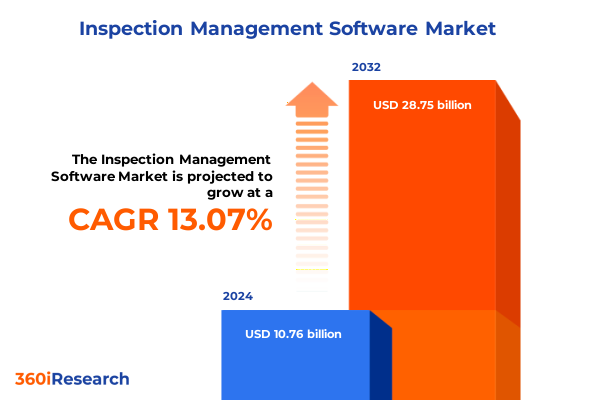

The Inspection Management Software Market size was estimated at USD 12.14 billion in 2025 and expected to reach USD 13.70 billion in 2026, at a CAGR of 13.10% to reach USD 28.75 billion by 2032.

Setting the Stage for Modern Inspection Management Solutions Driving Operational Efficiency Safety Compliance and Strategic Decision Making Across Industries

Inspection management software has emerged as a mission-critical backbone for organizations aiming to elevate operational efficiency, enforce rigorous safety standards, and streamline compliance protocols. In an environment where regulatory landscapes are continuously evolving and operational risks can translate into significant financial and reputational costs, the need for a unified digital platform that consolidates inspection workflows has never been more pronounced. Beyond merely automating routine checklists, modern inspection solutions integrate data analytics, mobile interfaces, and secure cloud storage to deliver real-time visibility into asset integrity and process adherence.

Over the past decade, we have witnessed a shift from paper-based reporting to sophisticated digital frameworks that provide holistic oversight of inspection activities. This transformation has empowered quality assurance teams, maintenance engineers, and safety officers to detect anomalies early, prioritize corrective actions, and document compliance with precision. Simultaneously, the rise of remote and distributed workforces has underscored the importance of mobile-first inspection tools that can operate offline and synchronize seamlessly upon reconnection.

Within this executive summary, readers will discover a clear introduction to the drivers reshaping inspection management, a detailed analysis of geopolitical impacts, comprehensive segmentation insights, and a forward-looking set of actionable recommendations. By framing both the current state and emerging trajectories, this overview equips stakeholders with the strategic context needed to make informed technology adoption and investment decisions.

Navigating the Wave of Digital Disruption in Inspection Management Through AI IoT Integration Cloud Mobility and Data-Driven Compliance

The inspection management landscape is undergoing a profound metamorphosis driven by the convergence of artificial intelligence, Internet of Things (IoT) connectivity, and cloud computing. Machine learning-powered analytics now enable anomaly detection that would have been inconceivable with traditional statistical models, while IoT sensors continuously feed operational data into centralized dashboards. This amalgamation makes it possible to forecast potential failures before they occur, substantially reducing unplanned downtime and maintenance expenses.

The shift toward cloud-hosted platforms has accelerated as organizations value the scalability and security these environments provide. Cloud deployments offer seamless software updates, robust disaster recovery options, and the flexibility to shift between public, private, or hybrid infrastructures. At the same time, mobile inspection applications have matured to facilitate offline data capture in remote locations, ensuring that field technicians remain productive regardless of connectivity constraints.

Furthermore, there has been a marked realignment in buyer expectations. Inspection management solutions are now expected to deliver modular components that can be tailored to unique operational requirements, whether it be food safety audits, industrial quality checks, or infrastructure health monitoring. As regulatory agencies introduce more stringent reporting mandates, platforms that can generate audit-ready documentation and provide comprehensive traceability are gaining prominence. These transformative shifts highlight an industry that is increasingly data-driven, predictive in its maintenance philosophy, and integrated across the enterprise ecosystem.

