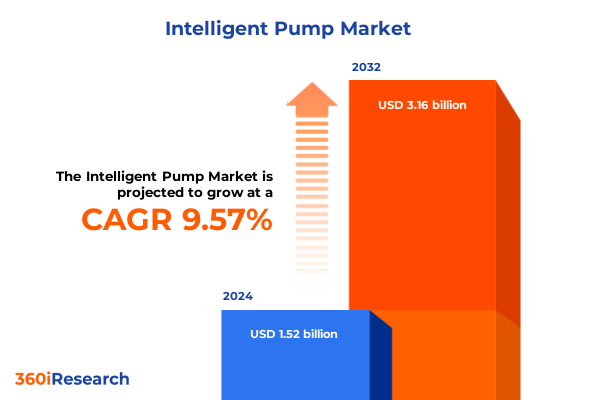

The Intelligent Pump Market size was estimated at USD 1.63 billion in 2025 and expected to reach USD 1.76 billion in 2026, at a CAGR of 9.85% to reach USD 3.16 billion by 2032.

An authoritative overview of the intelligent pump industry highlighting key themes, market context, and emerging drivers shaping future growth

The intelligent pump market stands at a pivotal juncture, where advances in digitalization and automation are converging with rising demands for energy efficiency and predictive maintenance. Intelligent pump solutions integrate smart sensors, control algorithms, and connectivity features that allow for real-time monitoring and adaptive performance adjustments. These capabilities are transforming traditional pumping systems into proactive assets that optimize throughput, reduce unplanned downtime, and extend equipment lifespan. As global industries grapple with tightening environmental regulations and escalating operational costs, intelligent pumps are emerging as indispensable components of industrial infrastructures.

Against this backdrop, stakeholders across manufacturing, water treatment, oil and gas, and power generation sectors are accelerating investments in IoT-enabled pumping systems. Leading original equipment manufacturers are forging partnerships with software providers to deliver integrated platforms that unify data analytics, remote diagnostics, and automated controls. Meanwhile, end users are placing greater emphasis on lifecycle value, leveraging machine learning models to predict maintenance needs and orchestrate maintenance cycles more efficiently. Consequently, the intelligent pump market is evolving from a niche technology segment into a mainstream industrial solution, driven by the twin imperatives of sustainability and operational resilience.

Significant technological, regulatory, and sustainability-driven transformations that are redefining operational efficiencies and competitive dynamics in the pump industry

Over the last two years, the intelligent pump industry has undergone a series of transformative shifts driven by rapid digitalization and heightened regulatory scrutiny. Cloud computing and edge analytics now enable pumps to process vast streams of operational data locally, unlocking new possibilities for real-time performance optimization. This shift toward decentralized intelligence has reduced latency in critical decision-making and enhanced system redundancy, ensuring continuous operation even amid network disruptions. Furthermore, cybersecurity frameworks tailored to industrial control systems are gaining prominence as vendors embed encryption, authentication, and anomaly detection features directly into pump architectures.

Simultaneously, sustainability mandates are reshaping procurement criteria, with end users demanding pumps that minimize energy consumption and greenhouse gas emissions. Manufacturers are responding by innovating variable frequency drives and adaptive control strategies that automatically modulate motor speed to match process demands. As a result, the boundary between standard pumping equipment and smart, self-regulating systems is blurring. Taken together, these technological and regulatory accelerants are redefining competitive dynamics, prompting incumbents and new entrants alike to recalibrate product portfolios and prioritize modular, software-driven solutions.

Comprehensive assessment of the multifaceted effects of United States 2025 tariff implementations on supply chains, pricing structures, and strategic procurement for pump manufacturers

In 2025, the United States introduced a suite of tariffs targeting critical industrial components, including electric motors and semiconductor sensors integral to intelligent pump systems. These levies have introduced complexity across global supply chains, elevating input costs for pump manufacturers and creating ripple effects in aftermarket service pricing. Many suppliers have initiated dual-sourcing strategies to mitigate tariff exposure, distributing procurement across tariff-exempt regions and localizing assembly where feasible. However, these adjustments have introduced logistical challenges, such as extended lead times and increased inventory carrying costs.

Additionally, the tariff landscape has accelerated the onshoring of key manufacturing processes, with forward-thinking producers investing in domestic production lines to bypass import duties. While this trend enhances supply chain resilience and supports local employment, it also requires significant capital outlays and shifts in workforce skill requirements. On the downstream side, end users are reassessing total cost of ownership calculations to account for higher replacement part prices and service fees. Collectively, the 2025 tariff measures are reshaping cost structures and strategic imperatives across the intelligent pump ecosystem, prompting industry players to adopt more flexible, regionally diversified operational models.

