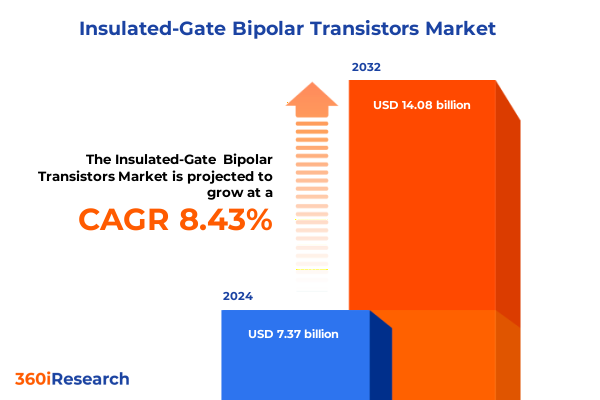

The Insulated-Gate Bipolar Transistors Market size was estimated at USD 7.95 billion in 2025 and expected to reach USD 8.57 billion in 2026, at a CAGR of 8.51% to reach USD 14.08 billion by 2032.

Comprehensive overview of the strategic importance evolution and core technologies underpinning the insulated-gate bipolar transistor market

Insulated-Gate Bipolar Transistors (IGBTs) have emerged as the cornerstone of modern power electronics, driving unprecedented efficiency gains across diverse sectors. Combining the fast switching and low-loss characteristics of MOSFETs with the high current-carrying capability of bipolar transistors, IGBTs facilitate the precise control of high-power applications ranging from motor drives to renewable energy systems. Their unique architecture enables system designers to optimize performance while minimizing thermal stress, contributing to both operational reliability and reduced energy consumption.

Over the last decade, IGBTs have transitioned from niche components in industrial drives to fundamental enablers of electrification in automotive, energy, and consumer electronics landscapes. The convergence of stringent energy regulations, ambitious carbon-reduction targets, and skyrocketing demand for electric vehicles has intensified the imperative for power devices that balance efficiency, cost, and reliability. As industry stakeholders seek to decarbonize power generation and transportation, IGBTs stand at the forefront of this transformation, empowering next-generation inverters, converters, and drive systems.

Exploring the unprecedented technological innovations and market dynamics reshaping the insulated-gate bipolar transistor industry landscape

The IGBT market is being reshaped by a confluence of technological breakthroughs and shifting market dynamics that are redefining power-conversion paradigms. Advances in module integration have given rise to intelligent power modules that embed gate drivers, temperature sensors, and protective circuitry alongside discrete transistors. This integration reduces board space and simplifies system design, enabling compact, high-performance solutions in electric vehicles and industrial automation.

Concurrently, the rise of wide-bandgap semiconductors-particularly silicon carbide and gallium nitride-is prompting established IGBT manufacturers to innovate new device architectures. While wide-bandgap devices promise even higher switching speeds and temperature resilience, next-generation IGBTs are leveraging trench-gate designs and enhanced carrier lifetime control to close the performance gap, preserving cost advantages and established supply chains.

Finally, digitalization and real-time system monitoring are transforming how IGBTs are specified, tested, and maintained. Embedded sensors and predictive analytics platforms allow for proactive thermal management and fault prediction, minimizing downtime and extending the operational life of critical assets in manufacturing facilities, data centers, and electric grids.

Analyzing the far-reaching effects of the 2025 United States tariffs on imported insulated-gate bipolar transistors and supply chain resilience

In 2025, the United States implemented a series of tariffs targeting imported power-semiconductor modules, with insulated-gate bipolar transistors among the most affected. These measures have increased landed costs for devices originating from key Asian manufacturing hubs, prompting OEMs to reassess sourcing strategies. Many global power-electronics companies are now diversifying their supply chains, balancing imports with domestic and near-shore production to mitigate exposure to trade policy volatility.

The tariffs’ cumulative impact extends beyond immediate pricing pressures. Inventory management practices have evolved to accommodate longer lead times, with firms maintaining strategic safety stocks and adopting just-in-case approaches in lieu of leaner inventory models. At the same time, alliances between North American test-and-assembly facilities and regional distributors have deepened, fostering more resilient ecosystems that can absorb supply-chain shocks and protect critical production lines.

Looking ahead, these shifts are accelerating investment in local semiconductor fabrication and advanced packaging capabilities. Public-private partnerships are being formed to bolster domestic capacity, ensuring that high-volume IGBT production aligns with national energy-security objectives and supports the electrification push across transportation and infrastructure.

Unveiling critical segmentation learnings across end-use industries application domains module configurations and performance characteristics

Insight into end-use industries reveals that automotive electrification is the single largest driver of IGBT demand, with passenger cars, commercial vehicles, and hybrid platforms each exerting unique requirements on device topology and thermal management. Consumer electronics applications, while lower in power, prioritize miniaturization and high switching frequencies. Industrial automation continues to rely on rugged, high-voltage modules, whereas the renewable energy sector demands robust medium- and high-current devices for solar inverters and wind-turbine converters. Telecommunications infrastructure, particularly 5G base stations, is increasingly integrating compact IGBTs to optimize power-amplifier efficiency.

