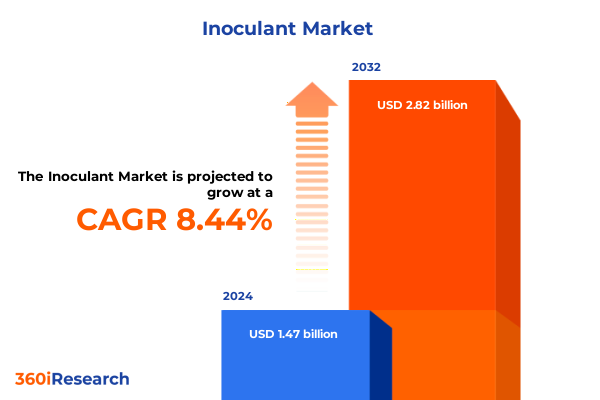

The Inoculant Market size was estimated at USD 1.59 billion in 2025 and expected to reach USD 1.73 billion in 2026, at a CAGR of 8.46% to reach USD 2.82 billion by 2032.

Pioneering Sustainable Crop Enhancement with Bioinoculants Driving Soil Health and Yield Resilience Through Microbial Innovation

Agricultural inoculants, often termed bioinoculants or microbial solutions, represent a pivotal evolution in crop management by harnessing beneficial microorganisms to improve soil health and plant vigor. These bio-based products leverage bacteria, fungi, and other microbes to enhance nutrient uptake, promote growth under stress, and reduce dependency on synthetic chemicals. This shift toward biological inputs has been accelerated by rising environmental concerns and an urgent need for climate-smart agriculture, as exemplified by global awards recognizing breakthroughs in microbial applications that significantly boost yield while curbing fertilizer use.

In recent years, governments and regulatory bodies have introduced incentives and streamlined approval pathways to encourage the adoption of microbial inoculants. Scientific advances in genomics and precision formulation enable developers to tailor inoculant strains to specific crops and soil conditions, while artificial intelligence and digital platforms optimize field-level application timing and dosage. These innovations are complemented by growing consumer demand for residue-free produce and corporate sustainability commitments that prioritize regenerative farming practices.

Despite clear benefits, widespread adoption faces challenges related to product shelf life, logistical constraints, and farmer education. Microbial viability can be compromised during storage and transport, necessitating robust formulation and cold chain solutions. In parallel, extension services and agronomic specialists must collaborate with producers to build confidence, demonstrating consistent field performance under diverse agroecological scenarios.

As the agricultural sector navigates resource constraints and climate variability, bioinoculants stand out as essential tools. Ongoing efforts in research, public–private partnerships, and policy support will determine the trajectory of these products, shaping a more resilient and environmentally sustainable future for global food systems.

Revolutionary Technological and Agronomic Transformations Redefining Microbial Inoculant Integration in Modern Farming Practices

The landscape of microbial inoculant development is undergoing rapid transformation driven by cutting-edge technologies and strategic industry shifts. Venture capital interest in agtech has refocused toward niche yet scalable solutions such as precision formulating and targeted delivery systems, with investments at the intersection of robotics, IoT and bio-based innovations. This convergence is empowering next-generation inoculants that integrate seamlessly with digital farm management platforms, enabling data-driven application timing based on real-time soil and plant analytics.

Simultaneously, major agribusiness players are consolidating expertise through acquisitions and collaborations to secure intellectual property in biologic solutions. A notable example is the acquisition of a genetic repository by Syngenta from Novartis, which strengthens Syngenta’s biologic pipeline and underscores the strategic importance of natural compound libraries for crop protection and plant growth enhancement. Such moves reflect a broader trend of multi-disciplinary R&D alliances that bring together molecular biology, bioinformatics, and formulation science.

Advancements in genetic editing tools, including CRISPR-based approaches, are poised to enhance microbial strain resilience and efficacy under stress conditions. Meanwhile, encapsulation and controlled-release technologies are improving shelf life and field performance, addressing long-standing stability challenges. Beyond the lab, precision application devices-from seed coatings to in-furrow liquid inoculant dispensers-are redefining how bioinoculants reach target soil zones, ensuring maximal colonization and activity.

