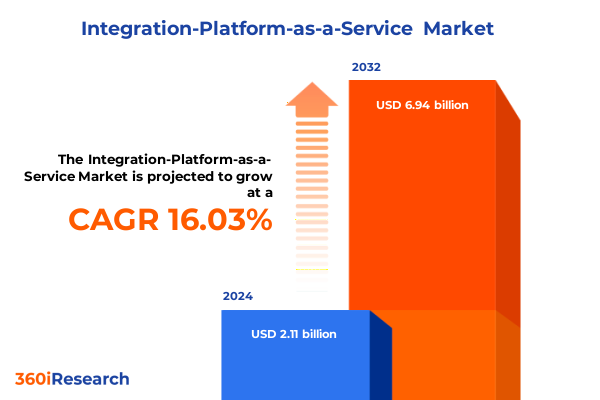

The Integration-Platform-as-a-Service Market size was estimated at USD 2.44 billion in 2025 and expected to reach USD 2.82 billion in 2026, at a CAGR of 16.09% to reach USD 6.94 billion by 2032.

Unveiling the New Era of Integration Platforms to Empower Agile Connectivity and Streamlined Process Orchestration Across Enterprise Ecosystems

Integration-Platform-as-a-Service (IPaaS) has emerged as a foundational pillar for enterprises seeking to unify their diverse application landscapes, data repositories, and business processes. As digital transformation initiatives accelerate, organizations are confronted with the complexity of managing legacy on-premises systems alongside modern cloud-native applications. IPaaS solutions respond to these challenges by offering a unified framework that simplifies connectivity, accelerates development cycles, and enhances operational agility. Leaders who leverage IPaaS effectively can orchestrate seamless data flows, enforce governance policies consistently, and scale integration capabilities in line with evolving business demands.

Against the backdrop of rapid technological change and shifting market expectations, IPaaS has evolved from a niche offering to a strategic imperative. Enterprises no longer view integration as a purely technical concern; instead, it is recognized as a driver of innovation, customer experience, and revenue growth. This report begins by setting the stage for our analysis, outlining the key forces reshaping the IPaaS ecosystem and highlighting why organizations of all sizes must adopt integration fabric to maintain competitive advantage in a hybrid and multi-cloud world.

Navigating the Convergence of Hybrid Connectivity, Real-Time Processing, and AI-Driven Integration in Today’s IT Landscape

The IPaaS landscape is experiencing transformative shifts driven by enterprise demands for hybrid connectivity, real-time data processing, and low-code integration tools. Modern businesses require solutions that bridge cloud-to-cloud, cloud-to-on-premises, and on-premises-to-on-premises environments without sacrificing performance or security. For example, the proliferation of microservices architectures has created a need for event-driven integration models that can process millions of transactions per second with minimal latency. At the same time, the rise of containerization and Kubernetes orchestration compels IPaaS providers to deliver native support for container workloads and service mesh integrations.

Moreover, the advent of AI and machine learning in integration platforms is redefining how integration patterns are discovered, configured, and maintained. Intelligent mapping, automated schema detection, and anomaly identification enhance developer productivity and reduce time to deployment. Furthermore, citizen developers are empowered by visual, low-code interfaces that abstract away complex coding tasks yet maintain enterprise-grade governance. Collectively, these transformative shifts are reshaping the expectations for integration platforms, compelling vendors to innovate rapidly and enterprises to rethink their integration strategies.

Assessing How Emerging US Trade Tariffs Are Reshaping Infrastructure Costs and Catalyzing Cloud-Native Integration Adoption

In 2025, the United States enacted a series of tariffs impacting technology import prices, which have had a cumulative effect on enterprises leveraging Integration-Platform-as-a-Service solutions. Increased duties on semiconductors, networking hardware, and enterprise software components have elevated the total cost of ownership for on-premises gateway appliances and proprietary integration appliances. These additional costs have driven many organizations to reevaluate their infrastructure strategies, often accelerating migrations toward fully managed, cloud-native IPaaS offerings that mitigate tariff exposure and reduce capital expenditures.