Application-based segmentation highlights electric vehicles’ nuanced landscape, where commercial fleets require high-power modules optimized for fast-charging cycles, while passenger cars focus on cost, efficiency, and integration density. Motor drives leverage medium-voltage discrete modules, whereas solar inverters use intelligent power modules with embedded protections. Uninterruptible power supplies depend on low-voltage, high-current devices, and welding equipment demands robust switching characteristics under harsh thermal cycling.

Module-type insights underscore the shift toward smart modules, which embed control electronics and diagnostics within the power module. While bare die remains crucial for custom OEM solutions and cost-sensitive applications, discrete modules still dominate industrial markets. Voltage and current ratings segmentation reinforces that high-voltage modules are proliferating in traction and utility-scale renewable projects, while low-voltage, high-current devices are central to data centers, UPS systems, and localized power conversion.

Thermal management continues to be a differentiator, with air-cooled designs sufficient for many installations but liquid and phase-change cooling gaining traction in high-power, high-density environments. Similarly, switching-frequency segmentation indicates that high-frequency IGBTs are essential for compact, weight-sensitive applications, whereas medium- and low-frequency modules persist in heavy-duty industrial contexts. Packaging formats also influence adoption: power modules offer ease of integration at scale, surface-mount solutions drive miniaturization, and through-hole parts remain vital for legacy systems. Finally, sales-channel dynamics are evolving, as OEM agreements secure volume contracts, direct sales foster strategic partnerships, and aftermarket channels support maintenance of installed bases.

This comprehensive research report categorizes the Insulated-Gate Bipolar Transistors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Module Type

- Voltage Rating

- Current Rating

- Cooling Method

- Switching Frequency

- Packaging Type

- End-Use Industry

- Application

- Sales Channel

Highlighting regional performance disparities and strategic opportunities across the Americas EMEA and Asia-Pacific for IGBT deployments

The Americas region is witnessing robust adoption of IGBTs, propelled by aggressive electric-vehicle rollouts in the United States and Canada, alongside substantial investments in grid modernization and data-center expansion. Incentives for green infrastructure are catalyzing demand for medium- and high-current power modules in renewable energy installations, while industrial automation projects in Mexico are driving discrete module sales.

In Europe, the Middle East & Africa corridor, decarbonization goals and stringent efficiency regulations are fuelling consistent uptake of IGBT-based converters across wind and solar farms. Germany’s leadership in automotive manufacturing continues to underpin high-volume procurement of automotive-grade modules, whereas the Middle East is focusing on utility-scale solar inverters that rely on high-voltage, liquid-cooled designs. Africa’s nascent electrification projects are gradually incorporating low-voltage IGBTs to power rural microgrids and telecom base stations.

Asia-Pacific remains the largest single market, dominated by China’s expansive EV ecosystem and massive renewable-energy deployments. Japan and South Korea maintain leadership in advanced semiconductor manufacturing and module integration, driving innovation in smart modules and high-frequency devices. Meanwhile, India’s accelerating electrification agenda is igniting demand for cost-optimized, rugged IGBTs in motor drives and solar inverters, supported by domestic assembly initiatives.

This comprehensive research report examines key regions that drive the evolution of the Insulated-Gate Bipolar Transistors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining strategic positioning collaborative ventures and competitive advantages among leading IGBT manufacturers globally

Leading IGBT manufacturers are strategically positioning themselves through a combination of technology partnerships, capacity expansions, and portfolio diversification. Infineon Technologies has doubled down on silicon carbide and trench-IGBT advances, leveraging its acquisition of Cypress to integrate advanced gate-driver control modules. Mitsubishi Electric continues to deepen its foothold in rail traction and industrial automation, focusing on ultra-high-voltage devices and proprietary thermal-management coatings.

ON Semiconductor has carved out a competitive position through cost-optimized discrete modules and robust direct-sales networks, particularly in the Americas. STMicroelectronics is expanding its intelligent power module lineup, integrating digital controls and predictive-diagnostics features to address the growing need for condition-based maintenance in factory automation. Toshiba and Rohm Semiconductor are collaborating on next-generation packaging solutions that combine high-density interconnects with advanced cooling materials, catering to the data-center and telecom sectors.

Notably, several consortiums have formed to develop open-standard test protocols and accelerate qualification cycles, reducing time-to-market for new IGBT platforms. These collaborative efforts are fostering interoperability and easing cross-vendor integration challenges, ultimately benefiting end users through faster innovation cycles and more reliable component performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insulated-Gate Bipolar Transistors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alpha and Omega Semiconductor

- Analog Devices Inc.

