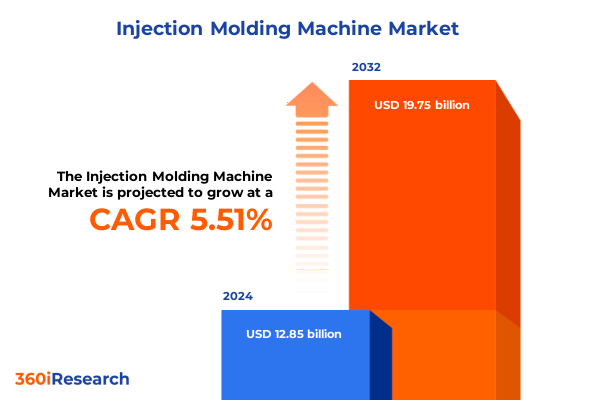

The Injection Molding Machine Market size was estimated at USD 13.52 billion in 2025 and expected to reach USD 14.23 billion in 2026, at a CAGR of 5.56% to reach USD 19.75 billion by 2032.

Unlocking the Foundation of Precision and Innovation Driving the Future of Injection Molding Machine Markets Internationally

Injection molding machines have served as a cornerstone of modern manufacturing, enabling the mass production of components with unparalleled precision, consistency, and cost-efficiency. At the heart of industries ranging from automotive to healthcare, these sophisticated systems transform raw materials into complex parts at high throughput rates. In recent years, the landscape has evolved dramatically, propelled by the demand for lightweight materials, miniaturization of components, and the integration of advanced control systems. As a result, manufacturers are compelled to reassess legacy frameworks and pursue strategies that align with both global sustainability targets and heightened customer expectations.

This executive summary introduces the pivotal themes shaping the injection molding machine market today, emphasizing the interplay between technological innovation, regulatory pressures, and shifting supply chain paradigms. By contextualizing current trends within a broader industrial narrative, readers will gain a holistic appreciation of how evolving material science and digital transformation converge to redefine competitiveness. Through this lens, decision-makers are better positioned to harness emerging opportunities, mitigate potential disruptions, and chart a course toward long-term growth in an increasingly dynamic environment.

Charting the Revolutionary Transitions Redefining Competitive Dynamics and Technological Evolution in Injection Molding Machine Industry

The injection molding machine sector is undergoing a period of transformative change driven by rapid advancements in automation, digital connectivity, and environmentally sustainable practices. Across the board, manufacturers are integrating smart sensors and cloud-based analytics into control interfaces, enabling real-time monitoring of cycle times, energy consumption, and part quality. This shift toward Industry 4.0 frameworks not only reduces downtime through predictive maintenance but also streamlines production workflows by offering adaptive process adjustments based on data-driven insights.

Simultaneously, materials innovation is catalyzing new applications across traditional and emerging markets. Biocompatible polymers and recycled resins are being validated for medical and consumer products, reflecting broader industry commitments to circular economy principles. At the same time, additive manufacturing techniques are complementing injection molding for rapid prototyping, encouraging a hybridized approach to product development that accelerates time-to-market. As the competitive landscape intensifies, companies are also exploring modular machine architectures to support quick tooling changes and varied shot capacities, further reinforcing the need for agility in design and operations.

Assessing the Comprehensive Consequences of New United States Tariffs on the Injection Molding Machine Sector Throughout 2025

In 2025, the implementation of revised United States tariffs on imported machinery components has prompted strategic recalibrations across the injection molding ecosystem. Newly imposed duties on core subassemblies, including electric drives and precision hydraulic units, have elevated landed costs for certain international OEMs and suppliers. In response, several key players have initiated dual-sourcing strategies, securing domestic alternatives for control systems to mitigate the risk of prolonged customs inspections and duty spikes.

On the operational front, increased tariffs have accelerated nearshoring initiatives, with leading contract manufacturers evaluating facility expansions in Mexico and the southern United States to optimize their North American supply chains. While these moves alleviate some cost pressures, they also introduce complexities related to workforce training, regulatory compliance, and local infrastructure readiness. Despite these hurdles, the tariff environment has stimulated investment in advanced automation to offset higher labor and logistics expenses, ultimately driving a reinvigorated focus on process efficiency and total cost of ownership metrics.