In-depth exploration of market segmentation across pump types, end use industries, control technologies, fluid types, power ratings, drive types, and materials revealing strategic insights

An examination of market segmentation across pump types reveals that centrifugal pumps, particularly multi-stage configurations, are increasingly favored for applications demanding high pressure differentials and continuous operation. In contrast, diaphragm and peristaltic pumps are gaining traction in pharmaceutical and chemical processing environments where contamination prevention is critical. Positive displacement varieties, from reciprocating to rotary configurations including gear and vane designs, offer precise flow control and are leveraged in metering applications requiring tight tolerances.

Turning to end use industries, oil and gas operators are embracing intelligent solutions to optimize upstream extraction and downstream processing workflows, while municipal utilities prioritize predictive maintenance for wastewater and clean water distribution networks. In sectors such as power generation and mining, adaptive control systems enable continuous performance tuning under variable load conditions. Control technologies like condition monitoring and variable frequency drives are now central to enhancing pump reliability and energy efficiency. Fluid type segmentation shows growing demand for pumps designed explicitly for slurries in mining and wastewater treatment, whereas clean water and chemical handling applications rely on corrosion-resistant materials and finely tuned flow control algorithms.

Power rating considerations reveal that units operating under 5 kilowatts are tailored for laboratory and small-scale industrial settings, while above 50 kilowatts serve heavy industrial and municipal infrastructure projects. Drive type selection-ranging from electric motors to gas turbines-depends on site-specific power availability and operational exigencies. Material choices spanning bronze, stainless steel, and specialized polymers are informed by fluid compatibility and regulatory standards, reinforcing the importance of holistic segmentation analysis for strategic product development and market positioning.

This comprehensive research report categorizes the Intelligent Pump market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Control Technology

- Fluid Type

- Power Rating

- Drive Type

- Material

- End Use Industry

Strategic perspectives on regional variations in demand, regulatory environments, and infrastructural developments across the Americas, Europe Middle East Africa, and Asia-Pacific markets

Regional dynamics in the intelligent pump market demonstrate distinct growth drivers and regulatory landscapes. In the Americas, infrastructure modernization initiatives and stringent environmental regulations are catalyzing demand for energy-efficient and low-emission pumping solutions. Governments at federal and state levels are offering incentives for utilities to upgrade aging water and wastewater treatment facilities, translating into robust procurement pipelines for intelligent pump providers.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and cross-border funding mechanisms are facilitating large-scale industrial and municipal projects. In Europe, the drive toward carbon neutrality is accelerating adoption of smart pumping systems that integrate seamlessly with renewable energy infrastructures. Meanwhile, in the Middle East and Africa, rapid urbanization and resource scarcity challenges are propelling investments in advanced water management technologies, including intelligent pumps equipped with adaptive flow controls.

In Asia-Pacific, the intersection of manufacturing growth and government-backed digitalization programs is fostering widespread deployment of Industry 4.0-enabled pumping assets. Countries such as China and India are prioritizing domestic production capacity, leading to strategic partnerships between global technology providers and regional original equipment manufacturers. This confluence of policy support and market demand underpins a dynamic regional landscape where competitive differentiation hinges on localized solutions and end-to-end service offerings.

This comprehensive research report examines key regions that drive the evolution of the Intelligent Pump market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical analysis of leading technology providers, manufacturing innovators, and emerging challengers shaping competitive positioning and driving innovation in the intelligent pump landscape

Leading players in the intelligent pump domain are distinguished by their integrated hardware-software platforms and robust service networks. Prominent multinational corporations leverage proprietary cloud analytics to offer subscription-based monitoring services, enabling customers to track performance metrics and schedule maintenance proactively. Meanwhile, medium-sized innovators are carving niches by focusing on specialized applications such as corrosion-resistant pumps for chemical processing or explosion-proof models for oil and gas environments.

Several emerging challengers are disrupting traditional value chains by enabling modular hardware offerings that can be retrofitted onto existing pump installations. These providers capitalize on open API standards to deliver third-party analytics integrations and flexible licensing models. Additionally, aftermarket service specialists are expanding their footprint by bundling remote diagnostics with field support, thereby creating differentiated value propositions centered on uptime guarantees. Collectively, the competitive landscape is evolving toward a services-oriented model, compelling companies to forge ecosystem partnerships and invest in talent capable of delivering end-to-end digital solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intelligent Pump market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Atlas Copco AB

- Bosch Rexroth AG

- CIRCOR International, Inc.

