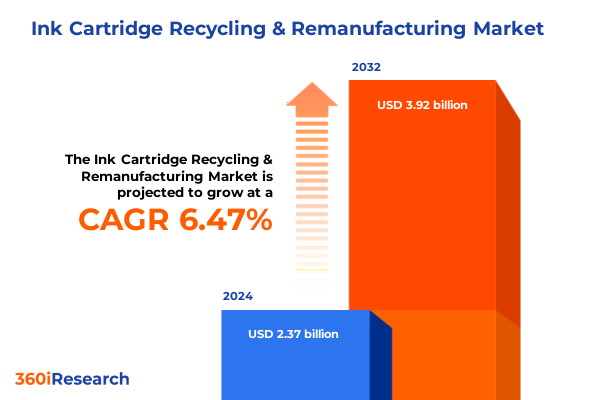

The Ink Cartridge Recycling & Remanufacturing Market size was estimated at USD 1.64 billion in 2025 and expected to reach USD 1.74 billion in 2026, at a CAGR of 6.37% to reach USD 2.53 billion by 2032.

Unveiling the Critical Role of Ink Cartridge Recycling and Remanufacturing in Driving Sustainable Supply Chains, Cost Efficiencies, and Circular Economy Growth

In recent years, mounting environmental concerns and evolving regulatory standards have elevated ink cartridge recycling and remanufacturing from niche initiatives to core elements of a sustainable supply chain. Organizations across sectors are seeking ways to reconcile ongoing printing requirements with circular economy objectives, transforming waste management from a compliance obligation into a competitive advantage. By reclaiming and refurbishing spent cartridges through processes such as cartridge refilling and component replacement, stakeholders not only reduce reliance on virgin raw materials but also minimize landfill volumes and greenhouse gas emissions.

As the printing industry grapples with fluctuating material costs and heightened consumer expectations for eco-friendly practices, remanufactured cartridges are gaining credibility for delivering performance on par with original equipment. This evolution has been supported by technological advances in quality control, precision refilling, and component restoration. Consequently, companies can confidently integrate remanufactured supplies into their procurement portfolios, reinforcing corporate sustainability goals while capturing economic benefits through lower total cost of ownership.

Examining the Transformative Technological, Regulatory, and Consumer Behavior Shifts Redefining the Future of Ink Cartridge Recycling and Remanufacturing Industry

Technological innovation has been pivotal in redefining how spent ink cartridges are processed and revitalized. Automated refilling stations now employ precise volumetric measurement and sensor-driven quality checks, ensuring consistent yield and color fidelity. Simultaneously, advancements in component replacement techniques allow remanufacturers to restore critical elements-such as seals and chips-enhancing compatibility with printer firmware updates. These breakthroughs have narrowed the performance gap between remanufactured and OEM cartridges, fostering greater confidence among corporate procurement teams.

Regulatory frameworks are also in flux. Governments across North America, Europe, and Asia-Pacific are tightening waste diversion targets and implementing extended producer responsibility schemes. This shift has incentivized manufacturers to design products for disassembly and to collaborate with third-party refurbishers. Coupled with growing consumer demand for transparent sustainability credentials, the industry is witnessing a move toward standardized certification programs that validate the environmental claims of remanufactured supplies.

Moreover, changing end-user behavior is reshaping market dynamics. Small offices and home users increasingly prioritize eco-labels when selecting consumables, while large print service providers leverage remanufacturing partnerships to differentiate their offerings. As a result, the competitive landscape is evolving, with new entrants and established players aligning around circular business models and co-creative supply chain networks.

Assessing the Comprehensive Impacts of United States Tariffs Implemented in 2025 on Ink Cartridge Recycling and Remanufacturing Operations

The introduction of new United States tariffs in early 2025 has injected both challenges and opportunities into the ink cartridge recycling and remanufacturing ecosystem. Tariffs under the International Emergency Economic Powers Act (IEEPA) imposed on imports from China, Canada, and Mexico have driven up the cost of virgin components and OEM equivalents, making remanufactured solutions more cost-competitive by comparison. Although certain goods claiming compliance with the United States-Mexico-Canada Agreement are exempt, many non-compliant accessories and raw materials are subject to rates as high as 25 percent.

By elevating the landed costs of imported cartridges and parts, these measures have prompted remanufacturers to deepen relationships with domestic suppliers of chips, seals, and plastic housings. In turn, localized sourcing strategies have shortened supply chains and improved responsiveness to firmware changes and printer model introductions. At the same time, some remanufacturers have secured tariff mitigation by investing in onshore component production, reinforcing near-shoring as a strategic priority.

Nevertheless, navigating the evolving tariff landscape requires agility. Companies must continuously monitor rule-of-origin determinations and certification processes to maximize preferential duty treatments. Those with robust trade compliance functions are better positioned to avoid unexpected duties, reclaim overpayments, and maintain stable pricing for corporate end users. As firms adapt, the cumulative effect of these trade policies is fostering a more resilient and regionally diversified remanufacturing network.

