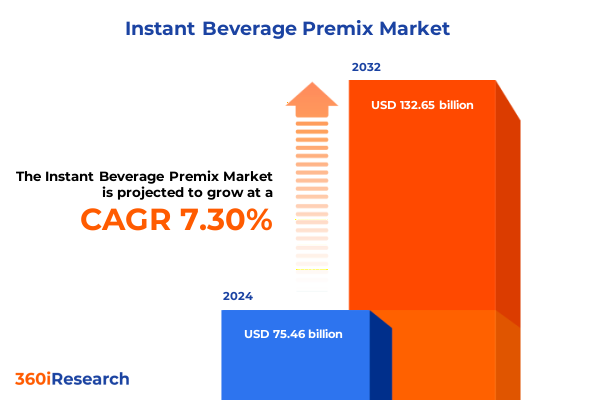

The Instant Beverage Premix Market size was estimated at USD 80.24 billion in 2025 and expected to reach USD 85.33 billion in 2026, at a CAGR of 7.44% to reach USD 132.65 billion by 2032.

An Engaging Overview to Illuminate the Instant Beverage Premix Market Dynamics alongside Emerging Consumer Preferences Technological Innovations and Competitive Drivers

The instant beverage premix sector has rapidly evolved into a dynamic arena characterized by shifting consumer tastes, advanced production technologies, and a growing emphasis on health and sustainability. This introduction lays the foundation by outlining the market’s historical roots in convenience and affordability, while tracing its progression toward premiumization and functional innovation. Early formulations primarily addressed basic needs for quick preparation, yet over time, industry participants have expanded their offerings to incorporate protein fortification, natural sweeteners, and botanical infusions.

Moreover, consumer expectations have shifted dramatically, with modern buyers seeking not just speed but also nutritional transparency, clean labels, and minimal environmental impact. In response, manufacturers are leveraging novel processing techniques such as spray drying and agglomeration to preserve flavor and nutritional integrity without relying on artificial additives. At the same time, packaging innovations-from eco-friendly sachets to reusable tins-underscore a commitment to reducing waste while enhancing shelf appeal and portability.

Consequently, this overview emphasizes the intersection of consumer demand, regulatory environments, and technological advances that collectively define the instant premix landscape. By establishing this context, readers will gain a clear understanding of the forces shaping current strategies, the drivers behind product differentiation, and the emerging opportunities awaiting those poised to balance convenience with increasingly sophisticated performance criteria.

Identifying Transformative Shifts Reshaping the Instant Premix Landscape through Consumer Behavior Evolution Technological Integration and Sustainability Imperatives

Over recent years, transformative shifts have redefined the instant beverage premix landscape, catalyzing fresh avenues for growth and differentiation. One of the most pronounced changes involves the transition from traditional powdered mixes toward multifunctional formulations that support wellness objectives. Ingredients such as adaptogens, collagen peptides, and prebiotic fibers are now commonplace, catering to consumers who view their daily drinks as vehicles for holistic health improvement.

Furthermore, advances in ingredient encapsulation technologies have enabled producers to preserve sensitive bioactives, ensuring consistent flavor profiles alongside enhanced shelf stability. These technical breakthroughs have dovetailed with the rise of direct-to-consumer e-commerce models, empowering niche brands to build loyal followings through targeted digital marketing and subscription offerings rather than relying solely on brick-and-mortar distribution.

In parallel, environmental considerations have gained prominence, compelling stakeholders to reevaluate sourcing practices and carbon footprints. Companies are increasingly forging partnerships with sustainable ingredient suppliers and investing in renewable energy for production facilities to satisfy regulatory requirements and socially conscious consumers. As a result, the sector’s trajectory is influenced as much by ecological stewardship and corporate responsibility as by flavor innovation and convenience, creating a multifaceted competitive environment.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Raw Materials and Distribution Channels within the Instant Beverage Premix Industry

In 2025, a series of tariff adjustments enacted by the United States government have exerted a pronounced influence on the instant beverage premix supply chain, particularly in the procurement of key raw materials such as specialty proteins, botanical extracts, and high-purity sugar alternatives. Tariffs introduced on imported cocoa powders and coffee extracts have elevated input costs, prompting manufacturers to explore alternative sourcing geographies or renegotiate long-term agreements to maintain cost-competitiveness without compromising quality.

