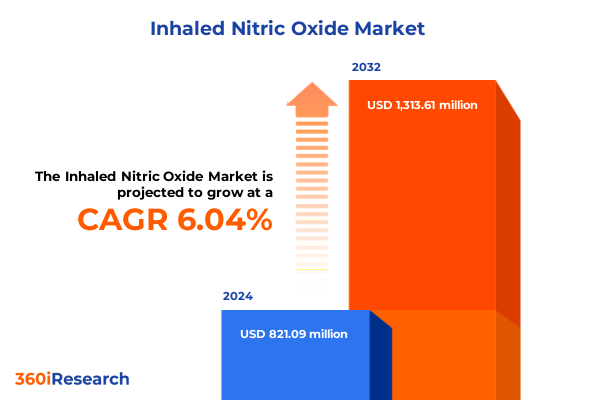

The Inhaled Nitric Oxide Market size was estimated at USD 871.37 million in 2025 and expected to reach USD 917.53 million in 2026, at a CAGR of 6.03% to reach USD 1,313.61 million by 2032.

Unveiling the Evolution and Strategic Importance of Inhaled Nitric Oxide Therapies in Critical Care Settings: Driving Innovation and Patient Outcomes

The landscape of pulmonary therapeutics has been dramatically reshaped by the introduction and continuous evolution of inhaled nitric oxide, a vasodilatory gas that revolutionized the management of pulmonary hypertension and refractory hypoxemia. Since its initial approval for neonatal pulmonary hypertension, the therapeutic profile of inhaled nitric oxide has expanded to encompass adult pulmonary arterial hypertension and acute respiratory distress syndrome, underscoring its adaptability across diverse clinical contexts. Consequently, healthcare providers now integrate inhaled nitric oxide protocols into complex care algorithms, leveraging its rapid onset of action to stabilize oxygenation and mitigate pulmonary vascular resistance.

Moreover, the maturation of inhaled nitric oxide delivery systems has underpinned its broader adoption. Traditional cylinder-based approaches have been supplemented by advanced on-site gas generators, offering hospitals and specialty clinics a more reliable and cost-effective supply chain solution. As a result, medical facilities can deploy inhaled nitric oxide therapies with enhanced continuity and confidence, establishing this modality as a cornerstone in critical care settings. The continued refinement of administration interfaces and monitoring tools further underscores the shifting dynamics of this market, highlighting the importance of operational efficiency and clinical outcomes.

Navigating Disruptive Technological Advances and Regulatory Transformations Shaping the Future of Inhaled Nitric Oxide Treatment Protocols

Recent years have witnessed transformative technological breakthroughs that have elevated the therapeutic and logistical dimensions of inhaled nitric oxide treatment. Cutting-edge gas generation systems now enable on-demand synthesis of high-purity nitric oxide, reducing dependence on compressed cylinder inventories and mitigating supply chain vulnerabilities. Furthermore, the adoption of digital platforms for real-time monitoring of dosing parameters has enhanced clinical oversight, empowering multidisciplinary teams to tailor therapy regimens with unprecedented precision.

Simultaneously, regulatory landscapes have evolved to accommodate the growing evidence base and expanding indications for inhaled nitric oxide. Legislative bodies have streamlined approval pathways and introduced adaptive licensing frameworks, accelerating the integration of novel inhaled nitric oxide modalities into routine practice. In parallel, competition from inhaled prostacyclins and emerging nitric oxide donor compounds has catalyzed active research and development, driving manufacturers to differentiate their portfolios through value-added services, such as integrated telehealth monitoring and predictive analytics.

Consequently, the intersection of regulatory reform, digital innovation, and competitive pressures is redefining how inhaled nitric oxide therapies are developed, regulated, and deployed. Providers and manufacturers alike must navigate these converging forces to capitalize on new opportunities while sustaining clinical excellence.

Assessing the Far-Reaching Implications of 2025 United States Tariff Policies on the Inhaled Nitric Oxide Supply Chain and Pricing Dynamics

The imposition and adjustment of United States tariffs in 2025 have exerted palpable effects across the inhaled nitric oxide ecosystem, impacting the availability and cost structure of both hardware and consumable supply. Tariff escalations on imported nitric oxide generators, along with ancillary components originating from key international suppliers, prompted several manufacturers to reassess their global sourcing strategies. As a consequence, many organizations accelerated initiatives to bolster domestic production capacity, thereby insulating critical supply lines from future trade volatility.

Moreover, the additional duties applied to cylinder imports and specialized packaging materials have led procurement teams to renegotiate vendor agreements and explore alternative supply partnerships. This recalibration has necessitated a closer alignment between clinical demand forecasts and inventory optimization practices. In tandem, distribution partners have adjusted pricing models and service contracts to reflect the cumulative impact of tariff-driven cost increases, ensuring that end users maintain uninterrupted access to therapeutic gas while managing budgetary constraints.

Consequently, the 2025 tariff landscape has catalyzed a series of strategic pivots among stakeholders, from upstream manufacturing adjustments to downstream contract renegotiations. These developments underscore the critical importance of proactive supply chain management and highlight the need for industry leaders to anticipate and mitigate trade-related disruptions.

