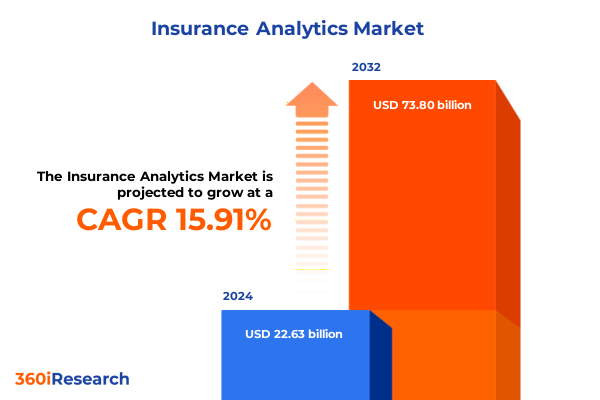

The Insurance Analytics Market size was estimated at USD 26.20 billion in 2025 and expected to reach USD 30.33 billion in 2026, at a CAGR of 15.94% to reach USD 73.80 billion by 2032.

Unleashing the Power of Data-Driven Intelligence to Revolutionize Risk Assessment and Customer Engagement in Modern Insurance

Insurance analytics has emerged as a cornerstone of modern risk management and customer engagement. Where traditional actuarial approaches once relied on historical loss experience and static rate tables, today’s carriers harness machine learning and predictive modeling to continuously refine their risk assessments. This evolution reflects broader technological progress, as advanced algorithms now parse unstructured data streams-from social media interactions to IoT sensor feeds-to reveal nuanced insights into policyholder behavior and emerging risk patterns.

Integrating massive data lakes with scalable cloud platforms has enabled real-time decision support, empowering underwriters to adjust pricing dynamically and claims teams to prioritize cases with automated triage workflows. As telematics devices supply live driving metrics and wearable technologies track health indicators, insurers can sculpt personalized offerings that align closely with individual risk profiles. This shift toward behavior-based pricing and proactive risk mitigation underscores the growing strategic importance of analytics across the insurance value chain.

Amid volatile economic conditions and evolving regulatory demands, the ability to generate reliable, timely insights constitutes a decisive competitive differentiator. By weaving together predictive models for fraud detection, churn management, and capital optimization, insurers can navigate complexity with greater agility. Consequently, the introduction of this report establishes the foundational questions shaping insurance analytics strategy: how can organizations balance innovation with governance, scale advanced analytics responsibly, and cultivate the specialized talent needed to sustain continuous improvement?.

Technological, Regulatory, and Behavioral Catalysts Are Driving Deep Transformations Across the Insurance Analytics Value Chain

The insurance analytics landscape is undergoing transformative shifts driven by converging technological advancements and changing market expectations. Artificial intelligence and machine learning solutions have matured from isolated experiments into enterprise-grade platforms capable of processing terabytes of claims documentation and policy records at scale. Insurers now deploy deep learning frameworks to interpret medical imaging for health claims, and they leverage natural language processing engines to analyze customer communications for early indicators of dissatisfaction. These innovations are reshaping underwriting precision, accelerating claims resolutions, and enhancing fraud detection capabilities across life and non-life lines.

Simultaneously, the proliferation of cloud-native infrastructures and data lake architectures is democratizing access to advanced analytics. Carriers can spin up on-demand environments, experiment with new models, and integrate third-party data sources within secure, governed frameworks. This elasticity supports rapid prototyping of usage-based insurance programs and real-time pricing engines, while modular architectures mitigate vendor lock-in. Moreover, the integration of Internet of Things data-from telematics sensors in vehicles to environmental monitors for property risks-offers unmatched granularity in risk profiling and policy customization.

Regulatory emphasis on data privacy and algorithmic transparency further shapes the competitive landscape. With jurisdictions mandating explainable AI and stringent data protection requirements, insurers are investing in robust governance frameworks and audit trails. Concurrently, strategic partnerships between established carriers and insurtech innovators are catalyzing ecosystem development, blending actuarial expertise with agile development methodologies. In this dynamic environment, organizations that can orchestrate technological stacks, ensure compliance, and foster collaborative innovation will set new performance benchmarks in the industry.