These disruptive shifts are reshaping traditional product portfolios, forcing incumbents and startups alike to reimagine their go-to-market strategies. As environmental regulations tighten and sustainability metrics become integral to corporate performance, the integration of advanced microbial solutions into mainstream agriculture represents both an opportunity and an imperative for industry stakeholders.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Inoculant Supply Chains Farm Economics and Producer Viability

In early 2025, the United States implemented a series of tariffs that have directly impacted the agricultural inputs landscape, particularly affecting the import of fertilizers and related soil amendments. New 25 percent duties on key trading partners Canada and Mexico, alongside a 20 percent levy on Chinese imports, were introduced to address broader trade and national security objectives. While certain critical minerals like potash received a temporary 10 percent carve-out, these measures have nonetheless reverberated across supply chains.

As a consequence, production costs for U.S. growers have risen significantly. With approximately 85 percent of potash fertilizer sourced from Canada, and substantial volumes of phosphates and nitrogenous compounds also imported, the increased duties have translated into higher per-acre input expenses. Farmers reliant on precision-fertilization approaches must now navigate elevated baseline costs for both traditional chemicals and emerging bio-based amendments.

In parallel, trading partners have responded with retaliatory tariffs targeting American agricultural exports, including soybeans, wheat and dairy, exacerbating market volatility. Exporters faced order cancellations and redirected volumes, leading to reduced revenue streams and logistical challenges in reallocating supply lines. This tit-for-tat environment has underscored the interconnected nature of global agricultural trade.

Over the longer term, producers and input suppliers are exploring strategies to mitigate these pressures. Industry groups have petitioned for tariff exemptions on essential fertilizer components, while policymakers consider diplomatic resolutions to restore low-cost access to critical nutrients. As cost management becomes paramount, the imperative for more efficient, targeted inoculant applications that reduce overall nutrient demand has intensified, spotlighting microbial solutions as potential alleviators of tariff-driven expense inflation.

Uncovering Strategic Market Segmentation Insights for Bioinoculant Applications Tailoring Solutions Across Crop Types Formulations and Delivery Methods

The inoculant market is characterized by a nuanced tapestry of segmentation factors that influence product development, marketing strategies and end-user adoption. By crop type, demand drivers diverge across cereals and grains, which prioritize high-volume nitrogen fixation, versus fruits and nuts where precise root colonization is crucial for nutrient uptake and stress tolerance. Pulse and oilseed systems seek rhizobium-based solutions for efficient nitrogen cycling, while turf and others demand formulations optimized for rapid establishment and aesthetic considerations. Vegetable producers, in contrast, emphasize both yield consistency and resistance to soil-borne pathogens.

Form-based segmentation further dictates manufacturing and logistics considerations. Granular inoculants cater to fertilizer blend compatibility and mechanized spreading, whereas liquid suspensions are favored for in-furrow and drench applications, delivering swift microbial activation. Powder preparations offer cost-efficient shelf stability and simplicity in seed treatment operations. Variations in application method create additional layers of complexity: foliar sprays provide above-ground microbial biostimulation, whereas seed treatments, subdivided into dry coatings and thin-film technologies, directly equip seedlings with protective microbiota. Soil applications, including in-furrow delivery systems and post-emergence drenching, ensure targeted deployment into the rhizosphere.

Microorganism type dictates the mode of action and compatibility with specific agronomic objectives. Azospirillum and Azotobacter strains focus on nitrogen enrichment and root development, while mycorrhizal fungi enhance phosphorus and micronutrient uptake. Rhizobium species remain the cornerstone for legume inoculation, ensuring effective nodule formation. Composition strategy, whether single-strain precision formulas or multi-strain consortia, determines the breadth of functional benefits and product complexity. Distribution channels have evolved to blend traditional offline dealer networks, valued for field-level advisory services, with online platforms including e-commerce marketplaces and manufacturer direct-sales websites, enabling rapid order fulfillment and access to niche specialty products.

This layered segmentation matrix underscores the need for tailored inoculant portfolios. Manufacturers and service providers must align product features with application workflows, stakeholder knowledge levels and regional supply chain capabilities to achieve meaningful market penetration.