Illuminating Critical Segmentation Insights Across Product Modalities Applications End Users and Distribution Channels for Strategic Market Positioning

A nuanced understanding of market segmentation reveals distinct patterns in product utilization, clinical application, end-user adoption, and distribution strategies, each underpinning unique growth drivers and operational considerations. From a product perspective, medical facilities leverage cylinder formats for emergency or backup supply, while on-site generators address continuous high-volume demand. Conversely, tankers serve large hospital campuses or integrated care networks where bulk storage yields economies of scale and streamlined logistics.

Clinical applications delineate further granularity. In adult pulmonary hypertension, practitioners distinguish between idiopathic and secondary forms when tailoring inhaled nitric oxide regimens, adjusting dosing strategies to optimize vascular remodeling outcomes. In acute respiratory distress syndrome, extracorporeal membrane oxygenation protocols incorporate inhaled nitric oxide to complement mechanical ventilation, whereas invasive ventilation pathways prioritize real-time dosage modulation to improve oxygenation dynamics. Similarly, neonatal pulmonary hypertension cases managed with extracorporeal membrane oxygenation emphasize precision delivery to fragile physiology, while mechanical ventilation cohorts rely on protocol-driven administration to reduce ventilator-induced lung injury.

End-user preferences vary across ambulatory surgical centers that require portable or generator-based solutions, homecare providers that emphasize user-friendly delivery systems, hospitals that demand robust bulk supply via cylinders or tankers, and specialty clinics that focus on flexible distribution agreements. Distribution channels further shape market access, with direct tender arrangements facilitating large institutional contracts, distribution partners offering regional expertise and logistics support, and online platforms enabling streamlined procurement for smaller providers. Together, these segmentation dimensions create a multifaceted landscape for strategic positioning and targeted engagement.

This comprehensive research report categorizes the Inhaled Nitric Oxide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Distribution Channel

- Application

- End User

Delineating Regional Growth Drivers and Constraints in the Americas EMEA and Asia-Pacific to Guide Strategic Expansion Priorities

Regional dynamics exert a powerful influence on the adoption and diffusion of inhaled nitric oxide therapies, reflecting divergent healthcare infrastructures, reimbursement frameworks, and clinical priorities. In the Americas, robust tertiary care networks and advanced pulmonary care centers embrace innovations in gas generation and digital monitoring. Government reimbursement policies that recognize inhaled nitric oxide as a life-saving intervention further lower barriers to adoption across both neonatal and adult critical care segments.

In contrast, the Europe Middle East & Africa region exhibits marked heterogeneity in regulatory pathways and payment models. Western European nations prioritize cost-effectiveness analyses and value-based purchasing agreements, spurring providers to demonstrate tangible improvements in patient outcomes. Meanwhile, emerging markets within the Middle East & Africa region are venturing into public-private partnerships to expand access to inhaled nitric oxide, channeling international aid and investment to upgrade neonatal intensive care units and referral centers.

Asia-Pacific dynamics are characterized by rapid healthcare modernization in key markets such as China, India, Japan, and Australia. Rising incidence of pulmonary disorders, coupled with increased public health funding, is driving capital investments in both cylinder infrastructure and on-site generation technology. Consequently, regional manufacturers are forging collaborations with global leaders to localize production and accelerate regulatory approvals, positioning the Asia-Pacific region as an increasingly influential player in the global inhaled nitric oxide landscape.

This comprehensive research report examines key regions that drive the evolution of the Inhaled Nitric Oxide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Trends and Strategic Partnerships Driving Innovation Among Leading Inhaled Nitric Oxide Market Participants

Competitive activity among leading entities reflects a balance between innovation in delivery technologies and strategic partnerships that enhance market reach. One prominent manufacturer has intensified its focus on modular generator systems, investing in research to improve purity control and streamline maintenance protocols. In parallel, a second market participant has forged alliances with prominent hospital networks, embedding service agreements that encompass training, device validation, and 24/7 technical support.

Additionally, a specialty biotech firm is differentiating its pipeline through next-generation inhaled nitric oxide donor molecules, seeking to extend pharmacodynamic properties and broaden clinical applications. Another organization has pursued an acquisitive strategy, integrating smaller regional distributors to gain foothold in adjacent therapeutic segments and develop cross-selling opportunities. Collaborative ventures between device manufacturers and software developers have also emerged, melding gas delivery platforms with predictive analytics and telehealth modules to elevate patient management capabilities.

These competitive maneuvers underscore a broader trend toward convergence between therapeutic gas provision and digital health solutions, as companies aim to deliver holistic offerings that optimize both clinical efficacy and operational performance. Stakeholders striving for leadership must therefore balance product innovation with partnership-driven service models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inhaled Nitric Oxide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- BOC Ltd.

- Circassia Pharmaceuticals plc

- Ikaria, Inc.

- Linde plc

- Mallinckrodt plc

- Messer Group GmbH

- Novoteris, LLC

- Praxair, Inc.

