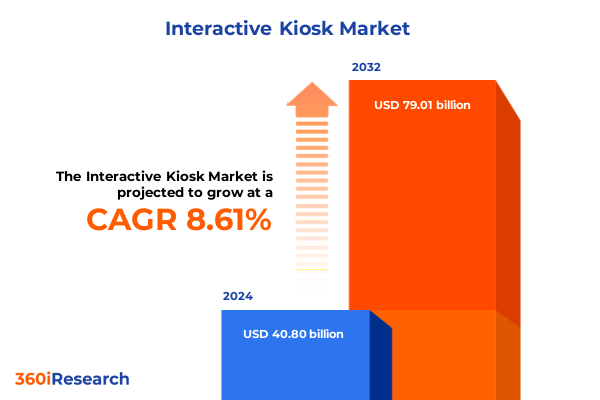

The Interactive Kiosk Market size was estimated at USD 44.14 billion in 2025 and expected to reach USD 47.76 billion in 2026, at a CAGR of 8.67% to reach USD 79.01 billion by 2032.

A clear and contemporary introduction to how interactive kiosks have moved from optional conveniences into essential distributed service endpoints across industries

The interactive kiosk ecosystem stands at the convergence of accelerated digital expectations and pragmatic operational necessity. Across retail floors, transportation hubs, healthcare facilities, and government service centers, self-service terminals are increasingly relied upon to reduce friction in customer journeys while enabling enterprises to reallocate labor toward higher-value activities. Technological advances in touchscreens, sensors, secure payments, and remote management software have moved kiosks from isolated hardware endpoints to instrumented nodes in a distributed service fabric, enabling real-time telemetry, remote troubleshooting, and incremental feature rollouts.

Moreover, changing customer behavior - driven by preferences for contactless transactions, faster service, and omnichannel continuity - has elevated kiosks from optional conveniences to essential components of a modern physical experience. As operators seek to balance guest satisfaction with operational efficiency, kiosks are being specified not merely for transaction throughput but for adaptability: modular mounting options, periphery flexibility for payments and identification, and hardened designs for both indoor and outdoor deployments. Looking forward, the introduction of more sophisticated user interfaces and integration with loyalty and CRM systems promises to deepen kiosks’ role as both service delivery and data-capture points within enterprise ecosystems.

Detailed analysis of the transformative technological, operational, and regulatory shifts reshaping kiosk design, deployment, and lifecycle management

The landscape for interactive kiosks is undergoing transformative shifts that touch technology, user expectations, and operational models simultaneously. On the technology front, AI-enabled interfaces, advanced computer vision, and improved human-machine interaction are making kiosks more intuitive, reducing the time required for users to complete tasks and lowering support overhead. In parallel, the payments landscape has moved decisively toward contactless and mobile-led interactions; kiosks today must support an expanding palette of payment rails while maintaining robust security and compliance.

From an operational perspective, organizations are placing greater emphasis on manageability and resilience. Remote device management, predictive maintenance driven by device telemetry, and unified software stacks are enabling centralized operations teams to monitor large fleets with fewer field visits. Meanwhile, regulatory and social dynamics are reshaping deployment strategies: privacy expectations influence how customer data is collected at kiosks and accessibility requirements drive design parity for diverse user groups. Taken together, these technological and market forces are pushing kiosk solutions toward modularity, networked observability, and a heightened focus on lifecycle economics rather than one-off hardware purchases.

An evidence-based examination of how U.S. tariff policy developments in 2025 are complicating procurement, sourcing, and hardware design decisions for kiosk programs

The cumulative policy changes in U.S. trade and tariff regimes during 2025 have introduced an additional layer of procurement and supply-chain complexity for manufacturers and deployers of interactive kiosks. New reciprocal tariff actions and targeted import levies on specific hardware categories have increased the cost and logistical friction associated with sourcing key components such as enclosure metals, display panels, and certain electronics assemblies. As a result, procurement teams have been compelled to reassess sourcing geographies, expand vendor qualification workflows, and build contingency plans that prioritize component traceability and tariff classification expertise.

Consequently, hardware architects and integrators are revisiting design choices to enable greater localization of value content and to reduce exposure to vulnerable imported subassemblies. At the same time, commercial teams are renegotiating supplier contracts to incorporate tariff pass-through clauses and longer lead-time protections. These adjustments have emphasized the importance of transparency across the bill of materials and the need for scenario planning that accounts for sudden policy shifts and the administrative burden of compliance. The net effect has been a more cautious approach to large-scale refreshes and a preference for modular designs that can be reconfigured with locally sourced alternatives when necessary.

Key segmentation intelligence revealing how kiosk type, placement, mounting, and industry use-cases determine design trade-offs and deployment priorities

Insightful segmentation helps reveal where value is created and where adoption pressure is strongest across use-cases and form factors. Based on the way kiosks are used and the environments they serve, demand differentiates notably with respect to the type of device deployed; solutions designed primarily to inform or guide users require different ergonomics and software integration than payment-focused terminals or high-throughput ticketing systems. Likewise, deployment location exerts a direct influence on engineering and service needs because indoor kiosks permit lighter housings and different cooling strategies, while outdoor kiosks must factor in environmental sealing, display brightness, and thermal control.

