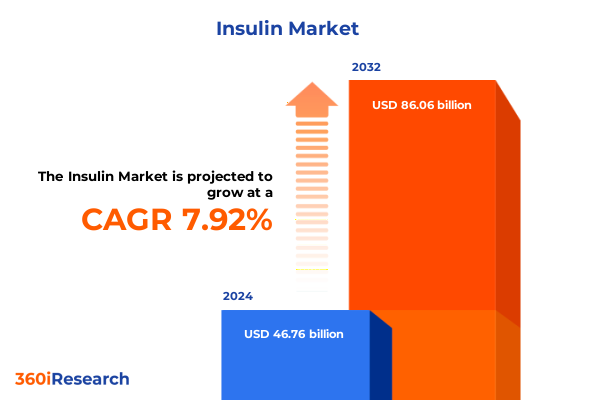

The Insulin Market size was estimated at USD 50.34 billion in 2025 and expected to reach USD 54.19 billion in 2026, at a CAGR of 7.96% to reach USD 86.06 billion by 2032.

Uncovering the Multi-Faceted Evolution of Insulin Therapeutics Amidst Technological Innovations and Shifting Patient-Centric Diabetes Management Trends

Insulin therapy has been at the forefront of diabetes management for nearly a century, transforming what was once a fatal diagnosis into a manageable chronic condition. Over the years, advances in molecular engineering have produced a spectrum of insulin analogs tailored to mimic physiological secretion profiles, while patient-centric delivery innovations have redefined how individuals interact with their treatment regimens. The confluence of these scientific breakthroughs, alongside shifting healthcare policies and emerging digital health platforms, has created a dynamic environment that demands continuous monitoring and strategic foresight.

This report provides a holistic lens on the evolving insulin landscape, highlighting the critical drivers, regulatory inflection points, and technological milestones shaping the future of diabetes care. Our analysis synthesizes qualitative interviews, regulatory documents, and secondary research to present an integrated view of current trends and the forces redefining market dynamics. By grounding our insights in real-world clinical and commercial practice, we aim to equip stakeholders-from pharmaceutical manufacturers to healthcare providers-with a clear, actionable understanding of where value is being created and where opportunities for innovation remain untapped.

Analyzing the Pivotal Technological Breakthroughs and Policy Reforms Redefining the Insulin Therapeutics Landscape for Improved Patient Outcomes

The insulin sphere has witnessed a series of transformative shifts, anchored both in scientific ingenuity and policy adaptation. First, the advent of ultra-rapid and ultra-long-acting insulin profiles has enhanced glycemic control by more closely approximating physiological secretion, reducing the incidence of post-prandial spikes and nocturnal hypoglycemia. These molecular refinements have been complemented by digital integration, as smart pens, connected pumps, and closed-loop systems usher in an era of automated dosing algorithms that relieve patients of the relentless burden of manual titration.

Concurrently, policy and reimbursement paradigms have begun to embrace value-based frameworks, incentivizing manufacturers to demonstrate not just safety and efficacy but also real-world cost-effectiveness and patient-reported outcomes. This shift has catalyzed novel contracting models and piloted risk-sharing arrangements, incentivizing broader adoption of next-generation insulin therapies in both public and private healthcare systems. Moreover, regulatory agencies have streamlined biosimilar pathways, accelerating the launch of alternative insulins without compromising rigorous safety requirements. Collectively, these scientific, digital, and policy-driven developments are propelling the industry toward a more personalized, outcome-focused future, where the intersection of technology and therapeutics holds the key to driving sustainable improvements in diabetes care.

Assessing the Comprehensive Ramifications of 2025 United States Tariff Policies on Insulin Supply Chains and Stakeholder Cost Structures

In 2025, the United States enacted revised tariff schedules affecting key pharmaceutical imports, including foundational and analog insulin products. While tariffs aim to encourage domestic manufacturing and bolster onshore supply resilience, they have also introduced complexities for multinational procurement channels and contract negotiations. Manufacturers reliant on global supply chains have faced elevated input costs for active pharmaceutical ingredients sourced from international partners, prompting a reevaluation of production footprints and vendor agreements to mitigate exposure to fluctuating duty rates.

Healthcare providers, in turn, have witnessed shifts in procurement strategies, balancing the imperative for uninterrupted patient access with budgetary constraints. Hospitals and retail pharmacies have intensified engagement with domestic API producers and local fill-finish facilities to insulate supply lines, while home care distributors are adapting their inventory buffers to account for longer lead times. Though end users have not experienced immediate shortages, the marketplace has adjusted to accommodate cost absorption across the value chain and explore novel efficiency measures.

Looking beyond near-term adjustments, stakeholders are exploring collaborative models that span manufacturing, policy advocacy, and patient support programs to minimize downstream price pressures. By fostering transparent dialogue among governmental bodies, manufacturers, and patient advocacy groups, the industry seeks to align tariff policy objectives with the overarching goal of ensuring equitable insulin access across diverse payer landscapes.

