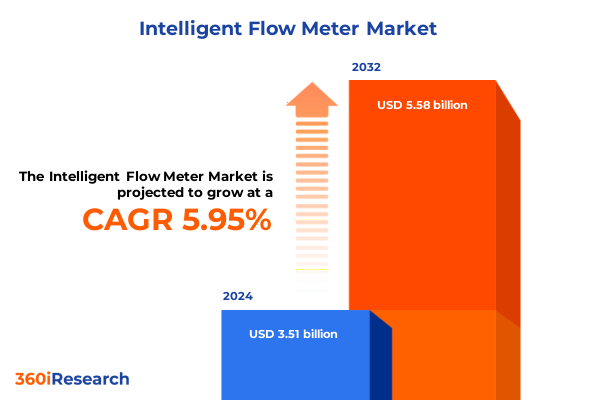

The Intelligent Flow Meter Market size was estimated at USD 3.66 billion in 2025 and expected to reach USD 3.83 billion in 2026, at a CAGR of 6.19% to reach USD 5.58 billion by 2032.

Unveiling the Critical Market Forces and Technological Catalysts Driving Intelligent Flow Meter Solutions for Industrial Efficiency and Sustainability

The introduction to intelligent flow meter solutions sets the stage for understanding how digital innovation has reshaped fluid measurement across industrial operations worldwide. At its core, the intelligent flow meter merges traditional sensing mechanisms with embedded computing power, enabling real-time analytics, advanced diagnostics, and seamless integration into supervisory control and data acquisition ecosystems. This convergence of hardware and software not only increases measurement accuracy but also reduces operational downtime by predicting maintenance needs and facilitating remote configuration adjustments.

As industries progress toward Industry 4.0 paradigms, the demand for instrumentation that provides both precision and connectivity continues to intensify. Today’s flow meters are expected to communicate critical process parameters instantaneously to centralized control systems or cloud platforms, fostering data-driven decision making and optimizing resource allocation. Consequently, organizations are prioritizing the replacement of legacy mechanical meters with smart devices that deliver continuous performance tracking and adaptive calibration algorithms.

Furthermore, regulatory requirements surrounding environmental compliance and energy efficiency are elevating the importance of transparent, auditable data streams. Intelligent flow meters thus serve as foundational components in sustainability initiatives, enabling companies to demonstrate adherence to stringent emissions and water usage standards. In essence, the introduction to this market reflects a transformative shift from passive measurement tools to active participants in industrial workflows, poised to drive productivity gains and long-term resilience.

Exploring the Pivotal Technological, Regulatory, and Market Shifts Reshaping Intelligent Flow Meter Adoption Across Diverse Industrial Sectors

The landscape of intelligent flow meter adoption is being reshaped by a confluence of technological innovations, shifting regulatory frameworks, and evolving end-user priorities. Over the past two years, advancements in edge computing hardware and low-power microprocessor design have significantly enhanced the on-board data processing capabilities of flow meters, enabling sophisticated algorithms to run directly on the sensor module. As a result, edge-based analytics now facilitate anomaly detection and self-calibration routines without continuous cloud connectivity, reducing latency and ensuring uninterrupted operation even in remote installations.

Simultaneously, regulatory authorities in key markets have introduced digital reporting mandates, compelling firms to maintain verifiable logs of fluid handling operations. This has spurred a wave of retrofitting projects, where traditional flow meters are paired with smart transmitters and communication modules to meet audit requirements. Moreover, the drive toward lower carbon footprints and water conservation has intensified focus on leak detection and efficiency optimization, positioning intelligent flow meters as dual-purpose tools for compliance and cost savings.

On the market side, strategic partnerships between instrumentation manufacturers and industrial IoT platform providers have accelerated the rollout of integrated solutions that combine hardware, software, and analytics services. This ecosystem approach is fostering vendor consolidation, as end users prefer turnkey offerings over fragmented component sourcing. Looking ahead, the interplay between evolving digital technologies, legislative drivers, and collaborative business models will continue to sculpt the intelligent flow meter landscape, setting new benchmarks for performance and interoperability.

