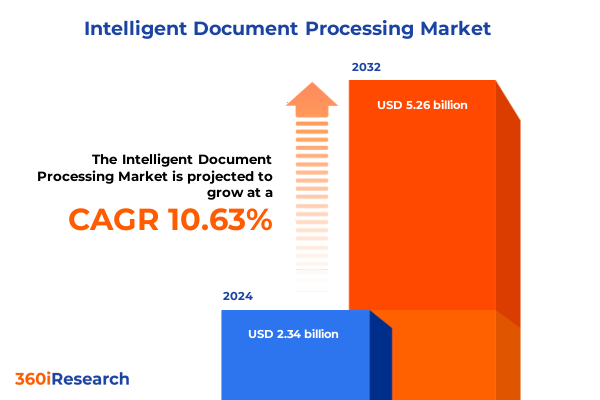

The Intelligent Document Processing Market size was estimated at USD 2.56 billion in 2025 and expected to reach USD 2.80 billion in 2026, at a CAGR of 10.81% to reach USD 5.26 billion by 2032.

Revealing the strategic imperative of intelligent document processing in accelerating enterprise efficiency and competitive advantage

The rapid proliferation of digital data has made legacy document management methods untenable. Organizations across verticals are confronting unprecedented volumes of unstructured content, from invoices and purchase orders to tax and shipping documents. This influx of information underscores a pressing need for solutions that transcend traditional optical character recognition and rule-based processing. As enterprises strive for operational excellence, intelligent document processing emerges as a strategic linchpin for enhancing accuracy, accelerating workflows, and mitigating compliance risk.

In this context, the current executive summary delineates the transformative potential of intelligent document processing within the broader digital transformation journey. It sets the stage by exploring the macro drivers propelling adoption, including the quest for real-time insights, cost containment pressures, and evolving regulatory landscapes. By framing the discussion around key market dynamics and segment-specific nuances, this introduction offers a foundational perspective that informs subsequent sections. Ultimately, it positions intelligent document processing not merely as a tactical tool, but as a catalyst for sustainable competitive advantage, empowering stakeholders to extract actionable intelligence from every page of content they encounter.

Exploring how AI, cloud, and hybrid workflows are revolutionizing document management across modern enterprises

The landscape of document-centric operations has undergone profound transformation in recent years. What began as isolated pilot projects has evolved into enterprise-wide deployments, fueled by advances in artificial intelligence, cognitive automation, and cloud-native architectures. Unlike early iterations that relied on manual rule-writing and rigid workflows, modern platforms leverage machine learning and natural language understanding to adapt dynamically to diverse document formats and languages.

Furthermore, the rise of hybrid work models has intensified expectations for seamless, remote access to critical information. In response, vendors are embedding collaboration features and robust security controls to ensure that sensitive financial statements or healthcare records remain protected across disparate environments. Additionally, the convergence of intelligent document processing with adjacent technologies, such as robotic process automation and data analytics, is creating end-to-end pipelines that transform raw documents into strategic data assets. These transformative shifts are not abstract possibilities but realities reshaping how organizations conceive of and execute document-driven processes.

Assessing the impact of evolving US tariff policies on procurement costs and deployment strategies for document solutions

In 2025, a series of tariff adjustments in the United States have had a cumulative effect on the cost structure and operational strategies of solutions providers and end users alike. By imposing higher duties on imported scanning hardware, imaging components, and certain specialized software licenses, these tariffs have contributed to elevated procurement expenses. As a result, some vendors have reevaluated their supply chains, exploring nearshoring options or partnerships with domestic manufacturers to mitigate cost increases and potential disruptions.

Moreover, the ripple effects extend beyond hardware. Providers with on-premise deployments have faced additional expenditures for maintenance and warranty services, as replacement parts also fall under tariff classifications. Conversely, cloud-based offerings have benefited from amortized capital expenditure but must contend with the underlying infrastructure costs that are partially derived from hardware subject to levies. Consequently, there has been a discernible shift toward subscription-based models that transfer capital outlays to operational budgets, preserving budget flexibility. These dynamics underscore the necessity for stakeholders to monitor trade policies and adopt agile procurement strategies to sustain momentum in their intelligent document processing initiatives.