Meanwhile, levies on packaging components-ranging from composite sachets to aluminum tins-have further pressured margins, encouraging firms to reevaluate material compositions and supplier networks. As transportation costs rose in tandem with duties, logistics teams have responded by consolidating shipments, optimizing warehouse footprints, and increasing reliance on regional manufacturing hubs to attenuate cross-border exposure.

Consequently, these cumulative impacts have underscored the importance of supply-chain agility and risk mitigation strategies. Companies that swiftly diversified their supplier portfolios and invested in near-shoring solutions have managed to stabilize production volumes and preserve product availability. Going forward, proactive tariff monitoring and dynamic cost modeling will remain crucial for navigating an environment where trade policies can rapidly alter the cost structure of instant beverage premixes.

Uncovering Key Insights Through Detailed Segmentation Spanning Product Types Distribution Channels Packaging Varieties Forms and Diverse Applications

Analyzing the market through multiple segmentation lenses reveals nuanced opportunities and potential choke points for industry participants. When considering product type, formulations span Chocolate Mix with its subsegments of Dark Chocolate, Milk Chocolate, and White Chocolate to Coffee Mix offerings including Cappuccino, Instant Coffee, and Latte, while Dairy Mix presents through Evaporated Milk, Instant Creamer, and Milk Powder. Energy Drink Mix is bifurcated into Caffeine Based and Vitamin Enriched variants, whereas Fruit Drink Mix covers Mango, Mixed Fruit, and Orange profiles, and Tea Mix focuses on Black Tea, Green Tea, and Herbal Tea infusions, each addressing unique taste preferences and nutritional demands.

Shifting focus to distribution channels, instant beverage premixes navigate a pathway that includes Convenience Stores for on-the-go purchases, Foodservice environments such as Cafes, Hotels, and Restaurants for bulk or customized applications, Online Retail via Company Websites, E Commerce Portals, and Third Party Apps for subscription and direct delivery, and Supermarkets & Hypermarkets serving broad consumer bases through high-footfall outlets. Packaging type also exerts influence, with products packaged in Bottles-both Glass and PET-or Jars crafted from Glass and Plastic, as well as Pouches presented in Flat and Stand Up formats, and Sachets differentiated by Multi Serve and Single Serve designs, while Tins offer a premium aesthetic.

Further granularity emerges when examining form factors: Granule compositions are classified as Agglomerated or Instant, Liquid Concentrate appears as Concentrate or Syrup, Powder undergoes Roller Drying or Spray Drying processes, and Tablet formats are either Compressed or Effervescent. Lastly, applications span Commercial settings like Hotels & Restaurants and Institutional environments to Household use, revealing divergent purchasing behaviors driven by volume requirements, pricing strategies, and customization needs. By integrating these segmentation insights, stakeholders can pinpoint where to channel innovation, adapt packaging, and tailor marketing to specific consumer cohorts and operational use cases.

This comprehensive research report categorizes the Instant Beverage Premix market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Form

- Application

- Distribution Channel

Revealing Pivotal Regional Trends and Distinctive Market Dynamics across the Americas Europe Middle East & Africa and Asia Pacific Regions

Regional dynamics in the instant beverage premix market reflect the interplay of consumer preferences, regulatory frameworks, and supply-chain infrastructures across the Americas, Europe Middle East & Africa, and Asia-Pacific landscapes. In the Americas, tastes gravitate toward high-protein and functional blends, supported by robust retail networks that emphasize private-label opportunities and digital engagement. Regulatory clarity around labeling and ingredient claims fosters a transparent environment for innovation, enabling faster product introductions.

