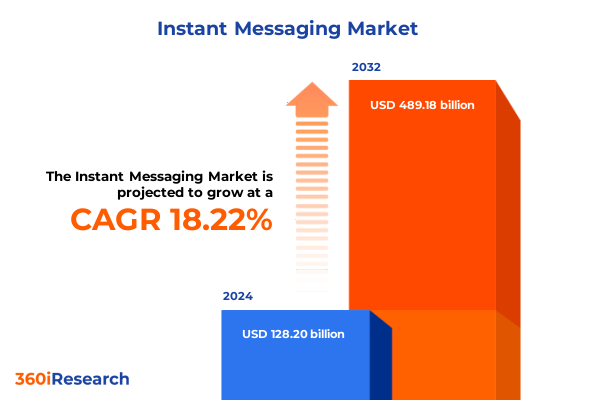

The Instant Messaging Market size was estimated at USD 151.85 billion in 2025 and expected to reach USD 179.85 billion in 2026, at a CAGR of 18.18% to reach USD 489.18 billion by 2032.

Setting the Stage for Informed Decision Making Amid Rapid Technological Advances, Policy Evolutions, and Emerging Market Dynamics

Organizations today stand at the confluence of accelerating digital transformation, shifting regulatory landscapes, and intensifying global competition. In this context, leaders must navigate an intricate web of technological innovation, evolving trade policies, and dynamic consumer behaviors. This executive summary distills critical developments across technology, policy, and market forces that will define strategic imperatives in 2025.

Emerging advancements in artificial intelligence, cloud computing, and edge technologies are converging to redefine operational models, enabling organizations to harness real-time data and predictive analytics. Concurrently, governments around the world are revisiting tariff structures, data privacy regulations, and industry-specific compliance frameworks. Such policy evolutions are poised to reshape supply chains, cost structures, and market entry strategies. In addition, shifting end-user expectations-driven by heightened demand for seamless digital experiences, sustainability credentials, and agile service delivery-are compelling providers to innovate across hardware, software, and service portfolios.

As executive decision-makers confront these multifaceted challenges, an integrated perspective is essential. This analysis offers a structured exploration of transformative shifts in industry dynamics, the cumulative impact of United States tariffs in 2025, nuanced segmentation insights across product types and end-user categories, and differentiated regional drivers. Drawing on leading-edge research methodologies and validated primary insights, the report illuminates the pathways to strategic resilience and competitive advantage. In the following sections, stakeholders will discover actionable recommendations tailored to current market realities, empowering data-driven choices and sustainable success.

Charting Unprecedented Transformations as Digital Disruption Reshapes Industry, Consumer Behavior, and Global Competitive Landscapes

Digital disruption continues to accelerate at an unprecedented pace, challenging traditional business models and unlocking new opportunities for innovation. Organizations are reshaping their value propositions by adopting hybrid cloud architectures that blend on-premise systems with cloud-based and edge infrastructures. This transition is bolstered by increasingly sophisticated integration platforms and low-code/no-code tools, enabling faster deployment cycles and greater operational agility.

Moreover, the proliferation of artificial intelligence and machine learning is catalyzing a new era of intelligent automation. From predictive maintenance in manufacturing to personalized customer engagements in retail, AI-driven solutions are delivering measurable ROI while reducing time-to-market. In addition, services such as managed consulting, support, and training are becoming critical differentiators, as firms seek end-to-end transformation partners rather than isolated technology vendors.

Consumer behavior is concurrently evolving, with demand for seamless omnichannel interactions, subscription-based offerings, and real-time support reaching new heights. Businesses are responding by enhancing mobile applications, streamlining digital payments, and investing in immersive experiences powered by augmented and virtual reality. At the same time, sustainability considerations are influencing procurement strategies, with organizations integrating eco-friendly hardware components and energy-efficient data centers into their roadmaps.

Consequently, market competition is intensifying as new entrants and established incumbents vie for leadership across hardware, services, and software domains. Partnerships, alliances, and strategic investments are rapidly reshaping the competitive landscape, underscoring the need for continuous innovation and adaptive strategies. In light of these transformative shifts, industry leaders must cultivate dynamic capabilities and forward-looking vision to capitalize on emerging market opportunities and mitigate evolving risks.