Key Segmentation Insights Revealing Product Types, Applications, Sales Channels, Color Options, and Yield Variations Driving Market Dynamics

Insight emerges when examining market dynamics through multiple segmentation lenses. When categorizing by product type, stakeholders recognize the interplay among compatible cartridges, original equipment manufacturer offerings, and remanufactured cartridges-each serving distinct customer priorities around cost and reliability. Within remanufactured cartridges, refilling services and component replacement practices are unlocking new performance thresholds, appealing to both price-sensitive buyers and those demanding stringent print quality. Shifting focus to application reveals diverse usage patterns: home and education environments often favor cost-effective refilling programs, while office settings require turnkey supply agreements featuring service level guarantees. Print service providers, by contrast, leverage high-volume remanufacturing partnerships to differentiate on sustainability and total cost efficiency.

Sales channel segmentation further illuminates market behaviors. Direct sales channels enable manufacturers and remanufacturers to cultivate deep customer relationships and subscription models, whereas e-commerce platforms deliver convenience and rapid replenishment. Retail stores continue to serve as critical touchpoints for on-demand purchases, especially in regions with limited online infrastructure. In the color dimension, black-and-white cartridges dominate routine document printing, but color supplies drive higher margins in graphic-intensive applications and specialist print services. Finally, yield segmentation underscores strategic procurement decisions: high-yield cartridges appeal to large print environments seeking minimal intervention, while standard-yield products support balanced cost-per-page considerations for moderate usage profiles.

This comprehensive research report categorizes the Ink Cartridge Recycling & Remanufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Processing Type

- Cartridge Type

- Color Layout

- Material Composition

- End User

Critical Regional Insights Highlighting the Distinct Dynamics of Ink Cartridge Recycling and Remanufacturing Across Americas, EMEA, and Asia-Pacific Regions

Regional differences exert a profound influence on recycling and remanufacturing strategies around the globe. In the Americas, mature aftermarket channels are bolstered by extended producer responsibility regulations in select states, driving leading brands and remanufacturers to invest heavily in take-back programs and reverse logistics infrastructure. Meanwhile, collaborative industry consortia have emerged to standardize quality benchmarks and facilitate cross-border material flows within the United States, Canada, and Mexico.

Across Europe, the Middle East, and Africa, divergent national regulations and recycling mandates have led to a patchwork of compliance requirements. Western European markets exhibit high adoption of certified remanufactured supplies, underpinned by stringent waste-reduction targets and consumer preferences for closed-loop solutions. In contrast, emerging markets in Eastern Europe and parts of the Middle East prioritize incremental improvements in landfill diversion and have demonstrated growing interest in public-private partnerships to build remanufacturing capacity. Africa’s nascent recycling infrastructure is attracting strategic investments aimed at developing skills, standards, and localized remanufacturing hubs to meet rising printing demands.

In Asia-Pacific, government incentives for circular economy initiatives are accelerating industry transformation. China, Japan, Australia, and South Korea have introduced grant programs and tax benefits for remanufacturing facilities, spurring the scale-up of automated refilling lines and chip resetting technologies. At the same time, developing economies in Southeast Asia are emerging as assembly and distribution centers for recycled components, leveraging cost advantages and burgeoning consumer awareness of sustainable print solutions.

This comprehensive research report examines key regions that drive the evolution of the Ink Cartridge Recycling & Remanufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Company Insights Profiling Leading Players Innovating and Collaborating to Advance Ink Cartridge Recycling and Remanufacturing Practices Globally

Leading companies are charting diverse pathways to strengthen their positions in the ink cartridge recycling and remanufacturing landscape. OEM manufacturers continue to enhance cartridge designs for easier disassembly, equipping end users with proprietary tools and official take-back channels. These initiatives, combined with closed-loop collaborations with accredited remanufacturers, help protect brand integrity and ensure high-performance outcomes.

Independent remanufacturers are investing in state-of-the-art refilling and component replacement equipment, adopting six-sigma quality controls and ISO 14001 certification to differentiate their offerings. Strategic partnerships with chemical suppliers yield proprietary ink formulations that match or exceed OEM color fidelity, catering to demanding print service providers. Some companies have integrated advanced data analytics to forecast printer model lifecycles and optimize component inventory, reducing lead times and minimizing obsolete stock.

New entrants are leveraging platform-based models to connect corporate users directly with local remanufacturing centers, enabling rapid turnaround under service-level agreements. At the same time, legacy print service providers are embedding remanufacturing capabilities within their service suites, offering managed print services that bundle hardware, supplies, and recycling under a single contract. This convergence blurs traditional boundaries, positioning leading players to capture value across the entire cartridge lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ink Cartridge Recycling & Remanufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Clover Imaging Group LLC

- Cartridge World LLC

- Ninestar Corporation

- LD Products Inc.

- Evolve Recycling

- ARMOR GROUP

- Office Depot Inc.

- Planet Green Cartridges Inc.

- Zero Waste Recycling

- Ink & Toner Recycling Ltd.

- Inkfarm

- Cartridge Junction

- Dynamic Cassette International

- IMEX Co,. Ltd.

- Ink Technologies, LLC

- Ink4Less

- Katun Corporation

- Konica Minolta, Inc.

