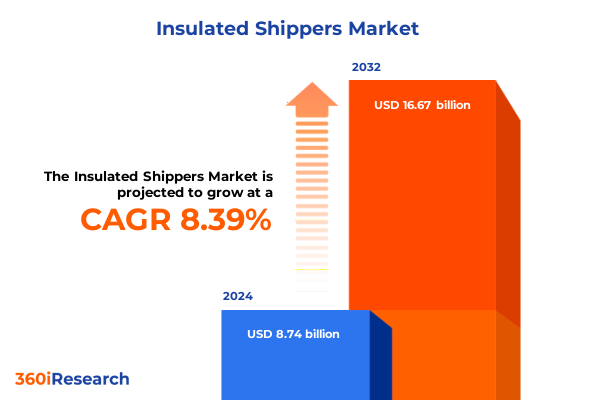

The Insulated Shippers Market size was estimated at USD 9.40 billion in 2025 and expected to reach USD 10.11 billion in 2026, at a CAGR of 8.52% to reach USD 16.67 billion by 2032.

Setting the Stage for Innovation in Temperature-Controlled Logistics with Insulated Shippers Driving Cold Chain Reliability and Efficiency Across Industries

Insulated shippers have become indispensable in maintaining the integrity of temperature-sensitive goods across global supply chains. As the demand for biologics, vaccines and high-value perishable foods continues to accelerate, these specialized packaging solutions play a critical role in ensuring product quality from origin to end destination.

Despite the inherent complexity of preserving precise thermal conditions over extended transit periods, modern insulated shipper designs have evolved to address diverse requirements. Innovations in phase change materials, vacuum insulation panels and advanced polymer foams have redefined the benchmark for thermal stability, enabling carriers to meet increasingly stringent regulatory and customer expectations without compromising sustainability goals.

When considering the diverse array of insulated shipping configurations, packaging solutions range from cryogenic dry ice containers through flexible gel pack assemblies to rigid foam and vacuum panel systems. End use applications span chemical reagents, electronic components, specialty food items and life sciences products, each with unique thermal performance demands and logistical constraints.

This executive summary offers a concise yet comprehensive overview of the insulated shipper market, examining the key forces driving transformation and identifying the core segmentation insights essential for strategic decision-making. Subsequent sections explore the macroeconomic and regulatory shifts, analyze the implications of recent tariff adjustments in the United States, and provide a clear framework for understanding market dynamics across packaging types, end use industries, temperature profiles and transportation modes. Finally, actionable recommendations will guide industry leaders seeking to optimize operational efficiency and future-proof their cold chain strategies.

Uncovering the Transformative Forces Shaping the Insulated Shippers Market Amid Sustainability Pressures Digitalization and Evolving Cold Chain Demands

In recent years, sustainability has risen to the forefront of insulated shipper development, prompting manufacturers to adopt recyclable materials and low-carbon manufacturing processes. Driven by consumer awareness and tightening environmental regulations, players in the packaging industry are transitioning away from traditional expanded polystyrene toward bio-based polymers and reusable vacuum insulation panels designed to reduce waste and lower carbon footprints. Lifecycle assessments now guide design choices, ensuring that thermal performance enhancements do not come at the expense of ecological viability.

Concurrently, the integration of digital technologies has transformed how temperature-controlled shipments are monitored and managed. Embedded sensors paired with real-time data transmission enable shippers to track internal temperatures, humidity levels and even shock events throughout transit. This digitalization not only enhances visibility across complex logistics networks but also enables predictive analytics to forecast potential temperature excursions, empowering stakeholders to intervene proactively and minimize product loss.

At the same time, the rapid growth of decentralized fulfillment and the proliferation of direct-to-consumer delivery models have imposed new operational strains on cold chain infrastructure. Organizations are restructuring supply networks to accommodate smaller, more frequent shipments, driving innovation in packaging configurations that can maintain precise thermal stability over shorter transit durations while supporting flexible routing.

As this landscape continues to evolve, companies must adapt their offerings to balance performance, compliance and environmental stewardship.

Examining the Complex Effects of 2025 United States Tariff Adjustments on Imported Insulated Shippers and Their Downstream Supply Chain Dynamics

In January 2025, amendments to the United States Harmonized Tariff Schedule introduced revised duty rates on a range of insulated packaging components, including polymeric foams, phase change materials and vacuum insulation panels sourced from key exporting countries. Under these adjustments, duty rates on certain polymer insulation categories rose by up to fifteen percent, while new classifications for advanced composite thermal barriers attracted a ten percent levy. These changes are part of a broader trade policy initiative aimed at bolstering domestic manufacturing and reducing reliance on offshore suppliers.

