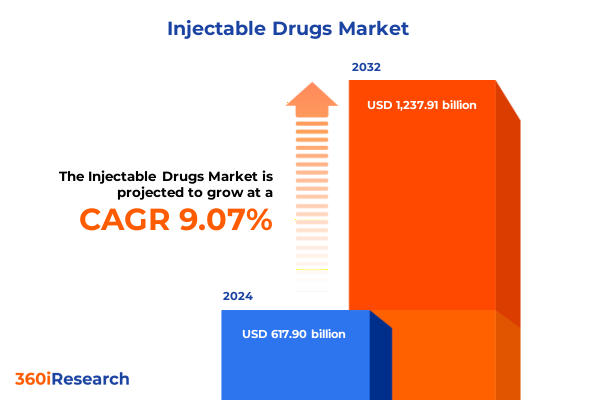

The Injectable Drugs Market size was estimated at USD 671.10 billion in 2025 and expected to reach USD 729.69 billion in 2026, at a CAGR of 9.14% to reach USD 1,237.91 billion by 2032.

Exploring the Dynamic Landscape of Injectable Therapeutics Shaped by Technological Advances Regulatory Shifts Patient-Centric Trends and Innovations to Market Access

In recent years, the injectable therapeutics space has undergone transformative shifts driven by rapid scientific breakthroughs, evolving regulatory frameworks, and heightened patient expectations. Cutting-edge biologics development platforms have accelerated the translation of novel molecules from bench to bedside, fostering a wave of large molecule innovations that target previously intractable disease pathways. At the same time, pharmaceutical manufacturers have embraced self-administration models and advanced delivery systems to improve patient adherence and reduce the burden on healthcare infrastructure. These parallel trends underscore the importance of a holistic understanding of the injectable drugs ecosystem-spanning discovery, formulation, packaging, and distribution-to navigate the opportunities and challenges ahead.

Against a backdrop of increasing healthcare costs and growing demand for personalized medicine, stakeholders across the value chain-from raw material suppliers to contract manufacturing organizations-are compelled to reassess traditional paradigms. Digital health integration, including smart injector devices and remote monitoring solutions, is redefining expectations for real-time data collection and patient engagement. Moreover, shifting global supply chain dynamics, influenced by geopolitical considerations and sustainability imperatives, necessitate agile sourcing strategies. This introduction sets the stage for an in-depth exploration of the key drivers reshaping the injectable drugs market, providing executives with the strategic context required to make informed decisions in an era defined by both complexity and innovation.

Unpacking the Transformative Shifts in Injectable Drug Delivery Driven by Biologics Advancements Digital Health and Decentralized Care Models

The injectable drugs market stands at the intersection of multiple transformative forces that have fundamentally altered its trajectory. Technological advances, particularly in biologics engineering and formulation science, have enabled longer-acting, higher-potency therapies delivered through optimized injection platforms. Simultaneously, the advent of digital dosing trackers and connected health interfaces is enhancing adherence monitoring and enabling real-time patient support, effectively shifting care models from centralized infusion centers to home-based self-administration.

In parallel, regulatory agencies have issued updated guidance to streamline approval pathways for biosimilars and interchangeable products, fostering competitive pricing while maintaining rigorous safety standards. Decentralized clinical trial designs are further accelerating therapeutic validation by incorporating remote sampling and virtual patient visits, expanding access to more diverse patient populations. Together, these trends are lowering barriers to entry for novel injectable candidates and prompting incumbents to innovate in delivery technologies, patient engagement strategies, and go-to-market approaches. As a result, the market is witnessing unprecedented convergence between pharmaceutical innovation, digital health capabilities, and patient empowerment.

Analyzing the Cumulative Impact of United States 2025 Tariffs on the Injectable Drugs Sector Including Supply Chain Dynamics and Cost Implications

The United States’ implementation of new tariff measures in 2025 has introduced significant headwinds for the injectable drugs sector, reshaping cost structures and supply chain configurations. Duties targeting active pharmaceutical ingredients sourced from key global suppliers have driven manufacturers to reevaluate supplier contracts and explore nearshore alternatives. In many instances, the increased costs have been partially absorbed through leaner production processes and strategic inventory management, yet the ripple effects across downstream logistics and cold chain services remain pronounced.

Moreover, the tariffs have catalyzed a strategic pivot among industry participants, spurring investment in domestic API manufacturing capacities and public-private partnerships aimed at bolstering resilience. While these initiatives promise long-term supply security, the transitional phase has seen price volatility for specific molecule classes, particularly complex biologics requiring specialized raw materials. As stakeholders adapt to this new fiscal landscape, collaborative models that leverage contract development and manufacturing organizations with diversified sourcing footprints have emerged as effective mitigants to tariff-related cost pressures.