Analyzing the Ripple Effect of 2025 United States Tariffs on Inspection Management Ecosystem Supply Chains and Technology Adoption Dynamics

The introduction of new tariffs on imported technology and equipment by the United States in early 2025 has had a cascading effect on the inspection management sector. With levies imposed on key hardware components-such as high-precision cameras, advanced sensors, and ruggedized mobile devices-total cost of ownership for inspection initiatives has risen. As a result, organizations are re-evaluating procurement strategies, negotiating vendor contracts, and seeking to localize certain hardware production to mitigate exposure to import duties.

In parallel, the increased cost pressure has accelerated interest in more software-centric solutions that rely on existing sensor networks, edge computing modules, and virtual inspection environments. By focusing on algorithmic enhancements and predictive analytics, vendors have been able to offset hardware expenses while still delivering robust inspection capabilities. This pivot underscores a broader industry trend toward maximizing the value extracted from installed infrastructure rather than provisioning entirely new devices.

Supply chain disruptions stemming from tariff-driven vendor realignments have also led to strategic partnerships between technology providers and domestic manufacturers. These alliances aim to reduce lead times and stabilize pricing, ensuring that mission-critical inspection deployments remain on schedule. Despite these challenges, the sector has demonstrated remarkable adaptability, using the tariff landscape as an impetus to innovate in software architecture, forge local alliances, and streamline overall cost frameworks.

Unpacking Segmentation Dynamics Across Deployment Modes Components Organization Sizes Industries and Applications Shaping Inspection Management Strategies

Inspection management solutions can be analyzed through the lens of how they are deployed, the functional components they encompass, the size of organizations that adopt them, the industries they serve, and the specific applications they enable. When considering deployment mode, cloud-based systems have gained significant traction because of their rapid provisioning, automatic updates, and lower upfront infrastructure costs, whereas on-premises deployments continue to appeal to highly regulated industries or those with stringent data sovereignty requirements. Shifting focus to system architecture, the distinction between software and service components becomes evident: core software modules handle workflow orchestration, data capture, and reporting, while professional services support customization, user training, and ongoing maintenance.

Organizational scale introduces a further dichotomy: large enterprises typically require full-featured platforms with advanced analytics, extensive integration capabilities, and global rollout support, whereas small and medium enterprises often gravitate toward streamlined solutions that offer rapid implementation and pre-configured templates. Industry verticals add another layer of nuance; within healthcare environments, inspection platforms must align closely with patient safety and accreditation standards, manufacturing settings prioritize automated visual inspection and throughput optimization, oil and gas firms demand rigorous non-destructive testing and safety inspection protocols, and transportation entities seek to monitor infrastructure health across bridges, rails, and roadways.

Finally, slicing the market by application underscores the diversity of use cases. Food safety inspection encompasses both HACCP compliance checks and broader quality control inspections, ensuring that perishable goods meet stringent regulatory standards. Industrial inspection covers automated visual inspection for assembly line defects, predictive maintenance inspections driven by sensor analytics, and traditional non-destructive testing methods. Infrastructure inspection spans specialized bridge, rail, and road assessments, while safety inspection focuses on fire safety systems and worker safety protocols. By weaving together these segmentation dimensions, decision-makers gain an integrated view of solution positioning and potential adoption scenarios.

This comprehensive research report categorizes the Inspection Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Application

- Organization Size

- End User Industry

Comparing Regional Nuances in Inspection Management Adoption Regulatory Drivers and Innovation Trends Across Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping inspection management adoption and innovation trajectories. In the Americas, robust technology ecosystems in North America have fostered rapid uptake of cloud-native inspection platforms, while Latin American markets are increasingly investing in mobile inspection tools to enable remote audits across expansive geographies. Regulatory frameworks in the United States and Canada continue to evolve, driving demand for platforms that can support complex reporting requirements in food safety, healthcare, and industrial sectors.

