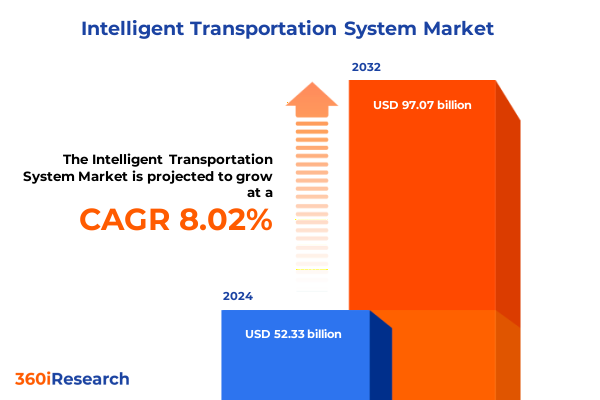

The Intelligent Transportation System Market size was estimated at USD 56.32 billion in 2025 and expected to reach USD 60.66 billion in 2026, at a CAGR of 8.08% to reach USD 97.07 billion by 2032.

Unveiling the Urgent Need for Intelligent Transportation Systems in an Era of Urban Congestion Safety Imperatives and Digital Connectivity Revolution

The acceleration of global urbanization and the increasing complexity of modern mobility challenges have thrust intelligent transportation systems into the spotlight as a critical solution for managing congestion, enhancing safety, and optimizing network performance. Cities are growing at unprecedented rates, placing immense pressure on existing infrastructure and demanding innovative approaches to traffic flow management and traveler experience enhancement. As urban planners and transportation authorities grapple with record-high commuter volumes, the urgency to deploy interconnected, data-driven solutions has never been greater, setting the stage for transformative investments in digital technologies and infrastructure integration.

Against this backdrop, recent federal legislation has significantly bolstered the momentum for modernization, with dedicated funding streams allocated to safety programs, EV charging networks, and the creation of advanced research bodies focused on infrastructure innovation. By earmarking billions for transportation safety enhancements, passenger rail improvements, and a nationwide electric vehicle charging network, policymakers have signaled a clear commitment to enabling smarter, more resilient mobility systems. Such proactive measures are reshaping procurement priorities and catalyzing partnerships between public agencies and private technology providers, ensuring that digital solutions move from pilot stages to full-scale deployments.

Complementing these efforts, the convergence of cutting-edge connectivity platforms and next-generation communication protocols is unlocking powerful new capabilities. Vehicle-to-everything communication is rapidly evolving, supported by ultra-low latency 5G networks, which together facilitate real-time data exchange across vehicles, infrastructure elements, and cloud analytics engines. This seamless interoperability elevates traffic management from reactive control to proactive optimization, allowing operators to anticipate congestion points and dynamically adjust signal timings, reroute fleets, and deliver timely traveler information. Such networked intelligence underscores why smart mobility remains a top strategic priority for cities and agencies worldwide.

Exploring How Artificial Intelligence Connectivity and Public Private Research Partnerships Are Redefining Modern Mobility Operations

The intelligent transportation landscape is undergoing a profound metamorphosis as digital technologies pervade every aspect of mobility operations. Artificial intelligence–powered analytics platforms now ingest vast streams of sensor data to identify emerging traffic patterns, detect safety risks, and optimize signal coordination across citywide networks. These capabilities are not only enhancing efficiency but are also enabling a fundamental shift toward predictive and preventative interventions, where anomalies such as near-miss events and equipment malfunctions are flagged before they escalate into service disruptions or safety incidents.

Concurrently, the Internet of Things is extending the reach of transportation management systems beyond traditional control centers, embedding intelligence into roadside cabinets, transit vehicles, and even travelers’ smartphones. This expansive sensor web generates actionable insights for corridor-level congestion mitigation, facility maintenance scheduling, and adaptive traveler information services. As the scale of connected endpoints grows, so too does the potential for integrating new modalities-such as shared micromobility, on-demand transit, and autonomous shuttles-into unified platforms, forging a holistic mobility ecosystem that transcends legacy silos.

Moreover, government agencies are harnessing partnerships with advanced research programs to accelerate innovation and testbed deployments. Drawing inspiration from ARPA-E’s proven model, the Department of Transportation’s ARPA-I initiative is experimenting with high-risk, high-reward projects aimed at advancing cybersecurity for connected infrastructure, exploring quantum-secure vehicle connectivity, and piloting disruptive traffic control algorithms. These strategic investments in research and development are reducing time-to-market for pioneering solutions and fostering a collaborative environment where public entities, academia, and industry co-innovate to address the most pressing transportation challenges of our time.

