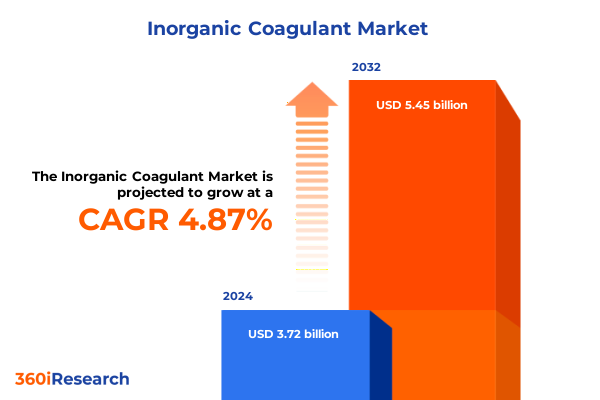

The Inorganic Coagulant Market size was estimated at USD 3.89 billion in 2025 and expected to reach USD 4.08 billion in 2026, at a CAGR of 4.90% to reach USD 5.45 billion by 2032.

Unveiling Fundamental Functions and Contemporary Drivers Shaping the Inorganic Coagulant Landscape

Inorganic coagulants have become indispensable agents in water and wastewater treatment processes, playing a critical role in ensuring the safety, clarity, and compliance of potable and industrial effluents. Their unique chemical properties enable rapid destabilization and aggregation of suspended particles, facilitating efficient removal of turbidity, organic load, and contaminants. Over the past decade, shifts in regulatory frameworks, heightened environmental awareness, and evolving industrial requirements have propelled these chemicals into the spotlight as pivotal components of modern treatment systems.

Stakeholders across municipal, industrial, and specialized sectors increasingly prioritize coagulant performance metrics such as dosage efficiency, sludge minimization, and operational cost reduction. This growing scrutiny has catalyzed innovations in formulation, blending traditional inorganic salts with tailored polymeric additives to optimize floc characteristics and treatment outcomes. Concurrently, advancements in process monitoring and automation have enabled real-time optimization of coagulant dosing, driving further gains in resource utilization and treatment consistency.

As water scarcity concerns intensify and regulatory thresholds tighten for emerging contaminants, inorganic coagulants will continue to serve as foundational tools in both established and novel treatment applications. This introduction sets the stage for a comprehensive exploration of the market’s transformative shifts, the impact of recent trade dynamics, segmentation intricacies, regional differentiators, leading industry players, and strategic recommendations.

Examining the Intersection of Regulatory, Technological, and Sustainability Forces Reshaping Coagulant Applications

The landscape of inorganic coagulants is undergoing transformative shifts driven by a convergence of environmental, technological, and regulatory forces. In recent years, sustainability mandates have compelled end users to reduce chemical footprints and energy consumption, prompting manufacturers to reformulate classic salts with advanced high-polymer additives that enhance floc density while curbing dosage rates. This evolution toward greener chemistries reflects broader commitments to circular economy principles and lower carbon intensities in treatment operations.

Simultaneously, the rise of digital water platforms and smart monitoring technologies is revolutionizing coagulant dosing strategies. Operators are now leveraging real-time turbidity and conductivity data to automate coagulant injection, minimizing human intervention and reducing chemical waste. These digital interventions not only improve process reliability but also open pathways for predictive maintenance, where machine learning models anticipate shifts in feed water quality and adjust dosages proactively.

In parallel, the imperative to address microplastics, pharmaceutical residues, and algal toxins has spurred the development of hybrid treatment schemes. Inorganic coagulants are increasingly integrated with advanced oxidation processes, membrane filtration, and adsorption units to meet stringent contaminant removal targets. Through pilot programs and full-scale deployments, this multi-barrier approach is demonstrating enhanced removals of trace pollutants, underscoring the coagulant’s role as a critical enabler of comprehensive water purification.

Collectively, these shifts underscore a market in flux, where chemical innovation, digital transformation, and multi-technology synergies are redefining performance benchmarks and unlocking new application frontiers.