Escalating Tariff Measures Are Reshaping Insurance Analytics Procurement Strategies and Operational Budgets in 2025

The escalation of United States tariffs in 2025 has introduced significant headwinds for insurance analytics budgets and procurement strategies. In the auto insurance domain, tariffs on imported vehicle parts have driven up repair costs and parts inflation, complicating loss forecasting models. Industry analyses highlight that sharper repair expenses and higher vehicle valuations are likely to increase claims severity, compelling insurers to account for elevated loss cost projections in their pricing algorithms. This dynamic has already led several carriers to delay rate reductions that had been anticipated for 2025.

Beyond property and casualty, macroeconomic effects of tariff policy are influencing carriers’ broader investment outlook. According to the Swiss Re Institute, global economic growth is projected to slow notably in 2025 as trade tensions dampen business spending and consumer confidence. This deceleration in GDP growth is expected to weigh on premium growth and constrain discretionary technology budgets within insurance organizations. As a result, analytics roadmaps are becoming more conservative, with an increased emphasis on cost efficiency and return on investment analysis.

Technology procurement has also felt the impact of broader IT hardware and services tariffs. Firms report that higher server prices, increased fees passed through by cloud providers, and elevated networking equipment costs are straining analytics infrastructure investments. In many cases, IT leaders are extending hardware refresh cycles, diversifying vendor relationships, and exploring hybrid deployment models to mitigate the financial pressure. These tactical adjustments underscore the need for flexible, portable analytics architectures that can adapt to a shifting tariff landscape without compromising performance or compliance.

Decoding the Diverse Segmentation Layers That Drive Tailored Analytics Strategies Across Insurance Submarkets and Business Applications

A nuanced segmentation framework reveals how diverse business requirements demand tailored analytics solutions across the insurance spectrum. In the realm of insurance type, life insurers face unique challenges in endowment product cash‐flow projections and level term policy risk scoring, while non‐life carriers leverage real‐time telematics data for motor insurance optimization and geospatial models for property risk assessment. Within life insurance, the need to balance long‐term cash value accumulation for whole life policies with dynamic liability modeling for decreasing and level term variants underscores the importance of flexible actuarial analytics platforms.

When considered by application, analytics adoption spans the full insurance value chain. Claims management groups integrate sophisticated claim analytics engines and automated processing workflows to accelerate settlements and reduce leakage. Customer analytics teams deploy predictive churn and sentiment models to refine retention strategies and upsell offers. Fraud detection functions rely on anomaly detection and pattern recognition algorithms to uncover illicit activities with greater speed and accuracy. Marketing divisions utilize campaign performance analysis and lead scoring techniques to maximize acquisition efficiency, while risk assessment and underwriting groups blend algorithmic risk modeling with rule‐based profiling and manual review processes for complex cases.

Deployment model preferences further influence solution design. Cloud environments, whether public, private, or hybrid, offer rapid scalability and on‐demand provisioning for data science experimentation, whereas on‐premise infrastructures-anchored in either legacy or modernized hardware-provide controlled environments for sensitive data and low‐latency applications. Organization size also plays a pivotal role: large enterprises maintain dedicated data labs with in‐house talent and full‐fledged analytics centers, while small and medium enterprises often gravitate toward managed services and software‐as‐a‐service subscriptions to access enterprise capabilities without heavy upfront investment. Finally, end users of analytics encompass both primary insurers and reinsurers seeking actuarial and predictive insights, as well as third‐party providers-ranging from strategic consultants to specialized IT firms-embedding analytics into client engagements and technology implementations.