Analyzing the Deepening Financial Pressures Supply Chain Disruptions and Global Competitiveness Challenges from New U.S Tariff Measures

In January 2025, the U.S. government doubled tariff rates on a swath of electronic components-including semiconductors, diodes, and processors-raising duties from 25 percent to as high as 50 percent. This abrupt policy shift has sharply elevated the cost base for manufacturers of intelligent transportation hardware, particularly modules critical to traffic signal control, vehicle-to-infrastructure communication, and sensor arrays. The consequence has been a swift repricing of procurement contracts and capital projects, forcing public agencies and system integrators to reassess budgets and explore design modifications to mitigate raw cost inflation.

Beyond price inflation, the expanded tariffs have strained global supply chains that had already been reeling from logistical bottlenecks and component shortages. Extended lead times-now averaging six to twelve weeks for critical automation elements-have disrupted installation schedules and deferred planned upgrades to roadside cabinets and transit control centers. With shipping delays exacerbated by heightened customs scrutiny, project timelines have slipped and contingency inventories have swollen, placing further pressure on agency working capital and eroding cost efficiencies that were achieved through just-in-time procurement models.

Moreover, U.S.-based solution providers are facing a growing competitiveness gap in global markets as tariff-driven input costs elevate their pricing positions relative to European and Asian peers. Analysis indicates that firms exposed to these duties operate with a structural cost disadvantage of up to 12 percent, undermining bid competitiveness in infrastructure tenders and limiting export opportunities. At the same time, ambiguities in tariff classification for dual-use components have led to compliance challenges and penalties, adding legal risk to a landscape already fraught with financial uncertainty and procurement complexity.

Dissecting Critical Component Service and Application Segments to Unlock Targeted Opportunities Across the Intelligent Transportation Ecosystem

A nuanced understanding of market segmentation reveals that stakeholders must tailor their strategies to the distinct requirements of each layer in the intelligent transportation ecosystem. From the foundational level of hardware components-spanning communication modules, control processors, and precision sensors-to the diverse portfolio of services encompassing managed maintenance, remote monitoring, consulting, and system integration, each element demands specialized approaches for deployment and support. Software platforms, including analytics engines, security suites, and signal control applications, must be architected to interoperate seamlessly with this heterogeneous infrastructure, ensuring data fidelity and operational resilience.

Application segments further refine the business case for ITS investments, whether in optimizing commercial vehicle fleets through route analytics and telematics, enhancing urban safety with collision avoidance and video surveillance, or streamlining revenue collection via electronic tolling and enforcement systems. Traffic management functions bifurcate into incident response and urban flow control, while traveler information services leverage real-time data to empower pedestrians and commuters with actionable route guidance. In each scenario, the selection of service delivery models-from outcome-based managed offerings to bespoke professional engagements-shapes total cost of ownership, risk exposure, and long-term value realization.

Operationally, the market divides into specialized clusters such as electronic toll collection technologies (from conventional lane-based systems to free-flow architectures), dynamic traffic monitoring frameworks powered by incident detection and video analytics, and comprehensive transportation management suites that incorporate predictive scheduling, telematics-enhanced diagnostics, and fleet telematics. End-user verticals-from aviation and railway to maritime and urban highways-introduce further differentiation, mandating compliance with sector-specific standards, regulatory regimes, and performance benchmarks. Savvy market participants will leverage these segmentation lenses to pinpoint high-opportunity niches, forge targeted partnerships, and engineer solutions that resonate with the distinct operational priorities of each customer cohort.

This comprehensive research report categorizes the Intelligent Transportation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Communication Type

- Application

- End User

- Deployment Mode

Illuminating Regional Adoption Patterns and Strategic Technology Priorities across the Americas EMEA and Asia Pacific Markets

Regional dynamics are playing an outsized role in shaping deployment timelines and technology preferences across the intelligent transportation landscape. In the Americas, agencies and operators are intensely focused on integrating advanced traffic management systems with electric vehicle charging infrastructure as part of broader clean mobility initiatives. Public funding programs and smart city pilots are accelerating adoption of connected vehicle services, while private mobility providers collaborate with municipalities to roll out Mobility-as-a-Service applications that alleviate urban congestion and support sustainability targets.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and cross-border transportation corridors are driving demand for interoperable tolling and incident management solutions. Governments in EMEA are prioritizing smart infrastructure investments that enhance freight corridor visibility and bolster road safety, leveraging public-private consortia to co-fund large-scale ITS deployments. Emerging markets in the region are also capitalizing on scalable ITS packages that address urbanization challenges and facilitate tourism-driven transportation flows.

