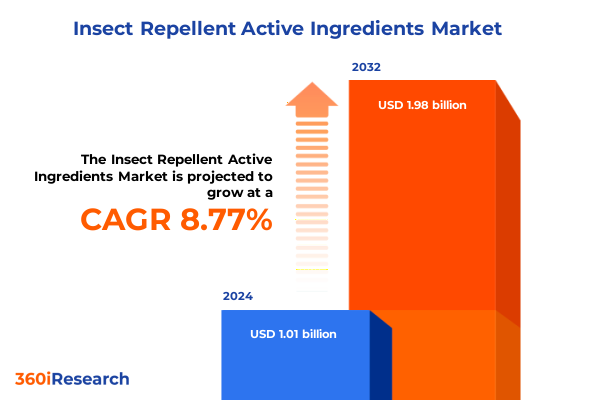

The Insect Repellent Active Ingredients Market size was estimated at USD 1.08 billion in 2025 and expected to reach USD 1.17 billion in 2026, at a CAGR of 8.97% to reach USD 1.98 billion by 2032.

Navigating the Complexities of the Global Insect Repellent Active Ingredients Market: Trends, Challenges, and Opportunities Awaiting Industry Stakeholders

The insect repellent active ingredients market is characterized by a dynamic interplay of scientific innovation, regulatory oversight, and evolving consumer preferences. Active compounds such as DEET, Oil of Lemon Eucalyptus, Permethrin, and Picaridin underpin the efficacy and safety profiles of leading products, driving competitive differentiation. Across product portfolios, manufacturers are adapting ingredient blends to meet diverse performance requirements - from long-duration protection in high-risk zones to gentle formulations suitable for sensitive skin. This multifaceted environment demands that stakeholders stay attuned to both technical developments and shifting consumer expectations to remain competitive.

Industry participants must navigate a complex regulatory landscape shaped by agencies like the U.S. EPA and analogous bodies worldwide. Regulatory approvals, registration processes, and compliance standards influence product formulation timelines and market entry strategies. Concurrently, consumer trends are prioritizing natural and non-synthetic options, elevating ingredients such as Oil of Lemon Eucalyptus and Picaridin for their perceived safety and pleasant sensory profiles. Recognizing these converging forces is essential for organizations seeking to optimize their active ingredient pipelines and deliver value to end users while maintaining compliance with stringent safety requirements.

Unveiling the Transformative Forces Redefining Insect Repellent Active Ingredients: Innovation Drives, Regulatory Shifts, and Consumer Mindset Evolutions

The landscape of insect repellent active ingredients is being reshaped by breakthroughs in formulation science and an intensified focus on consumer-centric products. Technological advancements like microencapsulation and controlled-release matrices are extending protection durations while reducing skin overload, enabling repellents to be integrated seamlessly into daily routines without sacrificing comfort. Moreover, wearable repellent technologies and scent-infused materials are emerging as novel channels to deliver active compounds, reflecting a broader shift towards user-friendly delivery systems that align with lifestyle demands (turn2search8).

Consumer consciousness around health and environmental sustainability has accelerated the pivot from traditional synthetic compounds to plant-derived alternatives. Ingredients such as Oil of Lemon Eucalyptus and IR3535 are gaining traction as credible substitutes to DEET, spurred by positive safety perceptions and regulatory endorsements. This naturals-driven momentum is prompting formulators to explore botanical extracts and essential oils, balancing efficacy with ecological considerations (turn2search2). As such, the market is witnessing a renaissance in ingredient sourcing and processing methodologies, underpinned by rigorous efficacy testing and eco-toxicological evaluations.

Assessing the Cumulative Impact of New 2025 U.S. Tariff Regulations on the Procurement and Cost Dynamics of Insect Repellent Active Ingredients

In early April 2025, a sweeping 10% reciprocal tariff was imposed on nearly all U.S. imports, followed by country-specific rates taking effect April 9, introducing significant layers of duty on ingredients originating from China, Vietnam, the European Union, and other trading partners (turn1search1). This broad tariff framework has since faced a legal challenge, with the U.S. Court of International Trade permanently enjoining the duties in late May, creating an environment of uncertainty for importers and formulators alike (turn1search5). Compounding this volatility, a temporary suspension of numerous subheading duties was enacted from July 9 through August 1, 2025, further complicating import planning and cost projections (turn1search6).