Across Europe, the Middle East, and Africa, a tapestry of regulatory regimes and industry maturity levels creates both challenges and opportunities. Western European nations often mandate rigorous environmental and safety audits, compelling companies to deploy comprehensive inspection suites. In contrast, Middle Eastern markets frequently emphasize oil and gas infrastructure integrity, leading to specialized non-destructive testing solutions. African countries, grappling with infrastructure development and maintenance backlogs, are increasingly turning to software-enabled inspection workflows to enhance project management and compliance tracking.

The Asia-Pacific region exhibits some of the fastest growth rates in inspection software adoption, fueled by large-scale infrastructure investments, manufacturing modernization initiatives, and tightening food safety regulations. Countries with advanced digital transformation agendas are piloting AI-powered inspection drones for remote infrastructure monitoring, while emerging economies are leveraging cost-effective cloud platforms to standardize inspection processes across geographically dispersed operations. This regional mosaic underscores the need for solution providers to offer configurable platforms that can address diverse regulatory, technological, and operational landscapes.

This comprehensive research report examines key regions that drive the evolution of the Inspection Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves of Leading Inspection Management Providers Through Partnerships Innovation Roadmaps and Competitive Differentiation Approaches

Leading inspection management providers are differentiating themselves through targeted mergers and acquisitions, strategic partnerships, and continuous product innovation. Several established software vendors have expanded their portfolios by integrating specialized AI engines for anomaly detection, enabling customers to automate defect analysis with higher accuracy. Concurrently, a growing number of service-oriented firms have established alliances with hardware manufacturers to bundle advanced sensor arrays and mobile devices with inspection software, offering turnkey solutions for complex environments.

Innovation roadmaps are increasingly focused on enhancing user experience and interoperability. Providers are launching low-code configuration tools that allow business users to tailor inspection protocols without extensive developer involvement. At the same time, open application programming interfaces (APIs) are becoming standard practice, facilitating seamless integration with enterprise resource planning architectures, maintenance management systems, and digital twin environments.

In the competitive arena, smaller nimble vendors are carving out vertical-specific niches, delivering pre-configured modules for industries such as pharmaceutical production or renewable energy infrastructure. Their ability to rapidly implement domain-specialized workflows has attracted attention from large enterprise clients seeking faster time to value. As a result, the market is characterized by a blend of full-suite global players and agile specialists, each vying to address evolving customer requirements in inspection management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inspection Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AssurX Inc.

- AuditBoard, Inc.

- Autodesk, Inc.

- ComplianceQuest, Inc.

- Dassault Systèmes SE

- Donesafe Pty Ltd

- ETQ Inc.

- Gensuite LLC

- Greenlight Guru, Inc.

- Hexagon AB

- InspectAll, Inc.

- Intelex Technologies Inc.

- IQS, Inc.

- MasterControl, Inc.

- MetricStream, Inc.

- MoonVision Inc.

- Oracle Corporation

- Penta Technologies, Inc.

- Pilgrim Quality Solutions, Inc.

- PTC Inc.

- SafetyCulture

- SAP SE

- Siemens AG

- Sparta Systems, Inc.

- Veeva Systems Inc.

Empowering Industry Leaders to Capitalize on Inspection Management Innovations Through Targeted Adoption Roadmaps Training and Strategic Technology Investments

To harness the full potential of inspection management technologies, industry leaders should pursue a multi-phased adoption roadmap that emphasizes both organizational readiness and technological maturity. Initially, executives must assess existing workflows and data repositories to identify gaps in inspection coverage and opportunities to consolidate disparate tools onto a unified platform. This assessment phase should involve cross-functional teams, including quality assurance, IT, and operations stakeholders, to ensure comprehensive alignment on objectives and success metrics.

Subsequently, piloting a cloud-enabled inspection solution in a controlled environment can validate integration capabilities with existing enterprise systems, such as maintenance management software or digital twin applications. During this pilot, attention should be paid to user training programs that instill best practices around data capture, anomaly reporting, and compliance documentation. Equipping field technicians with mobile devices configured for offline operation and intuitive interfaces will drive higher adoption rates and data integrity.

