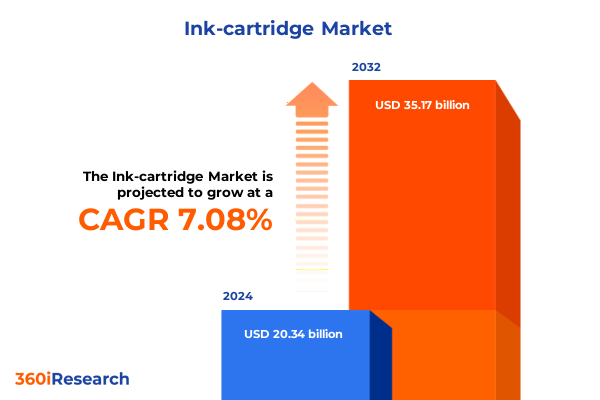

The Ink-cartridge Market size was estimated at USD 21.70 billion in 2025 and expected to reach USD 23.15 billion in 2026, at a CAGR of 7.14% to reach USD 35.17 billion by 2032.

Elevating Print Quality and Efficiency Through Advanced Ink Cartridge Innovations Amid Rapid Supply Chain and Market Dynamics

In today’s rapidly evolving printing landscape, ink cartridges have transcended their role as mere consumables to become pivotal components of comprehensive print ecosystems. Advances in printhead technology and ink chemistry are enabling higher-resolution output, faster print speeds, and extended cartridge lifecycles, reshaping customer expectations across commercial, industrial, and residential segments. Concurrently, environmental considerations are driving manufacturers and end users to prioritize sustainable formulations and recycling initiatives, signaling a profound shift toward circular economy principles within the ink supply chain.

At the same time, global supply chain volatility-driven by logistical bottlenecks, fluctuating raw material availability, and unpredictable trade policies-has underscored the importance of resilience and diversification. OEMs are increasingly exploring multi-sourcing strategies and nearshoring options to mitigate risks associated with transportation delays and tariff fluctuations. This dynamic backdrop is fostering intense competition among original equipment manufacturers, compatible cartridge producers, and remanufacturers, each vying to deliver optimal combinations of performance, cost-effectiveness, and sustainability.

As digital transformation continues to permeate print operations, data-driven approaches to fleet management and consumables replenishment are gaining traction. Connected printers and IoT-enabled cartridges facilitate real-time monitoring of ink levels and predictive maintenance, empowering enterprises to reduce waste and maximize uptime. This integration of hardware, software, and analytics is redefining value propositions, enabling vendors to differentiate through subscription-based models and outcome-oriented services.

Embracing Digitalization and Sustainability as Catalysts for Next-Generation Ink Cartridge Solutions

The ink cartridge market is experiencing transformative shifts driven by the convergence of digitalization and sustainability imperatives. Digital printing technologies, including on-demand and direct-to-substrate systems, are enabling shorter run lengths and personalized outputs, which in turn demand cartridges formulated for precision ink deposition and rapid curing. This shift toward customization extends beyond traditional office environments into packaging and labeling applications, where variable data printing delivers enhanced brand engagement and supply chain traceability.

Meanwhile, environmental regulations and corporate sustainability commitments are catalyzing the development of eco-friendly ink chemistries and closed-loop recycling initiatives. Leading suppliers are investing in bio-based solvents and pigment dispersions that reduce volatile organic compound emissions, while collaborative partnerships with waste management firms facilitate end-of-life cartridge collection and remanufacturing. Such initiatives not only comply with stringent global standards but also resonate with eco-conscious consumers and enterprises seeking to minimize their carbon footprints.

Furthermore, artificial intelligence and analytics are being harnessed to optimize print operations and consumables usage. Predictive algorithms analyze historical usage patterns to recommend cartridge replacements and maintenance schedules, reducing unplanned downtime and lowering total cost of ownership. As organizations embrace Industry 4.0 principles, these data-driven insights will become integral to holistic print management platforms, fostering tighter alignment between consumables suppliers and end users.