Unraveling Critical Insights from Product, Insulin Type, Delivery Mode, End User, and Distribution Channel Segmentation to Drive Strategic Decision-Making

Understanding the insulin market through multiple segmentation lenses reveals nuanced pathways for strategic focus. Products classified as analog insulin continue to drive clinical differentiation through precise pharmacokinetic profiles, whereas human insulin remains critical in cost-sensitive settings and emerging economies due to its established safety record and familiar handling characteristics. Within this context, intermediate, long, rapid, short, and ultra long-acting insulin types present a continuum of therapeutic utility, permitting tailored regimens that align with patient lifestyle requirements, dietary patterns, and risk profiles for hypoglycemia.

Delivery modes such as pen injectors, pumps, and traditional syringes each offer unique advantages and adoption challenges, influencing patient adherence and device lifecycle economics. End users-clinics, home care providers, and hospitals-manifest distinct procurement priorities: clinics emphasize ease of administration and patient training; home care segments prioritize interoperability with digital monitoring platforms; and hospitals focus on bulk acquisition and formulary alignment. Meanwhile, distribution channels spanning hospital pharmacies, online pharmacies, and retail pharmacies shape accessibility and service delivery models, with each channel balancing immediacy, cost, and patient support offerings in distinct ways. Collectively, these segmentations highlight the complexity of optimizing product portfolios and go-to-market approaches, underscoring the necessity for granular market intelligence that aligns with specific stakeholder needs.

This comprehensive research report categorizes the Insulin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Insulin Type

- Delivery Mode

- End User

- Distribution Channel

Exploring Nuanced Regional Dynamics in the Insulin Market across the Americas, Europe Middle East & Africa, and Asia-Pacific to Optimize Market Penetration

Regional heterogeneity plays a pivotal role in shaping insulin market dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust research infrastructure and competitive biosimilar pipelines coexist with mounting pressure on payers and policymakers to address affordability and access challenges. While the United States leads in regulatory innovation and adoption of digital health tools, Latin American countries are progressively strengthening procurement frameworks and local manufacturing partnerships to reduce dependency on imports.

In Europe Middle East & Africa, stringent price controls and centralized tendering mechanisms often constrain manufacturer margins but also guarantee broad patient coverage under national health systems. Western European markets increasingly prioritize outcome-based contracting and integrated care pathways, whereas Middle Eastern nations are rapidly investing in healthcare infrastructure to manage rising diabetes prevalence. In parts of Africa, donor-funded programs and public-private alliances remain critical to expanding distribution networks and patient education efforts.

Asia-Pacific exhibits a dynamic blend of large-scale public markets and private sector growth. Countries such as China and India are accelerating domestic biosimilar manufacturing, driving down unit costs and improving supply chain resilience. Meanwhile, advanced healthcare economies like Japan and Australia emphasize premium analog insulin adoption and digital adherence solutions. Across the region, strategic alliances between global innovators and local players are fostering knowledge transfer and unlocking new channels for market expansion.

This comprehensive research report examines key regions that drive the evolution of the Insulin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into Competitive Strategies and Product Portfolios of Leading Insulin Manufacturers Shaping the Future of Diabetes Care Innovation and Accessibility

Leading insulin manufacturers are deploying differentiated strategies to solidify their positions and capitalize on emerging opportunities. Eli Lilly leverages its broad analog portfolio and digital adherence platforms to deliver integrated care solutions, while Novo Nordisk pairs its ultra-long-acting analogs with patient support programs that enhance treatment continuity. Sanofi remains a key player in both human insulin supply and next-generation analog innovation, augmenting its presence through strategic acquisitions and co-development agreements. At the same time, Biocon’s biosimilar insulin offerings have gained traction in cost-sensitive markets, supported by joint ventures that boost local manufacturing capacity and regulatory acumen.

Beyond the established players, a growing cohort of biotechnology firms is focusing on novel delivery technologies and peptide engineering to extend market frontiers. Collaborative initiatives between device developers and pharmaceutical sponsors are refining closed-loop and smart administration systems, while digital health start-ups contribute predictive analytics and remote monitoring services. This multifaceted ecosystem, characterized by alliances, licensing deals, and targeted R&D investments, underscores the importance of agility and collaboration in driving future growth and meeting the diverse needs of diabetic populations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insulin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADOCIA

- AstraZeneca PLC

- Baxter International, Inc.

- Biocon Limited

- Bioton S.A.

- CardioVends

- Dong-A ST Co., Ltd.

- Eli Lilly and Company

- Eva Pharma

- Fuji Pharma Co., Ltd.

- Genesys Biologics Private Limited

- Glenmark Pharmaceuticals Ltd.

- Gulf Pharmaceutical Industries

- JW Pharmaceutical Corporation

- MannKind Corporation

- Merck & Co., Inc.

- MJ Biopharm Pvt. Ltd.

- Novartis AG

- Novo Nordisk A/S

- Oramed Pharmaceuticals Inc.

- Pfizer Inc.

- Sanofi S.A.

- Wockhardt Limited

- Zhejiang Huahai Pharmaceutical Co., Ltd.

