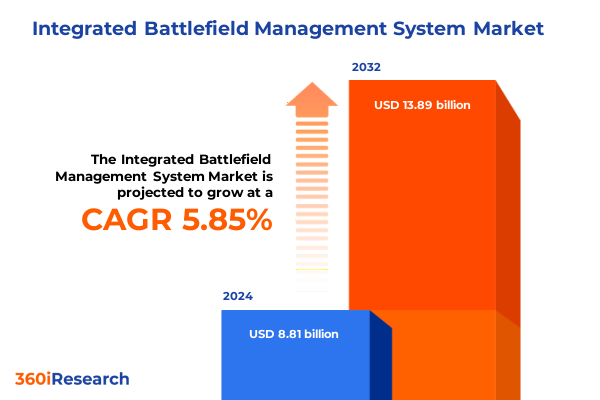

The Integrated Battlefield Management System Market size was estimated at USD 9.30 billion in 2025 and expected to reach USD 9.82 billion in 2026, at a CAGR of 5.89% to reach USD 13.89 billion by 2032.

A clear, operational framing that places integrated battlefield management systems at the crossroads of technology evolution, trade policy, and supply chain resilience

Integrated battlefield management systems are at the intersection of rapidly advancing technologies and shifting policy instruments that directly influence acquisition, sustainment, and operational readiness. This introduction situates readers within the broader context where hardware innovation, software-defined command and control, and services that bind those elements together must be evaluated against evolving trade policy, export controls, and supplier concentration risks. By anchoring the analysis in supply chain realities and regulatory dynamics, the study foregrounds how procurement decisions made today will shape capability availability tomorrow.

Across the following sections, the narrative weaves together technology trends, procurement imperatives, and the strategic levers available to program managers and industry leaders. The goal is to present integrated analysis that is both analytically rigorous and operationally useful, enabling defense planners to prioritize resilience, reduce single-source exposure, and sequence investments to preserve operational tempo. Transitional linkages throughout the report highlight cause-and-effect relationships between policy actions, supplier responses, and capability delivery timelines.

How converging trade measures, export controls, and rapid sensor and AI advances are reshaping supplier strategies and procurement approaches across defense ecosystems

The landscape for integrated battlefield management systems is undergoing transformative shifts driven by three converging forces: policy-driven trade measures, tightened export controls, and rapid maturation of sensing, data fusion, and edge compute technologies. These forces are reordering supplier strategies, altering sourcing geographies, and amplifying the strategic value of interoperable software architectures that decouple hardware dependency from mission capability. As national security priorities deepen, procurement organizations are increasingly designing requirements that reflect upstream supply chain realities rather than assuming stable global inputs.

Policy interventions have become more targeted and consequential, applying differentiated tariffs and export constraints to strategically important inputs such as semiconductors, wafers, and certain critical minerals; this reorientation changes commercial calculus for vendors and primes and accelerates reshoring and diversification initiatives. Concurrently, advances in command-and-control software, communication management suites, and data fusion platforms are enabling modular architectures that can absorb component disruptions more gracefully. These software-first approaches are creating optionality for acquisition professionals: when hardware becomes constrained, systems that rely on open standards, containerized microservices, and cross-platform interoperability can preserve mission effectiveness downstream.

In operational terms, the pace of AI-enabled analytics and sensor fusion is collapsing sensor-to-shooter timelines, while at the same time provoking new scrutiny from policymakers who view advanced compute and high-performance components through a national security lens. As a result, industry is responding with split-sourcing strategies, localized assembly centers, and partnerships that marry domestic engineering with offshore manufacturing where permissible. Together, these shifts demand a more integrated acquisition playbook-one that balances performance requirements with supply-chain provenance, exportability, and lifecycle sustainment.

Assessment of how targeted 2025 tariff adjustments and export-control updates are reshaping procurement, supplier behavior, and supply chain resilience for defense systems

The cumulative impact of United States tariff actions in 2025 has been to crystallize supply chain risk assessments and to force program-level adjustments in sourcing, supplier qualification, and lifecycle sustainment. Targeted tariff increases on high-value upstream inputs including wafers, polysilicon, and certain strategic minerals have raised the cost and complexity of procuring components that feed into sensors, processors, and other hardware segments of battlefield management systems. These measures were announced as part of the statutory Section 301 review and took effect at the beginning of calendar year 2025, underscoring that strategic industrial inputs are now subject to explicit trade policy levers that producers and integrators must manage proactively.

