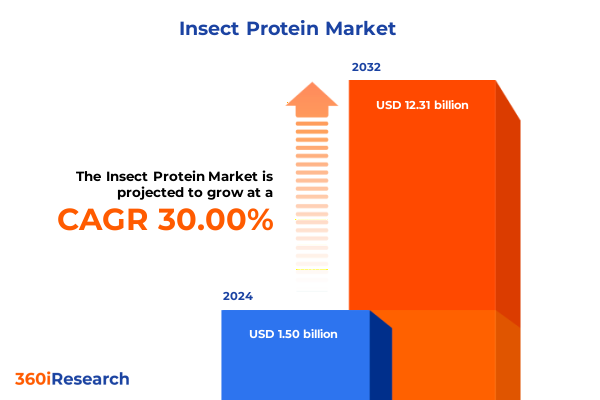

The Insect Protein Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.48 billion in 2026, at a CAGR of 29.90% to reach USD 12.31 billion by 2032.

Unveiling the Insect Protein Revolution and Its Rising Significance Across Animal Feed, Aquaculture, Human Nutrition, and Pet Food Industries

Insect protein has swiftly evolved from a niche concept to a transformative force challenging conventional protein sources across multiple industries. With unprecedented environmental pressures mounting on traditional agriculture, alternative proteins are emerging as critical solutions to mitigate resource constraints and reduce ecological footprints. Among these alternatives, insect-derived ingredients stand out for their remarkable efficiency in converting feed into high-quality protein, their minimal land and water requirements, and their capacity to valorize organic waste streams. As such, stakeholders from feed manufacturers to food and pet brands are increasingly scrutinizing insect protein’s potential to reinforce supply chain resilience and address burgeoning global protein demands.

Moreover, this rise is expedited by a convergence of market factors that collectively underscore the strategic urgency of understanding insect protein dynamics. Regulatory agencies in key markets have begun to pave the way for broader approvals, while ongoing investments in farming technologies are rapidly scaling production capacities. Concurrently, shifts in consumer preferences toward sustainability and clean-label sourcing are amplifying demand signals, prompting a reevaluation of long-established development pathways. In light of these drivers, industry participants must cultivate a nuanced comprehension of the insect protein value chain, from rearing systems through processing innovations, to stay ahead in an increasingly competitive environment. Consequently, this executive summary synthesizes the critical insights necessary for informed decision-making and strategic positioning within the emerging insect protein sector.

Mapping the Transformative Shifts That Are Redefining Supply Chains, Consumer Preferences, Regulatory Frameworks, and Technological Innovations in Insect Protein

The insect protein ecosystem has undergone a rapid metamorphosis, with technology advancements and cross-sector partnerships rewriting the rules of supply and demand. Initially limited by fragmented production capabilities and regulatory ambiguity, the landscape now features integrated vertical operations encompassing breeding, processing, and formulation. These developments are underpinned by automated feeding systems, precision climate controls, and ultrasonic processing techniques that enhance yield consistency and product safety. As a result, what was once a high-cost experimental input is steadily transforming into a commercially viable protein source capable of meeting industrial-level specifications.

Simultaneously, strategic alliances between insect farms, ingredient formulators, and end-market brands have emerged as catalysts for innovation. Feed trial partnerships with animal nutrition experts are demonstrating performance parity-and in some cases superiority-to conventional protein meals, while collaborations with food manufacturers are accelerating novel product launches in functional bars and sports nutrition segments. This interconnected network of stakeholders is fostering a virtuous cycle where shared knowledge accelerates product optimization, scales supply, and facilitates regulatory approvals. As the sector advances, these transformative shifts underscore an inflection point: insect protein is no longer an alternative novelty but a mainstream contender reshaping protein supply paradigms.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Cross-Border Insect Protein Trade Dynamics and Cost Structures

In 2025, the United States implemented revised tariff structures targeting select protein ingredients, with insect-based raw materials becoming a focal point. The new tariff classifications have introduced incremental duties that vary by insect type and processing form, thereby altering relative cost competitiveness for imported black soldier fly, cricket, and mealworm derivatives. Domestic rearing operations have gained a comparative advantage as a direct consequence, incentivizing local investments in breeding infrastructure and processing plants. Over time, this shift is anticipated to accelerate vertical integration, with companies seeking to mitigate exposure to cross-border duties and secure uninterrupted ingredient flows.

Furthermore, these tariffs have reshaped supply chain logistics by elevating the importance of trade compliance and tariff engineering. Organizations now face heightened scrutiny of their sourcing strategies, prompting supply chain teams to reevaluate landed cost models and renegotiate supplier agreements. In parallel, some market participants are exploring tariff mitigation tactics, such as dual-sourcing from low-duty jurisdictions and optimizing harmonized system coding through advanced customs consultancy. The net effect of these developments is a recalibration of production economics that favors regionalized supply chains and underscores the strategic imperative of agile procurement and compliance capabilities in a dynamically charged trade environment.

