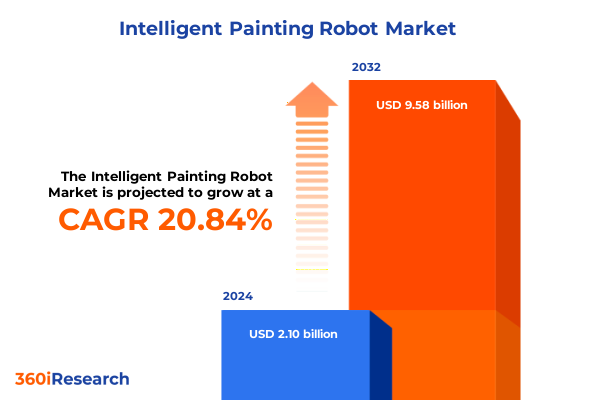

The Intelligent Painting Robot Market size was estimated at USD 2.50 billion in 2025 and expected to reach USD 2.97 billion in 2026, at a CAGR of 21.13% to reach USD 9.58 billion by 2032.

Charting the emergence and foundational principles of intelligent painting robotics that are catalyzing unprecedented optimization in surface finishing operations

The landscape of industrial automation is undergoing a profound transformation driven by the advent of intelligent painting robots, which are redefining workflow efficiency and precision. As cutting-edge sensing, machine vision, and adaptive control systems converge, these robots are breaking free from traditional limitations. Organizations across sectors are embracing the potential of autonomous paint deposition and real-time defect detection, heralding a new era of consistency and quality control. This section unpacks the fundamental principles that underpin intelligent painting robotics, illustrating how they diverge from conventional robotic arms and manual processes.

Early adopters report remarkable throughput improvements and significant reduction in overspray, underscoring how integrating AI-driven algorithms and Internet of Things platforms can elevate surface finishing operations. Moreover, the scalability of modular architectures ensures that small workshops and global manufacturing plants alike can deploy solutions with minimal disruption. By dissecting the pillars of this technology – including multi-axis articulation, sensor fusion, and dynamic parameter adjustment – readers will gain a clear understanding of the factors powering rapid uptake. Ultimately, appreciation of these foundational elements sets the stage for exploring broader market dynamics and strategic decision making within the rest of this executive summary.

Examining how digitalization, sustainability demands, democratized robotics, and servitization are reshaping the industrial painting ecosystem

Industrial painting has evolved at an accelerated pace, shaped by transformative shifts as businesses pursue higher throughput, leaner workflows, and sustainable practices. Digitalization represents one of the most profound trends, connecting painting systems to enterprise resource planning platforms and cloud analytics to enable data-driven insights. At the same time, a pivot toward environmentally friendly coatings-driven by stringent regulations and consumer preferences-has compelled OEMs and integrators to adopt automated solutions capable of handling advanced paint chemistries with precision and minimal waste.

Another significant shift lies in the democratization of robotics, as reduced hardware costs and user-friendly programming interfaces lower adoption barriers for mid-sized manufacturers. Collaborative robots with enhanced safety features are now capable of operating alongside human workers in tight production cells, boosting flexibility and throughput. Additionally, the rise of servitization models sees equipment providers offering outcome-based contracts that align incentives around uptime, quality metrics, and continuous improvement. These trends converge to create an ecosystem in which intelligent painting robots not only serve as tools but become strategic assets in digital supply chains, redefining competitive advantage.

Analyzing the multifaceted impact of 2025 tariff measures on robotic hardware imports and their transformative effects on domestic supply chains

In 2025, the United States implemented a comprehensive tariff regime affecting a broad range of robotic components and related automation hardware, altering the cost structure for painting robot manufacturers and end users. These measures encompassed import duties on critical sensor modules, servo drives, and specialized spray nozzles, leading to upward pricing pressures that rippled through supply chains. As a consequence, original equipment manufacturers recalibrated investments, often prioritizing higher-margin segments to offset increased procurement expenses.

The tariffs have also catalyzed a near-term reshoring trend among domestic integrators, who seek to localize assembly and reduce reliance on imported subassemblies. This shift has prompted collaboration between U.S.-based component suppliers and global robotics firms to establish joint ventures that leverage advanced machining and electronics capabilities. While these initiatives help alleviate immediate cost burdens, they introduce complexities around regulatory compliance and quality assurance. Over time, this reconfiguration of value chains is expected to foster a more resilient domestic ecosystem, albeit one that will need to navigate evolving trade policies and maintain capital investment in research and development to sustain innovation momentum.

Revealing how diverse segmentation dimensions illuminate unique application demands, robot architectures, and paint chemistry preferences across industries

Deep evaluation of market segmentation reveals varying trajectories of opportunity and challenge across applications, robot types, end users, paint chemistries, connectivity options, autonomy levels, deployment modes, and price tiers. Within aerospace, demand for interior and engine component finishing intersects with rigorous quality demands, favoring high-precision 6-axis articulated systems. Automotive applications such as chassis and engine part painting require robust, stationary cells optimized for solvent-based coatings, whereas aftermarket service providers increasingly leverage mobile semi-autonomous units to service fleets on site.