Assessing the Aggregate Consequences of Tariff Adjustments on Supply Chains, Procurement Strategies, and Competitive Positioning in 2025 United States

The United States’ tariff adjustments in 2025 have introduced significant perturbations across supply chains, procurement processes, and pricing strategies for technology products and services. Major hardware components, including laptops, smartphones, and tablets, have experienced cost increases tied to elevated import duties, prompting organizations to reevaluate vendor relationships and negotiate alternative sourcing agreements. In response, supply chain executives are exploring diversification strategies, such as nearshoring and multi-sourcing, to mitigate exposure to concentrated tariff risks.

Within the services segment, where consulting, support, and training form essential pillars of digital transformation initiatives, increased operational costs have been partially absorbed through revised contract structures and tiered service packages. Providers are leveraging remote delivery models and digital training platforms to maintain margin integrity while ensuring client engagement and knowledge transfer remain uninterrupted.

Software offerings, spanning cloud-based, hybrid, and on-premise deployments, have also faced indirect consequences from tariff-related hardware cost escalations. Cloud service providers have adjusted subscription fees to offset infrastructure expenditure, while on-premise license models have been reexamined to accommodate shifts in customer capex-to-opex preferences. Additionally, the introduction of component-level tariffs has incentivized software vendors to optimize their solutions for lower-cost hardware configurations, reinforcing a trend toward leaner, containerized architectures.

Trade policy uncertainty has further impacted strategic decision-making, as organizations recalibrate long-term technology roadmaps to account for potential tit-for-tat measures. To stay ahead, leaders are conducting scenario planning exercises, engaging in active dialogue with policymakers, and reinforcing cross-functional collaboration between procurement, finance, and technology teams. This comprehensive approach aims to preserve business continuity, maintain competitive positioning, and unlock new pathways for cost containment amidst evolving tariff regimes.

Unearthing Actionable Market Insights by Decoding Diverse Product Types, End Users, Distribution Channels, and Pricing Models

A nuanced understanding of market segmentation reveals diverse performance drivers and opportunity areas across product types, end-user categories, distribution channels, and pricing models. In the product domain, the hardware segment-encompassing laptops, smartphones, and tablets-continues to advance through iterative improvements in processing power, battery life, and design aesthetics, driving sustained replacement cycles. Services offerings, ranging from high-value consulting to tailored support and immersive training experiences, are evolving to prioritize outcome-based engagements and remote delivery capabilities. Meanwhile, software solutions span cloud-based, hybrid, and on-premise architectures, each catering to distinct organizational preferences for scalability, security, and control.

End-user segmentation further underscores differentiated buying behaviors and budget allocations. Large enterprises within banking & finance, healthcare, manufacturing, and retail sectors demand robust, compliance-driven solutions backed by extensive support infrastructures. Government entities at the federal and state & local levels follow distinct procurement guidelines, emphasizing transparency, interoperability, and long-term maintenance commitments. Conversely, midsize and small businesses exhibit heightened sensitivity to total cost of ownership and often favor turnkey packages with predictable subscription fees.

Distribution channels present another layer of complexity. Offline routes such as direct sales, distributors, and retail stores offer the advantage of in-person demonstrations and established local relationships, while online platforms-spanning company websites, mobile applications, and third-party e-commerce marketplaces-cater to buyers seeking speed, convenience, and digital self-service experiences. Companies that seamlessly integrate offline and online touchpoints are poised to capture incremental market share by delivering unified customer journeys.

Pricing models affect adoption dynamics and revenue streams across segments. Freemium structures, with basic and premium tiers, lower barriers to entry and accelerate trial usage. Pay-per-use frameworks, including metered billing and transactional options, align costs with consumption. Perpetual licensing, delivered through enterprise and on-premise licenses, suits organizations preferring capital expenditures, while subscription offerings-available on annual or monthly cycles-provide predictable recurring revenue and ongoing engagement opportunities. By applying these segmentation lenses, decision-makers can pinpoint high-potential niches, tailor go-to-market strategies, and optimize resource allocation for maximal impact.