Analyzing the Economic and Operational Ramifications of 2025 U.S. Tariff Actions on Ink Cartridge Supply Chains

In early 2025, a new wave of U.S. trade tariffs reshaped the cost structure for ink cartridge components and color materials. The Congressional Budget Office projected that these tariffs, implemented between January and May, would increase inflation by an average of 0.4 percentage points in 2025 and 2026, eroding purchasing power for both businesses and consumers while reducing real economic output in the United States. These macroeconomic shifts compelled industry players to reassess pricing strategies and supply chain footprints.

Major pigment and dye suppliers, including Sun Chemical, responded by introducing tariff surcharges on impacted color materials to offset elevated import costs. Despite a high proportion of domestic sourcing for base chemicals, the additional duties substantially increased production expenses for imported pigments and intermediary compounds. Tariff surcharges, varying by country of origin, were communicated directly to customers, prompting printers and OEMs to negotiate revised long-term supply agreements and explore alternative raw material sources.

Industry associations voiced concerns regarding trade policy volatility and its downstream effects on production costs and competitiveness. Statements from the American Coatings Association and specialty chemical stakeholders emphasized the disruption of well-established supply chains across North America and the potential ripple effects on essential consumer goods and industrial applications. These developments underscored the need for continuous monitoring of geopolitical shifts and proactive collaboration among raw material suppliers, cartridge producers, and end users to safeguard market stability.

Unlocking Strategic Opportunities Through In-Depth Segmentation Analysis of the Ink Cartridge Market

The competitive landscape of the ink cartridge market is best understood through a nuanced examination of its segmentation. When evaluated by type segmentation, original equipment manufacturer offerings continue to set performance benchmarks, though compatible and remanufactured alternatives have gained ground by offering cost advantages without significant compromises in print quality. Insights into formulation segmentation reveal that dye-based inks, favored for vibrant color reproduction, coexist alongside pigment-based formulations prized for archival permanence and waterfastness, each serving distinct application needs across office and photographic printing.

Cartridge color segmentation further differentiates market dynamics, as black ink remains the ubiquitous workhorse for document printing, while color cartridges-encompassing cyan, magenta, yellow, and combinations-drive value in graphic-intensive applications such as photo printing and product labeling. Capacity segmentation highlights the strategic trade-offs between standard-yield cartridges, which align with light-usage environments, and high-yield variants designed for heavy usage, enabling reduced frequency of replacements and improved total cost of ownership metrics within commercial and industrial settings.

Distribution channel segmentation underscores the evolution of procurement behaviors. Offline channels maintain significance through distributors and retail outlets-ranging from office supply stores to supermarkets-while online channels, including direct-to-consumer portals and marketplaces, offer convenience and subscription models that bolster recurring revenue streams. The end-user segmentation spans commercial enterprises that demand reliability and service agreements, industrial users requiring specialized ink chemistries, and residential customers seeking user-friendly solutions. Application segmentation delineates label printing, office document production, and photo printing, each with sub-segments for packaging and product labels, form and document printing, and consumer versus professional photography, reflecting diverse performance and regulatory requirements.

This comprehensive research report categorizes the Ink-cartridge market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Formulation

- Cartridge Color

- Cartridge Capacity

- Application

- Distribution Channel

- End User

Decoding Regional Growth Patterns and Sustainability Drivers Across the Global Ink Cartridge Landscape

Regional dynamics within the ink cartridge market are shaped by distinct economic factors and consumer preferences. In the Americas, a mature print environment and well-established distribution networks underpin steady demand for both OEM and aftermarket cartridges. Corporate sustainability mandates in North America are driving adoption of remanufactured cartridges and closed-loop recycling initiatives, while Latin American markets are experiencing growth in small business printing due to expanding microfinance and digitalization efforts.