Unveiling Deep Segmentation Insights That Illuminate Distinct Pathways for Machine Types Products Components End Users and Sales Channels

Deep segmentation analysis reveals differentiated growth drivers that underscore the nuanced nature of demand for injection molding machines. Across machine types, electric systems have gained traction for their superior energy efficiency and precision control over clamping pressure, while hybrid architectures continue to attract manufacturers seeking a balance between cost and performance. Traditional hydraulic machines remain entrenched in high-pressure applications, particularly for thick-walled parts, though they are progressively retrofitted with smart monitoring modules to enhance reliability.

When examining product types, plastic components dominate volume applications, with thermoplastics preferred for their recyclability and cost advantages, and thermosets utilized in high-temperature contexts such as electrical insulators. Metal and ceramic parts are typically processed through specialist equipment, reflecting stringent material handling and tooling requirements. Rubber molding continues to serve niche industries, where elastomeric properties are critical for seals and vibration-dampening applications.

Insight into machine components underscores the importance of robust hydraulic systems and injection units, which account for the bulk of maintenance interventions, while control units are increasingly the focal point for digital upgrades. Tie bars and clamping units see periodic overhaul cycles dictated by part complexity and tonnage demands, and cooling units have emerged as a prime candidate for efficiency retrofits.

End-user analysis highlights automotive segments-driven by exterior component molding for lightweight car bodies and interior trim elements-alongside burgeoning opportunities in electronics and healthcare devices. Consumer goods maintain steady uptake of plastic molds, while medical device manufacturing sets the pace for high-cleanliness standards. Finally, sales channel evaluation indicates that offline machine purchases, facilitated through direct OEM relationships and machinery expos, persist as the primary route, yet online platforms are gaining ground for spare parts and service contracts, reflecting a shift toward digital procurement engagements.

This comprehensive research report categorizes the Injection Molding Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Product Type

- Machine Components

- End-User

- Sales Channel

Highlighting Regional Market Differentiators and Growth Potential Across Americas Europe Middle East Africa and Asia-Pacific Territories

Regionally, the Americas present a mature market environment where North America’s established automotive clusters and medical equipment hubs drive sustained demand for high-precision electric and hybrid injection molding systems. Mexico’s growth trajectory benefits from nearshoring trends, as manufacturers leverage geographic proximity and trade agreements to secure stable component supply, while South American markets demonstrate selective adoption driven by cost-sensitive consumer applications and emerging infrastructure investments.

In Europe, Middle East & Africa, German and Italian OEMs maintain leadership through advanced engineering and a strong emphasis on sustainability, often integrating closed-loop cooling and energy-recovery modules into machine designs. Regulatory frameworks around carbon emissions and waste reduction in the European Union amplify the adoption of low-energy injection platforms. Meanwhile, Middle Eastern manufacturers are exploring partnerships to localize production capabilities, and African markets remain nascent but show promise in sectors such as packaging and consumer appliances.

Asia-Pacific continues to be the fastest-growing region, with China and India at the forefront of capacity expansion fueled by automotive electrification and consumer electronics proliferation. Japan’s long-standing reputation for process innovation sustains demand for high-end, precision-focused machinery, while Southeast Asian countries are increasingly targeted for assembly lines due to competitive labor costs and evolving trade dynamics. This region’s robust aftermarket services and spare parts networks further cement its position as a critical node in global injection molding supply chains.

This comprehensive research report examines key regions that drive the evolution of the Injection Molding Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Strategies Innovations Collaborations and Competitive Advantages Shaping the Injection Molding Machine Arena

Leading industry players have adopted distinct strategies to secure competitive advantages in the injection molding machine space. Some organizations have prioritized the development of proprietary software platforms, integrating artificial intelligence modules to optimize cycle parameters and predict maintenance needs. Others are forging partnerships with materials suppliers to co-innovate advanced resin formulations that expand the scope of molded applications, from lightweight structural components to biocompatible medical devices.

Several key machine manufacturers have also pursued targeted acquisitions to enhance their service portfolios, enabling them to offer comprehensive lifecycle support encompassing retrofit packages and remote diagnostics. Collaborative ventures between OEMs and university research centers are emerging as fertile ground for next-generation process breakthroughs, including in-mold sensors and variable-speed drive technologies. Meanwhile, smaller specialist firms are focusing on niche segments-such as micro-injection and high-temperature molding-to capture unique market pockets and command premium pricing through technical differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Injection Molding Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARBURG GmbH + Co KG

- FANUC CORPORATION

- Haitian Plastic Machinery Group Co., Ltd.

- Hillenbrand, Inc.

- Huarong Group

- Husky Technologies

- KraussMaffei Group GmbH

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Ningbo Haida Plastic Machinery Co., Ltd

- Sumitomo Heavy Industries, Ltd.