This comprehensive research report categorizes the Insurance Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Insurance Type

- Organization Size

- Application

- Deployment Model

- End User

Mapping Regional Dynamics Reveals How Geographic Variations Are Shaping Insurance Analytics Adoption Globally

Regional dynamics exert a profound influence on insurance analytics adoption, reflecting variations in regulatory regimes, technological maturity, and competitive pressures. In the Americas, North American carriers lead the way with mature analytics programs supported by extensive data lake investments, embedded AI governance frameworks, and a culture of continuous model validation. Latin American insurers, by contrast, prioritize cloud‐based platforms to extend underwriting reach and streamline claims processing, often collaborating with local technology service providers to overcome resource constraints and accelerate digital transformation.

Across Europe, Middle East, and Africa, stringent data protection laws such as GDPR and emerging privacy regulations have elevated the bar for analytics implementations. Western European insurers invest heavily in advanced risk modeling for cyber liability and climate‐related exposures, while Gulf region markets harness state‐led digitization initiatives to modernize national insurance infrastructures and foster public–private partnerships. In sub‐Saharan Africa, microinsurance programs coupled with mobile‐first distribution strategies rely on lightweight analytics solutions to expand financial inclusion and manage portfolio risk under resource‐constrained conditions.

The Asia‐Pacific region presents a tapestry of opportunity and complexity. Mature markets like Japan and Australia deploy real‐time telematics and wearable health data to tailor motor and group health programs with unparalleled granularity. In contrast, emerging economies in Southeast Asia and India focus on cost‐effective, cloud‐native architectures to rapidly scale policy issuance and claims adjudication. Strategic alliances between local carriers and global analytics specialists are catalyzing talent development, enabling knowledge transfer and accelerating the adoption of cutting‐edge methodologies across the region.

This comprehensive research report examines key regions that drive the evolution of the Insurance Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Pioneers That Are Setting the Benchmark for Innovation and Competitive Advantage in Insurance Analytics

Leading technology firms and specialized analytics providers are setting new performance standards through targeted investments and strategic alliances. Global cloud and software platforms now offer embedded insurance analytics modules that support end‐to‐end functions, including underwriting automation, claims triage, and fraud detection. These turnkey solutions reduce time to value, enabling insurers to integrate advanced analytics into core systems without extensive in‐house development. Meanwhile, traditional consulting firms are expanding their analytics advisory services to include dedicated innovation labs, where insurers can co‐create proof‐of‐concept models and rapidly iterate on emerging use cases.

Managed service providers are also playing a critical role by delivering fully outsourced analytics operations-from data integration and model governance to performance monitoring and regulatory compliance. These firms emphasize robust audit trails and bias mitigation protocols to satisfy evolving regulatory requirements and maintain stakeholder trust. Concurrently, a wave of specialist analytics startups is carving out vertical niches, such as chronic disease risk platforms for health insurers and computer vision–based damage assessment tools for motor and property claims. By combining domain expertise with technical innovation, these focused providers are driving measurable efficiency gains and unlocking new revenue streams for their clients.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insurance Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Applied Systems, Inc.

- Artivatic Data Labs Private Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- CyberCube Analytics Inc.

- Fair Isaac Corporation

- Guidewire Software, Inc.

- Hexaware Technologies Limited

- InsuredMine Inc.

- International Business Machines Corporation

- LexisNexis Risk Solutions Group

- MicroStrategy Incorporation

- Open Text Corporation

- Oracle Corporation

- Pegasystems Inc.

- Pentation Analytics

- Resilience Cyber Insurance Solutions LLC

- Rockville Risk Management Inc.

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Tata Consultancy Services Limited

- Verisk Analytics, Inc.

Strategic Imperatives and Tactical Steps Industry Leaders Must Execute to Capitalize on Insurance Analytics Opportunities

To capitalize on the full potential of insurance analytics, industry leaders must pursue a strategic roadmap that balances agile innovation with prudent governance. A cloud-centric architecture should serve as the foundational platform, supporting hybrid and multi-cloud deployments that deliver scalability, cost control, and adherence to data sovereignty mandates. Establishing a centralized analytics center of excellence is critical to standardize best practices, manage reusable assets, and prevent fragmented initiatives across business units. This approach ensures consistent model governance and accelerates time to insight by fostering cross-functional collaboration between actuarial, data science, and IT teams.