Supply chain disruptions tied to trade policy shifts have also influenced deployment timelines. Delays in hardware deliveries for edge integration and network appliances have prompted enterprises to adopt virtualized integration nodes hosted in domestic cloud environments. As a result, managed service providers have seen increased demand for hardware-agnostic deployment models that can be scaled on demand. Furthermore, to cope with fluctuating component prices, organizations are negotiating more flexible licensing agreements with integration vendors, aligning software costs with consumption rather than fixed on-premises licensing. These adaptive strategies demonstrate how tariff policy has indirectly accelerated IPaaS adoption.

Uncovering Strategic Variances in Integration Services, Connectivity Patterns, and Industry-Specific Deployment Preferences

Analysis of market segmentation reveals distinct deployment and service preferences across enterprises. Organizations requiring rapid time-to-value are increasingly opting for managed IPaaS offerings, while those maintaining complex in-house IT teams continue to favor professional services engagements for custom integration projects. Connectivity requirements vary: a growing subset of enterprises is prioritizing cloud-to-cloud integration to streamline interactions between SaaS applications, whereas others emphasize cloud-to-on-premises bridges to ensure continuity with legacy systems. A third group retains on-premises-to-on-premises integrations, often to support mission-critical workflows and data sovereignty mandates.

From an application perspective, the split between application integration and data integration workloads is becoming more pronounced. Customer-facing processes typically demand low-latency application integration, while analytics and reporting initiatives drive high-throughput data integration. Hybrid and on-premises deployment models coexist, reflecting differing risk tolerances and regulatory compliance needs. Large enterprises deploy IPaaS across global business units to centralize governance, whereas small and medium enterprises leverage platform simplicity and subscription-based pricing to minimize upfront investment. Finally, end-user industries from financial services and healthcare to manufacturing and retail are customizing integration workflows to meet sector-specific requirements, underscoring the versatility of modern IPaaS solutions.

This comprehensive research report categorizes the Integration-Platform-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Connectivity

- Deployment

- Organization Size

- Application

- End-User Industry

Examining Regional Adoption Patterns and Regulatory Influences Shaping Integration Platform Strategies Around the Globe

Regional dynamics in the IPaaS arena reflect distinct cloud adoption rates, regulatory landscapes, and digital transformation maturity levels. In the Americas, advanced cloud marketplaces and a strong ecosystem of system integrators have created fertile ground for IPaaS growth, particularly as enterprises seek to consolidate multiple SaaS subscriptions under unified integration governance. Meanwhile, data residency regulations in certain jurisdictions have encouraged hybrid models that combine domestic edge nodes with global cloud services.

Across Europe, the Middle East, and Africa, regulatory frameworks such as GDPR and emerging data sovereignty laws are compelling organizations to implement granular access controls and localized integration nodes. Public sector modernization projects in the region are driving investments in government cloud platforms, with integration capabilities serving as critical connectors between citizen services and back-end systems. In the Asia-Pacific region, high-growth markets are characterized by a surge in mobile-first applications, digital payments, and IoT deployments. As a result, integration platforms that offer robust API management and event streaming capabilities are in high demand. Furthermore, regional partnerships between local technology providers and global IPaaS vendors are creating hybrid solutions tailored to emerging market needs.

This comprehensive research report examines key regions that drive the evolution of the Integration-Platform-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Decoding How Vendor Partnerships, Acquisitions, and Platform Innovation Are Driving Competitive Advantage in the IPaaS Sector

Leading IPaaS providers are advancing their platforms through continuous innovation in areas such as API management, event-driven architecture, and embedded analytics. Strategic alliances between integration vendors and cloud hyperscalers have become commonplace, enabling seamless provisioning of integration services within public cloud marketplaces. Meanwhile, partnerships with systems integrators and managed service providers are expanding go-to-market reach and accelerating complex implementations for large-scale enterprises.

Competitive dynamics are further influenced by acquisitions and mergers, as established vendors bolster their portfolios with niche integration and data transformation startups. Simultaneously, disruptors are entering the market with specialized offerings focused on real-time streaming, low-code orchestration, and embedded AI-driven mapping. This diverse vendor ecosystem challenges buyers to carefully evaluate integration use cases, scalability requirements, and total cost of ownership. Additionally, vendor roadmaps now emphasize governance frameworks, security certifications, and compliance with emerging standards, reflecting the increasing importance of risk mitigation in integration architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Integration-Platform-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Boomi, Inc.