Across Europe, Middle East & Africa, the market is influenced by stringent environmental regulations and a strong emphasis on energy efficiency. The European Union’s eco-label directives encourage suppliers to enhance cartridge recyclability and reduce volatile organic compound emissions. In the Middle East, infrastructural investments are expanding commercial printing services, whereas Africa’s nascent digital printing sector is leapfrogging traditional technologies, favoring versatile inkjet solutions that accommodate both industrial and small-format requirements.

In Asia-Pacific, high-growth economies such as China and India are driving volumes through burgeoning e-commerce and packaging printing sectors. Local OEMs and aftermarket suppliers are capturing share by offering competitively priced cartridges optimized for regional print habits and climate conditions. Australasia’s mature market continues to emphasize sustainability and service-based models, with managed print services integrating IoT-enabled cartridges to monitor usage and automate replenishment across distributed enterprise fleets.

This comprehensive research report examines key regions that drive the evolution of the Ink-cartridge market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Collaborative Models Among Key Ink Cartridge Industry Stakeholders

Leading technology providers maintain dominant positions by leveraging extensive R&D capabilities and brand recognition. HP, Canon, Epson, and Brother continue to innovate in printhead design and ink formulations, securing high-margin opportunities in both office and professional printing segments. Concurrently, aftermarket specialists such as Ninestar and static control suppliers are expanding their portfolios through strategic partnerships and investments in proprietary chip technologies that ensure compatibility and performance consistency.

Vertical integration is becoming more prevalent among major ink suppliers. Companies like Sun Chemical are strengthening their presence in the inkjet cartridge value chain by offering complete pigment and dye solutions, thereby capturing greater value and ensuring supply chain resilience. At the same time, remanufacturers are consolidating to achieve economies of scale and broaden service offerings, focusing on certified pre-owned cartridges and warranty-backed solutions that appeal to cost-conscious enterprises.

Strategic alliances between OEMs and managed print service providers are also reshaping competitive dynamics. By embedding analytics and subscription models into service contracts, industry leaders are shifting from transactional sales to outcome-based engagements, aligning incentives around uptime, productivity, and sustainability targets. This collaborative approach is fostering deeper customer relationships and unlocking recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ink-cartridge market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Brother Industries, Ltd.

- Canon Inc.

- Cartridge World Australia Pty Ltd

- Dynamic Cassette International

- Fujifilm Holdings Corporation

- HP Inc.

- Konica Minolta, Inc.

- Kyocera Corporation

- Lexmark International, Inc.

- Ninestar Corporation

- Oki Electric Industry Co., Ltd.

- Panasonic Corporation

- Print‑Rite Holdings Ltd.

- Ricoh Company, Ltd.

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- Sharp Corporation

- Static Control Components, Inc.

- Toshiba Tec Corporation

- Xerox Holdings Corporation

Implementing Sustainable Practices Data-Driven Supply Strategies and Outcome-Oriented Service Models for Market Leadership

Industry leaders should prioritize investment in sustainable ink chemistries and circular-economy initiatives to meet escalating regulatory and customer demands. Establishing robust take-back and remanufacturing programs not only mitigates environmental impact but also creates alternative revenue streams and enhances brand reputation. By forging partnerships with recycling specialists and leveraging digital tracking of cartridge lifecycles, stakeholders can demonstrate measurable progress toward corporate responsibility targets.

To navigate ongoing supply chain uncertainties, organizations must diversify raw material sourcing and adopt dual-sourcing strategies for critical pigments and printheads. Nearshoring production facilities or forging regional alliances can reduce lead times and exposure to tariff fluctuations. Additionally, integrating predictive analytics into inventory management systems will enable more accurate demand forecasting and minimize safety stock requirements, balancing cost efficiency with service reliability.

Embracing data-driven service models will unlock new growth opportunities. By embedding IoT sensors within cartridges and connecting these to cloud-based analytics platforms, suppliers can offer proactive maintenance, automated replenishment, and usage-based billing. Such outcome-oriented services not only differentiate offerings but also foster recurring revenue, strengthen customer loyalty, and generate valuable usage data to inform future product development.