In Asia-Pacific, high-density megacities and strong vendor ecosystems have cultivated rapid uptake of next-generation ITS technologies, from 5G-enabled V2X networks to AI-fueled traffic analytics. National strategies emphasize digital railway signaling upgrades and maritime port efficiency improvements, while smart corridor initiatives blend IoT sensing, edge computing, and automated enforcement to deliver quantifiable gains in throughput and safety. Regional superclusters of technology suppliers and research institutions further accelerate innovation cycles, creating a fertile environment for pilot-to-production transitions.

This comprehensive research report examines key regions that drive the evolution of the Intelligent Transportation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling How Leading Technology Telecommunications and Infrastructure Firms Are Shaping Interoperable Connected Mobility Platforms

Leading corporations across transportation and technology sectors are shaping the evolution of intelligent mobility solutions through targeted innovation and strategic partnerships. Industry stalwarts specializing in traffic management and tolling systems are augmenting their portfolios with AI-driven analytics platforms and cloud-native service offerings, enabling rapid scalability and centralized operations. Meanwhile, telecommunications firms are embedding Edge-of-Network compute capabilities into roadside assets, reducing latency and enhancing the reliability of safety-critical data exchanges.

The emergence of dedicated software players has catalyzed a shift toward open architecture frameworks, where modular signal control and security applications interoperate with multi-vendor hardware ecosystems. These software innovators are collaborating with infrastructure integrators to deliver turnkey solutions that span design, installation, and long-term maintenance contracts. Automotive suppliers and OEMs are also forging alliances with government agencies to embed V2X connectivity into new vehicle fleets, laying the groundwork for a cohesive transportation network that bridges mobile and fixed assets.

As the competition intensifies, forward-thinking enterprises are investing in co-development labs and joint testing facilities, aligning R&D roadmaps with evolving regulatory requirements and user expectations. By combining domain expertise, standardized interfaces, and shared data platforms, these leading players are not only capturing a growing share of project pipelines but also setting new benchmarks for interoperability, cybersecurity, and service excellence across the ITS marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intelligent Transportation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AECOM

- Agero, Inc.

- AlmavivA S.p.A

- Axiomtek Co., Ltd.

- Bridgestone Corporation

- Cellint Traffic Solutions Ltd.

- Conduent Business Services, LLC

- Cubic Corporation

- Daktronics

- Denso Corporation

- DIMTS Ltd.

- EFKON GmbH

- Garmin Ltd.

- GMV Innovating Solutions S.L.

- Hitachi, Ltd.

- Indra Sistemas, S.A.

- Intel Corporation

- International Business Machines Corporation

- Iteris, Inc.

- Kapsch TrafficCom AG

- Lanner Electronics, Inc.

- Mitsubishi Heavy Industries, Ltd.

- N-iX Ltd

- PTV Planung Transport Verkehr GmbH

- Q-Free ASA

- Ricardo PLC

- Robert Bosch GmbH

- Sensys Networks, Inc.

- Serco Inc.

- Siemens AG

- Singapore Technologies Engineering Ltd

- Stantec Inc.

- SWARCO AG

- TagMaster

- Teledyne FLIR LLC

- Thales S.A.

- TomTom International BV

- TransCore

- Transmax Pty Ltd.

- Verra Mobility Corporation

- WSP Global Inc.

- Xerox Corporation

Establishing a Supply Chain Diversification Innovation Collaboration and Modular Architecture Mindset for Sustainable Competitive Advantage

Industry leaders seeking to outpace competitors and deliver resilient intelligent transportation solutions should adopt a multi-pronged strategy centered on supply chain diversification, technological agility, and stakeholder collaboration. First, enterprises must proactively identify alternative sourcing regions and establish multi-supplier partnerships to mitigate the financial shock of tariff fluctuations and logistics disruptions. Implementing dynamic procurement protocols and leveraging trade compliance expertise will fortify operations against future policy shifts.