The immediate repercussion of these tariff modifications has been a marked uptick in landed costs for imported insulated shippers, prompting multinational pharmaceutical and food companies to reevaluate their packaging procurement strategies. Many stakeholders have responded by negotiating longer-term supply agreements with domestic producers to hedge against further tariff volatility. In parallel, several organizations have explored redesigning packaging configurations to incorporate locally sourced phase change materials and foam alternatives less subject to import duties.

Further downstream, logistics providers and third-party fulfillment centers have adjusted their operational models by consolidating shipments to optimize container utilization and by extending inventory holding periods to smooth cost fluctuations. Some supply chain teams have also accelerated efforts to qualify alternative suppliers in near-shore markets, tapping into manufacturing hubs in Mexico and Canada to mitigate exposure to U.S. import duties.

As policymakers continue to reassess trade measures, industry stakeholders must remain vigilant and responsive to evolving tariff frameworks to safeguard cold chain resilience.

Deriving Actionable Segmentation Insights by Analyzing Packaging Types End Use Industries Insulation Materials Temperature Profiles and Transport Modes

A nuanced evaluation of packaging types reveals specific thermal and logistical strengths tailored to diverse cold chain applications. Dry ice containers, encompassing measured packs and loose ice, achieve ultralow temperatures essential for biopharmaceutical shipments, whereas foam solutions-expanded polystyrene and polyurethane variants-offer cost-effective insulation for ambient to refrigerated transit. Gel pack packages range from reusable cold gel packs to single-use alternatives, phase change material containers employ inorganic and organic formulations for extended temperature control, and vacuum insulation panel containers in both advanced and standard grades deliver superior R-values within minimal envelope thickness.

Segmentation by end use underscores varied product requirements across industries. Chemical logistics must accommodate agrochemical, petrochemical and specialty chemical shipments with strict temperature and safety specifications. Consumer electronics and semiconductor supply chains demand shock mitigation and precise temperature stability. The food and beverage sector spans beverages, dairy, meat and seafood, packaged foods and fresh produce, each with distinct spoilage profiles. Pharmaceutical and biotechnology shipments-including biologics, clinical trial materials and vaccines-require the highest standards of thermal integrity and regulatory compliance.

An inspection of insulation materials highlights performance–operational trade-offs. Gel packs in cold and freezer grades provide adaptable, low-capex solutions for short-haul shipments. Phase change materials, whether salt-based inorganic or fatty acid–based organic, maintain set points over extended periods. Polystyrene foams-expanded or extruded-remain fixtures for high-volume, cost-sensitive operations, while rigid and spray polyurethane foams combine structural resilience with enhanced thermal performance. Next-generation vacuum panels, available in premium and baseline versions, offer unmatched insulation efficiency for space-limited payloads.

Integrating temperature profiles with transport modes refines packaging choices. Controlled ambient configurations suit shelf-stable pharmaceuticals, frozen solutions address both deep-frozen cryogenic and standard frozen needs, and refrigerated solutions cater to chilled and cool perishables. Air transport solutions prioritize lightweight, pressure-resistant containers for express and standard air freight, rail networks utilize insulated boxcars and refrigerated rail cars, road transport relies on last-mile and long-haul trailer adaptations, and maritime freight employs insulated or reefer containers designed for prolonged ocean journeys.

This comprehensive research report categorizes the Insulated Shippers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Insulation Material

- Temperature Type

- Mode Of Transportation

- End Use Industry

Revealing Regional Perspectives in the Insulated Shippers Landscape with Focus on Americas EMEA and Asia-Pacific Operational and Regulatory Nuances

The Americas region benefits from a robust network of domestic packaging manufacturers and a mature cold chain infrastructure, underpinned by extensive air and road transportation frameworks. In the United States, stringent regulatory requirements for pharmaceutical and food safety have catalyzed the adoption of advanced insulated shipper solutions, driving innovations in reusable packaging and real-time monitoring capabilities. Latin America presents opportunities associated with emerging life sciences hubs, although logistical challenges and varying customs protocols necessitate tailored supply chain strategies.

Europe, the Middle East and Africa (EMEA) exhibit diverse market dynamics shaped by regional trade agreements, environmental directives and varying levels of infrastructure development. The European Union’s comprehensive sustainability targets have accelerated the shift toward recyclable insulation materials and reusable systems, while stringent Good Distribution Practice guidelines govern pharmaceutical shipments. In the Middle East and Africa, investments in cold chain hubs and growing demand for refrigerated food imports are fostering collaboration between local distributors and global packaging specialists to enhance reliability across long-distance supply routes.