This comprehensive research report categorizes the Instant Messaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pricing Model

- End User

- Distribution Channel

Exploring Regional Dynamics and Growth Drivers Spanning the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Geographic dynamics play a pivotal role in shaping market performance and competitive intensity. In the Americas region, the United States maintains its position as a technology innovator, with mature infrastructure and a regulatory environment that fosters digital adoption. Canada and Mexico contribute complementary strengths through burgeoning manufacturing hubs and evolving government initiatives aimed at digital transformation, creating a synergistic North American ecosystem.

Across Europe, Middle East, and Africa, a mosaic of regulatory frameworks and economic conditions influences buyer behavior and go-to-market strategies. Western European markets, driven by stringent data privacy and sustainability mandates, are characterized by high investment in secure cloud and edge solutions. Emerging economies in Eastern Europe and the Middle East are rapidly modernizing public sector systems and critical infrastructure, while Africa presents untapped growth potential fueled by mobile-first approaches and fintech innovations.

Asia-Pacific stands out for its scale, diversity, and supply chain significance. China, Japan, South Korea, and Australia represent advanced markets with deep digital ecosystems, whereas India and Southeast Asian nations are experiencing exponential growth in enterprise adoption of cloud and collaboration tools. Regional manufacturing hubs and logistics corridors underpin global hardware supply chains, making Asia-Pacific a focal point for both tariff mitigation strategies and next-generation technology development.

Understanding these regional nuances empowers stakeholders to tailor market entry, partnership, and localization approaches. By aligning product, service, and channel strategies with local regulatory requirements, cultural preferences, and infrastructure capabilities, organizations can unlock new revenue streams, optimize operational efficiency, and build resilient footprints across the globe.

This comprehensive research report examines key regions that drive the evolution of the Instant Messaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders: Innovations, Strategic Partnerships, and Competitive Differentiators Driving Success in a Complex Marketplace

Leading organizations are differentiating through sustained investments in research and development, strategic alliances, and customer-centric innovation. Major hardware manufacturers are introducing modular designs and advanced component integration to reduce manufacturing complexity and support sustainable end-of-life programs. Simultaneously, global consulting and support firms are deepening domain expertise in vertical markets, offering tailored packages for banking & finance, healthcare, and manufacturing clients.

Cloud service providers have solidified their market positions by expanding global data center footprints and enhancing platform capabilities in areas such as artificial intelligence, analytics, and security. Hybrid cloud offerings have become critical, enabling clients to migrate workloads gradually while maintaining compliance with data sovereignty rules. In parallel, software companies are forging partnerships with independent software vendors and systems integrators to create interoperable ecosystems that streamline deployment and maintenance.

Additionally, mid-tier technology vendors are emerging as formidable competitors through niche specialization and agile service delivery. These companies leverage local market knowledge, flexible pricing models, and rapid development cycles to capture share in underserved segments. Their ability to deliver turnkey solutions, combined with strong channel relationships, underscores the importance of adaptability in a shifting competitive landscape.

Strategic mergers and acquisitions continue to reshape the industry, as leaders seek to augment capabilities in areas like cybersecurity, IoT, and managed services. By integrating complementary assets and expert teams, organizations are accelerating time-to-market for next-generation offerings. Observing these dynamics provides clarity on competitive differentiators, helping stakeholders to benchmark performance and identify partnership opportunities that reinforce strategic objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Instant Messaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlassian Corporation

- BigAnt China

- Bopup Communication Server

- Brosix Inc.

- Chanty, Inc.

- Chatwork Co., Ltd.

- Cisco Systems, Inc.

- Flock FZ-LLC

- Google LLC

- International Business Machines Corporation

- Kakao Corp.

- LINE Corporation

- Mattermost, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Rocket.Chat Technologies Corp.

- Ryver LLC

- Signal Messenger LLC

- Slack Technologies, LLC

- Snap Inc.

- Tango by Uptodown Technologies SL

- Telegram Group Inc.

- Troop Messenger

- Viber Media S.a r.l.

- WeChat

Formulating Tactical and Strategic Recommendations to Empower Industry Leaders to Navigate Disruption, Accelerate Growth, and Enhance Resilience

To thrive amid persistent disruption and policy headwinds, executives should pursue a multifaceted approach that balances short-term agility with long-term resilience. First, diversifying supply chains through strategic nearshoring and multi-vendor sourcing is essential to mitigate tariff exposures and ensure continuity of critical hardware components. Investment in real-time supply chain analytics and collaborative planning platforms will further enhance visibility and responsiveness.

