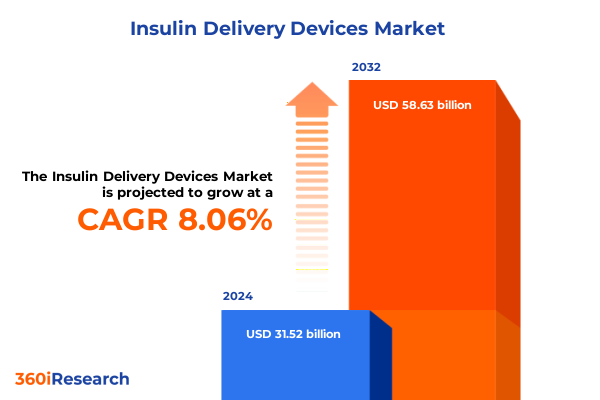

The Insulin Delivery Devices Market size was estimated at USD 33.86 billion in 2025 and expected to reach USD 36.45 billion in 2026, at a CAGR of 8.15% to reach USD 58.63 billion by 2032.

Exploring the Crucial Role Played by Advanced Insulin Delivery Devices in Addressing Escalating Diabetes Prevalence and Emerging Healthcare Innovation Needs

In the wake of a global rise in diabetes diagnoses, insulin delivery devices have emerged as critical enablers of effective glycemic management and improved patient self-care. Clinicians and individuals living with diabetes now demand solutions that combine reliable dosing precision with intuitive interfaces, fueling rapid evolution in device innovation. Recent breakthroughs in smart connectivity, closed-loop integration, and advanced materials underscore the heightened role these solutions play in supporting personalized therapeutic regimens and remote monitoring paradigms.

These technological strides are transforming traditional analog tools into sophisticated platforms that deliver real-time feedback, adherence tracking, and seamless integration with digital health ecosystems. This fusion of hardware, software, and clinical insights has redefined expectations around usability, safety, and patient empowerment.

Stakeholders across healthcare systems, from payors to provider networks, now view advances in delivery platforms as key differentiators in therapeutic outcomes. The interplay between regulatory frameworks, reimbursement policies, and innovation cycles has catalyzed progressive product iterations that prioritize safety and patient adherence. This dynamic has elevated device manufacturers into strategic partners within multidisciplinary care teams, rather than mere suppliers of hardware.

Against this backdrop, this executive summary distills the most impactful shifts shaping the insulin delivery landscape. It synthesizes insights on trade policy influences, nuanced segmentation perspectives across methods, formulations, channels, settings, and demographics, and regional dynamics that underpin market adoption. Leaders will gain an integrated understanding of competitive positioning, actionable strategies to navigate a tariff-sensitive environment, and foundational context to guide investment in next-generation therapeutic delivery systems.

Unveiling the Transformational Shifts Driven by Digital Connectivity, Closed Loop Systems, and Patient-Centric Technology in Insulin Administration

Over the past decade, the insulin delivery sector has undergone transformative shifts driven by the integration of advanced digital connectivity and algorithmic control. Closed-loop insulin pump systems, often referred to as artificial pancreas platforms, have matured from experimental prototypes to commercially available solutions that automatically adjust dosing based on continuous glucose sensor feedback. This progression has elevated clinical confidence in automated dose modulation while simultaneously reducing the burden of manual calculations for end users.

Concurrently, the proliferation of mobile health applications and cloud-based data platforms has revolutionized patient engagement. Individuals can now remotely share glucose trends, receive real-time dosing recommendations, and access tailored educational content directly through smartphone interfaces. These capabilities foster tighter collaboration among endocrinologists, diabetes educators, and patients, effectively transforming episodic clinic visits into continuous care pathways that optimize glycemic control and reduce complication risks.

Moreover, material science advancements have led to slimmer, more discreet delivery devices that cater to user preferences across age groups and lifestyle demands. Ergonomic designs minimize injection discomfort, while connectivity features empower users to integrate management routines into daily activities with minimal disruption. Taken together, these developments signify a paradigm shift from purely functional hardware to holistic therapeutic ecosystems that prioritize personalization, data-driven insights, and seamless interoperability across care settings.

Assessing the Cumulative Impact of United States Tariffs on Insulin Delivery Equipment and Supply Chain Viability in a Post-2024 Trade Environment

In early 2025, the imposition of revised tariff schedules on imported medical devices by the United States introduced new cost variables for insulin delivery equipment manufacturers and distributors. These measures, enacted under broader trade policy adjustments, encompassed a range of finished goods and critical components, prompting stakeholders to reassess production sourcing and logistics frameworks. The cumulative impact of these trade levies extends beyond immediate price adjustments, influencing procurement strategies across the entire supply chain.