Asia-Pacific stands out as the fastest-growing market, propelled by the expansion of pharmaceutical manufacturing in India and China, the proliferation of e-commerce in Southeast Asia and the emergence of advanced logistics corridors. Investments in high-speed rail links and airport cold chain facilities have improved transit times, enabling the wider use of vacuum insulation panels and phase change materials for cross-border shipments. However, fragmented regulatory frameworks and varying infrastructure readiness levels require comprehensive risk assessments and partnership strategies to optimize cold chain performance across the region.

This comprehensive research report examines key regions that drive the evolution of the Insulated Shippers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing the Competitive Arena by Profiling Key Insulated Shippers Providers and Evaluating Their Strategic Footprints in the Cold Chain Ecosystem

The competitive landscape for insulated shippers is characterized by a blend of established global players and innovative niche providers, each vying to differentiate through material science advancements, digital integration and service offerings. Leading industry suppliers such as Cryopak leverage decades of experience in phase change materials and technical gel packs, continuously refining formulations to extend thermal control durations and reduce environmental impact. Cold Chain Technologies has made significant strides in vacuum insulation panel development, introducing next-generation core materials that enhance mechanical robustness while maintaining ultra-low thermal conductivity.

Multinational packaging enterprises like Sonoco ThermoSafe and Pelican BioThermal command broad geographic reach, offering modular insulated container systems paired with real-time temperature data loggers and logistics management platforms. Their strategic emphasis on turnkey solutions caters to life sciences customers seeking end-to-end visibility and compliance across stringent regulatory environments. Va-Q-tec, with its proprietary vacuum panel technology, focuses on ultra-thin, high-performance thermal barriers that address the growing demand for reduced payload footprint in air and rail shipments. Envirotainer, recognized for its active controlled-temperature container services, differentiates through integrated cold chain management programs that combine leasing models with tracking and remote temperature control services.

Emerging contenders like DGP Intelsius have responded to market pressures by pioneering reusable packaging solutions that integrate smart telemetry features and advanced phase change materials, supporting sustainable cold chain initiatives. Collectively, these companies are investing heavily in research and development, forging partnerships with logistics service providers and expanding their certification portfolios to align with evolving global standards. As end users increasingly prioritize circular economy principles, competitive success hinges upon a company’s ability to deliver high-value, low-waste packaging ecosystems that seamlessly integrate with digital supply chain infrastructures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insulated Shippers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACH Foam Technologies, LLC

- Amcor plc

- American Aerogel Corporation

- Atlas Molded Products

- Berry Global, Inc.

- Cold Chain Technologies, Inc.

- Cryoport, Inc.

- CSafe Global, LLC

- Delta T

- Envirotainer AB

- Exeltainer

- FEURER Group GmbH

- Huhtamaki Oyj

- Inmark Global

- International Paper Company

- Mondi plc

- Nordic Cold Chain Solutions A/S

- Pactiv Evergreen Inc.

- Sealed Air Corporation

- SkyCell AG

- Sonoco Products Company

- Tempack Packaging Solutions, Inc.

- Therapak Corporation

- Tower Cold Chain

- WestRock Company

Offering Targeted Strategic Recommendations for Industry Leaders to Enhance Supply Chain Resiliency Operational Efficiency and Environmental Sustainability

As the insulated shipper market evolves under the twin imperatives of environmental stewardship and technological innovation, industry leaders should prioritize the integration of recyclable and reusable materials into their packaging portfolios. Collaborating with material science partners to develop bio-based polymers and advanced phase change formulations will not only reduce ecological footprints but also position organizations to meet increasingly stringent regional sustainability mandates. Concurrently, piloting vacuum insulation panel solutions in targeted product corridors can yield valuable insights into cost-benefit trade-offs, particularly where payload volume constraints amplify the value proposition of high-performance thin-wall systems.

To bolster supply chain resilience in the face of shifting tariff landscapes, executives are advised to diversify their procurement strategies by qualifying a balanced mix of domestic and near-shore suppliers. Establishing long-term partnerships with regional manufacturers can mitigate the impact of import duties and currency fluctuations, while parallel supplier development efforts in neighboring markets facilitate contingency planning for geopolitical disruptions. Transparent contractual frameworks coupled with shared risk-management protocols will enhance agility and ensure continuity of insulated packaging supply.

Digital transformation must remain a strategic focus; embedding IoT-enabled sensors and analytics platforms within insulated shippers supports proactive temperature excursion detection, real-time visibility and predictive maintenance. Investing in standardized data interfaces and cloud-based monitoring dashboards will streamline cross-functional collaboration, enabling quality and operations teams to respond swiftly to anomalies and reduce product waste.