Analyzing How Recent United States Tariffs Enacted in 2025 Have Altered Supply Chains, Cost Structures, and Competitive Strategies in the Intelligent Flow Meter Market

The introduction of new tariffs by the United States government in early 2025 has had a pronounced effect on the economics and strategies of intelligent flow meter providers and end users alike. By imposing additional duties on imported industrial automation components, including sensor elements and communication modules, average landed costs for complete flow meter assemblies have increased by an estimated eight to twelve percent. This cost inflation has reverberated through supply chains, prompting many original equipment manufacturers to reevaluate their global sourcing strategies and negotiate volume discounts with domestic suppliers to mitigate financial exposure.

As a consequence, a notable supply chain realignment is underway, with several manufacturers expanding production capacity within North America to avoid punitive tariff barriers. This localization trend has improved lead-times for critical components, yet it has also required substantial capital investment to establish compliant manufacturing footprints. From the end-user perspective, increased equipment costs have accelerated the shift toward longer asset lifecycles and performance-based service contracts, as maintenance providers deliver proactive monitoring to justify elevated initial expenditures.

Competitive dynamics have also shifted, with vendors that had previously relied on low-cost offshore production facing margin contraction. In contrast, companies with established domestic operations have leveraged their proximity advantage to secure new contracts with utilities and process industries, where total cost of ownership considerations now favor reduced logistical complexity. Ultimately, the cumulative impact of the 2025 tariffs reinforces the strategic importance of supply chain resilience and cost optimization in sustaining growth within the intelligent flow meter market.

Uncovering Strategic Insights from Segmenting the Intelligent Flow Meter Market by Type, Communication Technology, Installation, Measurement Range, and End User Industries

A nuanced understanding of market segmentation reveals the diversity of solution sets and the tailored value propositions required to address distinct customer requirements. When considering meter type, the range extends from high-precision mass flow measurement enabled by Coriolis technology and the robust performance of Magnetic sensors in corrosive or conductive fluids to the volumetric reliability of Positive Displacement meters. Turbine meters continue to serve high-speed liquid applications, while Ultrasonic devices offer non-invasive measurement capabilities. Vortex meters, leveraging vortex shedding principles, provide an economical option for steam and gas flow analysis.

Turning to communication technology, wired installations incorporate standardized protocols such as Ethernet for high-speed data transfer, Fieldbus systems for deterministic network performance, and industry-specific interfaces like HART and Modbus that facilitate seamless integration with existing distributed control systems. Conversely, wireless architectures capitalize on protocols such as LoRaWAN to enable long-range, low-power connectivity in sprawling process plants, while WirelessHART modules secure mesh-networked data transmission in environments where cabling costs are prohibitive.

Installation choices reflect situational constraints, with clamp-on meters allowing non-intrusive retrofitting on existing pipelines, thereby minimizing process interruptions, and inline devices directly inserted into the fluid stream to deliver continuous direct measurement with superior signal fidelity. Measurement range segmentation differentiates high flow applications-commonly found in large utility pipelines-from medium and low flow scenarios, which address precision dispensing and laboratory instrumentation. End user industries embody a spectrum of performance drivers, from the stringent purity demands of pharmaceutical and food and beverage processing to the rugged requirements of oil and gas upstream operations, the regulatory imperatives of water and wastewater management, and the critical energy balance focal points of chemical, petrochemical, and power generation sectors.

This comprehensive research report categorizes the Intelligent Flow Meter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Meter Type

- Communication Technology

- Installation

- Measurement Range

- End User Industry

Revealing How Regional Dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific Influence Intelligent Flow Meter Innovation and Adoption

Regional dynamics exert a profound influence on how intelligent flow meter solutions are developed, deployed, and maintained. In the Americas, the maturation of shale gas extraction and the modernization of aging water infrastructure have driven demand for high-accuracy flow measurement and predictive maintenance capabilities. The United States remains a strong adopter of edge-based analytics, while Canada places greater emphasis on wireless sensor networks to monitor remote pipeline sections. Across Latin America, emerging industrial hubs are investing in clamp-on installation approaches to retrofit existing assets with minimal downtime.

Europe, the Middle East & Africa present a diverse regulatory mosaic where European Union directives on emissions and water usage necessitate certified flow meter devices with traceable audit trails. Manufacturers serving EMEA markets must comply with CE marking requirements and adhere to sector-specific standards, such as ATEX certification for explosive atmospheres common in Middle Eastern petrochemical complexes. African utilities, grappling with water scarcity, prioritize ultrasonic and electromagnetic technologies that deliver leak detection capabilities and support decentralized water distribution models.