Proposing Data-Driven Strategic Imperatives and Collaborative Initiatives for Industry Stakeholders to Accelerate Insulin Access and Technological Advancement

Industry participants must embrace a spectrum of strategic imperatives to navigate the evolving insulin environment effectively. First, investing in modular manufacturing platforms and local fill-finish capabilities can reduce exposure to international tariff fluctuations and enhance supply flexibility. Concurrently, forging cross-industry partnerships with digital health providers will accelerate the integration of automated dosing solutions and personalized care pathways.

Stakeholders should also pursue proactive engagement with regulators and payers to shape value-based contracting frameworks grounded in real-world evidence and patient-reported outcomes. By demonstrating tangible health and economic benefits, manufacturers can secure favorable reimbursement terms and expand access across diverse healthcare settings. Moreover, leveraging data analytics to segment patient populations and tailor support offerings will heighten adherence and foster long-term brand loyalty.

Finally, embedding patient education and advocacy initiatives within commercial strategies will elevate treatment literacy and empower individuals to manage their regimens effectively. Through coordinated outreach programs and digital communities, industry leaders can cultivate trust, gather real-time feedback, and refine product design iteratively. Collectively, these recommendations provide a roadmap for stakeholders to drive both clinical impact and commercial success in a field marked by rapid innovation and shifting policy landscapes.

Detailing the Rigorous Multi-Source Research Methodology and Analytical Framework Employed for Comprehensive Insight into the Insulin Therapeutics Market

This analysis draws upon a rigorous research methodology combining primary interviews, secondary literature synthesis, and data triangulation to ensure robust and nuanced insights. Primary research included in-depth discussions with endocrinologists, supply chain executives, policy experts, and patient advocacy groups, capturing firsthand perspectives on clinical practice evolution, procurement challenges, and unmet patient needs. Secondary sources comprised peer-reviewed journals, regulatory filings, clinical trial registries, and open-access white papers, providing a comprehensive backdrop to contextualize market trends.

Quantitative data points, such as prescription volumes, adoption rates of delivery technologies, and reimbursement frameworks, were assembled from publicly available healthcare databases and international trade records. These datasets were validated through cross-referencing with industry reports, ensuring consistency and reliability. Additionally, a series of validation workshops with key opinion leaders and in-house domain experts were conducted to refine interpretations and align findings with lived market realities.

By integrating qualitative narratives with quantitative evidence, our analytical framework delivers a multi-dimensional view of the insulin landscape. This approach not only illuminates current dynamics but also highlights potential inflection points and innovation pathways, equipping stakeholders with a clear understanding of the levers shaping future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insulin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insulin Market, by Product Type

- Insulin Market, by Insulin Type

- Insulin Market, by Delivery Mode

- Insulin Market, by End User

- Insulin Market, by Distribution Channel

- Insulin Market, by Region

- Insulin Market, by Group

- Insulin Market, by Country

- United States Insulin Market

- China Insulin Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Findings and Strategic Imperatives to Empower Stakeholders in Navigating the Rapidly Evolving Insulin Therapeutics Landscape

As insulin therapy continues to evolve through molecular innovation, digital integration, and policy realignment, stakeholders are presented with both unprecedented opportunities and complex challenges. The diversified product landscape-from human insulin staples to ultra-long-acting analogs-requires precise alignment of R&D pipelines and go-to-market strategies with the distinct needs of patient cohorts and healthcare systems.

Regional variances underscore the importance of tailored approaches, as the Americas, Europe Middle East & Africa, and Asia-Pacific markets each exhibit unique regulatory, infrastructural, and socioeconomic characteristics. In tandem, segmentation insights reveal that delivery modalities, end-user preferences, and distribution channels must be orchestrated to optimize patient adherence and cost-effectiveness.

Leading companies are showcasing how strategic collaborations, biosimilar adoption, and digital health partnerships can drive both innovation and access. To succeed in this environment, stakeholders must adopt a holistic perspective that unites manufacturing resilience, value-based contracting, and patient engagement.

By synthesizing the findings presented in this report, decision-makers can chart a path forward-anticipating market shifts, mitigating supply chain risks, and delivering meaningful advancements in diabetes care. The insights herein serve as a strategic compass for guiding investments, fostering collaboration, and ultimately enhancing outcomes for the global diabetic community.

Engage with Associate Director Ketan Rohom Today to Unlock In-Depth Insulin Market Insights and Secure Your Comprehensive Research Report with Expert Guidance

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore the full breadth of our insulin market research and unlock data-driven opportunities in diabetes care. By partnering with this dedicated expert, you will gain tailored insights that align precisely with your strategic objectives, ensuring you remain ahead in a market defined by rapid innovation and evolving policy landscapes. Reach out to schedule a personalized consultation and discover how our comprehensive analysis can empower your organization to anticipate industry shifts, optimize stakeholder engagement, and drive sustainable growth. Take action now to secure competitive advantage and mobilize your initiatives with confidence and clarity.

- How big is the Insulin Market?

- What is the Insulin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?