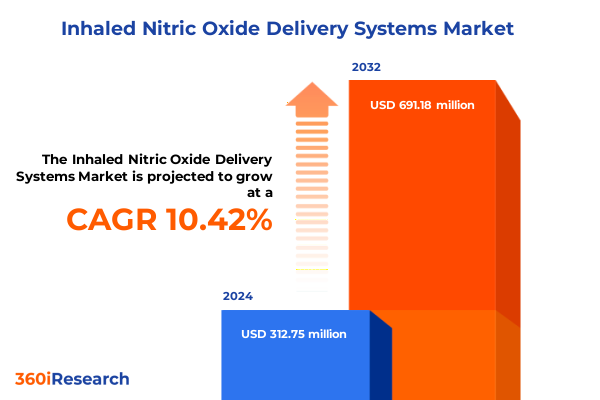

The Inhaled Nitric Oxide Delivery Systems Market size was estimated at USD 341.40 million in 2025 and expected to reach USD 379.33 million in 2026, at a CAGR of 10.60% to reach USD 691.18 million by 2032.

Exploring the Evolution of Inhaled Nitric Oxide Delivery Systems and Their Transformative Role in Contemporary Patient Care

Inhaled nitric oxide delivery systems have emerged as a cornerstone therapy in modern medicine, offering precision-targeted pulmonary vasodilation with minimal systemic side effects. Originally developed to manage persistent pulmonary hypertension in newborns, these systems have expanded their clinical footprint across adult critical care, cardiac surgery, and beyond. By delivering a controlled concentration of nitric oxide directly to the alveoli, they enable clinicians to achieve rapid improvement in oxygenation and reduce vascular resistance. Consequently, this technology has redefined therapeutic approaches in diverse care settings and has catalyzed ongoing innovation in device design, digital monitoring, and gas generation.

Against a backdrop of evolving regulatory frameworks and heightened demand for patient-centric solutions, inhaled nitric oxide systems now intersect with broader healthcare trends such as point-of-care diagnostics and telehealth integration. Providers and payers alike recognize the value of therapies that shorten intensive care stays, lower complication rates, and enable seamless transitions from hospital to home. As a result, the therapeutic promise of inhaled nitric oxide has driven collaboration between device manufacturers, gas suppliers, and clinical leaders, fostering an ecosystem dedicated to continuous performance optimization and robust safety monitoring.

How Cutting-Edge Generators and Digital Connectivity Are Revolutionizing Inhaled Nitric Oxide Therapeutics Across Care Settings

Over the past decade, transformative shifts have redefined how inhaled nitric oxide therapy is delivered, monitored, and integrated into patient care pathways. Advanced electronic generators capable of delivering calibrated gas concentrations on demand have supplanted traditional cylinder gas systems in many settings, enabling uninterrupted therapy and reducing logistical burdens. Moreover, miniaturized portable units have empowered ambulatory care centers and home healthcare providers to extend treatment beyond the hospital, aligning with the growing emphasis on decentralizing care and enhancing patient autonomy.

In parallel, integrated delivery platforms now combine real-time monitoring of pulmonary pressures and oxygenation metrics with automated dosage adjustments. These innovations leverage data analytics and connectivity to alert clinicians to deviations from therapeutic targets, facilitating early intervention and lowering the risk of rebound pulmonary hypertension. The convergence of hardware advances with digital health solutions has also spurred new service models, where remote monitoring and teleconsultations ensure continuity of care, support device troubleshooting, and enhance adherence to prescribed protocols.

Evaluating the 2025 United States Tariff Measures That Are Reconfiguring Supply Chains and Cost Dynamics in Inhaled Nitric Oxide Delivery

The imposition of new United States tariffs in early 2025 targeting imported medical gases and related delivery apparatus has exerted a cumulative impact on the inhaled nitric oxide ecosystem. Tariffs applied to cylinder gas imports have driven up procurement costs, compelling providers to reassess long-entrenched supply contracts and explore domestic gas generation alternatives. As a result, the demand for electronic nitrogen oxide generators has accelerated, with healthcare systems prioritizing capital investments that reduce reliance on imported cylinders and mitigate exposure to variable tariff regimes.

Furthermore, the broader tariff framework has affected distribution networks by shifting the economics of direct sales versus distributor partnerships. With cylinder vendors passing through tariff-related cost increases, hospitals and clinics have negotiated more favorable pricing on integrated systems, emphasizing total cost of ownership over per-unit gas expenses. This dynamic has catalyzed strategic alliances between device manufacturers and domestic gas suppliers, fostering collaborative innovation in generator design and service-based delivery models to preserve margin structures while ensuring uninterrupted patient care.