Finally, once foundational deployment is complete, organizations should invest in advanced analytics and machine learning modules to transition from reactive to predictive maintenance paradigms. Establishing a center of excellence for inspection management can centralize governance, facilitate continuous improvement, and ensure that emerging use cases-such as drone-based structural assessments or augmented reality-guided workflows-are systematically evaluated and scaled. By following this progressive roadmap, industry leaders can achieve measurable improvements in safety, quality, and operational uptime.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data and Analytical Frameworks to Ensure Robust Inspection Management Market Insights

This research synthesizes insights from both primary and secondary sources to ensure a comprehensive and balanced perspective on the inspection management market. Primary data collection involved in-depth interviews with C-level executives, inspection managers, and technology architects across diverse end-user industries. These conversations provided qualitative insights into technology adoption drivers, pain points, and strategic priorities. To complement these interviews, a series of structured surveys were conducted across a representative sample of organizations within healthcare, manufacturing, oil and gas, and transportation verticals.

Secondary research efforts encompassed a thorough review of regulatory filings, industry whitepapers, and technology roadmaps from leading providers. Publicly available standards documentation, including food safety accreditation guidelines and infrastructure inspection protocols, was analyzed to map platform feature requirements. Additionally, corporate press releases, patent filings, and partnership announcements were examined to chart competitive dynamics and innovation trajectories.

Data validation and triangulation processes were applied at multiple stages to reconcile findings from disparate sources, ensuring the robustness of insights. Throughout the research, a rigorous quality assurance framework guided the analysis, leveraging cross-functional expert reviews to mitigate bias and verify the relevance and accuracy of all presented information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inspection Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inspection Management Software Market, by Component

- Inspection Management Software Market, by Deployment Mode

- Inspection Management Software Market, by Application

- Inspection Management Software Market, by Organization Size

- Inspection Management Software Market, by End User Industry

- Inspection Management Software Market, by Region

- Inspection Management Software Market, by Group

- Inspection Management Software Market, by Country

- United States Inspection Management Software Market

- China Inspection Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Insights from Industry Transformation Drivers Regulatory Catalysts and Strategic Imperatives to Conclude on the Future Trajectory of Inspection Management

The inspection management landscape is at an inflection point where advancing technologies, shifting regulatory imperatives, and evolving business models converge to create new opportunities for value creation. By embracing cloud-based architectures, integrating AI-driven analytics, and adopting mobile-first workflows, organizations can significantly enhance operational resilience, improve safety outcomes, and ensure regulatory compliance with greater efficiency.

While external factors such as tariff adjustments and regional regulatory variations present challenges, they also catalyze innovation by compelling stakeholders to optimize existing assets and forge strategic alliances. Segmentation analysis reveals that tailored solutions-whether by deployment mode, organizational scale, industry vertical, or specific application-are critical to addressing diverse customer requirements. Furthermore, regional insights underscore the importance of configurable platforms that can adapt to local compliance frameworks and infrastructure demands.

As leading providers continue to refine their product roadmaps and pursue targeted partnerships, industry participants are poised to move from reactive inspection regimes toward predictive and prescriptive maintenance models. This evolution not only reduces risk but also unlocks new efficiencies, positioning inspection management as a strategic enabler of operational excellence. Stakeholders who engage with these developments proactively will secure a competitive advantage in a rapidly transforming market.

Engage with Ketan Rohom to Access Comprehensive Inspection Management Market Intelligence and Drive Strategic Growth with Tailored Research Solutions Today

To learn more about how detailed market intelligence can drive your organization’s inspection management strategy forward, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you through the report’s insights and discuss how custom analyses can support your specific investment, procurement, and business development objectives. Engaging with Ketan ensures that you receive tailored recommendations on deployment models, technology integrations, and industry best practices drawn from rigorous primary and secondary research. Secure your competitive edge today by initiating a conversation with him to explore pricing options, licensing terms, and bespoke consultancy services that align with your strategic roadmap for inspection management excellence.

- How big is the Inspection Management Software Market?

- What is the Inspection Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?