Simultaneously, investing in modular software architectures and plug-and-play hardware configurations will accelerate deployment cycles and minimize integration complexity. By embracing containerized analytics modules, edge computing nodes, and standardized communication APIs, organizations can tailor system configurations to specific project requirements without incurring prohibitive customization costs. This architectural flexibility also facilitates continuous updates, enabling rapid adoption of emerging innovations in AI, cybersecurity, and 5G connectivity.

Finally, forging strong alliances with governmental research agencies, academic institutions, and private partners will create a collaborative innovation ecosystem. Joint pilot programs, data-sharing agreements, and interoperability testbeds will not only de-risk technology introduction but also generate compelling proof-of-concept outcomes that catalyze broader market acceptance. With this concerted approach, industry leaders can drive measurable improvements in safety, efficiency, and sustainability while securing long-term competitive advantage.

Detailing the Dual Phase Secondary and Primary Research Approach with Expert Validation and Data Triangulation

This comprehensive analysis is grounded in a dual-phase research methodology, beginning with an extensive secondary review of public domain materials, industry reports, legislative records, and patent filings. Key insights were extracted from federal infrastructure legislation, tariff announcements, and regulatory bulletins to assess market drivers, policy impacts, and technology trends. Concurrently, academic studies and open-source analyses provided context on urbanization patterns and digital infrastructure strategies.

Building upon this foundation, primary research was conducted through in-depth interviews with senior executives at transportation authorities, system integrators, and leading solution providers. Workshops with ITS practitioners and subject matter experts facilitated the validation of preliminary findings and the refinement of segmentation frameworks. Quantitative data from trade compliance records and project deployment databases was triangulated with qualitative insights to bolster reliability and uncover emerging market dynamics.

Rigorous cross-validation techniques, including expert peer reviews and confidence scoring, were applied to ensure that the conclusions and recommendations accurately reflect the evolving landscape. This methodological rigor underpins the credibility of the analysis and equips decision-makers with an authoritative resource for strategic planning, risk mitigation, and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intelligent Transportation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intelligent Transportation System Market, by Component

- Intelligent Transportation System Market, by Technology

- Intelligent Transportation System Market, by Communication Type

- Intelligent Transportation System Market, by Application

- Intelligent Transportation System Market, by End User

- Intelligent Transportation System Market, by Deployment Mode

- Intelligent Transportation System Market, by Region

- Intelligent Transportation System Market, by Group

- Intelligent Transportation System Market, by Country

- United States Intelligent Transportation System Market

- China Intelligent Transportation System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Summarizing How AI Enabled Modular Standards and Strategic Collaboration Will Unlock the Full Potential of Smart Mobility Ecosystems

The convergence of policy-driven investments, advanced connectivity technologies, and shifting global trade dynamics has positioned intelligent transportation systems at the forefront of mobility transformation. As urban centers demand smarter solutions to manage congestion, enhance safety, and meet sustainability goals, the interplay of AI analytics, V2X communication, and modular architectures will define the next generation of transportation networks.

Despite headwinds from elevated tariff regimes and supply chain bottlenecks, market participants that embrace agile procurement strategies, collaborative innovation models, and standardized interoperability can navigate complexity and capitalize on emerging opportunities. By leveraging segmentation insights and regional nuances, stakeholders can align offerings with specific operational imperatives, whether in tolling, transit management, or traveler experience applications.

Ultimately, the successful deployment of intelligent transportation systems will hinge on the ability of public agencies, technology providers, and integrators to coalesce around shared standards, invest in resilient infrastructure, and pursue data-driven decision-making. This collective effort will unlock the full potential of smart mobility, delivering safer, more efficient, and more sustainable transportation ecosystems for communities worldwide.

Contact Ketan Rohom to Unlock Detailed Market Intelligence and Strategic Insights Tailored to Drive Your Intelligent Transportation Initiatives

If you’re leading a team tasked with navigating the intricate world of intelligent transportation systems, securing the right market intelligence can make all the difference between seizing growth opportunities and being outpaced by the competition. To gain an in-depth understanding of industry dynamics, competitive strategies, regional nuances, and actionable insights tailored to your organization’s needs, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings extensive experience in guiding enterprises through complex technology landscapes and can provide you with personalized guidance on how this comprehensive report can support your strategic objectives. Take the next step toward empowering your leadership team with the insights required to capitalize on emerging trends, mitigate pressing risks, and drive sustainable growth in the evolving intelligent transportation ecosystem

- How big is the Intelligent Transportation System Market?

- What is the Intelligent Transportation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?