Suppliers of infusion sets, microchips for sensor integration, and precision-engineered pump casings encountered elevated duties, which translated directly into higher landed costs for original equipment manufacturers. As a result, device producers faced tightening margins and pressures to pass through incremental expenses to end users or healthcare payors. This cost escalation risked undermining efforts to enhance patient access, particularly in segments with limited reimbursement flexibility or high uninsured populations.

In reaction, leading medtech companies have accelerated nearshoring initiatives and diversified manufacturing footprints to mitigate tariff exposures. Collaborative ventures with domestic contract manufacturers have gained prominence, facilitating tariff avoidance while reinforcing supply resilience. Simultaneously, negotiations with regulatory bodies and trade policymakers aim to carve out exemptions for essential diabetes management tools based on public health imperatives. These adaptive strategies underscore the critical need for agile operational models capable of weathering shifting trade landscapes without compromising innovation trajectories or patient affordability.

Ultimately, the early 2025 tariff adjustments serve as a catalyst for recalibrating global value chains, underscoring the importance of strategic sourcing, agile distribution agreements, and proactive policy engagement in safeguarding the accessibility and affordability of life-sustaining insulin delivery solutions.

Illuminating Market Segmentation Insights to Capture Variations Across Delivery Methods, Insulin Formulations, Distribution Channels, End Users, Applications, and Age Cohorts

Analyzing market variations by delivery method reveals distinct user preferences and clinical trade-offs. Insulin pens, prized for their simplicity and portability, continue to dominate adoption among patients seeking familiar dosing routines. In contrast, insulin pumps offer automated basal control and flexible bolus administration, appealing to individuals requiring tight glycemic control. Traditional syringes remain prevalent in resource-constrained settings, while emerging jet injectors attract early adopters drawn to needle-free delivery experiences.

Differentiation by insulin formulation further influences device selection and therapy optimization. Intermediate-acting compounds lend themselves to once- or twice-daily administration with pens, whereas long-acting analogs integrated into pump reservoirs enable more stable basal profiles. Pre-mixed insulin variants simplify dosing regimens for type 2 diabetes management, and rapid-acting analogs are essential for fine-tuned bolus delivery in closed-loop systems.

Channels of distribution shape accessibility and supply chain efficiency. Hospital pharmacies function as primary points for inpatient and acute care device provisioning, while online pharmacies have surged as convenient outlets for home-delivery orders supported by digital prescription services. Retail pharmacies continue to serve as frontline distribution hubs, offering in-person counseling and immediate product availability.

End-user environments and patient demographics impose unique device requirements. Ambulatory care centers and specialty clinics demand integrations with electronic medical records and centralized monitoring, whereas homecare settings prioritize user-friendly interfaces and remote technical support. Hospitals implement robust quality control measures for device procurement. Applications range from gestational diabetes care protocols to complex management of type 1 and type 2 diabetes, with adult, geriatric, and pediatric cohorts each requiring tailored ergonomics, dose calculators, and educational aids.

This comprehensive research report categorizes the Insulin Delivery Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Delivery Method

- Insulin Type

- Distribution Channel

- End User

- Application

- Age Group

Analyzing Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Uncover Growth Drivers and Market Adoption Patterns in Insulin Delivery

The Americas region stands as a cornerstone for insulin delivery device innovation, underpinned by robust reimbursement frameworks, advanced clinical infrastructure, and a highly competitive medtech landscape. Widespread adoption of closed-loop systems and connected platforms in North America is driven by favorable insurance coverage, substantial investment in diabetes research, and strong patient advocacy. Latin American markets are experiencing gradual uptake, supported by strategic public–private partnerships aimed at expanding access to cost-effective pen and syringe solutions in communities with rising diabetes prevalence.

In Europe Middle East & Africa, regulatory convergence within the European Union facilitates smoother market entry for advanced pump and sensor-integrated devices, while varying national reimbursement policies influence regional disparities in adoption rates. Gulf Cooperation Council nations exhibit growing demand for high-end connected delivery systems as part of broader digital health initiatives. Meanwhile, Africa presents both challenges and opportunities: infrastructure limitations and cost barriers constrain widespread diffusion, yet targeted government programs and nonprofit partnerships are gradually increasing access to foundational insulin delivery tools.