- Colfax Corporation

- EBARA Corporation

- Flowserve Corporation

- Goulds Pumps

- Grundfos Holding A/S

- IFM Group

- ITT Inc.

- Kirloskar Brothers Limited

- KSB SE & Co. KGaA

- Pentair plc

- QuantumFlo, Inc.

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Siemens AG

- Spirax Group plc

- Sulzer Ltd

- Wanner International, Inc.

- Wilo SE

- Xylem Inc.

- Yaskawa Electric Corporation

Actionable guidance for industry executives to capitalize on emerging opportunities, mitigate risks, and align strategic priorities with evolving market dynamics and regulatory requirements

Industry leaders should prioritize the deployment of decentralized analytics capabilities that enable real-time decision making at the pump level. By embedding edge computing modules, organizations can minimize network latency and ensure uninterrupted operation, even in bandwidth-constrained environments. Moreover, companies must invest in cybersecurity protocols tailored to industrial IoT architectures, including encrypted communications and automated threat detection, to safeguard critical infrastructure against evolving risks.

To navigate tariff-induced cost pressures, executives are advised to adopt a multi-pronged sourcing strategy that balances local manufacturing investments with strategic partnerships in low-tariff regions. Collaborative agreements with component suppliers can secure preferred pricing and continuity of supply. Simultaneously, organizations should develop flexible financing models that allow end users to shift capital expenditures to operational expenditure structures, lowering adoption barriers and accelerating digital transformation. By embracing these recommendations, industry leaders can enhance resilience, capture market share, and deliver superior value to stakeholders.

Transparent outline of primary and secondary research processes, data triangulation techniques, and analytical frameworks employed to ensure robust and reliable market intelligence

This report synthesizes insights from a rigorous primary research phase involving in-depth interviews with pump OEM executives, system integrators, and end users across key industries. Secondary data sources included government tariff notifications, trade association publications, and technical whitepapers. Quantitative analyses were performed by triangulating multiple information streams to validate technology adoption patterns and supply chain shifts.

Analytical frameworks such as SWOT and PESTEL assessments were applied to evaluate competitive positioning and external influences. Data normalization techniques ensured consistency across disparate regional datasets, while expert panels provided qualitative validation of emerging trends. This methodical approach underscores the credibility of the findings, offering decision-makers a transparent view into the underlying assumptions and data sources that shaped the strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intelligent Pump market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intelligent Pump Market, by Pump Type

- Intelligent Pump Market, by Control Technology

- Intelligent Pump Market, by Fluid Type

- Intelligent Pump Market, by Power Rating

- Intelligent Pump Market, by Drive Type

- Intelligent Pump Market, by Material

- Intelligent Pump Market, by End Use Industry

- Intelligent Pump Market, by Region

- Intelligent Pump Market, by Group

- Intelligent Pump Market, by Country

- United States Intelligent Pump Market

- China Intelligent Pump Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesis of core findings emphasizing industry trajectories, competitive imperatives, and strategic imperatives to inform critical investment and operational decisions

The convergence of digital innovations, regulatory imperatives, and geopolitical developments is charting a new trajectory for the intelligent pump industry. Stakeholders equipped with integrated hardware and software solutions are poised to capture the value unlocked by predictive maintenance, energy optimization, and adaptive controls. Concurrently, the ripple effects of 2025 tariff policies underscore the importance of supply chain agility and regional diversification.

As market segmentation analysis reveals diverse applications and performance requirements, competitive advantage will increasingly derive from the ability to tailor solutions across pump types, end use industries, and operational environments. Regional dynamics further emphasize the need for localized strategies and differentiated service offerings. By synthesizing these insights, decision-makers can craft informed strategies that balance innovation with pragmatic risk management, ensuring sustained growth and resilience in a rapidly evolving market landscape.

Engaging call to action inviting stakeholders to collaborate with Ketan Rohom for tailored insights, comprehensive reporting, and informed decision-making support

Elevate your strategic outlook by securing the complete market research report through a personalized consultation with Ketan Rohom. His deep domain expertise and nuanced understanding of evolving tariff landscapes, technological innovations, and region-specific dynamics will empower your team to navigate complex challenges with confidence. By collaborating directly, you will gain targeted recommendations, tailored data visualizations, and actionable frameworks designed to accelerate decision-making and competitive positioning. Reach out to Ketan Rohom to unlock comprehensive insights, align your investments with market realities, and drive sustainable growth in the intelligent pump sector.

- How big is the Intelligent Pump Market?

- What is the Intelligent Pump Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?