Analyzing How 2025 Tariff Adjustments Are Realigning Production, Sourcing Strategies, and Innovation in Coagulant Markets

In 2025, the cumulative impact of United States tariffs on inorganic coagulants has reverberated throughout supply chains and operational budgets, compelling stakeholders to reassess procurement and manufacturing strategies. In response to anti-dumping investigations, tariff adjustments targeted key imports of aluminium-based and iron-based coagulants, elevating landed costs and incentivizing domestic production expansions. As a result, several manufacturers accelerated investment in U.S. facilities to mitigate exposure to fluctuating duties and secure more stable price structures.

These trade measures have further influenced the sourcing calculus of water treatment utilities and industrial processors. To offset cost escalations, many end users have diversified supplier portfolios, incorporating regional vendors and backward-integrating through partnerships with chemical producers. Such strategic realignments have fostered closer collaborations between utilities and raw material suppliers, enabling joint R&D initiatives aimed at formulating coagulants optimized for local water chemistries and operational requirements.

Moreover, the tariff environment has catalyzed innovation in alternative chemistries and blended formulations that reduce reliance on high-duty material streams. Researchers and process engineers are exploring synergistic combinations of locally available iron salts and poly-aluminium hydroxide precursors, delivering comparable performance at more competitive price points. These hybrid approaches not only alleviate tariff pressures but also support resilience in supply continuity, as localized feedstocks become increasingly attractive.

Looking ahead, the evolving tariff landscape will continue to shape capital allocation, sourcing decisions, and R&D priorities across the inorganic coagulant ecosystem, with cost and compliance considerations remaining at the forefront of strategic planning.

Uncovering How Type, Application, Form, and Distribution Channels Drive Divergent Coagulant Performance and Sourcing Preferences

The inorganic coagulant market exhibits nuanced performance across several critical segmentation axes, reflecting diverse chemical preferences, end-use requirements, and distribution pathways. Based on Type, the market is studied across aluminium sulfate, ferric chloride, ferric sulfate, and poly aluminium chloride. Within the latter, distinctions in polymerization degree-high, medium, and low-significantly influence charge density, settling times, and sludge dewaterability. These variations underpin tailored applications where rapid sedimentation or enhanced sludge compaction is prioritized.

Based on Application, usage spans industrial wastewater treatment, municipal water treatment, oil and gas operations, and pulp and paper processing. Within industrial wastewater, sectors such as chemical manufacturing, food and beverage production, metal and mining operations, and pharmaceutical facilities each present unique flocculation challenges. These end-use segments demand formulations that balance strict effluent guidelines with operational economics, driving iterative development of coagulants that optimize both clarity and sludge handling.

Based on Form, the market is studied across liquid and powder offerings. Liquid grades differentiate between high concentration and standard formulations, with concentrated blends facilitating reduced transportation volumes and enhanced dosing precision. Powdered grades, prized for longer shelf life and ease of storage, continue to serve remote installations or applications requiring flexible solubilization strategies.

Based on Distribution Channel, products reach end users through direct sales and distributor networks. Among distributors, retailers and wholesalers play pivotal intermediary roles, extending market reach into niche segments and facilitating small-scale or on-demand purchases. Each channel presents distinct service expectations and logistical considerations, shaping the go-to-market strategies of coagulant producers.

This comprehensive research report categorizes the Inorganic Coagulant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Grade

- Application

- Distribution Channel

- End Use Industry

Exploring Regional Drivers from Regulatory Mandates to Infrastructure Investment Shaping Coagulant Adoption Worldwide

Regional dynamics in the inorganic coagulant market are defined by regulatory landscapes, infrastructural investments, and industrial growth trajectories. In the Americas, a surge in municipal infrastructure upgrades, coupled with tighter effluent guidelines in North America, has spurred demand for advanced coagulants that deliver reliable turbidity removal and sludge management efficiencies. This focus on compliance has dovetailed with investments in digital control systems, positioning the region as an early adopter of integrated smart dosing platforms.

