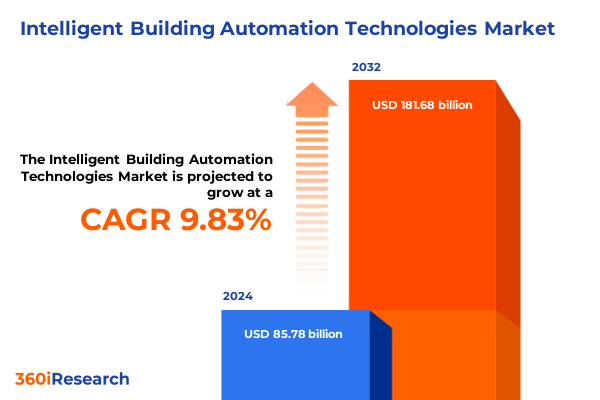

The Intelligent Building Automation Technologies Market size was estimated at USD 93.72 billion in 2025 and expected to reach USD 102.41 billion in 2026, at a CAGR of 9.91% to reach USD 181.68 billion by 2032.

Unveiling the Power of Intelligent Building Automation Transforming Facilities into Connected Efficient and Future Proof Ecosystems through Advanced Technologies

Intelligent building automation represents a transformational convergence of digital technologies, advanced control systems, and data-driven decision-making frameworks designed to optimize the performance of modern facilities. By integrating disparate subsystems-such as HVAC, lighting, security, and energy management-into a unified platform, organizations can achieve unprecedented levels of operational efficiency and occupant comfort. This holistic approach not only streamlines building operations but also establishes a foundation for continuous improvement through real-time analytics and automated responses to evolving environmental conditions.

Central to this evolution is the incorporation of Internet of Things (IoT) devices and edge computing nodes, which collect granular data on occupancy patterns, energy consumption, and system performance at the source. When combined with artificial intelligence and machine learning algorithms, these data streams enable predictive maintenance, adaptive control strategies, and scenario-based simulations that preemptively address inefficiencies and equipment failures. The result is a dynamic environment that continually self-optimizes, reducing downtime and operational costs while enhancing tenant satisfaction.

The driving forces behind the adoption of intelligent building automation include stringent sustainability mandates, rising energy costs, and an intensified focus on occupant health and well-being. As regulatory bodies and industry standards increasingly prioritize carbon reduction and indoor environmental quality, facility managers and real estate developers are turning to automation solutions as a means to achieve compliance and demonstrate corporate responsibility. Consequently, the intelligent building automation landscape is poised for accelerated growth, fueled by the dual imperatives of environmental stewardship and economic performance.

Emerging Paradigm Shifts Redefining Intelligent Building Automation with AI IoT Edge Computing Digital Twin and Tenant Centric Designs for Next Generation Spaces

The intelligent building automation sector is undergoing a paradigm shift driven by the integration of AI-driven analytics, which transforms traditional reactive maintenance models into proactive strategies. By harnessing machine learning to identify patterns in historical data, facilities can now anticipate equipment degradation and schedule interventions before critical failures occur. This proactive stance not only extends asset lifecycles but also optimizes resource allocation, minimizing both energy consumption and unplanned downtime.

Another transformative force is the rise of digital twin technology, which creates virtual replicas of physical building systems to simulate performance under varied conditions. Facility managers can use these digital twins to conduct scenario planning-testing control algorithms, energy management strategies, or emergency response protocols in a risk-free environment. The insights gained from this simulation-driven approach accelerate innovation cycles and enhance decision-making accuracy, ultimately delivering improved operational outcomes and occupant experiences.

Moreover, the convergence of hybrid edge-cloud architectures is redefining data processing and control hierarchies. By distributing intelligence between centralized cloud platforms and localized edge devices, building systems achieve both swift real-time responsiveness and deep portfolio-wide analytics. This dual-capacity model ensures critical functions-such as security protocols or HVAC adjustments-continue uninterrupted even during connectivity disruptions, while macro-level insights inform long-term strategic optimization.