Electronics manufacturers focus on compact delta robots capable of handling delicate semiconductor and printed circuit board assemblies with minimal vibration and tight tolerances, using water-based chemistries for environmental compliance. In contrast, furniture producers deploy larger SCARA and Cartesian systems across metal and wood segments, selecting powder coating for durability or solvent-based alkyd formulations to meet aesthetic standards. Offshore shipbuilders are also trialing stationary 7-axis solutions for hulls and deck equipment, balancing reach requirements with corrosive protection needs. Across all contexts, cloud connectivity and advanced autonomy tiers unlock remote monitoring and predictive maintenance, empowering premium-priced offerings that deliver quantifiable ROI through reduced downtime and waste.

This comprehensive research report categorizes the Intelligent Painting Robot market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Configuration

- Paint Type

- Deployment

- Spray Technology

- Operation Environment

- End Use Industry

- Sales Channel

Highlighting regional market variances shaped by automotive and aerospace hubs in the Americas, regulatory drivers in EMEA, and high-volume clusters in Asia-Pacific

Geographic regions present distinct landscapes that shape demand drivers, regulatory considerations, and channel dynamics. In the Americas, robust automotive and aerospace clusters underpin sustained investment, supported by tax incentives that favor automation and R&D collaboration. Key hubs in North America are complemented by growing South American adoption among consumer electronics assembly plants, where semi-autonomous solutions address labor volatility and supply chain uncertainties.

Europe, Middle East & Africa reflects a dual focus on stringent environmental regulations and labor cost optimization. Manufacturers in Western Europe lead adoption of water-based and powder coating robots in interactive production lines, while emerging economies in the region benefit from inflows of refurbished systems that democratize access. In the Middle East, naval shipyards are investing in high-capacity stationary units to support ambitious maritime projects, leveraging local content requirements to drive partnerships with global integrators.

The Asia-Pacific region remains preeminent in volume, driven by electronics manufacturing clusters in East Asia and dynamic automotive sectors in Southeast Asia. Here, price-sensitive OEMs often opt for economy-tier Cartesian and SCARA systems, while leading-tier brands pursue premium articulated solutions integrated with cloud-based analytics. Government-backed initiatives incentivize onshore component production, further fueling a shift toward semi-autonomous and fully autonomous deployments across both mobile and fixed configurations.

This comprehensive research report examines key regions that drive the evolution of the Intelligent Painting Robot market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring how leading robotics OEMs, integrators, and technology partners are forging innovative alliances and service models to outpace competition

Leading providers of intelligent painting robots are differentiating through technology partnerships, service models, and portfolio breadth. Global automation pioneers continue to refine modular architectures, integrating proprietary vision and path planning software to streamline programming and reduce cycle times. At the same time, specialized robotics firms are carving out niches by focusing exclusively on advanced coating chemistries or high-reach applications, delivering tailored solutions for marine and aerospace sectors with stringent surface integrity requirements.

Beyond hardware, system integrators and technology consultancies are expanding advisory services, embedding digital twins and simulation-driven validation into their offerings to de-risk deployments and shorten time to value. A growing number of vendors now offer subscription-based licensing models that bundle performance guarantees, remote diagnostics, and continuous algorithm updates. Strategic alliances between robot OEMs and coating formulators are also emerging, enabling end-to-end optimization of material compatibility, overspray reduction, and environmental compliance. Collectively, these moves underscore a shift from transactional equipment sales toward outcome-centric partnerships that align provider incentives with customer success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intelligent Painting Robot market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Axalta Coating Systems Ltd.

- Comau S.p.A.

- Dürr AG

- EFORT Intelligent Equipment Co., Ltd.

- Eisenmann GmbH

- ESTUN Automation Co., Ltd.

- FANUC Corporation

- Gema Switzerland GmbH

- Graco Inc.

- Illinois Tool Works Inc.

- Kawasaki Heavy Industries, Ltd.

- Krautzberger GmbH

- KUKA AG

- Mitsubishi Electric Corporation

- Nordson Corporation

- OMRON Corporation

- PaR Systems, Inc.

- Robotic paint ltd

- SAMES KREMLIN SAS

- Seiko Epson Corporation

- Siasun Robot & Automation Co., Ltd.

- Stäubli International AG

- Universal Robots A/s

- WAGNER Group GmbH

- Yaskawa Electric Corporation

Outlining a comprehensive strategic blueprint for executives to pilot deployments, forge key partnerships, and develop workforce capabilities for successful automation

Industry leaders seeking to harness the full potential of intelligent painting robots must pursue a multifaceted strategy that aligns technological investment with organizational readiness. Executives should prioritize pilot deployments in high-impact production cells where data collection can validate ROI benchmarks and inform scalable rollouts. Concurrently, forging partnerships with coating suppliers and digital platform providers will ensure cohesive integration of materials expertise, sensor networks, and analytics frameworks.