This comprehensive research report categorizes the Inoculant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inoculant Type

- Microbe Category

- Form

- Crop Category

- Application Method

- Distribution Channel

Illuminating Regional Dynamics and Growth Drivers Shaping the Inoculant Landscape and Trends in the Americas EMEA and Asia Pacific Markets

Across the Americas, robust policy frameworks and substantial research investments have cemented North America’s leadership in inoculant adoption. Government support programs and extension networks facilitate field trials that validate product performance under diverse climatic conditions, reinforcing confidence among large-scale grain and vegetable producers. Meanwhile, Latin American producers leverage inoculants to enhance sustainability credentials and reduce dependence on imported chemical fertilizers, with Brazil’s soybean sector in particular integrating rhizobia-based solutions for cost-effective nitrogen management.

In Europe, Middle East and Africa, regulatory evolution is set to accelerate biological input adoption. The European Commission’s plan to fast-track biopesticide and biocontrol approvals through a forthcoming Biotech Act aims to cut authorization timelines from nearly a decade to a matter of years, thus aligning Europe with competitive markets in North America and Latin America and encouraging innovation in microbial plant protection and fertility enhancement. Concurrent revisions to plant health regulations will further streamline cross-border deployment of novel formulations, reducing red tape for startups and established players alike.

Asia-Pacific markets are witnessing the fastest growth trajectory, driven by national initiatives to bolster food security and cultivate biotech self-sufficiency. China’s strategic guidelines for gene-editing in major crop varieties promise to catalyze localized inoculant R&D, while India’s government subsidy schemes under programs like Paramparagat Krishi Vikas Yojana are expanding the footprint of biofertilizers across millions of hectares. Southeast Asian producers are increasingly integrating inoculants within integrated pest management and regenerative agriculture frameworks to mitigate yield losses from erratic monsoon patterns and soil degradation.

This comprehensive research report examines key regions that drive the evolution of the Inoculant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Industry Players and Competitive Strategies Driving Innovation Market Expansion and Collaboration in Inoculant Development

Major agribusiness and specialty biotech firms are strategically positioning themselves to capture emerging opportunities in the inoculant sector. Syngenta’s acquisition of Novartis’ genetic compound repository underscores the value of curated strain libraries and natural molecule diversity in bolstering biologic crop protection and growth-promoting portfolios. By integrating complementary R&D capabilities, Syngenta enhances its ability to develop tailored microbial solutions and accelerate commercialization timelines.

Meanwhile, innovative cleantech enterprises are harnessing mycorrhizal fungi and other beneficial microbes to address sustainability imperatives. Companies like Groundwork BioAg, backed by significant public funding, are deploying advanced digital soil mapping and data analytics to optimize inoculant selection and application, thereby increasing carbon sequestration potential and reducing conventional fertilizer use. Such initiatives illustrate how microbial solutions are converging with precision agriculture platforms to deliver quantifiable environmental benefits.

Leading life-science conglomerates, including BASF and Bayer, are expanding their microbial pipelines through internal innovation and external collaborations. Novozymes and Corteva continue to invest in next-generation spore technologies and encapsulation methods that improve microbial viability and field performance under adverse conditions. Startups focusing on genome-edited strains and synthetic consortia are attracting strategic partnerships and growth capital, signaling that the balance of power may shift toward agile biotech innovators with specialized expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inoculant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrauxine By Lesaffre

- Archer Daniels Midland Company

- BASF SE

- Bayer AG

- BIO-CAT Inc.

- BrettYoung

- Cargill, Incorporated

- Corteva Agriscience

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Lallemand Inc.

- MBFi Group

- Novozymes A/S

- Nufarm Ltd.

- Precision Laboratories, LLC

- Premier Tech Group

- Provita Supplements GmbH

- Queensland Agricultural Seeds Pty. Ltd.

- Sumitomo Chemical Co., Ltd.

- Terramax, Inc.

- UPL SOUTH AFRICA (PTY) LTD.

- Verdesian Life Sciences LLC

- Xitebio Technologies Inc.

- Yara International ASA

Actionable Strategic Recommendations for Industry Leaders to Advance Bioinoculant Adoption Regulatory Engagement and Sustainable Market Growth

Industry leaders should prioritize the integration of advanced formulation technologies to enhance microbial viability and stability across diverse supply chains. By investing in encapsulation and controlled-release systems, companies can significantly extend product shelf life and performance consistency. Concurrently, forming cross-sector partnerships-spanning biotech startups, precision ag technology providers and academic institutions-will accelerate R&D pipelines and facilitate rapid field validation across multiple agroecological zones.