Assessing the Cumulative Impact of Recent U S Tariffs on Intelligent Building Automation Components Supply Chains and Market Dynamics in 2025

In 2025, the cumulative impact of U.S. tariffs on intelligent building automation technologies has manifested through a tapestry of cost pressures, supply chain realignments, and strategic pivots among leading manufacturers. Tariffs of up to 54% on Chinese imports and levies on European and Canadian components have elevated input costs for control devices, sensors, actuators, and relays, leading to an average 5%–15% increase in hardware production expenses. This heightened cost environment has prompted companies to recalibrate pricing models and absorb margins to maintain competitive positioning.

Beyond pricing implications, these trade measures have induced prolonged lead times and fragmented procurement processes. Organizations reliant on just-in-time inventory models have grappled with customs delays and logistical bottlenecks, disrupting project timelines for large-scale commercial and industrial deployments. In response, integration specialists have diversified their supplier bases, evaluating alternative components from tariff-exempt regions in Southeast Asia and Latin America, while also fortifying engineering plans to accommodate modular substitutions without compromising system interoperability.

Simultaneously, the tariffs have catalyzed a resurgence in domestic manufacturing investments. Industry giants such as ABB have committed upward of $120 million to expand local production facilities in Tennessee and Mississippi, aiming to achieve over 90% U.S.-based output for critical low-voltage electrical equipment. This strategic onshoring not only mitigates tariff-related risks but also enhances supply chain resilience, reducing exposure to global disruptions and ensuring continuity of service for time-sensitive projects.

Yet, this landscape of opportunity is tempered by the challenges confronting smaller firms and innovative startups. Capital-intensive efforts to establish domestic production lines require significant workforce training and extended lead times, potentially delaying the introduction of next-generation wireless sensors, advanced analytics platforms, and energy optimization software. The result is a bifurcated market where established players leverage scale and diversified supply chains, while emerging companies must navigate financial constraints and strategic partnerships to survive and thrive.

Revealing Key Segmentation Insights That Drive Tailored Strategies in Intelligent Building Automation across Components Connectivity Applications and End Users

A nuanced understanding of component-based segmentation reveals that the hardware spectrum-encompassing control devices, sensors, actuators, and switches-serves as the foundational investment tier, with specialized offerings such as smart relays and intelligent metering unlocking incremental value streams. Parallel to this, the services domain bifurcates into professional expertise and managed services, where design consultancy, system integration, and ongoing operational support converge to ensure system efficacy and client satisfaction. Complementing these layers, solutions spanning building management systems, data analytics platforms, energy management suites, security and access control, and smart lighting create holistic frameworks that adapt to fluctuating operational demands. Connectivity paradigms further enrich this landscape, as wired infrastructures coexist with wireless networks leveraging Bluetooth, Wi-Fi, and Zigbee protocols to deliver differential scalability, installation flexibility, and data throughput characteristics.

Application-centric segmentation underscores the multifaceted utility of automation technologies across building comfort and occupancy management, energy optimization, HVAC control and monitoring, lighting orchestration, fault detection and maintenance workflows, security surveillance, and environmental sustainability tracking. Within each use case, data-driven insights and predictive algorithms shutter inefficiencies and unlock cost savings, thus driving continuous upgrades and system proliferations across new and retrofitted facilities.

When examined through the lens of end-user profiles, the commercial sector-spanning hotels, office complexes, and retail environments-commands prominent adoption, attracted by the dual promise of enhanced guest experiences and operational economies. Industrial settings, notably manufacturing plants and warehouses, prioritize reliability and uptime, investing in automation to minimize disruptions and optimize throughput. Institutional facilities, including healthcare and education, leverage automation for safety compliance and occupant welfare, while the residential segment explores convergent smart-home integrations, binding comfort, security, and energy management into cohesive living experiences.

This comprehensive research report categorizes the Intelligent Building Automation Technologies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Application

- End-User

Illuminating Regional Dynamics Shaping the Intelligent Building Automation Market Trajectories across the Americas EMEA and Asia Pacific Ecosystems

In the Americas, technological adoption is buoyed by significant infrastructure modernization initiatives and robust investment flows into smart city frameworks. Federal and state-level policies incentivize retrofit programs, while utility rebate schemes catalyze upgrades in commercial real estate portfolios. These drivers collectively foster an environment where cloud-based building management systems and AI-powered energy optimization platforms gain traction, empowering facility operators to meet stringent energy codes and sustainability benchmarks.