In Europe, Middle East and Africa, stringent water quality directives and environmental mandates are shaping coagulant consumption patterns. Regulatory bodies in the European Union continue to raise the bar on permissible contaminant levels, while emerging economies in the Middle East and Africa are investing in large-scale desalination and wastewater reuse projects. These mixed drivers have catalyzed demand for high-performance poly aluminium chloride formulations and iron-based coagulants tailored for brine treatment and arid region applications.

Asia-Pacific remains the fastest growing region, propelled by rapid urbanization, industrial expansion, and escalating concerns over water scarcity. China, India, Southeast Asia, and Australia are prioritizing upgrades to both municipal and industrial treatment infrastructure, with a growing emphasis on sustainable chemistries that minimize sludge footprints. Concurrently, government initiatives promoting public-private collaborations are accelerating the deployment of cutting-edge coagulation systems integrated with membrane and advanced oxidation processes.

This comprehensive research report examines key regions that drive the evolution of the Inorganic Coagulant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Collaborative Innovation, Localized Production Strategies, and Sustainability Commitments of Market Leaders

Leading companies in the inorganic coagulant sphere are advancing competitive differentiation through targeted R&D, strategic alliances, and operational excellence initiatives. A standout trend involves partnerships between chemical manufacturers and automation technology providers, enabling the co-development of smart dosing units calibrated specifically for new coagulant formulations. These collaborations underscore a broader shift toward solutions combining chemical expertise with digital water management platforms.

Meanwhile, producers are intensifying efforts to expand production footprint and bolster supply chain resilience. Investments in modular, scalable manufacturing units and localized blending facilities are enhancing responsiveness to regional demand fluctuations. This localized approach reduces lead times, mitigates tariff exposures, and facilitates co-creation of products aligned with specific water chemistries and regulatory contexts.

Sustainability commitments are also driving product innovation, with companies launching coagulants featuring biodegradable additives and lower carbon production pathways. Through streamlined raw material sourcing and process optimizations, these initiatives aim to align product life cycles with corporate net-zero targets. Collectively, these moves reflect an industry prioritizing integrated offerings that marry performance, compliance, and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inorganic Coagulant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aries Chemical, Inc.

- Avista Technologies Inc.

- Buckman Laboratories International Inc.

- ChemREADY by Zinkan Enterprises Inc.

- Chemtrade Logistics Inc.

- DEW PROJECTS AND CHEMICALS PVT. LTD.

- Ecolab Inc.

- Feralco AB

- Green Water Treatment Solutions

- Grupo Bauminas

- Holland Company Inc

- Ixom Operations Pty Ltd

- Kemira Oyj

- Prakash Chemicals International Pvt. Ltd

- Solenis LLC

- USALCO LLC

- Veolia Water Technologies and Solutions

- WaterSolve, LLC

Deploying Agile Manufacturing, Collaborative Co-Development, and Digital Integration to Elevate Coagulant Market Leadership

To navigate the evolving inorganic coagulant landscape, industry leaders should prioritize multifaceted strategies that address cost volatility, regulatory rigidity, and emerging performance demands. First, investing in modular production units and flexible blending systems enables rapid adaptation to tariff shifts and raw material availability, bolstering supply continuity. Parallel to this, forging strategic alliances with water utilities and industrial end users can accelerate co-development of bespoke formulations designed for local water matrices and compliance requirements.

Furthermore, integrating coagulant offerings with digital dosing and monitoring platforms can differentiate service propositions, delivering demonstrable chemical savings and operational transparency. This integrated model not only enhances customer retention but also generates valuable data streams for ongoing product refinement. Similarly, embedding sustainability metrics-such as carbon footprint and sludge volume reduction-into value propositions can resonate with environmentally conscious clients and regulatory agencies.