- Celigo

- Fivetran

- IBM Corporation

- Informatica LLC

- Jitterbit

- Microsoft Corporation

- MuleSoft, LLC

- Oracle Corporation

- SAP SE

- SnapLogic, Inc.

- Talend

- TIBCO Software Inc.

- Tray.io

- Workato, Inc.

Implementing a Hybrid Integration Blueprint with Embedded Governance and Cost Alignment to Unlock Sustainable Operational Agility

Industry leaders should prioritize a hybrid integration strategy that balances cloud-native agility with on-premises control for critical workloads. Embracing a shift-left approach to security and governance ensures that policies are embedded in integration templates and pipelines from the outset, reducing risk and accelerating compliance. Moreover, adopting a consumption-based licensing model can align costs with actual usage, enabling financial predictability amidst tariff volatility and shifting demand.

To maximize value, organizations must establish a Center of Excellence for integration practice, staffed with cross-functional experts who can define best practices, develop reusable assets, and drive continuous improvement. Investing in training programs for citizen integrators and professional developers alike will democratize integration capabilities and foster a culture of collaboration. Finally, evaluating vendor roadmaps for AI-enhanced features and container-native support will secure long-term flexibility, enabling seamless adaptation to evolving technology trends and business objectives.

Outlining a Two-Tiered Research Framework Combining Comprehensive Secondary Analysis with Rigorous Expert Interviews

This research leverages a two-pronged methodology combining rigorous secondary and primary research techniques. Initial secondary analysis encompassed a comprehensive review of industry publications, vendor documentation, white papers, and regulatory filings to map the current IPaaS ecosystem and identify emerging technology trends. Following this, primary research involved structured interviews with thirty CIOs, integration architects, and technology executives across diverse industry verticals to validate insights and capture firsthand experiences.

Data points were triangulated through proprietary frameworks that benchmark integration maturity across service, connectivity, and deployment dimensions. Regional adoption patterns were corroborated with publicly available trade data and regulatory reports. Vendor landscape analysis integrated financial reports, press releases, and patent filings to assess innovation trajectories. Throughout, stringent quality checks and peer reviews ensured accuracy, consistency, and relevance of findings, delivering a robust foundation for actionable recommendations and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Integration-Platform-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Integration-Platform-as-a-Service Market, by Service

- Integration-Platform-as-a-Service Market, by Connectivity

- Integration-Platform-as-a-Service Market, by Deployment

- Integration-Platform-as-a-Service Market, by Organization Size

- Integration-Platform-as-a-Service Market, by Application

- Integration-Platform-as-a-Service Market, by End-User Industry

- Integration-Platform-as-a-Service Market, by Region

- Integration-Platform-as-a-Service Market, by Group

- Integration-Platform-as-a-Service Market, by Country

- United States Integration-Platform-as-a-Service Market

- China Integration-Platform-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding with a Strategic Vision for Embedding Integration as a Core Enabler of Enterprise Agility and Innovation

Integration-Platform-as-a-Service has become an indispensable catalyst for enterprise digital transformation. By unifying disparate systems, automating workflows, and enabling real-time data synchronization, IPaaS platforms empower organizations to respond swiftly to market changes and customer demands. The convergence of hybrid cloud architectures, AI-driven automation, and low-code integration tools underscores a future where integration is not merely a technical enabler but a strategic differentiator.

As trade policies and technological advancements continue to reshape the landscape, enterprises must remain vigilant in selecting flexible, secure, and scalable integration solutions. Success will hinge on the ability to weave integration capabilities into the fabric of business processes, governance structures, and innovation pipelines. This report’s insights into segmentation, regional trends, vendor dynamics, and actionable strategies offer a comprehensive blueprint for navigating the complexities of the IPaaS market and driving sustained competitive advantage.

Reach Out to Ketan Rohom for Exclusive Access to a Comprehensive Integration-Platform-as-a-Service Market Research Report

To obtain the comprehensive Integration-Platform-as-a-Service market research report and unlock strategic intelligence for guiding your next initiatives, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in delivering tailored insights and solutions will ensure you gain a deep understanding of market dynamics, competitive positioning, and growth opportunities. Contact Ketan Rohom today to explore pricing, customization options, and the value that this report can bring to your organization’s strategic planning and execution.

- How big is the Integration-Platform-as-a-Service Market?

- What is the Integration-Platform-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?