Employing Comprehensive Multi-Source Research and Data Triangulation to Ensure Robust and Actionable Market Insights

The findings presented in this report are derived from a multi-faceted research approach combining exhaustive secondary research, primary stakeholder interviews, and rigorous data triangulation. Secondary research involved the review of industry publications, regulatory filings, patent databases, and trade association reports to map historical trends and emerging innovations. Primary research encompassed interviews with senior executives across OEMs, aftermarket specialists, distributors, and end users, providing nuanced perspectives on operational challenges and strategic priorities.

Quantitative data was collected from manufacturer and distributor shipment records, customs trade statistics, and financial disclosures, then corroborated with insights from third-party analytics platforms. Qualitative inputs were synthesized through scenario analysis workshops, exploring potential future states under varying tariff, sustainability, and technological adoption scenarios. The integration of both qualitative and quantitative dimensions ensures a comprehensive understanding of market dynamics and supports robust strategic planning.

Throughout the research process, findings were validated through iterative peer reviews and feedback loops with industry experts to ensure accuracy, relevance, and actionable applicability. This methodology underpins the report’s credibility and equips decision-makers with a reliable foundation for investment, product development, and strategic initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ink-cartridge market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ink-cartridge Market, by Type

- Ink-cartridge Market, by Formulation

- Ink-cartridge Market, by Cartridge Color

- Ink-cartridge Market, by Cartridge Capacity

- Ink-cartridge Market, by Application

- Ink-cartridge Market, by Distribution Channel

- Ink-cartridge Market, by End User

- Ink-cartridge Market, by Region

- Ink-cartridge Market, by Group

- Ink-cartridge Market, by Country

- United States Ink-cartridge Market

- China Ink-cartridge Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing Market Forces Technology Trends Sustainability Imperatives and Tariff Impacts to Guide Strategic Decision Making

Ink cartridge market evolution is being driven by simultaneous pressures: advancing print technologies, sustainability imperatives, and evolving trade landscapes. Digitalization and customization are redefining demand profiles, while environmental regulations and circular economy approaches are reshaping supplier strategies. The introduction of new U.S. tariffs in early 2025 has underscored the importance of supply chain agility, compelling stakeholders to adopt innovative sourcing and pricing strategies to mitigate cost pressures.

Segmentation analysis highlights distinct value propositions across OEM, compatible, and remanufactured offerings, each aligned to specific end-user requirements and spray-nozzle chemistries. Regional insights reveal mature markets in the Americas and Europe, contrasted with high-growth dynamics in Asia-Pacific. Competitive patterns indicate a shift toward integrated service models and strategic alliances, as leading players seek to capture recurring revenue through subscriptions and data-driven maintenance offerings.

Looking ahead, success in the ink cartridge market will hinge on the ability to balance technological innovation, environmental stewardship, and supply chain resilience. Organizations that effectively integrate sustainable practices, diversify sourcing, and embrace data-driven services will be best positioned to capitalize on growth opportunities and navigate ongoing market disruptions.

Ready to Elevate Your Market Strategy With Comprehensive Ink Cartridge Insights

Ready to Elevate Your Market Strategy With Comprehensive Ink Cartridge Insights?

Equip your organization with a strategic advantage by obtaining the full ink cartridge market research report. This comprehensive study delves into the latest industry transformations, tariff implications, segmentation nuances, regional dynamics, and competitive landscapes. By partnering with our expert authors, you will gain deep, data-driven insights that empower you to refine your product portfolio, optimize distribution channels, and enhance customer engagement.

Contact Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored licensing options, discuss enterprise-level access, or arrange a detailed walkthrough of the report’s methodology and key findings. Transform your understanding of the ink cartridge market into actionable strategies that drive growth and profitability.

- How big is the Ink-cartridge Market?

- What is the Ink-cartridge Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?