Unveiling Multifaceted Segmentation Insights That Guide Tailored Commercial Strategies and Clinical Deployment for Inhaled Nitric Oxide Solutions

Inhaled nitric oxide delivery systems exhibit multifaceted segmentation that informs both commercial strategy and clinical application. Within adult care, the therapy is predominantly deployed during cardiac surgery to address hypoxemia and pulmonary hypertension, whereas neonatal units focus on managing hypoxemic respiratory failure and persistent pulmonary hypertension in newborns. Pediatric applications straddle both spectrums, reflecting the nuanced needs of younger patients. At the same time, delivery extends across ambulatory care centers, clinics, home healthcare services, and hospitals, underscoring the necessity of flexible deployment models that align with diverse operational infrastructures.

Technological distinctions further shape market dynamics, as traditional cylinder-based approaches compete with electronic generator platforms, which themselves bifurcate into fixed installations for critical care units and portable units for decentralized settings. Systems are also categorized by device integration, with some healthcare providers opting for comprehensive platforms that combine gas generation, monitoring, and alarm functionality, while others prefer standalone devices that integrate with existing infrastructure. Distribution channels range from direct sales, which facilitate close manufacturer-provider collaboration, to distributor networks and growing online channels that offer rapid access and streamlined procurement. Finally, the choice between continuous and intermittent delivery modes enables clinicians to tailor therapy to patient response profiles, balancing efficacy, safety, and resource utilization.

This comprehensive research report categorizes the Inhaled Nitric Oxide Delivery Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Delivery Device Type

- Mode Of Delivery

- Application

- End User

- Distribution Channel

Assessing Dynamic Regional Variations in Technology Uptake, Regulatory Approval, and Clinical Adoption of Inhaled Nitric Oxide Therapy

Regional dynamics in the inhaled nitric oxide space reveal distinct patterns of technology adoption, regulatory environments, and clinical priorities. In the Americas, established reimbursement frameworks and high awareness among critical care specialists drive steady uptake of both traditional and electronic systems, with a growing emphasis on home healthcare solutions. Conversely, Europe, the Middle East, and Africa present a heterogeneous regulatory landscape: Western European nations lead in advanced device approvals and integration into neonatal intensive care protocols, while emerging markets in the Middle East and Africa are catalyzing new partnerships to improve access and affordability.

Across the Asia-Pacific region, rapid healthcare infrastructure expansion and rising incidence of pulmonary disorders underpin robust demand. Markets in Japan and Australia demonstrate early adoption of fixed electronic generators, supported by government-led innovation grants, whereas Southeast Asian economies increasingly leverage portable systems to overcome barriers in rural healthcare delivery. As regional stakeholders collaborate on clinical guidelines and reimbursement policies evolve, multinational manufacturers are adapting their market entry strategies to meet divergent regulatory requirements and provider preferences.

This comprehensive research report examines key regions that drive the evolution of the Inhaled Nitric Oxide Delivery Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Partnerships, Technological Differentiation, and Service Models That Define Competitive Leadership in Inhaled Nitric Oxide Delivery

Key companies operating in the inhaled nitric oxide delivery system arena have pursued differentiated strategies to strengthen their market positioning. Some global gas suppliers have expanded their portfolios through the development of in-house electronic generator platforms, integrating hardware, software, and service offerings to deliver end-to-end solutions. Established medical device manufacturers have leveraged partnerships with specialty gas producers to co-develop integrated systems that optimize performance metrics and ensure rigorous safety compliance. Meanwhile, emerging technology firms focus on niche innovations-such as portable, battery-powered generators with simplified user interfaces-to carve out dedicated segments within home healthcare and ambulatory settings.

Competition has also spurred investment in aftermarket services, with leading players offering subscription-based maintenance and remote monitoring solutions. These value-added programs not only secure long-term customer relationships but also generate recurring revenue streams beyond initial device sales. In addition, strategic acquisitions and licensing agreements have enabled several companies to expand their geographical reach and diversify their technological capabilities, reinforcing their ability to adapt to evolving clinical requirements and tariff-induced supply chain challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inhaled Nitric Oxide Delivery Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Air Water Inc.

- Bellerophon Therapeutics, Inc.

- Beyond Air, Inc.

- Chart Industries, Inc.

- Drägerwerk AG & Co. KGaA

- EKU Elektronik GmbH

- GE HealthCare Technologies Inc.

- Getinge AB

- INO Therapeutics LLC

- International Biomedical Ltd.

- Koninklijke Philips N.V.

- Linde plc

- Mallinckrodt Pharmaceuticals plc

- Medtronic plc

- Merck KGaA

- Messer Group GmbH

- NIOX Group plc

- Novoteris, LLC

- NU-MED Plus, Inc.

- SLE Ltd.