Conversely, the Europe Middle East & Africa region exhibits a mosaic of cultural legacies and economic conditions, where premium tea-based mixes find a receptive audience alongside fruit-forward formulations, yet emerging markets prioritize cost-effective solutions. Sustainability mandates from governing bodies spur the adoption of compostable packaging in Western Europe, while Middle Eastern hospitality sectors drive bulk demand for specialized mixes tailored to local tastes.

Meanwhile, Asia-Pacific markets demonstrate vigorous expansion, with consumers embracing both traditional flavors such as green tea and innovative concoctions incorporating indigenous botanicals. Rapid growth in e-commerce, particularly mobile commerce, has unlocked direct-to-consumer channels, facilitating swift adoption of novel premix formats. Government incentives for local manufacturing and investments in raw-material cultivation further bolster regional competitiveness, underscoring the strategic importance of geographically diversified production footprints.

This comprehensive research report examines key regions that drive the evolution of the Instant Beverage Premix market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Company Strategies and Competitive Positioning Driving Innovation Development Partnerships and Portfolio Expansion in Instant Premixes

A review of leading enterprises in the instant beverage premix sector highlights the centrality of strategic partnerships, research collaborations, and portfolio diversification in sustaining competitive advantage. Market frontrunners have consistently invested in alliances with ingredient innovators to secure exclusive formulations and maintain a pipeline of differentiated products. Simultaneously, in-house R&D teams are accelerating timelines for flavor exploration and nutritional enhancements by adopting predictive analytics and consumer sensory testing platforms.

Additionally, several prominent players have broadened their footprints through mergers and acquisitions, seamlessly integrating niche specialists focused on clean-label ingredients or sustainable packaging solutions. This consolidation trend not only streamlines supply-chain complexity but also unlocks cross-selling possibilities across established distribution networks. Concurrently, top firms are increasing investments in digital marketing and consumer engagement tools, leveraging social listening and data-driven personalization to drive brand loyalty and gather actionable feedback for future innovation cycles.

Furthermore, an emphasis on manufacturing flexibility-through modular production lines capable of rapidly switching between powder, granule, and liquid formats-has emerged as a critical differentiator. By balancing scale with versatility, these companies can respond swiftly to shifting demand patterns while optimizing resource utilization and reducing time to market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Instant Beverage Premix market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A1 A.K. Koh Group Berhad

- Ajinomoto Co., Inc.

- Archer-Daniels-Midland Company

- Associated British Foods plc

- Dunkin’ Brands Group, Inc.

- Hain Celestial Group, Inc.

- Ito En, Inc.

- JDE Peet’s N.V.

- Keurig Dr Pepper Inc.

- Luigi Lavazza S.p.A.

- Marley Coffee, Inc.

- Mondelēz International, Inc.

- Monster Beverage Corporation

- Nestlé S.A.

- PepsiCo, Inc.

- Reckitt Benckiser Group plc

- Starbucks Corporation

- Suntory Beverage & Food Limited

- Tata Consumer Products Limited

- The Kraft Heinz Company

- The Republic of Tea, Inc.

- Tingyi (Cayman Islands) Holding Corp.

- Twinings North America, Inc.

- Unilever PLC

Presenting Actionable Recommendations to Empower Industry Leaders with Strategic Initiatives for Growth Adaptation and Sustainable Competitive Advantage

Industry leaders seeking to capitalize on evolving market dynamics should begin by prioritizing multifunctional formulations that align with health and wellness trends, ensuring that new products address specific consumer needs such as immune support or cognitive focus. By integrating evidence-backed ingredients and validating claims through third-party certifications, companies can build consumer trust and justify premium pricing.

Moreover, strengthening resilience across the supply chain will be imperative in light of trade policy volatility. Organizations should diversify sourcing by forging relationships with multiple suppliers across different regions and exploring near-shoring opportunities that reduce exposure to tariff fluctuations. Concurrently, investments in digital supply-chain monitoring platforms can provide real-time visibility into logistics performance and inventory levels, enabling proactive adjustments before disruptions escalate.

