, End Users, and Manufacturer Profiles Driving Strategic Decisions

The inhalable drug delivery market exhibits considerable complexity when examined through the lens of multiple segmentation dimensions. From a device standpoint, the landscape is defined by dry powder inhalers, metered dose inhalers, nebulizers, and soft mist inhalers. Within the dry powder category, distinctions arise between capsule-based systems, pre-metered blister formats, and reservoir-type devices. Each configuration presents unique operational trade-offs in terms of dose uniformity, patient handling, and formulation stability. Nebulizers similarly span a spectrum of jet-driven platforms, mesh-based innovations, and ultrasonic technologies, each catering to varying clinical scenarios and patient capabilities.

Patient indication further refines the market narrative. Therapeutic solutions tailored to asthma account for an established user base focused on maintenance therapy and acute relief. Chronic obstructive pulmonary disease presents a distinct set of formulation and device challenges, wherein sustained-release properties and ease of inhalation are paramount. Meanwhile, cystic fibrosis and respiratory allergies drive demand for specialized drug combinations and sequential administration protocols designed to address multifaceted symptom profiles.

Distribution channels also play a pivotal role. Hospital pharmacies often serve acute care settings with high-volume usage and strict regulatory compliance, whereas retail and online pharmacies cater to chronic populations prioritizing convenience and cost-efficiency. End-user environments-ranging from outpatient clinics and home care settings to inpatient hospital wards-influence device selection criteria, support infrastructure requirements, and patient training protocols. Finally, the dichotomy between branded and generic manufacturers underscores the competitive landscape, with originator companies focusing on proprietary delivery systems and branded formulations, while generic players emphasize cost leadership and bioequivalent performance.

This comprehensive research report categorizes the Inhalable Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Indication

- Manufacturer Type

- Distribution Channel

- End User

Delineating Regional Dynamics Across Americas, EMEA, and Asia-Pacific: Regulatory Environments, Adoption Patterns, and Growth Trajectories in Inhalable Therapies

Regional heterogeneity in the inhalable therapeutics market is pronounced when comparing the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, the United States serves as a global innovation hub, propelled by robust research and development ecosystems, progressive regulatory pathways, and high per-capita healthcare expenditure. Canada complements this dynamic with strong reimbursement frameworks and a growing emphasis on remote patient monitoring, while Latin American markets exhibit variable adoption rates influenced by local infrastructure and public health initiatives.

Europe Middle East & Africa present a mosaic of regulatory environments and market maturity levels. Western Europe benefits from harmonized directives under centralized agencies, enabling cross-border product registrations and concerted public–private partnerships. The Middle East is rapidly evolving, with countries investing heavily in healthcare infrastructure and local manufacturing capabilities, whereas parts of Africa contend with logistical challenges and funding constraints that temper market expansion.

In the Asia-Pacific region, burgeoning prevalence of respiratory diseases, rising disposable incomes, and government-led healthcare modernization programs have accelerated inhalable drug uptake. Markets such as China, Japan, and Australia lead in advanced device adoption and domestic innovation, while emerging economies across Southeast Asia are forming collaborative research consortia to address rising unmet needs. Collectively, these regional dynamics underscore the critical importance of tailored strategies that reflect distinct regulatory, economic, and patient-access considerations.

This comprehensive research report examines key regions that drive the evolution of the Inhalable Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players in Inhalable Drug Delivery: Strategic Alliances, R&D Milestones, and Competitive Positioning Uncovered

The competitive landscape of inhalable drug delivery is characterized by a blend of established pharmaceutical giants, specialized device manufacturers, and emerging technology firms. Industry leaders have pursued strategic alliances to marry advanced formulation expertise with cutting-edge device engineering. Partnerships between multinational pharmaceutical companies and smart inhaler technology startups have matured, culminating in co-developed platforms that integrate real-time adherence monitoring with customized dosing algorithms.

Major players have also engaged in targeted acquisitions to bolster their product portfolios and expand geographic reach. These M&A transactions have encompassed both branded product lines and platform-based inhalation technologies, reflecting a dual focus on enhancing therapeutic efficacy and accelerating market entry. In parallel, device specialists continue to invest in next-generation platforms that prioritize user ergonomics, dose precision, and compatibility with a broad range of molecular entities, including complex biologics.

The competitive arena is further shaped by collaborative research initiatives that pool resources across academia, contract development organizations, and corporate R&D centers. Such consortia aim to address formulation challenges for high-potency compounds and explore novel excipient–drug interactions within inhalable matrices. Taken together, these strategic movements highlight the multifaceted efforts by industry stakeholders to secure leadership positions in an increasingly sophisticated inhalable therapeutics domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inhalable Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alembic Pharmaceuticals Limited

- Aradigm Corporation

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Chiesi Farmaceutici S.p.A.

- Cipla Limited

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Limited

- Hikma Pharmaceuticals PLC

- Kindeva Drug Delivery L.P.

- Lupin Limited

- Merck & Co., Inc.

- Mundipharma International Limited

- Mylan N.V.

- Nephron Pharmaceuticals Corporation

- Novartis AG

- Orion Corporation

- Pfizer Inc.

- Sanofi S.A.

- Sunovion Pharmaceuticals Inc.

- Teva Pharmaceutical Industries Ltd.