Analyzing how component, deployment, organizational, industry, and document type dimensions shape tailored intelligent document processing strategies

The intelligent document processing market exhibits multifaceted segmentation that informs targeted solution deployments. Within the component dimension, two primary categories emerge: services and solutions. Services encompass managed and professional offerings, each delivering tailored expertise in implementation, customization, and ongoing support. Meanwhile, solutions span document capture, classification, intelligent character recognition, optical character recognition, as well as semantic indexing and processing-technologies that work in concert to extract and contextualize data from complex documents.

When considering deployment type, the divide between cloud and on-premise installations reflects divergent organizational priorities regarding scalability, security, and upfront investment. Cloud deployments deliver rapid elasticity and lower initial capital requirements, whereas on-premise setups offer tighter control over sensitive information and integration with legacy systems. The scale of deployment further bifurcates according to organization size, where large enterprises typically pursue expansive, multi-country rollouts while small and medium-sized enterprises prioritize agility and cost efficiency.

The nuances become even more pronounced across end-user industries such as banking, financial services and insurance, government, healthcare and life sciences, IT and telecom, manufacturing, and retail, each with distinct document profiles and compliance mandates. Moreover, document type segmentation-including financial statements, invoices, purchase orders, receipts, shipping documents, and tax filings-drives use cases that range from automated invoice processing in retail supply chains to risk assessment in financial audits. Together, these segmentation insights reveal a landscape where tailored strategies are paramount to achieving process excellence.

This comprehensive research report categorizes the Intelligent Document Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Document Type

- Deployment Type

- End-User Industry

Mapping divergent adoption patterns and regulatory influences across the Americas, EMEA, and Asia-Pacific for document automation

Regional adoption patterns of intelligent document processing reveal distinct trajectories across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, organizations are accelerating investments in cloud-first strategies, driven by robust digital transformation roadmaps within banking and retail sectors. Mature regulatory frameworks and advanced IT infrastructures facilitate the integration of advanced capture and classification engines, enabling streamlined accounts payable and contract management processes.

Across Europe, Middle East & Africa, the emphasis is on data sovereignty and compliance with evolving privacy regulations. Public sector entities and large corporations in Western Europe are deploying hybrid architectures that balance on-premise security with cloud scalability. Concurrently, emerging markets within the region are leapfrogging legacy systems, favoring mobile-enabled document capture solutions to drive financial inclusion and citizen services.

In Asia-Pacific, surging demand for automation in manufacturing and healthcare is propelling adoption. Organizations in developed economies have embraced intelligent character recognition and semantic processing to meet stringent quality control and patient record management standards. Meanwhile, developing markets are adopting cost-effective managed services to overcome skill shortages and infrastructure constraints, underscoring a broadening competitive landscape across diverse economies.

This comprehensive research report examines key regions that drive the evolution of the Intelligent Document Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the competitive dynamics among incumbents, specialists, and channel partners driving market innovation and consolidation

Leading providers in the intelligent document processing arena are distinguished by their technology portfolios, partner ecosystems, and go-to-market agility. Established incumbents have deep domain expertise, offering holistic suites that integrate capture, AI-driven classification, and semantic processing within larger enterprise content management frameworks. These organizations frequently collaborate with global systems integrators to deliver turnkey solutions to large multinational clients.

Conversely, emerging specialists are carving out niches by focusing on advanced machine learning models optimized for high-volume invoice and purchase order processing or by offering API-first platforms that seamlessly embed into existing enterprise resource planning systems. Partnerships with cloud hyperscalers and analytics vendors further bolster their value proposition, enabling rapid deployment and continuous improvement through data-driven model training.

Across the competitive landscape, there is a trend toward consolidation as strategic acquirers seek to augment their portfolios with complementary capabilities, particularly in areas such as natural language understanding and workflow orchestration. At the same time, channel partnerships continue to expand, creating a diverse marketplace where end users can select from on-premise, hybrid, or cloud-native deployments to align with their specific operational and compliance requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intelligent Document Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABBYY Software Ltd

- Automation Anywhere, Inc

- Google LLC

- Hyland Software, Inc

- International Business Machines Corporation

- Kofax Inc

- Microsoft Corporation

- OpenText Corporation

- Parascript LLC

- UiPath

- UiPath Inc

Guiding enterprises to align objectives, architectures, and cross-functional collaboration for sustainable process automation success

For organizations seeking to harness the full potential of intelligent document processing, several actionable imperatives emerge. Firstly, aligning technology adoption with clearly defined business objectives ensures that initiatives deliver measurable outcomes, whether in reduced processing times, error rates, or compliance penalties. It is essential to establish governance frameworks that oversee model performance, data privacy, and change management, thereby safeguarding stakeholder trust and operational consistency.