In parallel, adopting sustainable packaging innovations will not only meet regulatory pressure but also resonate with eco-conscious consumers. Exploring compostable materials, refillable systems, or lightweight containers can minimize environmental impact while enhancing brand equity. Equally important is the expansion of direct-to-consumer capabilities through enhanced e-commerce platforms, subscription models, and dynamic pricing strategies that optimize lifetime customer value and improve margins.

Detailing a Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation to Ensure Robust Insights

This analysis is grounded in a rigorous research methodology that combines primary and secondary sources to ensure comprehensive coverage and robust insights. Primary data collection included in-depth interviews with key decision-makers across manufacturing, distribution, and retail segments, supplemented by structured surveys targeting end-users to capture evolving preferences and pain points. Through these engagements, firsthand perspectives on innovation hurdles, cost sensitivities, and brand perceptions were systematically gathered.

Secondary research encompassed a thorough review of industry publications, patent filings, regulatory documents, and company financial disclosures, providing context on historical trends, technological breakthroughs, and policy landscapes. Data triangulation techniques were employed to validate findings, cross-referencing qualitative feedback with quantitative indicators such as production capacities, import/export volumes, and sustainability reports. Additionally, site visits to processing facilities and packaging plants offered direct observations of operational practices and quality-control protocols.

Collectively, these methodological layers ensure that the conclusions and recommendations presented herein rest on a solid evidentiary foundation, delivering actionable intelligence with clarity and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Instant Beverage Premix market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Instant Beverage Premix Market, by Product Type

- Instant Beverage Premix Market, by Packaging Type

- Instant Beverage Premix Market, by Form

- Instant Beverage Premix Market, by Application

- Instant Beverage Premix Market, by Distribution Channel

- Instant Beverage Premix Market, by Region

- Instant Beverage Premix Market, by Group

- Instant Beverage Premix Market, by Country

- United States Instant Beverage Premix Market

- China Instant Beverage Premix Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Crafting a Concise Conclusion that Synthesizes Core Insights Highlights Strategic Implications and Reinforces the Critical Importance of Market Intelligence

In summary, the instant beverage premix market stands at the intersection of convenience, wellness, and sustainability imperatives. The convergence of advanced processing techniques, health-centric ingredient innovations, and evolving consumer expectations has forged a landscape rich in opportunity yet characterized by intensifying competition. Recent tariff developments have underscored the need for supply-chain agility, while segmentation analyses reveal distinct paths for targeting diverse consumer segments and use cases.

Regional variations further emphasize the importance of localized strategies, whether by catering to protein-focused buyers in the Americas, navigating regulatory mosaics in Europe Middle East & Africa, or tapping into the digital commerce boom across Asia-Pacific. Leading companies exemplify the merits of partnership-driven innovation, portfolio expansion, and manufacturing versatility, setting benchmarks for agility and differentiation.

Ultimately, companies that harmonize product development with sustainability commitments, robust risk management, and data-driven consumer engagement will be best positioned to navigate this multifaceted market. The insights and recommendations outlined in this report equip decision-makers with the clarity needed to formulate strategies that balance short-term resilience with long-term growth aspirations.

Engage with Our Associate Director to Access In Depth Instant Beverage Premix Market Intelligence Solutions Tailored to Fuel Your Strategic Decision Making

To explore how this comprehensive analysis can be tailored to your organization’s unique strategic objectives and to secure your access to the full market research report, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the report’s in-depth chapters, supplementary data files, and bespoke consulting options designed to drive your decision-making forward. Whether you seek granular insights into emerging product innovations or require support crafting a competitive entry strategy, Ketan will connect you with the precise solutions needed to turn insights into impact. Engage today and transform your understanding of the instant beverage premix landscape into a clear path toward profitable growth.

- How big is the Instant Beverage Premix Market?

- What is the Instant Beverage Premix Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?