Cultivating a data-driven culture is equally important. Executives should invest in continuous learning programs that blend domain expertise with data literacy, empowering underwriters, claims professionals, and marketing teams to engage directly with analytics outputs. Simultaneously, strategic partnerships with academic institutions, research consortia, and insurtech ecosystems can augment internal capabilities and accelerate the adoption of cutting-edge methodologies. Robust data governance practices, including explainable AI protocols and bias mitigation frameworks, will bolster transparency, ensure regulatory compliance, and build stakeholder confidence in analytics-driven decisions.

Explaining the Rigorous Multi-Phase Research Approach Underpinning the Credibility and Depth of This Insurance Analytics Study

This study employs a rigorous, multi-phase research methodology designed to ensure the validity and relevance of its findings. The process began with an extensive secondary research phase, reviewing industry publications, regulatory filings, white papers, and academic journals to map the competitive landscape and identify emerging use cases. Publicly available data from trade associations and government agencies was synthesized to establish baseline insights on regional dynamics and application‐specific trends.

In the second phase, primary research was conducted through in-depth interviews with senior stakeholders across insurance carriers, analytics vendors, and technology service providers. These conversations provided qualitative insights into investment priorities, implementation challenges, and success metrics. To triangulate these perspectives, the research team deployed a proprietary quantitative survey targeting insurer executives in multiple geographies and functional domains. Advanced analytical frameworks, including cross‐impact analysis and scenario modeling, were then applied to assess the influence of external factors-such as tariff policies, regulatory shifts, and macroeconomic uncertainty-on market evolution. All findings underwent a peer‐review validation process with industry experts and academic methodologists to ensure objectivity and rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insurance Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insurance Analytics Market, by Insurance Type

- Insurance Analytics Market, by Organization Size

- Insurance Analytics Market, by Application

- Insurance Analytics Market, by Deployment Model

- Insurance Analytics Market, by End User

- Insurance Analytics Market, by Region

- Insurance Analytics Market, by Group

- Insurance Analytics Market, by Country

- United States Insurance Analytics Market

- China Insurance Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Insights and Future Outlook to Illuminate the Strategic Path Forward for Insurance Analytics Success

Throughout this executive summary, the interplay between technological innovation, regulatory evolution, and strategic execution has been examined in depth. Insurance analytics has transcended its experimental roots to become a mission-critical capability that influences profitability, operational efficiency, and customer satisfaction. By synthesizing insights across market segmentation, regional dynamics, and competitive positioning, stakeholders gain a holistic understanding of the forces that will shape the industry’s future trajectory.

Looking forward, insurers that adopt a balanced, forward-looking approach-marrying advanced AI techniques with sound governance and continuous talent development-will outpace their competitors and capture new revenue opportunities. An unwavering commitment to data integrity, cross-functional collaboration, and agile execution will be the hallmarks of those who succeed in transforming risk management from a cost center into a strategic catalyst for growth.

Transform Your Data into Competitive Edge by Partnering with Ketan Rohom to Secure the Full Insurance Analytics Report

For executives seeking to transform data into decisive action, securing the full insurance analytics market research report is the essential first step. Collaborate with Ketan Rohom, Associate Director of Sales & Marketing, to tailor insights to your organization’s unique challenges and ambitions. Ketan’s expertise in delivering customized analysis ensures you will receive strategic recommendations, in-depth market context, and clear guidance to accelerate your analytics initiatives.

Contact Ketan via LinkedIn to arrange a personalized consultation and unlock the comprehensive data, expert interviews, and advanced methodologies that underpin this report. Equip your team with the intelligence needed to drive profitable growth, optimize risk management, and maintain a competitive advantage in today’s dynamic insurance landscape.

- How big is the Insurance Analytics Market?

- What is the Insurance Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?