The Asia-Pacific region manifests a dual trajectory of rapid market expansion and nuanced local requirements. China’s domestic manufacturing capacities and supportive medical device regulations have accelerated the introduction of smart pens and pump systems, complemented by telehealth integration in urban centers. India remains a key volume market for economy-minded pen and syringe devices, driven by strong generic insulin production and a burgeoning private healthcare sector. Emerging markets in Southeast Asia and Oceania are adopting hybrid models that balance cost sensitivities with selective deployment of connected devices in metropolitan areas.

This comprehensive research report examines key regions that drive the evolution of the Insulin Delivery Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders and Strategic Developments Among Prominent MedTech Companies Shaping the Insulin Delivery Device Ecosystem

Leading medtech and pharmaceutical companies have intensified strategic initiatives to consolidate market positions and diversify insulin delivery portfolios. Medtronic remains at the forefront through iterative enhancements to its sensor-augmented pump platforms and expansion of its interoperable ecosystem, incorporating advanced algorithms and user-friendly interfaces. Its recent collaborations with software developers underscore a commitment to fostering open-architecture frameworks that accelerate third-party innovation.

Insulet Corporation has leveraged its tubeless patch pump technology to capture niche segments seeking minimalistic, wearable solutions. By integrating Bluetooth connectivity and automated dose logging, the company has strengthened its appeal among technology-savvy patient cohorts. Recent tie-ups with electronic health record providers have streamlined clinical data sharing, reinforcing Insulet’s position in value-based care models.

Pharmaceutical innovators such as Novo Nordisk and Eli Lilly have deepened their involvement in delivery device development through joint ventures and licensing arrangements. Novo Nordisk’s strategic partnership with a leading digital therapeutics firm aims to launch smart pen injectors with adaptive dosing guidance, while Eli Lilly has invested in emerging startups specializing in needle-free injector technologies. These collaborations reflect a broader industry trend toward co-innovation across drug and device boundaries.

Additionally, specialty device manufacturers including Roche and BD Medical have strengthened their retail and hospital pharmacy relationships to ensure distribution efficiency. Roche’s entry into closed-loop trials and BD’s launch of next-generation prefilled pens demonstrate a dual focus on research-driven product pipelines and market-centric distribution strategies. Collectively, these company-level movements illustrate a competitive ecosystem that prizes agility, interoperability, and cross-sector partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insulin Delivery Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Ascensia Diabetes Care Holdings AG

- B. Braun SE

- Biocon

- Debiotech SA

- Eli Lilly and Company

- Embecta Corp.

- Gerresheimer AG

- ICU Medical, Inc.

- Insulet Corporation

- Jiangsu Delfu medical device Co.,Ltd

- Johnson & Johnson Services, Inc.

- MannKind Corporation

- Medtronic PLC

- Nipro Corporation

- Novo Nordisk A/S

- Owen Mumford Ltd.

- Roche Diabetes Care, Inc.

- Sanofi S.A.

- Sequel Med Tech, LLC

- SOOIL Developments Co., Ltd

- Tandem Diabetes Care, Inc.

- Terumo Corporation

- Wockhardt Limited

- Ypsomed AG

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Maximizing Innovation, Market Access, and Patient Engagement in Insulin Delivery

Industry leaders operating within the insulin delivery segment should prioritize interoperability and open-platform strategies to foster collaborative innovation. By adopting standardized communication protocols across pump, sensor, and software ecosystems, companies can create scalable solutions that integrate seamlessly with existing digital health infrastructures. This approach not only accelerates time to market for new features but also aligns with evolving regulatory expectations for data portability and patient safety.

Manufacturers must also invest in domestic production capabilities and nearshoring partnerships to mitigate tariff-related risks. Establishing localized assembly lines or contractual relationships with regional contract manufacturing organizations can reduce exposure to import duties while reinforcing supply chain resilience. Engaging proactively with trade policymakers to advocate for public health exemptions will further safeguard access to essential diabetes management tools.

A patient-centric lens should guide device ergonomics and user experience enhancements. Iterative usability studies across diverse age groups and care settings can inform design refinements that improve adherence and minimize training requirements. Embedding remote monitoring and telehealth compatibility as core features, rather than optional add-ons, will future-proof products against shifting clinician workflows and reimbursement models.