Revealing Intricate Segmentation Insights Across Application, Distribution Channel, Insect Type, and Product Form That Drive Strategic Decisions in Insect Protein

Strategic decision-making in the insect protein arena is fundamentally shaped by a multi-dimensional segmentation framework that illuminates specific growth vectors. When examining application areas, it becomes evident that animal feed absorbs vast volumes of insect meal, with subdivisions into poultry feed, ruminant feed, and swine feed each exhibiting distinct performance and formulation requirements. Likewise, the aquaculture segment, which encompasses both fish feed and shrimp feed, leverages the high digestibility and amino acid profiles of insect proteins to enhance growth rates and feed conversion ratios. In parallel, human food applications are mapping new frontiers, as industry pioneers integrate insect-derived ingredients into baked goods, functional foods, snacks, and supplements to meet consumer demands for nutrient-dense alternatives. Pet food innovators are also capitalizing on the sector’s promise by formulating kibble, specialty treats, and wet food blends that cater to companion animal wellness and clean-label expectations.

Equally important is the distribution channel matrix, which clarifies how substrates reach end markets. Offline pathways, including animal supply stores, traditional retail outlets, and wholesale distributors, continue to anchor long-standing procurement habits. At the same time, digital transformation has unlocked online channels, where direct sales models, broad e-commerce platforms, and niche specialty online retailers facilitate rapid product experimentation and consumer feedback loops. The juxtaposition of these pathways underscores the importance of omnichannel strategies to optimize market reach and foster brand recognition.

Insect type differentiation further deepens strategic insights, as black soldier fly larvae dominate due to superior biomass yield and feed conversion, while cricket and mealworm offerings appeal to specialty markets predicated on distinct nutritional profiles and sensory attributes. Finally, product form considerations-ranging from crude and refined insect oils to concentrate and ready-to-use pastes, as well as pellets, powders, and whole insect presentations-drive formulation flexibility and application scope. Together, this comprehensive segmentation reveals targeted pathways for investment, product development, and go-to-market strategies that align with diverse stakeholder requirements.

This comprehensive research report categorizes the Insect Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insect Type

- Product Form

- Application

- Distribution Channel

Deciphering Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia Pacific to Uncover Unique Opportunities and Challenges for Insect Protein Adoption

The Americas region has emerged as a bedrock for insect protein commercialization, benefiting from robust agricultural infrastructure, progressive regulatory milestones, and a growing network of pilot-scale producers. North American markets are witnessing increased R&D collaborations between academic institutions and private enterprises, accelerating product innovation in both feed and human consumption spheres. Meanwhile, Latin American stakeholders are exploring insect protein’s role in enhancing the resilience of smallholder farming systems, where on-farm rearing of black soldier fly larvae and mealworm cultivation is being trialed to valorize organic waste and supply local feed needs.

Transitioning to Europe, Middle East, and Africa, the EMEA region presents a mosaic of regulatory landscapes and consumer readiness. Western Europe leads with clear frameworks for novel food approvals, facilitating the launch of insect-enriched snacks and specialized aquafeed formulations. Conversely, markets in the Middle East are at early stages of regulatory definition but show potential through pilot programs targeting poultry and shrimp feed applications. African initiatives often intertwine with sustainable development goals, where insect protein projects aim to address food security, waste management, and economic empowerment in tandem.

In the Asia-Pacific sphere, escalating protein demand and limited arable land are driving accelerated adoption of insect rearing technologies. Southeast Asian nations, in particular, are leveraging decades of entomophagy cultural heritage to mainstream insect-based products ranging from protein bars to aquafeed supplements. At the same time, Australia and New Zealand are positioning themselves as exporters of premium insect proteins, capitalizing on stringent quality certifications and proximity to emerging Asian markets. Across all regions, distinct drivers and regulatory contexts offer varied but complementary pathways for sector growth and collaboration.

This comprehensive research report examines key regions that drive the evolution of the Insect Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Driving Growth Through Research Advancements, Partnerships, and Sustainable Practices in the Insect Protein Sector

Leading organizations are carving out competitive advantages through differentiated production models, strategic alliances, and technology investments. Some pioneers have focused on large-scale vertical integration, encompassing proprietary breeding genetics, automated rearing operations, and downstream processing capabilities that deliver a continuum of ingredient forms. Others have adopted modular approaches, outsourcing cultivation to specialized contract producers while concentrating internal resources on formulation science and market development. Partnerships between insect protein specialists and traditional feed mill operators have also surfaced, granting immediate access to established distribution networks and accelerating commercial scale-up.

On the innovation front, companies are investing in enzyme-assisted extraction techniques and high-pressure processing to enhance functional properties and ensure microbial safety. Collaborative research agreements with universities and technology providers are refining strain selection to maximize yields and tailor nutritional profiles for specific end uses. Meanwhile, joint ventures are forming to address feedstock availability, blending insect rearing with organic waste management operations to establish closed-loop systems. Collectively, these strategic initiatives illustrate the competitive contours of the insect protein sector, where differentiation is achieved not only through production scale but also via intellectual property, value-added formulations, and integrated supply chain partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insect Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALAPRE S.A.S.