Across Europe, the Middle East, and Africa, regulatory rigor and environmental mandates form the cornerstone of market growth. The European Union’s Energy Performance of Buildings Directive compels building owners to adopt automation solutions that deliver measurable reductions in carbon footprint, while Middle Eastern smart city projects emphasize occupant comfort and resource conservation. Africa’s urbanization trends and emerging digital ecosystems present a burgeoning opportunity for modular, scalable automation deployments that can leapfrog legacy infrastructures, delivering resilience in the face of climatic and demographic challenges.

In the Asia-Pacific region, rapid urban expansion and a tranche of government-led smart city programs underpin the accelerated uptake of intelligent automation. Nations such as China, India, and Singapore are channeling capital into next-generation grids and sustainable building frameworks, driving demand for integrated platforms that harmonize renewable energy assets with HVAC and lighting systems. This confluence of urban density, policy support, and technological innovation establishes APAC as a dynamic frontier for scalable, interoperable building automation deployments.

This comprehensive research report examines key regions that drive the evolution of the Intelligent Building Automation Technologies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leaders and Innovators Driving Intelligent Building Automation Technologies with Strategic Investments Partnerships and Disruptive Solutions

Market leadership emanates from established conglomerates that leverage extensive R&D budgets, global manufacturing footprints, and deep domain expertise to deliver end-to-end automation suites. Companies such as Honeywell International, Siemens AG, and Schneider Electric have fortified their positions by integrating advanced analytics and cybersecurity layers into their building management offerings, enabling seamless interoperability across multi-vendor environments. Johnson Controls and ABB further distinguish themselves through strategic acquisitions and localized production expansions that mitigate trade policy impacts while sustaining innovation pipelines.

In parallel, technology-centric entrants like Cisco Systems and IBM are harnessing their networking and data analytics prowess to penetrate the building automation space, offering platform-agnostic solutions that coalesce IT/OT convergence. These players emphasize cloud-native architectures, API-first designs, and outcome-based service models, challenging traditional hardware-heavy paradigms and ushering in subscription-based revenue streams.

Emerging specialists focus on niche enhancements, including digital twin development, edge AI modules, and occupant-centric wellness platforms. While operating at a smaller scale, these disruptors accelerate market evolution by proving new use cases, forging partnerships with systems integrators, and attracting venture investments that validate the long-term value of specialized automation capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intelligent Building Automation Technologies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 75F, Inc.

- ABB Ltd.

- Amazon Web Services, Inc.

- Analog Devices, Inc.

- Azbil Corporation

- Beckhoff Automation GmbH & Co. KG

- BELIMO Holding AG

- Carrier Global Corporation

- Cisco Systems, Inc.

- Delta Electronics, Inc.

- Ecosave LLC

- GEZE GmbH

- Hitachi, Ltd.

- Honeywell International Inc.

- Hubbell Incorporated

- Intelligent Buildings, LLC

- Johnson Control International PLC

- Kieback&Peter GmbH & Co. KG

- Lynxspring, Inc.

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Priva Holding B.V.

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Sauter Controls GmbH

- Schneider Electric SE

- Siemens AG

- Trane Technologies Company, LLC

- Wipro Limited

- Zoho Corporation Pvt. Ltd.

Actionable Industry Recommendations for Leveraging Intelligent Building Automation Innovations to Enhance Efficiency Sustainability and Competitive Advantage

Industry leaders should prioritize the development of modular, interoperable platforms that accommodate evolving protocol standards and third-party integrations. By adopting an open-architecture mindset, organizations can accelerate deployment cycles, reduce vendor lock-in, and unlock ecosystem value through seamless data sharing across energy, security, and space-management domains.