Revealing Critical Segmentation Insights Across Molecule Types Drug Classes Administration Categories Therapeutic Applications and End User Dynamics

A nuanced understanding of the injectable drugs market requires segmentation by multiple dimensions, each revealing distinct commercialization and development imperatives. Based on molecule type, large molecule therapies-such as monoclonal antibodies and cytokines-present intricate manufacturing and cold chain requirements, while small molecule injectables benefit from established synthetic processes and broader stability profiles. When focusing on drug class, categories ranging from anesthetics and anti-infective agents to blood factors, immunoglobulins, insulin, and peptide hormones each follow unique regulatory and reimbursement pathways reflective of disease prevalence and treatment paradigms.

Turning to product category, intravenous infusion bags remain central to hospital administration, whereas pre-filled syringes and vials & ampoules support both clinical and home-based applications, driving preferences for ease of use and dosing accuracy. Route of administration segmentation highlights intramuscular, intravenous, and subcutaneous delivery, with subcutaneous formats gaining traction for their compatibility with self-injection and wearable injector devices. Additionally, therapeutic applications span blood disorders, oncology, diabetes management, hormonal and neurological conditions, and pain management, each characterized by different development timelines and patient support needs. Finally, end user segmentation underscores that diagnostic laboratories, home healthcare providers, and hospitals & clinics each require tailored packaging, labeling, and service models to optimize operational workflows.

This comprehensive research report categorizes the Injectable Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Molecule Type

- Category

- Route Of Administration

- Therapeutic Applications

- End Users

Illuminating Regional Dynamics Shaping the Injectable Drugs Market across the Americas Europe Middle East Africa and Asia-Pacific Regions

Regional dynamics in the injectable drugs market reflect diverse healthcare infrastructures, regulatory frameworks, and patient demographics across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, advanced biomanufacturing hubs and progressive reimbursement models encourage rapid adoption of next-generation injectables, while regulatory convergence initiatives between the United States and Canada streamline cross-border approvals. Within EMEA, robust clinical research networks and increasing investments in biosimilar development are driving competitive offerings, with patient affordability and pharmacovigilance programs guiding market access strategies.

Conversely, the Asia-Pacific region demonstrates a dual trajectory: mature markets with established generics and biosimilars coexist alongside emerging economies rapidly expanding contract manufacturing and cold chain logistics. Market access in this region is influenced by diverse regulatory timelines and local content requirements, prompting global players to forge joint ventures and licensing arrangements with regional stakeholders. As cross-regional alliances proliferate, the ability to tailor value propositions to specific healthcare ecosystems-balancing cost, quality, and speed to market-has become a key determinant of commercial success.

This comprehensive research report examines key regions that drive the evolution of the Injectable Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Key Industry Players Shaping the Injectable Drug Market Through Strategic Collaborations Innovative Pipelines and Competitive Differentiation

Within the competitive landscape, leading pharmaceutical and biotech organizations are leveraging strategic partnerships, targeted acquisitions, and robust R&D pipelines to fortify their injectable portfolios. Major innovators are advancing high-potency biologics, including monoclonal antibodies and next-generation cytokine therapies, while simultaneously expanding capabilities in pre-filled syringes and wearable injector systems. Several key players are also investing in proprietary formulation platforms that enhance stability and reduce immunogenic responses, thereby addressing critical patient safety and compliance challenges.

Additionally, collaborations between established firms and specialized contract manufacturing organizations are accelerating time-to-market for complex injectables, offering scalable solutions for both clinical and commercial production. Competitive differentiation increasingly depends on integrated service offerings that encompass device design, digital adherence tools, and patient support programs. Firms that successfully harmonize pipeline innovation with end-to-end delivery solutions are positioned to capture premium segments, particularly in therapeutic areas with high unmet need such as oncology, autoimmune diseases, and diabetes management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Injectable Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Baxter International Inc.

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Chiesi Farmaceutici S.p.A.

- Cipla Limited

- Daiichi Sankyo Co., Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Eagle Pharmaceuticals, Inc.

- Eli Lilly and Company

- EVER Pharma Jena GmbH

- F. Hoffmann-La Roche Ltd.

- Ferring B.V.

- Fresenius SE & Co. KGaA

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Glenmark Pharmaceuticals Limited

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Merck & Co., Inc.