The cumulative effect of these tariff actions has manifested as heightened input cost pressures, supply chain disruptions, and accelerated sourcing diversification. Formulators reliant on specialty chemicals for active ingredient synthesis are re-evaluating vendor relationships and exploring nearshoring strategies to mitigate duty exposure. Moreover, local production incentives and tariff exemptions for certain EPA-approved cosmetic ingredients have spurred discussions around reformulation to leverage exempted components, underscoring the need for agile procurement protocols and robust tariff-impact modeling (turn0search0) (turn0search2).

Deep-Dive Segmentation Insights Uncovering Distinct Growth Drivers Across Active Ingredients, Product Forms, Channels, End Users, and Applications

Analyzing the market through active ingredient segmentation reveals that DEET maintains its longstanding leadership due to unmatched broad-spectrum efficacy, while Picaridin gains favor for its lower odor and reduced skin irritation. Oil of Lemon Eucalyptus is carving a niche among environmentally conscious consumers, and Permethrin remains indispensable for clothing treatments that deliver protective barriers on textiles (turn3search8). Parallel to ingredient shifts, formulation innovation has propelled aerosol and spray formats to the forefront, valued for rapid coverage and convenience. Lotions, creams, gels, and emerging wipe formats cater to users seeking precision application and portability, reflecting a nuanced alignment of delivery systems with lifestyle preferences (turn3search8).

Distribution channels are evolving in tandem with e-commerce growth and omnichannel strategies. While supermarkets and hypermarkets continue to command substantial shelf space and brand visibility, online retail channels are rapidly expanding, driven by consumer demand for convenience and access to niche product assortments (turn4search3). Pharmacies and specialty stores bolster credibility and professional endorsements, and the rise of direct-to-consumer subscription models underscores the importance of digital engagement in driving repeat purchases and personalized recommendations.

End user applications underscore the breadth of market demand. The residential segment remains the backbone of consumer consumption, fueled by heightened awareness of vector-borne diseases. Commercial users, encompassing hospitality and institutional facilities, leverage repellents as part of integrated pest management programs to meet regulatory hygiene standards. Agricultural users depend on specialized formulations to protect field workers and livestock, while institutional clients such as schools and healthcare facilities prioritize EPA-approved products that ensure safety and compliance (turn6search1). Application modalities span clothing treatments that embed actives into fabrics, spatial repellents designed for ambient protection in enclosed areas, and topical applications - including creams, gels, lotions, sprays, and wipes - catering to personal use scenarios ranging from outdoor recreation to day-to-day urban commuting.

This comprehensive research report categorizes the Insect Repellent Active Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Active Ingredient

- Form

- Application

- Distribution Channel

- End User

Exploring Regional Nuances Shaping Demand and Innovation in the Americas, EMEA, and Asia-Pacific Insect Repellent Market Ecosystems

In the Americas, the United States remains a pivotal market, reporting a revenue of USD 376.9 million in 2024 and continuing to shape product innovation through strong consumer demand for natural and multi-functional repellents (turn5search3). Canadian and Latin American markets are similarly influenced by public health initiatives targeting dengue and Zika, driving adoption of both traditional and botanical formulations. Growth in e-commerce and expansion of retail networks have enhanced product accessibility across North America and beyond.

European, Middle East, and African markets (EMEA) collectively represent approximately 20% of global insect repellent sales, with Western Europe exhibiting stable growth driven by disposable income gains and rigorous safety regulations. Southern Europe’s warmer climates catalyze seasonal spikes in demand, while North African and Middle Eastern markets are witnessing increased uptake of portable and travel-size products due to rising concerns about vector-borne diseases (turn7search4).

Asia-Pacific commands the largest share of global demand, accounting for roughly 35% of sales, propelled by high prevalence of malaria, dengue, and other insect-transmitted diseases. Key markets in India, China, and Southeast Asia demonstrate robust year-over-year growth, supported by government awareness campaigns and a proliferation of locally adapted formulations. Consumers in this region increasingly gravitate toward natural ingredients and formulations that balance efficacy with safety.

This comprehensive research report examines key regions that drive the evolution of the Insect Repellent Active Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Intelligence Spotlight on Leading and Emerging Companies Innovating and Consolidating the Insect Repellent Active Ingredients Market

The competitive landscape is anchored by established conglomerates such as SC Johnson & Son, Reckitt Benckiser, Spectrum Brands, Johnson & Johnson, BASF, and Bayer, each leveraging robust R&D pipelines and global distribution networks to maintain market leadership (turn6search0). These players invest heavily in formulation science and product diversification, aligning their portfolios with emerging consumer trends and regulatory requirements.

Emerging entities including Sawyer, Coghlan’s, Aurora, and Tropical Labs are carving out specialized niches by advancing plant-based actives and sustainable packaging solutions. The accelerating adoption of botanical extracts and novel natural chemistries has created opportunities for agile innovators to capture share from incumbents, underpinned by label-friendly claims and targeted marketing strategies (turn6search5).