Finally, stakeholders should cultivate robust real-world evidence programs to demonstrate clinical and economic value. By partnering with healthcare providers to capture longitudinal outcomes from device deployments, companies can build compelling case studies that support favorable coverage decisions. These evidence-driven strategies will not only differentiate offerings in a crowded marketplace but also contribute to sustainable growth by aligning product development with payer and patient priorities.

Detailing Rigorous Research Methodology Combining Qualitative Interviews, Secondary Data Review, and Competitive Landscape Analysis for Comprehensive Insights

This study employs a rigorous, multi-faceted research methodology designed to deliver comprehensive insights into the insulin delivery device landscape. Primary data collection included in-depth interviews with endocrinologists, diabetes educators, procurement specialists, and laboratory researchers, enabling nuanced understanding of clinical requirements, user preferences, and operational challenges across care settings.

Complementing qualitative inputs, extensive secondary research drew from peer-reviewed journals, regulatory filings, clinical trial databases, and public policy documents to validate technology trends and policy impacts. Competitive landscape analysis involved profiling leading device manufacturers and pharmaceutical partners, scrutinizing product pipelines, strategic alliances, and intellectual property filings. This triangulation of sources ensured that findings reflect both emerging innovations and established market dynamics.

Analytical frameworks incorporated segmentation analyses along delivery methods, insulin formulations, distribution channels, end-user environments, therapeutic applications, and demographic cohorts. Regional assessments were structured around macroeconomic indicators, regulatory regimes, and healthcare infrastructure maturity in the Americas, Europe Middle East & Africa, and Asia-Pacific. Trade policy implications were evaluated through scenario planning and sensitivity testing of tariff variables.

Throughout the research process, data integrity and objectivity were maintained through peer reviews and cross-functional validation teams. Limitations were addressed by acknowledging potential gaps in proprietary sales data and by supplementing estimates with conservative assumptions. The result is a robust, actionable intelligence platform tailored for decision-makers seeking to navigate the evolving insulin delivery device market with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insulin Delivery Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insulin Delivery Devices Market, by Delivery Method

- Insulin Delivery Devices Market, by Insulin Type

- Insulin Delivery Devices Market, by Distribution Channel

- Insulin Delivery Devices Market, by End User

- Insulin Delivery Devices Market, by Application

- Insulin Delivery Devices Market, by Age Group

- Insulin Delivery Devices Market, by Region

- Insulin Delivery Devices Market, by Group

- Insulin Delivery Devices Market, by Country

- United States Insulin Delivery Devices Market

- China Insulin Delivery Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Future Trajectory of Insulin Delivery Devices Within Evolving Clinical Practices and Technological Innovation Frameworks

As the insulin delivery device market continues to evolve, the intersection of technological innovation, regulatory developments, and shifting patient expectations will define future trajectories. The maturation of closed-loop systems and digital pen injectors signals a departure from standalone hardware toward integrated therapeutic ecosystems. These trends are poised to reshape standard clinical practices by fostering continuous remote monitoring and data-driven personalization of insulin regimens.

Simultaneously, geopolitical factors and trade policies are compelling stakeholders to optimize global supply chains and engage in targeted localization strategies. Market participants that successfully balance cost management with innovation imperatives will be best positioned to capture the benefits of expanding access initiatives, particularly in emerging economies. Moreover, robust partnerships between device manufacturers, pharmaceutical innovators, and healthcare providers will underpin the development of end-to-end solutions that offer seamless experiences from prescription to administration.

The convergence of patient-centric design, interoperability standards, and real-world evidence will drive the next wave of differentiation. Leaders must embrace a holistic approach that integrates user feedback, clinical outcomes, and economic value propositions into product development roadmaps. By doing so, they will not only deliver superior therapeutic performance but also foster greater adoption and reimbursement support, ultimately enhancing quality of life for individuals managing diabetes.

Connect with Ketan Rohom to Secure Your Comprehensive Market Research Report and Unlock Strategic Insights for Insulin Delivery Device Advancement

To gain full access to the detailed insights, strategic analyses, and comprehensive data sets that underpin this executive summary, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly, you will receive tailored guidance on how these findings align with your organizational objectives and can secure the complete market research report on insulin delivery devices. This report equips you with the actionable intelligence necessary to drive innovation, navigate complex trade environments, and accelerate market penetration. Reach out today to explore customization options and unlock the strategic advantage offered by this in-depth analysis.

- How big is the Insulin Delivery Devices Market?

- What is the Insulin Delivery Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?