Second, embedding modularity into solution architectures allows organizations to adapt quickly to changing customer requirements and regulatory constraints. By designing services and software with interchangeable components, providers can streamline customization processes and accelerate delivery timelines. In parallel, adopting flexible pricing frameworks-such as usage-based and subscription tiers-will expand addressable markets and align revenue with client value realization.

Third, cultivating a culture of continuous learning and cross-functional collaboration will fortify internal capabilities. Leadership teams should prioritize dedicated training programs in emerging technologies, regulatory compliance, and data-driven decision making. Establishing centers of excellence that bridge procurement, finance, and technology disciplines can unlock holistic insights and drive more informed strategic choices.

Finally, engaging proactively with policymakers and industry consortia will help influence future trade and regulatory developments. By contributing thought leadership and sharing best practices, organizations can advocate for balanced policies that support innovation while maintaining fair competitive conditions. These combined actions will position industry leaders to capitalize on evolving market dynamics, achieve sustainable growth, and maintain a competitive edge.

Elucidating Rigorous Research Methodologies and Data Collection Practices Underpinning Comprehensive Industry Analysis

This analysis synthesizes insights derived from a rigorous, multi-phase research methodology designed to ensure both depth and validity. Primary research consisted of structured interviews with C-level executives, procurement heads, and technology architects across diverse industry verticals. These discussions provided firsthand perspectives on tariff impacts, deployment challenges, and vendor differentiation strategies.

Secondary research complemented these findings through a systematic review of regulatory publications, industry whitepapers, and technology vendor briefs. This phase included comprehensive policy analysis to map tariff schedules and associated compliance requirements, as well as an examination of emerging standards in data privacy, sustainability, and security.

The data collection process also incorporated extensive surveys and expert panel workshops. Quantitative survey responses were triangulated with qualitative insights from thematic focus groups, enabling robust validation of key trends and strategic priorities. Advanced analytics methods, including cluster analysis and scenario modeling, were employed to examine segmentation patterns and forecast potential outcomes under varying trade policy scenarios.

Quality assurance protocols involved multiple rounds of peer review and fact-checking against publicly available sources, ensuring accuracy and consistency throughout the report. The research framework emphasizes transparency, reproducibility, and actionable relevance, equipping stakeholders with a comprehensive understanding of market dynamics and informed pathways for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Instant Messaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Instant Messaging Market, by Product Type

- Instant Messaging Market, by Pricing Model

- Instant Messaging Market, by End User

- Instant Messaging Market, by Distribution Channel

- Instant Messaging Market, by Region

- Instant Messaging Market, by Group

- Instant Messaging Market, by Country

- United States Instant Messaging Market

- China Instant Messaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Strategic Insights to Illuminate the Path Forward for Stakeholders in a Rapidly Evolving Market Environment

In conclusion, the convergence of digital transformation, evolving tariffs, and shifting consumer expectations demands a strategic posture rooted in agility, foresight, and collaboration. By integrating advanced technologies, diversifying supply chains, and aligning segmentation strategies, organizations can navigate uncertainty and capitalize on emerging opportunities across product types, end-user categories, regions, and pricing models.

Key findings underscore the imperative for modular architectures, flexible pricing frameworks, and proactive policy engagement to build resilience and drive sustainable growth. As competition intensifies, stakeholders who leverage data-driven insights, foster cross-functional partnerships, and maintain a clear focus on customer value will emerge as market leaders in 2025 and beyond.

This report equips decision-makers with the clarity and direction needed to craft informed strategies, optimize resource allocation, and execute with confidence in a rapidly evolving marketplace.

Connect with Ketan Rohom to Access In-Depth Strategic Market Research for Informed Decision-Making and Competitive Advantage in 2025

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored exploration of market forces, policy implications, and competitive dynamics shaping your strategic roadmap. By collaborating directly, you will gain privileged access to in-depth analyses, expert recommendations, and exclusive insights that empower decisive action and sustainable growth. Reach out today to acquire the comprehensive research report and position your organization at the forefront of innovation, resilience, and market leadership in 2025

- How big is the Instant Messaging Market?

- What is the Instant Messaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?