In Asia-Pacific, rapid industrial expansion and government-led smart city initiatives underpin robust uptake of intelligent flow meters across China, India, and Southeast Asia. Chinese OEMs are integrating native cloud platforms with local IIoT infrastructure, driving cost-competitive solutions. Meanwhile, India’s focus on water treatment and energy efficiency programs has elevated demand for inline electromagnetic and vortex meters. In markets such as Australia and Japan, where process industries are highly automated, vendors must offer advanced digital twin and lifecycle management functionalities to meet the exacting standards of sophisticated end users.

This comprehensive research report examines key regions that drive the evolution of the Intelligent Flow Meter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Intelligent Flow Meter Manufacturers and Their Strategic Initiatives in Technology Development, Partnerships, and Market Expansion

Leading instrumentation manufacturers are continuously evolving their offerings to meet the dual imperatives of enhanced measurement performance and seamless digital integration. Established industrial automation players are leveraging their broad technology portfolios to bundle intelligent flow meters with complementary hardware and software ecosystems. For instance, companies with deep expertise in control systems are embedding flow meter data streams into comprehensive asset management platforms, thereby enabling lifecycle analytics and operational benchmarking across heterogeneous equipment fleets.

Strategic partnerships and acquisitions have further shaped the competitive landscape, as specialized flow meter providers align with analytics software vendors to enrich their value propositions. These collaborations facilitate the rapid deployment of turnkey solutions that combine sensor hardware, secure communication gateways, and cloud-based dashboards. Meanwhile, a cohort of challenger brands has emerged, differentiating through user-centric designs that prioritize ease of configuration and modular scalability, addressing the needs of small and mid-tier enterprises seeking plug-and-play instrument architectures.

Geographical expansion strategies remain central to driving revenue growth, with leading players establishing regional service centers and training academies to bolster after-sales support. Emphasis on local calibration services and rapid spare parts delivery enhances customer retention, particularly in industries where flow meter downtime can translate into significant production losses. Collectively, these corporate maneuvers underscore the market’s transition toward holistic solution delivery, where data-driven services and digital maintenance offerings are becoming key competitive differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intelligent Flow Meter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Azbil Corporation

- Badger Meter, Inc.

- Baker Hughes Company

- Brooks Instrument, LLC

- Emerson Electric Co.

- Endress+Hauser AG

- Honeywell International Inc.

- Katronic Technologies Ltd.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Strategic Imperatives for Industrial Stakeholders to Drive Growth, Enhance Operational Resilience, and Capitalize on Next Generation Intelligent Flow Meter Technologies

To capitalize on the full potential of intelligent flow meter technologies, industry leaders should prioritize end-to-end digital integration strategies that unify sensor data with enterprise asset management and predictive maintenance platforms. By implementing a modular architecture that supports both wired and wireless communication protocols, organizations can maintain future readiness while accommodating diverse process control environments. Moreover, investing in edge-computing modules with embedded analytics will reduce reliance on continuous cloud connectivity and lower data-transportation costs.

Supply chain resilience must be bolstered through a dual-sourcing approach that balances domestic manufacturing capabilities with strategic offshore partnerships. This dual-track model will mitigate potential disruptions arising from trade policy shifts and logistical bottlenecks. Additionally, leaders should explore outcome-based service agreements, which align vendor revenue with performance metrics such as uptime, accuracy, and energy savings, thereby fostering shared incentives for continuous improvement.

Cybersecurity emerges as a critical consideration; embedding robust encryption standards and network segmentation practices at the flow meter communication layer will safeguard mission-critical process data and prevent unauthorized system access. Finally, executive teams should cultivate cross-functional collaboration between operations, IT, and sustainability departments to ensure that intelligent flow meter deployment not only boosts productivity but also advances environmental stewardship and regulatory compliance objectives.