Across the spectrum, market participants are engaging in strategic collaborations, mergers and acquisitions, and partnerships with digital retailers and public health agencies to extend reach and credibility. Companies are enhancing their omnichannel presence, optimizing supply chains for tariff resilience, and embracing eco-friendly manufacturing practices to reinforce brand equity and meet investor sustainability mandates (turn6search0).

This comprehensive research report delivers an in-depth overview of the principal market players in the Insect Repellent Active Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Clariant AG

- Coghlan’s Ltd.

- Dabur India Limited

- Enesis Group

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Jyothy Labs Limited

- Lonza Group AG

- Merck KGaA

- Reckitt Benckiser Group plc

- S. C. Johnson & Son, Inc.

- Sawyer Products, Inc.

- Spectrum Brands, Inc.

- Sumitomo Chemical Co., Ltd.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Market Trends, Mitigate Risks, and Enhance Competitive Advantage

Industry leaders should prioritize diversification of their active ingredient portfolios by incorporating both established synthetics like DEET and newer alternatives such as Picaridin and Oil of Lemon Eucalyptus. Investing in next-generation delivery technologies, including microencapsulation and wearable systems, will enhance user experience and facilitate premium positioning in crowded retail environments (turn2search0).

To mitigate tariff-induced cost fluctuations, organizations must adopt agile sourcing strategies, explore nearshoring opportunities within USMCA regions, and leverage duty exemption provisions where applicable. Establishing robust tariff-impact assessment processes and maintaining dynamic supplier scorecards will enable procurement teams to navigate regulatory shifts with minimal disruption (turn1search1).

Robust Research Methodology Outlining Comprehensive Primary and Secondary Data Collection, Analysis Techniques, and Validation Processes

This report employs a hybrid research methodology combining primary and secondary sources to ensure comprehensive coverage and data integrity. Primary research includes structured interviews with C-level executives, formulation chemists, procurement specialists, and regulatory authorities to capture firsthand perspectives on market dynamics. Quantitative surveys of end users across residential, commercial, agricultural, and institutional segments supplement qualitative insights to validate demand drivers and usage patterns.

Secondary research sources encompass peer-reviewed journals, government regulatory databases, proprietary trade publications, and industry association reports. Key data points are triangulated through cross-verification among multiple sources to enhance reliability. Data processing and analysis leverage advanced statistical techniques, including time series analysis and scenario modeling, to identify trends, correlations, and growth catalysts. All findings undergo rigorous validation and peer review by sector experts to uphold methodological rigor and ensure actionable accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insect Repellent Active Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insect Repellent Active Ingredients Market, by Active Ingredient

- Insect Repellent Active Ingredients Market, by Form

- Insect Repellent Active Ingredients Market, by Application

- Insect Repellent Active Ingredients Market, by Distribution Channel

- Insect Repellent Active Ingredients Market, by End User

- Insect Repellent Active Ingredients Market, by Region

- Insect Repellent Active Ingredients Market, by Group

- Insect Repellent Active Ingredients Market, by Country

- United States Insect Repellent Active Ingredients Market

- China Insect Repellent Active Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Reflections on Core Insights from Industry Dynamics, Tariff Impacts, Segmentation Analysis, and Strategic Pathways Forward

By synthesizing the latest trends-from ingredient innovation and evolving delivery formats to tariff developments and regional demand patterns-this analysis provides a holistic view of the insect repellent active ingredients landscape. Stakeholders are equipped to navigate regulatory complexities, harness emerging consumer preferences for natural and sustainable solutions, and optimize their strategic positioning amid competitive pressures.

Looking ahead, agility in formulation innovation and supply chain resilience will be paramount as market conditions evolve. Companies that effectively align their product portfolios with regional nuances, sustainability imperatives, and tariff dynamics will be best positioned to capture growth and fortify their market presence.

Engage with Ketan Rohom Today to Secure Your In-Depth Market Research Report on Insect Repellent Active Ingredients and Drive Growth

Seize this opportunity to gain a competitive edge with unparalleled insights into the insect repellent active ingredients market by purchasing the full report today. Ketan Rohom, Associate Director of Sales & Marketing, is ready to provide you with detailed information, bespoke support, and a tailored walkthrough of the report’s comprehensive findings. Reach out now to ensure timely access to actionable data that will inform your strategic planning, product development, and market entry decisions.

- How big is the Insect Repellent Active Ingredients Market?

- What is the Insect Repellent Active Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?