- Danfoss A/S

- Diodes Incorporated

- Fuji Electric Co. Ltd.

- Hitachi, Ltd.

- Infineon Technologies AG

- IXYS Corporation

- Littelfuse, Inc.

- Magnachip Semiconductor Corporation

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NEXPERIA B.V.

- NXP Semiconductors N.V

- PANJIT International Inc.

- Renesas Electronics Corporation

- ROHM Co. Ltd.

- Semiconductor Components Industries, LLC

- SEMIKRON International GmbH

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Corporation

- Vishay Intertechnology, Inc.

- WeEn Semiconductors

Driving future growth through integrated module innovation strategic supply-chain diversification and advanced digital workflows

Industry leaders should prioritize investment in integrated power modules that combine IGBT devices with embedded sensor and gate-driver technology, enabling predictive maintenance and streamlined system integration. Fostering partnerships with packaging specialists and raw-material suppliers will mitigate tariff-related cost fluctuations and enhance supply-chain visibility.

Further, adopting a dual-sourcing strategy that balances domestic production with established Asian supply channels can safeguard against geopolitical disruptions. Companies should also accelerate R&D efforts in trench-gate and carrier-lifetime-controlled IGBTs to offset the competitive threat posed by wide-bandgap semiconductors, ensuring they retain cost and performance leadership in high-power applications.

Finally, embedding advanced digital twins and real-time thermal-management simulations within design workflows will shorten development cycles and optimize device specifications for application-specific requirements. This approach not only drives time-to-market advantages but also reduces warranty costs and enhances customer satisfaction through improved reliability.

Comprehensive overview of primary and secondary research approaches ensuring robust and triangulated insights into the IGBT landscape

Our research methodology integrated both primary and secondary data collection to ensure comprehensive market insights. Primary research involved in-depth interviews with key industry stakeholders, including power-electronics engineers, procurement directors at OEMs, and technology heads at leading semiconductor foundries. These conversations provided firsthand perspectives on emerging design challenges, procurement strategies, and performance expectations.

Secondary research encompassed a rigorous review of white papers, technical journals, patent filings, and regulatory filings from global agencies. Publicly available financial reports, trade associations publications, and conference proceedings were analyzed to validate technology roadmaps and investment trends. Data triangulation techniques were applied to align qualitative insights with quantitative benchmarks, ensuring the report’s findings are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insulated-Gate Bipolar Transistors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insulated-Gate Bipolar Transistors Market, by Module Type

- Insulated-Gate Bipolar Transistors Market, by Voltage Rating

- Insulated-Gate Bipolar Transistors Market, by Current Rating

- Insulated-Gate Bipolar Transistors Market, by Cooling Method

- Insulated-Gate Bipolar Transistors Market, by Switching Frequency

- Insulated-Gate Bipolar Transistors Market, by Packaging Type

- Insulated-Gate Bipolar Transistors Market, by End-Use Industry

- Insulated-Gate Bipolar Transistors Market, by Application

- Insulated-Gate Bipolar Transistors Market, by Sales Channel

- Insulated-Gate Bipolar Transistors Market, by Region

- Insulated-Gate Bipolar Transistors Market, by Group

- Insulated-Gate Bipolar Transistors Market, by Country

- United States Insulated-Gate Bipolar Transistors Market

- China Insulated-Gate Bipolar Transistors Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1749 ]

Synthesizing the pivotal role of integration diversification and digitalization in the ongoing evolution of the insulated-gate bipolar transistor ecosystem

As global energy and transportation systems pivot toward electrification and decarbonization, IGBTs will remain central to achieving performance and efficiency targets. The convergence of advanced module integration, evolving supply-chain architectures, and proactive thermal management is creating a dynamic environment ripe for innovation. Stakeholders that embrace integrated power modules, diversify sourcing, and leverage digital design tools will be best positioned to capture the growth opportunities that lie ahead.

The interplay between traditional silicon-based IGBTs and emerging wide-bandgap technologies underscores a transitional period in which performance, cost, and supply-chain resilience must be carefully balanced. By staying abreast of regional regulatory shifts, tariff impacts, and segmentation-specific demands, companies can refine their strategies to deliver reliable, high-efficiency power solutions across industries.

Ultimately, success in this evolving market will depend on the ability to seamlessly integrate cross-functional expertise-from semiconductor physics to system-level engineering-ensuring that next-generation power electronics deliver on both economic and environmental objectives.

Secure your competitive advantage now by contacting Ketan Rohom for a tailored IGBT market intelligence report that drives business growth

Don’t miss this opportunity to gain a decisive strategic edge in the rapidly evolving insulated-gate bipolar transistor market. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive report today and empower your organization with data-driven insights that unlock new revenue streams, optimize supply chains, and future-proof your technology roadmap.

- How big is the Insulated-Gate Bipolar Transistors Market?

- What is the Insulated-Gate Bipolar Transistors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?