In parallel, strengthened export-control regimes on advanced semiconductors and related tools have constrained cross-border flows of high-performance compute and development equipment, which in turn amplifies near-term supply constraints for sophisticated processors and memory components used in edge compute and data-fusion nodes. The Bureau of Industry and Security published enhanced controls intended to limit the ability of adversary states to develop advanced military-capable semiconductors, and those controls have immediate implications for supplier certification, contract clauses, and lead-time planning. Procurement authorities are therefore revising clauses and source-approval processes to ensure compliance while minimizing operational exposure.

Taken together, tariffs and export controls have catalyzed practical responses across the defense industrial base. Prime contractors and subsystem suppliers are increasing transparency requests to first- and second-tier suppliers, stockpiling select critical materials where contractually permitted, and accelerating qualification of alternate vendors in allied jurisdictions. The Department of Defense has responded by prioritizing stockpile reviews and tasking supply-chain resilience programs to identify chokepoints in critical minerals and microelectronics. Recent government reporting highlights that many critical materials and upstream components are concentrated outside the United States, creating strategic points of failure that tariff and export-control policies aim to address but which also complicate near-term procurement.

Ultimately, the 2025 tariff posture functions less as an isolated cost shock and more as a policy signal: it forces stakeholders to internalize geopolitical risk into systems engineering, to accelerate investment in domestic industrial capacity where feasible, and to adopt procurement constructs that prioritize resilience, traceability, and compliance.

Segmented intelligence that identifies where component, platform, deployment, application, and end-user dynamics concentrate risk and resilience levers across battle management systems

A practical segmentation view reveals where risk concentrations and resilience levers coexist across the integrated battlefield management ecosystem. When the market is studied across components-hardware, services, and software and platforms-distinct risk and opportunity profiles emerge. Hardware, which includes communications equipment, displays, navigation and positioning devices, processors, and sensors, is most exposed to upstream raw materials and semiconductor constraints; as a result, acquisition authorities are emphasizing supplier source disclosure and design-for-manufacturability to enable substitution when discrete elements are constrained. Services such as maintenance and support, system integration, and training and simulation serve as the operational fabric that sustains systems over time, and they are increasingly a strategic differentiator because local services preserve readiness even when hardware sourcing becomes fluid. Software and platforms-spanning command and control software, communication management software, and data fusion and analytics platforms-offer modularity and upgrade paths that permit capability growth without full hardware replacement, creating an important buffer against hardware-centric supply shocks.

Platform type segmentation-airborne, ground, naval, and space-drives divergent sourcing and sustainment priorities since each domain imposes unique environmental, reliability, and certification requirements. Airborne systems, for example, demand weight- and power-optimized processors and sensors, whereas naval systems emphasize corrosion-resistant materials and long-life displays and communications suites. Ground systems prioritize ruggedized sensors and off-board communications resilience, and space platforms require radiation-hardened components and exceptionally strict provenance requirements. These distinctions require tailored supplier development strategies rather than one-size-fits-all procurement templates.

Deployment mode is another crucial axis: cloud and on-premise options present different risk trade-offs. On-premise deployments-whether in centralized operations centers or in field installations-reduce sovereign-control risk and can ease compliance with export rules, but they can increase logistics and sustainment burdens. Cloud deployments afford rapid scaling and analytical horsepower, yet they expose systems to cross-border data and service dependencies and to evolving regulatory scrutiny over data residency and controlled-technology processing.

Application segmentation-communications, electronic warfare, reconnaissance, and surveillance-further clarifies where integration complexity concentrates. Communication systems require low-latency, hardened links and secure management software; electronic warfare demands specialized RF front ends and tunable software layers; reconnaissance emphasizes sensor fusion and bandwidth-efficient data pipelines; and surveillance programs focus on persistent sensing and analytics. Finally, end-user segmentation-Air Force, Army, Navy, and Special Forces-drives differentiated requirements and sustainment models tied to doctrine, operational tempo, and deployment footprints. Together, this layered segmentation approach enables program offices to identify targeted interventions that reduce single-point dependencies while preserving mission performance.