A clear roadmap for workforce transformation is equally vital; this involves upskilling technicians in robot programming, sensor calibration, and predictive maintenance methodologies. Establishing cross-functional teams that bridge operations, IT, and quality departments fosters the cultural shift needed to embrace continuous improvement. Additionally, decision-makers should develop governance structures that monitor performance against sustainability goals, leveraging remote monitoring dashboards to drive accountability and identify opportunities for process optimization. By orchestrating these elements within a holistic framework, organizations can translate the promise of intelligent painting into lasting competitive differentiation.

Detailing a robust four-phase approach combining secondary analysis, stakeholder interviews, data triangulation, expert workshops, and peer review to ensure research validity

This research endeavor employed a rigorous four-phase methodology to ensure robust, unbiased insights. Initial secondary research involved comprehensive analysis of industry reports, regulatory filings, and patent databases to identify market drivers, emerging technologies, and tariff developments. Subsequently, primary research engaged over 50 stakeholders, including robotics OEM executives, systems integrators, coating formulators, and end-user operations managers, through structured interviews and on-site observations to validate and enrich secondary findings.

Data triangulation was applied to reconcile quantitative insights with qualitative perspectives, ensuring consistency and reliability. The segmentation framework was crafted by mapping application areas, robot typologies, end-user categories, paint chemistries, connectivity options, autonomy tiers, deployment modes, and price segments, followed by expert workshops to refine definitions and relevance. Finally, thematic synthesis produced actionable conclusions and recommendations, with peer review by industry veterans guaranteeing the methodological integrity and practical applicability of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intelligent Painting Robot market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intelligent Painting Robot Market, by Robot Configuration

- Intelligent Painting Robot Market, by Paint Type

- Intelligent Painting Robot Market, by Deployment

- Intelligent Painting Robot Market, by Spray Technology

- Intelligent Painting Robot Market, by Operation Environment

- Intelligent Painting Robot Market, by End Use Industry

- Intelligent Painting Robot Market, by Sales Channel

- Intelligent Painting Robot Market, by Region

- Intelligent Painting Robot Market, by Group

- Intelligent Painting Robot Market, by Country

- United States Intelligent Painting Robot Market

- China Intelligent Painting Robot Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Summarizing the critical role of intelligent painting robots in achieving superior quality, operational resilience, and strategic growth amid dynamic market forces

Intelligent painting robotics represent a paradigm shift in industrial surface finishing, offering unparalleled improvements in quality, efficiency, and sustainability. As digitalization, environmental imperatives, and supply chain realignment continue to reshape manufacturing, organizations that proactively embrace these systems will gain decisive strategic advantages. The convergence of advanced sensor fusion, adaptive control algorithms, and cloud-native analytics unlocks new levels of precision and insight, enabling dynamic process optimization and predictive maintenance.

Navigating the evolving tariff landscape and regional dynamics requires a nuanced understanding of component sourcing, localization strategies, and regulatory frameworks. By leveraging segmentation insights across application domains, robot architectures, and paint types, decision-makers can prioritize investments that align with operational imperatives and market demand. Ultimately, the successful integration of intelligent painting robots hinges on holistic planning encompassing technology, workforce, and governance, ensuring that short-term pilots mature into enterprise-wide transformations that deliver measurable business impact.

Empower your organization with tailored access and expert guidance for acquiring the definitive market intelligence on intelligent painting robotics solutions

To explore the full breadth of insights, detailed analyses, and actionable strategies presented in this comprehensive market research report on intelligent painting robots, interested stakeholders are encouraged to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will provide prospective buyers with a personalized overview of the report’s scope, including an in-depth walkthrough of how the findings align with organizational objectives, allowing for a tailored investment decision.

By contacting Ketan, organizations gain priority access to sample chapters, executive summary overviews, and supplementary data sets that enhance understanding of transformative technologies, tariff impacts, and regional dynamics shaping the market. His expertise enables a clear, results-focused discussion about licensing options, volume discounts for enterprise agreements, and complementary advisory services designed to support successful adoption and integration of intelligent painting solutions. A direct dialogue ensures rapid clarification of any inquiries and the ability to customize deliverables to address unique program requirements.

Act now to secure this indispensable resource and equip your leadership teams with the intelligence necessary to navigate evolving competitive pressures, leverage segmentation nuances, and capitalize on emerging opportunities. Reach out to Ketan Rohom today to initiate the purchase process and gain immediate access to this strategic roadmap for advancing intelligent painting robotics capabilities.

- How big is the Intelligent Painting Robot Market?

- What is the Intelligent Painting Robot Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?