- UBE Machinery Inc.

- Yizumi Holdings Co., Ltd.

Defining Actionable Strategies and Operational Roadmaps to Propel Market Leadership Efficiency and Resilience in Injection Molding Machine Enterprises

Industry leaders should expedite the integration of sensor-driven digital solutions to bolster predictive maintenance capabilities and minimize unplanned downtime, thereby safeguarding production continuity. Concurrently, diversifying supplier networks to include both domestic and international partners will mitigate tariff-related disruptions and strengthen supply chain resilience.

Investing in electric injection molding platforms and energy-recovery enhancements will not only align with global sustainability mandates but also reduce total cost of ownership over the equipment lifecycle. Executives are advised to establish cross-functional innovation councils that bring together process engineers, materials scientists, and digital experts to accelerate product development and enable agile responses to shifting end-user requirements.

In addition, cultivating aftermarket service excellence through remote monitoring, rapid spare parts fulfillment, and operator training programs can unlock new revenue streams while deepening customer loyalty. Finally, embedding circular economy principles-such as modular tooling, recyclable materials, and refurbishment pathways-into strategic roadmaps will future-proof operations and position enterprises to thrive amid evolving environmental regulations.

Detailing Rigorous Research Methodology Employing Qualitative and Quantitative Techniques to Ensure Accuracy Reliability and Industry Relevance

This research draws upon a rigorous mixed-methods approach, combining qualitative insights from in-depth interviews with senior executives, plant managers, and process engineers across leading OEMs and end-user organizations. These primary discussions were complemented by quantitative data collection, leveraging structured surveys and real-time performance metrics provided by machine monitoring systems.

Secondary research involved thorough analysis of industry journals, patent filings, and conference proceedings to map technology trajectories and identify emerging best practices. Publicly available trade data and regulatory filings informed the examination of tariff impacts and trade flows, while proprietary databases supplied historical analysis of machinery installations and aftermarket service adoption trends.

Methodological integrity was ensured through triangulation of findings across multiple data sources, peer review by independent subject-matter experts, and validation workshops with stakeholder groups. This multifaceted framework guarantees that the study’s conclusions reflect both current market realities and forward-looking perspectives, offering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Injection Molding Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Injection Molding Machine Market, by Machine Type

- Injection Molding Machine Market, by Product Type

- Injection Molding Machine Market, by Machine Components

- Injection Molding Machine Market, by End-User

- Injection Molding Machine Market, by Sales Channel

- Injection Molding Machine Market, by Region

- Injection Molding Machine Market, by Group

- Injection Molding Machine Market, by Country

- United States Injection Molding Machine Market

- China Injection Molding Machine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Consolidating Key Findings and Strategic Implications Offering a Clear Path Forward in the Evolving Injection Molding Machine Market

In summary, the injection molding machine industry stands at the convergence of technological innovation, shifting trade landscapes, and evolving sustainability priorities. The ascent of electric and hybrid machine architectures underscores a collective drive toward energy efficiency, while digital transformation initiatives deliver unparalleled visibility into operational performance. At the same time, new tariff regimes have spurred strategic nearshoring and supply chain diversification, demonstrating the sector’s capacity to adapt to complex regulatory environments.

Segmentation analysis has highlighted discrete opportunity areas, from high-precision medical components to cost-sensitive consumer goods, each underpinned by unique material and machine requirements. Regional differentiation further accentuates the need for tailored market approaches, whether it be the advanced engineering focus in Europe or the rapid expansion of automotive electrification in Asia-Pacific. As key players refine their competitive strategies through innovation partnerships and service augmentations, the industry is poised for continued evolution.

Decision-makers equipped with these insights can confidently chart their next moves, balancing investment in new technologies with strategic operational adjustments. By aligning resource allocation with clearly defined segmentation and regional imperatives, organizations will be well-positioned to capture growth, mitigate risks, and forge a resilient path forward in an increasingly dynamic competitive arena.

Take the Next Step Towards Harnessing Comprehensive Insights and Competitive Edge by Engaging with Our Expert Report Offering

We invite you to delve deeper into the comprehensive analysis and strategic insights outlined in this report by securing your copy today. For a tailored discussion on how these findings align with your unique business objectives, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the specialized data sets and bespoke recommendations designed to elevate your position within the injection molding machine market. Harness the full potential of this research to build resilience, optimize operational efficiency, and accelerate innovation in your organization.

- How big is the Injection Molding Machine Market?

- What is the Injection Molding Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?