This comprehensive research report categorizes the Integrated Battlefield Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Platform Type

- Deployment Mode

- Installation Type

- Application

- End User

Regional sourcing and industrial cooperation patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific that shape procurement choices and resilience pathways

Regional dynamics materially influence sourcing choices, alliance-based industrial cooperation, and mitigation options. In the Americas, policy emphasis centers on bolstering domestic industrial capability and leveraging nearshoring partnerships across North America; procurement teams in this region are prioritizing supplier base expansion within allied jurisdictions to preserve production continuity and to reduce tariff exposure. This approach often pairs domestic engineering and systems integration with regional manufacturing to minimize cross-border tariff and compliance friction.

Europe, the Middle East and Africa present a mix of industrial strengths and import dependencies that complicate procurement planning. European suppliers are strong in systems engineering, secure communications, and certain sensor technologies, enabling coalition interoperability; however, EMEA supply chains also rely on upstream materials and specialized components from third-party sources, which can be disrupted by geopolitical shifts and trade measures. Procurement strategies in this region increasingly emphasize interoperability standards, reciprocal certification pathways, and consortium-based supplier development to sustain capability across multilateral operations.

Asia-Pacific remains both a central source of advanced manufacturing and a region of heightened policy risk. Many high-performance components, including semiconductors and certain critical minerals, have production or processing nodes in Asia-Pacific economies. At the same time, the region’s geopolitical tensions and export-controls dynamics require careful navigation by defense contractors and procurement authorities. Where possible, program managers are seeking dual-sourcing arrangements that combine trusted allied suppliers with regional manufacturing partners to balance cost, capacity, and compliance.

This comprehensive research report examines key regions that drive the evolution of the Integrated Battlefield Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How prime integrators, specialized hardware suppliers, and software platform providers are reshaping commercial models to mitigate tariff exposure and procurement risk

Key companies across systems integration, specialized hardware, and software platforms are adapting their commercial models to manage tariff exposure, comply with export controls, and preserve delivery timelines. Prime integrators are embedding supplier-provenance clauses in contracts, accelerating supplier qualification pipelines for allied vendors, and expanding in-country sustainment hubs to localize support. Component vendors are responding by investing in dual manufacturing lines, segregating product families by destination compliance, and enhancing traceability through serialized BOMs and blockchain-enabled provenance systems. Software and analytics providers are shifting toward containerized, modular solutions that can be deployed on-premise or in sovereign clouds, reducing the degree to which a single hardware supplier can constrain capability delivery.

At the same time, smaller specialized firms-particularly those providing advanced sensors, EW payloads, or niche processors-are increasingly forming partnering arrangements with larger primes to access certification pathways and to meet the capital intensity of compliance-driven production. These partnerships often include technology-transfer clauses, reciprocal IP licensing, and staged qualification plans that align product roadmaps with procurement timelines. Collectively, corporate responses are creating an emergent industrial pattern: layered supplier networks, where strategic nodes are duplicated in allied jurisdictions and where software-defined capability layers provide continuity even when hardware availability fluctuates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Integrated Battlefield Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- Aselsan A.S.

- BAE Systems plc

- CACI International Inc.

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hexagon AB

- Honeywell International Inc.

- Indra Sistemas S.A.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Rolta India Limited

- Saab AB

- Safran S.A.

- Singapore Technologies Engineering Ltd

- Systematic A/S

- Thales S.A.

- The Boeing Company

Actionable, phased recommendations for primes and acquisition authorities to institutionalize supply-chain transparency, modular design, and allied manufacturing partnerships

Industry leaders should adopt an actionable, time-phased approach that balances immediate mitigation with medium-term industrial investment. In the near term, procurement officials and primes should require full supply-chain provenance disclosures for critical subsystems and incorporate contract mechanisms that allow rapid qualification of vetted alternate suppliers. Concurrently, companies should segregate product families for compliance management, and implement serialized bill-of-materials tracking to reduce time-to-detect for prohibited or high-risk components. These steps reduce operational surprise and create the administrative foundations necessary to react quickly when trade policy or export guidance changes.

Over the medium term, industry should prioritize modularity by design: standardize interfaces between command-and-control software, communication management layers, and sensor subsystems so that hardware swaps do not trigger extensive system-of-systems recertification. Invest in allied-jurisdiction manufacturing and localized sustainment hubs that shorten logistics chains and reduce tariff exposure, while also pursuing public-private partnerships to de-risk investment in critical-material processing and advanced packaging. Finally, develop a layered capability assurance plan that combines strategic stockpiles for select materials, supplier development programs for allied vendors, and contractual incentives that reward provenance and redundancy. These combined actions will materially reduce mission risk and improve acquisition agility.