- Novartis AG

- Novo Nordisk A/S

- Pfizer Inc.

- Sanofi S.A.

- SCHOTT PHARMA AG & CO. KGAA

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Market Disruptions Optimize Portfolios and Enhance Patient Engagement

To thrive in the evolving injectable drugs market, industry leaders must adopt a multifaceted strategic approach that balances innovation, operational resilience, and patient-centricity. First, investing in advanced delivery technologies-including connected injector devices and user-friendly formulations-will enhance treatment adherence and differentiate offerings in a crowded therapeutic landscape. Second, diversifying supply chain portfolios by cultivating domestic API capabilities and engaging multiple contract manufacturing partners can mitigate risks stemming from geopolitical tariffs or raw material shortages.

Simultaneously, forging strategic alliances for biosimilar development and co-promotion agreements can unlock cost efficiencies while expanding portfolio breadth. Companies should also prioritize real-world evidence generation and health economics outcomes research to substantiate value propositions in payer negotiations. Finally, embedding digital patient support platforms into therapeutic ecosystems will foster brand loyalty and provide actionable adherence insights. By implementing these targeted actions, organizations can strengthen their market positions, accelerate growth, and deliver sustained value to patients and stakeholders.

Detailing a Robust Research Methodology Integrating Primary Stakeholder Engagement Secondary Data Analysis and Quantitative-Qualitative Triangulation

This research integrates a rigorous methodology combining both qualitative and quantitative investigative techniques to ensure robust, reliable insights. Primary research involved in-depth interviews with industry executives, formulation scientists, clinical investigators, and regulatory experts to capture firsthand perspectives on development challenges and market trends. Complementing this, surveys were conducted with payers, procurement specialists, and end users to gauge evolving preferences for delivery formats and support services.

Secondary research comprised analysis of public regulatory filings, scientific publications, patent landscapes, and corporate financial disclosures to map the competitive environment and technological trajectories. Data triangulation was employed to reconcile qualitative inputs with quantitative market indicators, ensuring that key findings accurately reflect the multifaceted dynamics of the injectable drugs sector. This comprehensive approach provides a solid foundation for strategic decision-making and underscores the credibility of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Injectable Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Injectable Drugs Market, by Drug Class

- Injectable Drugs Market, by Molecule Type

- Injectable Drugs Market, by Category

- Injectable Drugs Market, by Route Of Administration

- Injectable Drugs Market, by Therapeutic Applications

- Injectable Drugs Market, by End Users

- Injectable Drugs Market, by Region

- Injectable Drugs Market, by Group

- Injectable Drugs Market, by Country

- United States Injectable Drugs Market

- China Injectable Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings from the Injectable Drug Market Analysis to Guide Strategic Decision Making in a Rapidly Evolving Healthcare Landscape

In summary, the injectable drugs market is undergoing a period of unprecedented transformation driven by technological innovation, shifting regulatory paradigms, and evolving patient expectations. The advent of novel biologics, coupled with digital health integration and strategic supply chain realignment, presents both opportunities and complexities for stakeholders. A granular segmentation analysis reveals diverse requirements across molecule types, drug classes, delivery formats, and end-user settings, highlighting the imperative for tailored strategies.

Regional disparities further underscore the need for market-specific approaches, from advanced biomanufacturing in the Americas to biosimilar competition in EMEA and the burgeoning contract production capacity in Asia-Pacific. Leading companies are differentiating through integrated delivery platforms, strategic collaborations, and patient-centric service models. By synthesizing these insights, this executive summary equips decision-makers with the strategic context necessary to navigate the injectable therapeutics landscape and chart a course for sustainable growth.

Connect Directly with Ketan Rohom to Secure Comprehensive Injectable Drugs Market Research and Drive Competitive Advantage Today

For organizations seeking granular, actionable insights into the complex injectable drugs landscape, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, offers unparalleled access to the comprehensive market research report. His expertise in tailoring solutions to address specific strategic needs ensures that stakeholders can swiftly obtain data-driven intelligence to inform product development, partnership opportunities, and go-to-market strategies. By securing a consultation, decision-makers will benefit from personalized guidance on leveraging the report’s in-depth analysis to unlock competitive advantages and drive sustainable growth in this rapidly evolving sector. Connect with Ketan Rohom to elevate your understanding of key market drivers, emerging trends, and critical success factors essential for navigating tomorrow’s injectable therapeutics environment and achieving your organizational objectives.

- How big is the Injectable Drugs Market?

- What is the Injectable Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?