- Taiyo Nippon Sanso Corporation

- Teleflex Incorporated

- VERO Biotech LLC

Actionable Recommendations for Industry Leaders to Drive Innovation, Secure Supply Chains, and Enhance Adoption of Inhaled Nitric Oxide Technologies

Industry leaders should prioritize investments in versatile electronic generator designs that can seamlessly transition between fixed and portable configurations to meet the full spectrum of care settings. By aligning product development roadmaps with emerging reimbursement policies and integrating advanced analytics for predictive maintenance, manufacturers can deliver demonstrable value to providers. Collaborative programs with home healthcare agencies can accelerate adoption of decentralized therapy, reducing total treatment costs and improving patient satisfaction.

Moreover, strengthening relationships with domestic gas suppliers will hedge against ongoing tariff uncertainties and enable joint innovation in next-generation gas purification and dosing algorithms. Investing in robust training modules and remote support platforms can enhance clinician confidence, minimize deployment errors, and differentiate offerings in a competitive marketplace. Finally, engaging proactively with regulatory bodies to shape guidelines around digital health integration and tariff policy will ensure that new solutions achieve timely approvals and secure favorable pricing frameworks.

A Robust Research Framework Combining Primary Stakeholder Engagement and Rigorous Secondary Analysis to Illuminate Inhaled Nitric Oxide Delivery Dynamics

This research employs a comprehensive methodology combining primary and secondary sources to deliver objective market insights. Extensive interviews with healthcare administrators, respiratory therapists, and procurement leaders provided firsthand perspectives on clinical workflows, purchasing priorities, and the operational impact of tariff measures. Secondary research encompassed peer-reviewed journals, clinical trial registries, regulatory filings, and government publications to validate trends in device approvals, reimbursement updates, and technical specifications.

Quantitative analysis was conducted using a bottoms-up approach that mapped installed base data against adoption rates across care settings and regions. Competitive benchmarking incorporated product feature comparisons, patent filings, and strategic alliance disclosures. The cumulative impact of 2025 tariff measures was assessed through simulation models that accounted for cost pass-through, supply chain reconfiguration, and potential shifts in channel preferences. Throughout the study, rigorous triangulation of data sources ensured the reliability of findings and the relevance of recommendations for stakeholders seeking to navigate this dynamic landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inhaled Nitric Oxide Delivery Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inhaled Nitric Oxide Delivery Systems Market, by Technology

- Inhaled Nitric Oxide Delivery Systems Market, by Delivery Device Type

- Inhaled Nitric Oxide Delivery Systems Market, by Mode Of Delivery

- Inhaled Nitric Oxide Delivery Systems Market, by Application

- Inhaled Nitric Oxide Delivery Systems Market, by End User

- Inhaled Nitric Oxide Delivery Systems Market, by Distribution Channel

- Inhaled Nitric Oxide Delivery Systems Market, by Region

- Inhaled Nitric Oxide Delivery Systems Market, by Group

- Inhaled Nitric Oxide Delivery Systems Market, by Country

- United States Inhaled Nitric Oxide Delivery Systems Market

- China Inhaled Nitric Oxide Delivery Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Strategic Insights on Technological Innovation, Tariff Impacts, and Market Dynamics to Chart Future Pathways in Inhaled Nitric Oxide Therapy

Inhaled nitric oxide delivery systems continue to reshape critical care and neonatal medicine by offering targeted pulmonary vasodilation with clinical precision. The convergence of advanced electronic generators, integrated monitoring platforms, and shifting tariff landscapes underscores the necessity for adaptable strategies that address evolving provider needs and regulatory requirements. Insights from detailed segmentation, regional analysis, and competitive benchmarking reveal pathways for innovation while highlighting the importance of service-based delivery models and digital health integration.

As the landscape evolves, industry stakeholders who adopt flexible device architectures, cultivate domestic supply partnerships, and engage proactively with payers and regulators will secure competitive advantage. The actionable recommendations presented in this report chart a clear course for organizations seeking to accelerate technology adoption, optimize cost structures, and expand access to life-saving therapies. Ultimately, the ability to leverage these insights will determine which players lead the next wave of growth and deliver improved outcomes for patients worldwide.

Contact Ketan Rohom Today to Unlock Strategic Insights and Propel Your Inhaled Nitric Oxide Delivery Initiatives to the Forefront of Medical Innovation

To explore how strategic insights can translate into tangible growth opportunities in inhaled nitric oxide delivery, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a detailed conversation that will clarify how this comprehensive report can guide your next steps, inform your investment priorities, and strengthen your competitive positioning. By securing full access to the research, you will obtain the actionable guidance needed to capitalize on emerging technologies, navigate regulatory complexities, and unlock new patient care paradigms. Schedule your personalized briefing today to ensure your organization stays ahead of market disruptions and seizes high-value opportunities in inhaled nitric oxide delivery systems.

- How big is the Inhaled Nitric Oxide Delivery Systems Market?

- What is the Inhaled Nitric Oxide Delivery Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?