Secondly, investing in cloud-native architectures can accelerate time to value by leveraging managed services, built-in scalability, and continuous feature updates. However, a hybrid deployment strategy may be warranted for highly regulated environments, combining on-premise security controls with the agility of cloud services. Thus, decision-makers should evaluate total cost of ownership holistically, incorporating both capital and operational expenditures.

Finally, fostering cross-functional collaboration between IT, operations, and compliance teams is critical. Upskilling staff through targeted training programs and establishing centers of excellence will drive sustained adoption and innovation. By integrating intelligent document processing with broader automation ecosystems such as robotic process automation and analytics platforms, organizations can unlock end-to-end efficiency gains and transform static documents into strategic data assets.

Detailing a comprehensive research methodology integrating primary interviews, quantitative surveys, and rigorous data validation processes

The insights presented in this summary are grounded in a rigorous methodology that combines primary and secondary research. Initially, syndicated literature and peer-reviewed publications were analyzed to map the evolution of intelligent document processing technologies and to identify emerging trends. Concurrently, structured interviews were conducted with senior executives, solution architects, and industry analysts to capture firsthand perspectives on deployment challenges and success factors.

Quantitative data was obtained from proprietary surveys administered to end users across multiple verticals, encompassing both large enterprises and small-to-medium organizations. Responses were validated through data triangulation, cross-referencing with publicly available case studies and vendor disclosures. Competitive intelligence was garnered through analysis of annual reports, partnership announcements, and patent filings, providing a comprehensive view of the market’s innovation pipeline.

Finally, all findings underwent a multi-stage quality assurance process involving methodological reviews, statistical validation, and internal peer audits. This approach ensures that the conclusions and recommendations are robust, replicable, and aligned with the strategic imperatives facing organizations today.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intelligent Document Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intelligent Document Processing Market, by Component

- Intelligent Document Processing Market, by Organization Size

- Intelligent Document Processing Market, by Document Type

- Intelligent Document Processing Market, by Deployment Type

- Intelligent Document Processing Market, by End-User Industry

- Intelligent Document Processing Market, by Region

- Intelligent Document Processing Market, by Group

- Intelligent Document Processing Market, by Country

- United States Intelligent Document Processing Market

- China Intelligent Document Processing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing the evolution, strategic considerations, and holistic alignment required to maximize value from document intelligence

In summary, intelligent document processing has transcended its origins as a niche automation tool to become a strategic enabler for enterprises navigating complex content environments. The convergence of advanced AI capabilities with flexible deployment models is empowering organizations to transform unstructured data into actionable intelligence, driving operational efficiencies and competitive differentiation.

However, as the market matures, stakeholders must remain vigilant in adapting to evolving trade policies, regulatory frameworks, and technological advancements. By leveraging segmentation insights and regional adoption patterns, decision-makers can tailor solutions to their unique requirements. Moreover, the growing convergence of document intelligence with broader automation ecosystems underscores the importance of holistic strategies, ensuring that investments in intelligent document processing yield sustainable value over time.

Ultimately, success in this dynamic landscape depends on a clear alignment between technology selection, organizational readiness, and strategic objectives. Enterprises that embrace this integrated approach will be well-positioned to harness the full potential of intelligent document processing, turning every document into a competitive asset.

Unlock tailored strategic intelligence by partnering with Ketan Rohom for your personalized market research acquisition

Elevate decision-making by securing the comprehensive market research report from Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to access an in-depth analysis tailored to your strategic priorities, and benefit from customizable insights that will inform your roadmap for intelligent document processing. Accelerate your competitive edge through personalized consultation, and equip your organization with the intelligence necessary to thrive in a dynamic environment. Reach out today to transform your document workflows with data-driven clarity tailored to your unique business landscape.

- How big is the Intelligent Document Processing Market?

- What is the Intelligent Document Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?