- All Things Bugs Ltd

- Amusca BV

- Aspire Food Group Inc.

- Beta Hatch Inc.

- Bugsolutely Ltd

- Chapul Cricket Protein LLC

- Entomo Farms Inc.

- EnviroFlight LLC

- Goterra Pty Ltd

- Hexafly Ltd

- Imago Insect Products GmbH

- InnovaFeed SAS

- Jimini’s SAS

- NextProtein Inc.

- Nutrition Technologies Sdn Bhd

- Proteine Resources Sp. z o.o.

- Protix B.V.

- SAS Ÿnsect

- Swarm Nutrition GmbH

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends, Navigate Regulatory Complexities, and Foster Sustainable Growth in Insect Protein

To capitalize on emerging opportunities, industry leaders should prioritize end-to-end sustainability by integrating organic waste valorization with insect rearing operations. This approach will reduce feedstock costs and enhance environmental credentials, resonating with both regulatory bodies and end-market customers. Concurrently, organizations must sharpen their regulatory intelligence by engaging early with authorities to streamline novel feed and food approvals, thereby accelerating time-to-market while ensuring compliance with evolving safety standards.

Further, a dual-channel distribution strategy-leveraging traditional supply chains alongside agile e-commerce platforms-will optimize market penetration and foster rapid consumer feedback. Companies can enhance competitive positioning by developing targeted formulations for high-value segments, such as functional nutrition, premium pet food, and specialty aquafeed, where willingness to pay for differentiated benefits is strongest. In parallel, collaborative R&D alliances should be pursued to share risk, pool intellectual property, and accelerate the refinement of processing technologies. Ultimately, these strategic imperatives underscore the need for an integrated approach that balances operational excellence, regulatory foresight, and market-driven innovation.

Outlining a Robust Research Methodology That Integrates Qualitative and Quantitative Analyses, Expert Interviews, and Data Triangulation to Ensure Accurate Insect Protein Insights

This research leverages a multi-method approach combining qualitative interviews, secondary data analysis, and expert validation. Primary insights were garnered through in-depth conversations with C-suite executives, supply chain directors, and R&D leaders across feed, aquaculture, human food, and pet food segments. Secondary intelligence was synthesized from technical journals, patent filings, and public regulatory filings to ensure a robust understanding of technological advancements and approval pathways. Throughout the study, data triangulation methods were employed to cross-verify findings, ensuring consistency between market narratives and stakeholder perspectives.

Quantitative assessments, while not presented here, were conducted internally to test hypotheses about cost structure impacts under various trade scenarios and to evaluate production yield benchmarks. Validation workshops with industry experts provided critical feedback loops, refining scenario analyses and stress-testing strategic recommendations. Together, this rigorous methodology underpins the credibility of the insights presented, providing a comprehensive foundation for action by market participants seeking to navigate the evolving insect protein ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insect Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insect Protein Market, by Insect Type

- Insect Protein Market, by Product Form

- Insect Protein Market, by Application

- Insect Protein Market, by Distribution Channel

- Insect Protein Market, by Region

- Insect Protein Market, by Group

- Insect Protein Market, by Country

- United States Insect Protein Market

- China Insect Protein Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Executive Findings and Strategic Considerations to Illuminate the Future Trajectory of the Insect Protein Market Amid Evolving Global Demands

Insect protein is poised to redefine global protein landscapes through its sustainable production, supply chain agility, and versatile application potential. As traditional protein systems grapple with resource constraints and evolving consumer expectations, insect-derived ingredients offer a pragmatic pathway toward environmental stewardship and nutrition security. Navigating this dynamic landscape requires a deep appreciation of segmentation nuances, regulatory terrains, and regional market differentiators.

By understanding the cumulative impact of policy shifts, such as the 2025 United States tariffs, and by dissecting segmentation insights across applications, channels, types, and formats, stakeholders can strategically align their investments and operational priorities. Coupled with actionable growth recommendations and validated through a rigorous research methodology, these insights lay the groundwork for decisive leadership in a sector that is rapidly transitioning from experimental to indispensable. The future of insect protein hinges on collaborative innovation, regulatory engagement, and targeted market development, setting the stage for this alternative protein source to achieve mainstream adoption.

Engage with Ketan Rohom to Unlock Comprehensive Insect Protein Insights and Guide Strategic Investments with a Customized Market Research Report Tailored to Your Needs

To explore the vast potential of insect protein and harness its strategic value for your organization, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure a bespoke market research report tailored to your specific needs. Engage in a detailed discussion that will equip your team with the actionable intelligence required to navigate supply chain complexities, optimize product portfolios, and capitalize on emerging applications across animal feed, aquaculture, human nutrition, and pet food. Don’t miss the opportunity to transform your business approach by leveraging cutting-edge insights and custom analyses designed to accelerate your growth in the rapidly evolving insect protein landscape. Contact Ketan today to arrange a discovery call and move forward with confidence.

- How big is the Insect Protein Market?

- What is the Insect Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?