- Vectura Group plc

Transforming Industry Strategies with Actionable Intelligence: Practical Recommendations for Enhancing Competitiveness and Operational Agility in Inhalable Drug Development

To thrive in the rapidly evolving inhalable therapeutics space, industry leaders should adopt a series of targeted measures that enhance their innovation pipelines and fortify operational resilience. First, integrating digital adherence solutions into core product offerings will not only differentiate portfolios but also generate valuable real-world data to inform future development. Investing early in sensor-enabled platforms and data analytics capabilities will position organizations to deliver patient-centric experiences and demonstrate outcome-based value to payers.

Second, diversifying supply chains beyond traditional import routes is essential to mitigate tariff-induced cost pressures and safeguard continuity. Establishing partnerships with regional component manufacturers and exploring modular contract manufacturing strategies can reduce lead times and buffer against geopolitical fluctuations. Simultaneously, companies should strengthen relationships with regulatory authorities through proactive engagement and transparent data sharing, thereby expediting approval pathways for innovative delivery systems.

Finally, cultivating collaborative ecosystems that bring together pharmaceutical developers, device engineers, digital health experts, and patient advocacy groups will foster cross-disciplinary insights and accelerate time-to-market. By aligning stakeholder incentives around shared objectives-such as improving adherence, enhancing safety, and expanding access-organizations can deliver differentiated inhalable solutions that meet evolving patient needs and capture sustainable competitive advantage.

Clarifying the Research Blueprint: Methodological Rigor, Data Collection Approaches, and Analytical Frameworks Underpinning the Inhalable Drug Market Study

The analysis underpinning this executive summary leverages a robust, multi-layered research approach designed to ensure accuracy and relevance. Primary data were collected through in-depth interviews with key opinion leaders, pharmaceutical executives, device engineers, regulatory specialists, and patient advocacy representatives. These qualitative insights were complemented by quantitative data harvested from publicly available regulatory filings, patent databases, clinical trial registries, and corporate financial disclosures.

Secondary research involved an extensive review of scientific literature, white papers, industry publications, and relevant conference proceedings. This was combined with a systematic analysis of trade tariffs, policy announcements, and market entry approvals to assess the impact of regulatory shifts on supply chain and pricing dynamics. To validate findings, iterative workshops were conducted with external subject matter experts and cross-functional internal stakeholders, ensuring triangulation of perspectives and minimization of potential bias.

Analytical frameworks included segmentation matrices, SWOT analyses, scenario modeling, and value chain mapping. By applying these methodologies, the study delivers a nuanced view of market forces, competitive positioning, and strategic imperatives. Limitations of the research are centered on the evolving nature of digital health regulation and potential unforeseen trade policy adjustments, which have been addressed through scenario planning and sensitivity assessments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inhalable Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inhalable Drugs Market, by Device Type

- Inhalable Drugs Market, by Indication

- Inhalable Drugs Market, by Manufacturer Type

- Inhalable Drugs Market, by Distribution Channel

- Inhalable Drugs Market, by End User

- Inhalable Drugs Market, by Region

- Inhalable Drugs Market, by Group

- Inhalable Drugs Market, by Country

- United States Inhalable Drugs Market

- China Inhalable Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Insights on the Evolution of Respiratory Therapeutics: Synthesizing Key Findings to Inform Future Strategic Directions in Inhalable Drug Delivery

The evolution of inhalable drug delivery has been defined by a convergence of technological innovation, shifting regulatory landscapes, and strategic market realignment. From the integration of digital adherence monitoring to the nuanced impacts of the 2025 tariff measures, the industry is navigating a complex interplay of opportunity and challenge. Segmentation analyses reveal that device selection, clinical indication, end-user environment, and manufacturer profile collectively shape competitive dynamics and inform tailored go-to-market strategies.

Regional examination underscores the necessity for localized approaches, as diverse regulatory frameworks and healthcare infrastructure profiles dictate differentiated adoption patterns across the Americas, EMEA, and Asia-Pacific. Moreover, the profiling of leading companies highlights the growing importance of cross-industry collaborations, mergers and acquisitions, and pipeline diversification to sustain innovation momentum.

Ultimately, the insights gathered through rigorous research and stakeholder engagement coalesce into a clear imperative: organizations must embrace agile strategies, leverage digital capabilities, and foster ecosystem partnerships to fully realize the potential of inhalable therapeutics. By internalizing these strategic imperatives, industry participants can chart a course toward enhanced patient outcomes, operational resilience, and sustained market leadership.

Seize Growth Opportunities in Inhalable Therapeutics Today by Engaging with Ketan Rohom to Acquire Comprehensive Market Research Insights

To unlock a comprehensive understanding of the inhalable drug delivery market and position your organization at the forefront of innovation, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in articulating tailored insights and delivering actionable intelligence will ensure you secure the strategic information necessary to drive growth, mitigate risk, and outperform competitors. Initiating a conversation today will provide you with a customized overview of the report’s depth, exclusive access to data-driven recommendations, and guidance on integrating the findings into your business strategy. Reach out without delay to explore partnership opportunities, request sample chapters, and arrange a personalized briefing that aligns with your unique objectives.

- How big is the Inhalable Drugs Market?

- What is the Inhalable Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?