- VERO Biotech LLC

Implementing Actionable Strategies to Optimize Supply Resilience Enhance Patient Access and Elevate Inhaled Nitric Oxide Service Excellence

Industry leaders are encouraged to adopt multifaceted strategies that fortify supply resilience while enhancing patient access. Prioritizing investment in on-site generation infrastructure can mitigate import exposure and safeguard against tariff-induced cost pressures. Concurrently, establishing dynamic inventory management systems-leveraging predictive demand signals-will optimize cylinder rotations and tanker deployments to align supply with clinical exigencies.

Moreover, integrating digital delivery management platforms into clinical workflows will generate actionable insights on therapy utilization, enabling data-driven protocol refinements and demonstrating real-world value to payers. Cultivating partnerships with regional hospitals and specialty clinics can facilitate training initiatives, reinforce best practices in dosing precision, and foster clinical champions who advocate for inhaled nitric oxide adoption. In addition, diversifying procurement channels-balancing direct tender contracts with relationships involving regional distribution partners and online requisition systems-will create agility in response to sudden clinical surges or logistical disruptions.

Finally, engaging proactively with regulatory authorities to pursue indication expansions, streamline labeling updates, and explore adaptive licensing frameworks will position your organization at the forefront of clinical innovation. By executing these recommendations with discipline and foresight, industry leaders can strengthen competitive differentiation and drive sustainable growth.

Outlining Rigorous Research Methodology Leveraging Primary and Secondary Data Sources for Comprehensive Market Analysis

This analysis synthesizes findings derived from a comprehensive research framework that integrates both primary and secondary data sources. Primary insights were garnered through in-depth interviews with key opinion leaders, including pulmonologists, neonatal intensivists, and hospital procurement directors, as well as structured surveys administered to a representative sample of end users. These engagements provided qualitative perspectives on therapeutic protocols, operational challenges, and emerging service requirements.

Secondary research included a systematic review of peer-reviewed journals, regulatory agency filings, clinical trial registries, and publicly available technical specifications. Market intelligence databases and corporate disclosures were also analyzed to map competitive landscapes and strategic partnerships. Quantitative data from device shipment records and procedural volume statistics were triangulated with qualitative feedback to ensure robust validation of emerging trends.

The methodological approach employed iterative data triangulation, cross-referencing insights to minimize bias and enhance reliability. Expert rounds were conducted to vet preliminary findings and refine thematic frameworks, ensuring that conclusions accurately reflect real-world dynamics. This rigorous framework underpins the credibility and actionable value of the insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inhaled Nitric Oxide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inhaled Nitric Oxide Market, by Product

- Inhaled Nitric Oxide Market, by Distribution Channel

- Inhaled Nitric Oxide Market, by Application

- Inhaled Nitric Oxide Market, by End User

- Inhaled Nitric Oxide Market, by Region

- Inhaled Nitric Oxide Market, by Group

- Inhaled Nitric Oxide Market, by Country

- United States Inhaled Nitric Oxide Market

- China Inhaled Nitric Oxide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Executive Summary with Strategic Imperatives Reinforcing the Critical Role of Inhaled Nitric Oxide in Evolving Patient Care

Inhaled nitric oxide has evolved from a niche neonatal therapy to a versatile tool in adult pulmonary care, driven by technological advances, regulatory reforms, and shifting clinical paradigms. The 2025 tariff environment has underscored the importance of resilient supply chains, while segmentation insights reveal nuanced demand patterns across product types, indications, and end-user settings. Regional analyses highlight differentiated growth trajectories, with the Americas leveraging established reimbursement frameworks, EMEA balancing cost-effectiveness requirements, and Asia-Pacific accelerating infrastructure investments.

Competitive landscapes are characterized by strategic alliances, innovation in delivery systems, and the integration of digital health applications that elevate both clinical and operational performance. Actionable recommendations guide industry stakeholders to fortify supply resilience, optimize utilization management, and pursue regulatory engagement for indication extensions. Underpinned by a rigorous research methodology, these insights offer a holistic view of the market’s evolution and strategic imperatives.

These findings collectively reinforce the critical role of inhaled nitric oxide therapies in meeting emergent patient care needs and sustaining competitive differentiation. As market dynamics continue to evolve, stakeholders who proactively align their strategies with these imperatives will secure enduring leadership in this vital therapeutic segment.

Contact Associate Director Ketan Rohom to Secure Your Comprehensive Inhaled Nitric Oxide Market Intelligence Report and Gain Competitive Advantage

Unlock unparalleled market intelligence by engaging with Ketan Rohom, Associate Director of Sales & Marketing. By securing this comprehensive Inhaled Nitric Oxide Market Intelligence Report, you’ll gain exclusive access to in-depth analysis, strategic recommendations, and critical trends that will empower your organization’s decision-making. Don’t miss the opportunity to elevate your competitive stance-reach out to arrange a personalized briefing and discover how these insights can drive revenue growth, optimize supply strategies, and strengthen stakeholder relationships. Take the next decisive step toward market leadership by contacting Ketan to explore tailored licensing options and unlock the full potential of this indispensable report.

- How big is the Inhaled Nitric Oxide Market?

- What is the Inhaled Nitric Oxide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?