Lastly, expanding technical support capabilities through training programs and process optimization services can elevate brand positioning from a chemical supplier to a comprehensive water treatment partner. By aligning commercial strategies with digital, sustainability, and service excellence imperatives, companies can secure leadership positions and unlock new growth pathways in the inorganic coagulant market.

Articulating a Structured Framework of Secondary Review, Stakeholder Engagement, and Data Triangulation to Derive Market Insights

The research methodology underpinning this study combines rigorous primary and secondary research techniques to ensure data integrity and industry relevance. Initially, a comprehensive secondary literature review was conducted, encompassing peer-reviewed journals, regulatory filings, and technical white papers to establish foundational insights into chemical properties, performance metrics, and regulatory frameworks. This desk research informed the design of primary research instruments, including structured interviews and detailed surveys.

Primary research entailed in-depth interviews with over two dozen industry stakeholders, spanning chemical producers, water treatment utilities, engineering consultants, and regulatory officials. These conversations provided firsthand perspectives on market dynamics, emerging challenges, and innovation trajectories. Complementing interview data, quantitative surveys captured adoption rates, application preferences, and procurement strategies across diverse geographic regions.

Data triangulation techniques were employed to reconcile findings from multiple sources, ensuring robustness in conclusions. Expert panels convened to validate segmentation structures, regional insights, and strategic recommendations, while continuous alignment checks with publicly available trade and tariff documentation maintained currency. The methodological framework culminates in a holistic portrayal of the inorganic coagulant market, delivering actionable intelligence grounded in empirical evidence and stakeholder expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inorganic Coagulant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inorganic Coagulant Market, by Type

- Inorganic Coagulant Market, by Form

- Inorganic Coagulant Market, by Grade

- Inorganic Coagulant Market, by Application

- Inorganic Coagulant Market, by Distribution Channel

- Inorganic Coagulant Market, by End Use Industry

- Inorganic Coagulant Market, by Region

- Inorganic Coagulant Market, by Group

- Inorganic Coagulant Market, by Country

- United States Inorganic Coagulant Market

- China Inorganic Coagulant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing the Role of Coagulants as Dynamic Enablers in a Rapidly Evolving Water Treatment Ecosystem

Inorganic coagulants remain core enablers of effective water and wastewater treatment, underpinning public health safeguards, environmental compliance, and industrial process efficiency. The landscape is at an inflection point, where regulatory stringency, digital transformation, and sustainability imperatives are coalescing to drive next-generation formulations and deployment strategies. Market participants must deftly navigate tariff complexities, segmentation nuances, and regional heterogeneities to capitalize on emerging opportunities.

Key takeaways include the escalating importance of hybrid treatment schemes, the strategic value of localized production and distribution, and the competitive edge afforded by integrated digital solutions. As microcontaminant removal and operational transparency ascend regulatory and customer agendas, the bar for coagulant performance will continue to rise. Companies that blend chemical innovation with agile manufacturing, data-driven services, and environmental stewardship will be best positioned to lead the market forward.

Ultimately, stakeholders across the value chain should view inorganic coagulants not just as commodities but as dynamic, performance-enhancing components of broader water treatment ecosystems. Embracing this perspective will unlock value across operational, regulatory, and environmental dimensions, paving the way for resilient, sustainable water management practices.

Engage with Our Associate Director of Sales and Marketing to Unlock the Inorganic Coagulant Market Research Report and Drive Strategic Decisions

To secure your organization’s competitive edge and gain comprehensive insights into the evolving inorganic coagulant market, connect with Ketan Rohom, Associate Director of Sales & Marketing, to access the detailed report. The analysis provides invaluable guidance on navigating regulatory shifts, supply chain realignments, and application-specific strategies that will shape business decisions in the coming years. With Ketan’s expertise and our rigorous research framework, you can customize your market entry and investment plans with confidence. Don’t miss the opportunity to leverage actionable intelligence tailored to your strategic goals; reach out today and empower your teams with the in-depth findings that will inform your next crucial moves.

- How big is the Inorganic Coagulant Market?

- What is the Inorganic Coagulant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?