Finally, cultivating cross-functional expertise through targeted training programs and pilot initiatives will accelerate organization-wide adoption of novel packaging concepts. By fostering a culture of experimentation and continuous improvement, companies can rapidly iterate on design specifications, validate performance under real-world conditions and realize tangible gains in both operational efficiency and customer satisfaction.

Detailing a Robust Research Framework Incorporating Primary Interviews Secondary Data and Rigorous Validation to Ensure Analytical Integrity

The research methodology underpinning this executive summary rests on a structured, multi-phase approach designed to ensure robustness and validity of market insights. Initially, comprehensive secondary research was conducted through a review of publicly available regulatory filings, academic publications and trade association white papers to map existing technical specifications, compliance frameworks and early indicators of innovation within the insulated packaging sector. This landscape analysis established the foundational taxonomy for packaging types, insulation materials, end use industries and transportation modes.

Building on this groundwork, a series of in-depth interviews with over twenty-five industry stakeholders-including packaging engineers, cold chain logistics managers and material scientists-provided qualitative perspectives on emerging trends, operational pain points and strategic priorities. These primary engagements were complemented by structured questionnaires administered to a broader cohort of supply chain decision-makers, capturing quantitative assessments of factors such as material performance, cost sensitivity and service quality expectations.

Subsequent data triangulation involved cross-referencing primary feedback with transactional data obtained from logistics providers and manufacturers, enabling validation of reported trends against real-world shipping volumes, seasonal demand cycles and pricing fluctuations. Advanced analytical techniques, including comparative scenario modeling and sensitivity analysis, were applied to evaluate the potential impact of trade policy changes and material innovation pathways on project economics and supply chain resilience.

Throughout the process, a cross-functional review board comprising subject-matter experts in regulatory compliance, material science and cold chain operations ensured methodological rigor and mitigated biases. This dynamic research framework, characterized by iterative validation loops and stakeholder alignment, underpins the strategic recommendations and segmentation insights detailed in this report, assuring both depth of analysis and practical relevance for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insulated Shippers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insulated Shippers Market, by Packaging Type

- Insulated Shippers Market, by Insulation Material

- Insulated Shippers Market, by Temperature Type

- Insulated Shippers Market, by Mode Of Transportation

- Insulated Shippers Market, by End Use Industry

- Insulated Shippers Market, by Region

- Insulated Shippers Market, by Group

- Insulated Shippers Market, by Country

- United States Insulated Shippers Market

- China Insulated Shippers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Synthesizing Core Insights and Strategic Imperatives to Illuminate Future Pathways for Sustainable Growth and Innovation in Insulated Shippers

The insulated shipper market stands at a pivotal juncture, shaped by converging forces of sustainability mandates, digital transformation and evolving global trade dynamics. Throughout this executive summary, we have delineated how packaging type innovations-from dry ice and foam containers to advanced vacuum insulation panels-intersect with the unique requirements of chemical, electronics, food and beverage, and life sciences supply chains. The cumulative effect of updated United States tariffs has underscored the importance of supply diversification and near-shore manufacturing options, while regional insights from the Americas, EMEA and Asia-Pacific underscore the strategic imperatives of local regulatory compliance and infrastructure readiness.

Looking ahead, the trajectory of this market will be defined by the ability of stakeholders to synthesize material science breakthroughs with data-driven temperature monitoring, thereby enhancing both performance and sustainability. Companies that successfully integrate recyclable insulation materials, real-time IoT-enabled visibility and agile procurement strategies will be best positioned to capitalize on emerging demand for high-value temperature-controlled logistics. Moreover, as circular economy considerations gain traction, the shift toward reusable packaging solutions and closed-loop logistics models will create new avenues for differentiation and cost optimization.

In sum, the landscape of insulated shipping solutions is poised for transformative growth, driven by a heightened emphasis on environmental accountability, operational resilience and technological integration. Stakeholders who embrace these cross-cutting imperatives can expect to unlock greater supply chain efficiency, reduced product loss and enhanced customer satisfaction across an increasingly complex global cold chain ecosystem.

Driving Engagement with a Compelling Invitation to Collaborate with Our Associate Director on Securing Your Comprehensive Insulated Shippers Market Analysis

Investing in a nuanced understanding of insulated shipping solutions is critical to maintaining competitive advantage in today’s temperature-sensitive supply chain environment. To access the full breadth of our market research report and engage in a strategic dialogue on how these insights can inform your organization’s packaging portfolio and logistics strategies, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in temperature-controlled logistics and can guide you through tailored options that align with your specific operational goals and sustainability commitments. Reach out today to explore how a deeper analysis of segmentation insights, regional nuances and competitive benchmarks can support your decision-making and drive tangible improvements in cost efficiency, risk mitigation and environmental impact.

- How big is the Insulated Shippers Market?

- What is the Insulated Shippers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?