Integrated methodology combining policy review, supplier mapping, expert interviews, and technology readiness assessments to produce operationally relevant insights

The research methodology underpinning this analysis combined primary-source policy documentation review, subject-matter expert interviews, and supplier ecosystem mapping to produce an integrated, evidence-based portrait of risk and opportunity. Policy and regulatory inputs included official releases from trade and commerce authorities and government audit reports that spotlighted critical-material dependencies and export-control changes. These official sources were synthesized with open-source reporting and targeted interviews with procurement officials, systems integrators, and component suppliers to validate operational implications and to identify practical mitigation options.

Supplier mapping used a layered approach that captured first- and second-tier dependencies, with attention to material origin, processing locations, and final assembly footprints. Technology readiness and integration risk assessments were conducted for candidate hardware families and software platforms, and sustainment risk was evaluated through analysis of repair-cycle logistics and local service capability. Where possible, conclusions were corroborated against government auditing authorities that assess supply-chain vulnerabilities and industrial-base fragility. The resulting methodology delivers an actionable intersection of policy, industrial capability, and operational requirement that supports defensible acquisition decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Integrated Battlefield Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Integrated Battlefield Management System Market, by Component

- Integrated Battlefield Management System Market, by Platform Type

- Integrated Battlefield Management System Market, by Deployment Mode

- Integrated Battlefield Management System Market, by Installation Type

- Integrated Battlefield Management System Market, by Application

- Integrated Battlefield Management System Market, by End User

- Integrated Battlefield Management System Market, by Region

- Integrated Battlefield Management System Market, by Group

- Integrated Battlefield Management System Market, by Country

- United States Integrated Battlefield Management System Market

- China Integrated Battlefield Management System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Concluding synthesis that ties policy shifts, supply-chain exposure, and technology architecture choices into a coherent roadmap for capability preservation and industrial resilience

In conclusion, integrated battlefield management systems now operate within a strategic environment where trade policy, export controls, and supplier concentration are as consequential as technological performance. The twin trends of targeted tariff measures and tightened export control have moved supply-chain provenance from a compliance checkbox to a core determinant of program risk and schedule. Yet, this environment also opens opportunity: software modularity, allied manufacturing partnerships, and disciplined supplier-development programs can preserve capability delivery even under constrained input flows.

Decision-makers who invest in provenance transparency, modular architectures, and symbiotic public-private industrial initiatives will be better positioned to navigate the near-term disruptions and to shape a more resilient industrial base over time. The balance of policy and technology places a premium on strategic planning, not simply tactical sourcing. By integrating policy foresight into systems engineering and procurement practice, stakeholders can maintain operational advantage while supporting broader national objectives of supply-chain resilience and allied industrial cooperation.

Secure a tailored, tactical briefing and purchase the comprehensive report to access supplier mapping, policy trackers, and an actionable mitigation toolkit aligned to program timelines

For decision-makers ready to move from analysis to action, purchase of the full market research report offers authoritative intelligence, executable recommendations, and supplier-level transparency required to accelerate program decisions and manage risk across complex defense value chains. Engaging directly will provide your team with the underlying data tables, supplier mapping, technology readiness assessments, and contract-lean procurement playbooks that accompany this executive synthesis.

To request the report and arrange a bespoke briefing tailored to program priorities, contact Ketan Rohom, Associate Director, Sales & Marketing. A direct briefing will clarify scope options, optional add-on modules (such as supplier due‑diligence deep dives or geographic sourcing heat maps), and timeline for delivery so stakeholders can align acquisition milestones with procurement, compliance, and industrial-base initiatives.

Act now to secure prioritized access to primary-source supplier profiles, policy-tracking briefers, and an applied mitigation toolkit that helps reduce supply chain exposure while optimizing capability delivery pathways. Purchasing the full report unlocks quarterly update windows that track tariff, export-control, and regulatory changes affecting integrated battlefield technologies, and ensures your acquisition plans remain informed and defensible in a rapidly evolving strategic environment.

- How big is the Integrated Battlefield Management System Market?

- What is the Integrated Battlefield Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?