Illustrating the Comprehensive Research Approach Combining Primary Interviews, Secondary Data Synthesis, and Rigorous Analytical Frameworks to Ensure Robust Market Insights

The research methodology underpinning this executive summary encompasses a rigorous blend of primary and secondary approaches designed to deliver a holistic market perspective. Secondary research involved the systematic review of peer-reviewed journals, industry white papers, regulatory filings, and corporate disclosures to establish a foundational understanding of technological advancements, standardization trends, and policy developments impacting flow meter applications. This desk research provided critical context for identifying growth drivers, competitive dynamics, and regulatory landscapes across key geographies.

Primary research was conducted through structured interviews and surveys with a diverse set of stakeholders, including C-level executives at instrumentation manufacturers, plant engineers at end-user organizations, technology integrators, and regional distributors. Insights gleaned from these engagements were instrumental in validating desk-based findings, clarifying the practical implications of emerging use cases, and quantifying investment priorities among early adopters. To ensure analytical robustness, data triangulation techniques were applied, cross-comparing top-down market sizing estimates with bottom-up revenue collection approaches and regional consumption analyses.

The research process also integrated workshops with subject matter experts to stress-test preliminary conclusions and refine segmentation frameworks. Quality assurance protocols, including consistency checks and hypothesis testing, were implemented throughout the data collection and synthesis phases. The result is a set of well-substantiated market insights that balances quantitative metrics with qualitative perspectives, offering stakeholders a comprehensive and reliable guide for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intelligent Flow Meter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intelligent Flow Meter Market, by Meter Type

- Intelligent Flow Meter Market, by Communication Technology

- Intelligent Flow Meter Market, by Installation

- Intelligent Flow Meter Market, by Measurement Range

- Intelligent Flow Meter Market, by End User Industry

- Intelligent Flow Meter Market, by Region

- Intelligent Flow Meter Market, by Group

- Intelligent Flow Meter Market, by Country

- United States Intelligent Flow Meter Market

- China Intelligent Flow Meter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways and Future Outlook for Intelligent Flow Meter Innovations Driving Industrial Efficiency and Sustainability in Evolving Market Conditions

In summary, the intelligent flow meter market is undergoing a profound transformation driven by the convergence of digital technologies, regulatory imperatives, and evolving end-user expectations. Technological progress in edge computing, advanced sensing principles, and wireless communications is enabling a new class of smart instruments that deliver actionable insights in real time. Meanwhile, market segmentation analysis underscores the importance of customizing solutions across a spectrum of meter types, communication protocols, installation modalities, measurement ranges, and industry applications to address diverse operational challenges.

Regional dynamics continue to shape adoption patterns, with the Americas focusing on supply chain localization and digital retrofits, EMEA navigating stringent compliance requirements and infrastructure modernization, and Asia-Pacific capitalizing on industrial expansion and government-backed smart city programs. The imposition of new U.S. tariffs in 2025 has further highlighted the need for resilient manufacturing strategies and agile sourcing models. Corporate leaders are responding through integrated service models, strategic alliances, and enhanced after-sales support to maintain market share and differentiate their offerings.

Looking ahead, the trajectory for intelligent flow meter innovation will be defined by deeper integration with AI-driven analytics, an increasing shift toward outcome-based contracting, and accelerated adoption of modular platform architectures. Companies that proactively align their technology roadmaps, supply chain strategies, and service portfolios with these emerging trends will be best positioned to capture value and lead the industry’s next evolution.

Unlock Deep-Dive Insights into the Intelligent Flow Meter Market by Connecting with Ketan Rohom to Acquire the Comprehensive Research Report

We appreciate your interest in this executive summary, which highlights the critical insights needed to navigate the evolving intelligent flow meter market. For organizations seeking a deeper analysis of market dynamics, technology roadmaps, competitive landscapes, and tailored strategic recommendations, the full market research report offers an unparalleled level of detail and actionable data. To secure access to comprehensive chapter breakdowns, detailed data tables, and proprietary forecasts that will empower your decision-making, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan Rohom, you can obtain customized pricing information, explore bundled consulting options, and schedule a confidential briefing to align our research findings with your strategic objectives.

Act swiftly to leverage this robust intelligence, refine your innovation roadmap, and solidify your competitive positioning in a market defined by rapid technological advancement and shifting regulatory frameworks. Reach out today to acquire the complete market research report and ensure your organization is at the forefront of intelligent flow meter adoption and industry transformation.

- How big is the Intelligent Flow Meter Market?

- What is the Intelligent Flow Meter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?