Investing in hybrid edge-cloud infrastructures offers a dual advantage: real-time local control ensures operational continuity during connectivity lapses, while cloud-based analytics drive strategic insights at portfolio scale. This architectural balance not only enhances system resilience but also enables tiered service offerings-from basic monitoring to advanced predictive maintenance subscriptions.

To navigate tariff-induced cost pressures, stakeholders must diversify supply chains by qualifying alternative component sources and expanding domestic manufacturing partnerships. Simultaneously, expanding value-added services such as managed analytics, cybersecurity audits, and performance-based contracting can offset hardware margin compression and foster deeper client engagement.

Finally, cultivating cross-sector collaborations-spanning utilities, technology vendors, and regulatory bodies-will amplify collective capabilities in demand response, renewable integration, and occupant health initiatives. By shaping industry consortia and participating in standards bodies, automation providers can influence policy frameworks and accelerate the adoption of uniform interoperability guidelines.

Describing a Robust Research Methodology Integrating Primary Intelligence Secondary Analysis and Data Triangulation to Ensure Market Insights Accuracy

This analysis synthesized insights through a multi-layered research framework combining primary interviews with technology executives, facility managers, and policy experts, supplemented by secondary data gathered from industry publications, regulatory databases, and academic research. Structured discussions with C-suite leaders and systems integrators validated market drivers, use cases, and technology adoption barriers in real-world deployments.

Secondary research encompassed public filings, technical white papers, and patent analyses to map innovation trajectories and competitive positioning. Data triangulation techniques cross-verified quantitative inputs-such as investment trends and tariff schedules-with qualitative perspectives, ensuring consistency and reliability in thematic conclusions.

An iterative validation process involved peer reviews from subject-matter experts in IoT platform development, AI-driven analytics, and cybersecurity for building control systems. This collaborative approach bolstered the report’s accuracy and relevance, providing decision-makers with a robust foundation of evidence to guide strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intelligent Building Automation Technologies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intelligent Building Automation Technologies Market, by Component

- Intelligent Building Automation Technologies Market, by Connectivity

- Intelligent Building Automation Technologies Market, by Application

- Intelligent Building Automation Technologies Market, by End-User

- Intelligent Building Automation Technologies Market, by Region

- Intelligent Building Automation Technologies Market, by Group

- Intelligent Building Automation Technologies Market, by Country

- United States Intelligent Building Automation Technologies Market

- China Intelligent Building Automation Technologies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding the Strategic Imperatives for Intelligent Building Automation Adoption to Unlock Operational Excellence Sustainability and Future Ready Infrastructure

In conclusion, intelligent building automation stands at the nexus of digital innovation, sustainability imperatives, and evolving occupant expectations. The convergence of AI, IoT, edge computing, and open-architecture platforms is forging an era where buildings transform from static assets into adaptive, self-optimizing ecosystems.

Amid evolving trade dynamics and tariff regimes, strategic onshoring and supply chain diversification emerge as critical enablers of resilience. Meanwhile, modular service models and outcome-based contracts foster new revenue streams, aligning vendor incentives with operational performance improvements.

As regional markets advance-driven by regulatory rigors in EMEA, infrastructure investments in the Americas, and rapid urbanization in APAC-industry participants must embrace a global perspective while tailoring solutions to local nuances. By championing interoperability, fostering partnerships, and anchoring offerings in tangible value creation, automation providers can secure a leadership position in this dynamic landscape.

Connect with Ketan Rohom to Gain Exclusive Access to In-Depth Market Research Insights on Intelligent Building Automation and Drive Informed Decision-Making

Are you ready to elevate your strategic planning and operational performance with unparalleled insights into intelligent building automation technologies? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to explore how our comprehensive report can empower you to stay ahead of market shifts and capitalize on emerging opportunities. Engage with Ketan to discuss tailored research solutions that address your specific challenges-from optimizing system integration and enhancing energy efficiency to navigating tariff-driven supply chain dynamics. Act now to secure your copy of this essential market intelligence, and transform data into decisive action that drives innovation, resilience, and sustainable growth in your organization.

- How big is the Intelligent Building Automation Technologies Market?

- What is the Intelligent Building Automation Technologies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?