Advocacy for streamlined regulatory frameworks should remain a top strategic objective. Active engagement with policymakers to support fast-track approval mechanisms and clear definitions of microbial products will reduce market entry barriers and promote global harmonization. Leaders must also drive educational initiatives for growers and distributors, leveraging digital platforms to provide real-time agronomic guidance and build end-user confidence in microbial solutions.

Diversifying product portfolios to address distinct segmentation layers-from single-strain formulations for targeted legume inoculation to multispecies consortia for broad-spectrum biostimulation-will meet the evolving needs of growers across crops and geographies. Finally, aligning corporate sustainability goals with inoculant adoption-by quantifying reductions in chemical fertilizer use and carbon emissions-will enhance brand value and compliance with increasingly stringent environmental standards.

Comprehensive Research Methodology Leveraging Primary Interviews Secondary Data Analysis and Data Triangulation Techniques for Market Insights

The research methodology underpinning this executive summary combines both primary and secondary data sources to ensure a comprehensive understanding of inoculant market dynamics. Primary research included structured interviews with key stakeholders, such as crop advisers, product formulators and distribution channel partners, enabling rich qualitative insights into emerging adoption drivers and operational challenges.

Secondary research encompassed an extensive review of regulatory publications, scientific journals and reputable industry reports to contextualize technological developments and policy shifts. Trade press articles and press releases were systematically analyzed to capture real-time developments in tariff policy, regional market expansions and corporate transactions.

Data triangulation techniques were employed to validate findings across disparate sources. Quantitative data points, such as import duty rates and subsidy program scopes, were cross-checked against official government releases and international trade databases. Qualitative themes emerging from interviews were compared with published literature and media reports to detect convergent trends and address potential biases.

This methodological framework ensures that the insights presented are both factually robust and reflective of the latest industry intelligence, providing decision-makers with clear, actionable guidance for navigating the evolving inoculant market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inoculant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inoculant Market, by Inoculant Type

- Inoculant Market, by Microbe Category

- Inoculant Market, by Form

- Inoculant Market, by Crop Category

- Inoculant Market, by Application Method

- Inoculant Market, by Distribution Channel

- Inoculant Market, by Region

- Inoculant Market, by Group

- Inoculant Market, by Country

- United States Inoculant Market

- China Inoculant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Concluding Synthesis of Inoculant Market Evolution Technological Advancements Strategic Imperatives and Comprehensive Understanding for Stakeholders

The evolution of agricultural inoculants reflects a broader shift toward sustainable, data-driven farming paradigms. As environmental regulations tighten and consumer expectations heighten, microbial solutions are increasingly recognized as essential components of holistic nutrient management and crop protection strategies. Technological breakthroughs-ranging from AI-enabled field analytics to CRISPR-enhanced microbial strains-have lowered barriers to adoption and expanded the functional scope of inoculant offerings.

Geopolitical factors, including the imposition of tariffs and shifting trade alliances, have underscored the vulnerability of traditional input supply chains and highlighted the need for resilient, locally sourced bio-inputs. Meanwhile, evolving regulatory landscapes in Europe and targeted subsidy programs in Asia-Pacific are creating differentiated regional opportunities. Leading agribusiness firms and agile biotech innovators alike are forging strategic collaborations and consolidations to capitalize on these trends.

In this dynamic environment, success hinges on the ability to align R&D investments with market segmentation intricacies-from crop-specific strain formulation to channel-optimized delivery models. Decision-makers must balance near-term cost pressures with long-term sustainability imperatives, advocating for regulatory clarity while fostering end-user education and digital engagement. By embracing a tailored approach to product development and go-to-market strategies, stakeholders can drive meaningful adoption, deliver quantifiable environmental benefits and secure competitive advantage in the rapidly maturing inoculant sector.

Empower Your Decision Making with Exclusive Inoculant Market Research Insights Connect Directly with Ketan Rohom to Secure Your Custom Report

To explore tailored strategies for harnessing the power of microbial inoculants and gain a competitive edge in your agricultural initiatives, reach out to Ketan Rohom. As Associate Director of Sales & Marketing at 360iResearch, he will guide you through the range of customizable data solutions available in our comprehensive inoculant market research report. Secure your copy today to unlock in-depth intelligence, actionable insights, and expert analysis designed to drive sustainable growth and innovation in your organization.

- How big is the Inoculant Market?

- What is the Inoculant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?