- Rcube

- Refeel Cartridge Engineering

- Ricoh Company, Ltd.

- Staples, Inc.

- Stinkyink

Actionable Recommendations Empowering Industry Leaders to Optimize Sustainability, Operational Efficiencies, and Strategic Partnerships in the Ink Cartridge Recycling Realm

To capitalize on emerging opportunities, industry leaders should pursue best-in-class collaboration across value chain partners. Establishing formal alliances between OEMs, independent remanufacturers, and logistics providers can facilitate circular supply networks that secure high-quality cores at scale. Investing in automation and robotics for cartridge disassembly and chip resetting will enhance yield recovery and ensure consistency.

It is critical to engage proactively with regulatory bodies to shape extended producer responsibility frameworks and certification standards that balance environmental objectives with operational feasibility. Offering transparency through digital chain-of-custody platforms will reinforce customer trust and demonstrate compliance with evolving legislation. Prioritizing research into next-generation materials-such as bio-derived polymers and non-toxic inks-can further bolster sustainability credentials and drive differentiation.

Finally, companies should leverage targeted marketing campaigns that articulate the tangible cost savings and environmental benefits of remanufactured supplies. Combining managed print service agreements with subscription-based remanufacturing packages will create recurring revenue streams and deepen customer loyalty, laying the foundation for sustained growth in the circular economy era.

Robust Research Methodology Outlining Comprehensive Data Collection, Analysis Frameworks, and Validation Techniques for Evaluating Ink Cartridge Lifecycle Dynamics

This report draws upon a multifaceted research methodology to deliver robust, validated insights. Primary research included in-depth interviews with senior executives at OEMs, leading remanufacturers, and major print service providers. These conversations illuminated evolving procurement priorities, supply chain challenges, and emerging technology adoption patterns.

Secondary research encompassed analysis of industry publications, regulatory filings, and academic journals related to circular economy principles, waste management legislation, and material science innovations. Trade association data provided historical context on recycling volumes and remanufacturing trends, while government reports offered insights into tariff regimes and extended producer responsibility frameworks.

Complementing these approaches, site visits to remanufacturing facilities enabled firsthand observation of disassembly, refilling, and component replacement processes. Process flow mapping and quality audit findings were subjected to cross-validation with interview data to ensure accuracy. Finally, the research underwent peer review by subject-matter experts, refining conclusions and recommendations to withstand rigorous industry scrutiny.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ink Cartridge Recycling & Remanufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ink Cartridge Recycling & Remanufacturing Market, by Processing Type

- Ink Cartridge Recycling & Remanufacturing Market, by Cartridge Type

- Ink Cartridge Recycling & Remanufacturing Market, by Color Layout

- Ink Cartridge Recycling & Remanufacturing Market, by Material Composition

- Ink Cartridge Recycling & Remanufacturing Market, by End User

- Ink Cartridge Recycling & Remanufacturing Market, by Region

- Ink Cartridge Recycling & Remanufacturing Market, by Group

- Ink Cartridge Recycling & Remanufacturing Market, by Country

- United States Ink Cartridge Recycling & Remanufacturing Market

- China Ink Cartridge Recycling & Remanufacturing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Future Trajectory of Ink Cartridge Recycling and Remanufacturing Amid Evolving Market, Regulatory, and Technological Forces

As the ink cartridge recycling and remanufacturing landscape continues to mature, the convergence of technological innovation, regulatory momentum, and shifting customer expectations will define competitive advantage. Organizations that adopt holistic circular economy strategies-integrating product design, reverse logistics, and service offerings-will achieve superior environmental performance and cost efficiencies.

Moreover, the cumulative impact of trade policies and tariff adjustments is driving a strategic shift toward regional supply chain resilience. Stakeholders capable of aligning procurement, compliance, and manufacturing functions will unlock greater stability in an uncertain trade environment. Simultaneously, embracing digital traceability solutions will facilitate compliance and foster transparency, strengthening stakeholder confidence across the value chain.

In summary, the market’s trajectory favors those willing to invest in collaborative ecosystems, leverage automation for scale, and advance sustainable materials research. By adhering to best practices and proactively anticipating regulatory developments, companies will be well positioned to capture long-term value in this rapidly evolving segment.

Engage Now to Secure Strategic Insights and Expert Guidance from Ketan Rohom for Purchasing the Definitive Ink Cartridge Recycling Market Research Report

If you’re ready to harness the competitive edge offered by an in-depth understanding of the ink cartridge recycling and remanufacturing landscape, reach out to Ketan Rohom, Associate Director, Sales & Marketing, at 360iResearch. He will guide you through the process of acquiring the comprehensive market research report packed with strategic insights, custom data visualizations, and actionable plans. This report equips decision-makers with the clarity needed to optimize operations, lead sustainability initiatives, and forge partnerships that drive long-term value. Contact Ketan today to secure your organization’s position at the forefront of circular economy innovation and operational excellence.

- How big is the Ink Cartridge Recycling & Remanufacturing Market?

- What is the Ink Cartridge Recycling & Remanufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?