Mounting type also materially affects installation planning and total cost of ownership; ceiling-hung or wall-mounted units change electrical and network routing considerations compared with freestanding or floor-mounted deployments, and countertop or desktop options often prioritize compact footprints and integrated peripherals. Finally, the industries that adopt kiosks - spanning banking and financial services, government service centers, healthcare clinics, hospitality venues, retail environments, and transportation nodes - dictate not just the hardware but the integration posture for backend systems. For example, financial services and transportation typically require more stringent security and identity verification workflows, while hospitality and retail place higher emphasis on guest experience, upsell capability, and loyalty integration. These segmentation lenses together offer a toolkit for operators to match solution architecture to business outcomes and to prioritize investments that unlock the quickest operational return.

This comprehensive research report categorizes the Interactive Kiosk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Kiosk Type

- Deployment Location

- Mounting Type

- End User Industry

Actionable regional intelligence explaining how demand patterns, procurement behavior, and regulatory pressures differ across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics continue to shape vendor strategies and deployment priorities, with differentiated demand patterns and procurement constraints across the Americas, Europe–Middle East–Africa, and Asia–Pacific. In the Americas, emphasis has been on scaling contactless payments and self-service checkout implementations in retail and transportation, alongside a mature aftermarket for ongoing maintenance and managed services. Regulatory debate about in-store kiosk supervision and theft mitigation has also influenced retailer deployment strategies, prompting more nuanced approaches to self-checkout implementations and attendant staffing models.

In EMEA, projects frequently emphasize multi-language interfaces, accessibility compliance, and integration with public sector service delivery platforms, while vendors often contend with diverse procurement processes across national markets. The Asia–Pacific region displays a mix of rapid adoption in high-density urban centers, particularly for ticketing and wayfinding in transit and entertainment venues, combined with aggressive innovation cycles driven by local hardware manufacturers and integrators. Across all regions, supply-chain considerations and tariff exposure vary, so global programs increasingly prioritize regional assembly and localized component sourcing to maintain deployment cadence and service-level commitments.

This comprehensive research report examines key regions that drive the evolution of the Interactive Kiosk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic company insights illustrating how vendor specialization, systems-integration strength, and service models determine competitive advantage in kiosk programs

A practical way to understand competitive dynamics is to examine the strategic orientations of established kiosk vendors and integrators that define product breadth and service capability. Companies that emphasize modular hardware platforms and strong systems-integration services are well-positioned to win large enterprise programs that require complex backend connectivity and long-term managed services. Other vendors differentiate through specialization: rugged outdoor engineering, rapid-ship product lines, or vertical templates for banking and healthcare that compress time-to-value for buyers.

Partnerships between enclosure manufacturers, software platform providers, payment processors, and systems integrators also create a matrix of capabilities that buyers evaluate beyond sticker price. In many high-value projects, the commercial decision balances device reliability and support SLAs with the vendor’s ability to provide certified peripherals, secure payment integrations, and field service coverage. These vendor attributes often outweigh raw hardware features when organizations are planning multi-site rollouts or mission-critical installations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Interactive Kiosk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Kiosks, Inc.

- Aila Technologies

- Armagard Ltd.

- Diebold Nixdorf AG

- Digi UK Ltd.

- ELO Touch Solutions

- Fujitsu Limited

- Glory Ltd

- Hypertec Group

- iNUI Studio

- Kiosk Information Systems

- KIOSK Manufacturer, Inc.

- KioTek

- KioWare Software

- Makro Kiosk

- Meridian Kiosks

- MultiTouch Ltd.

- NCR Corporation

- Olea Kiosks, Inc.

- Optika Solutions

- PDC Blackbox

- POSBANK

- Provisio, Inc.

- Pyramid Computer GmbH

- RedyRef

- SmartSource Technologies

- Zivelo, Inc.

- Zytronic, PLC

Action-oriented recommendations for executive leaders to strengthen resilience, reduce operational risk, and maximize value from kiosk deployments

Industry leaders can take pragmatic, actionable steps to strengthen resilience and accelerate value capture from kiosk programs. First, reframe hardware procurement around modularity and lifecycle planning so that enclosures and internal modules can be upgraded independently of the entire device; this reduces exposure to tariff-driven cost shocks and shortens refresh cycles. Second, prioritize device telemetry and centralized fleet management to enable predictive maintenance, minimize downtime, and capture usage analytics that feed product roadmaps and operational playbooks.

Third, embed payment and identity security as architectural priorities rather than afterthoughts; mandating certified payment modules and robust encryption standards reduces compliance risk and protects customer trust. Fourth, develop a supplier playbook that incorporates tariff-sensitivity clauses, dual-sourcing strategies, and regional assembly options to preserve deployment cadence when tariffs or logistics constraints change. Finally, invest in user-centered design and accessibility testing to ensure kiosks serve a broad demographic and reduce abandonment; doing so enhances adoption and reduces the need for costly in-field interventions.

A clear description of the mixed-methods research approach combining vendor interviews, buyer input, and documentary review to validate practical insights for practitioners

Research for this executive summary combined primary engagement with solution providers and a review of publicly available operational and industry materials to ensure an applied and verifiable perspective. Primary inputs included interviews with engineering and product leaders at hardware manufacturers, conversations with enterprise buyers, and structured questionnaires focused on deployment challenges, mounting preferences, and aftersales support requirements. These discussions were complemented by a targeted review of vendor product literature, trade publications, and policy briefings that affect procurement and supply chains.

In synthesizing findings, the research team prioritized triangulation: claims made by vendors were validated against buyer experiences and independent reporting on policy and market dynamics. Where possible, documentation such as product specifications, field support programs, and public statements on tariffs and trade policy were referenced to ensure that recommendations reflect implementable choices for procurement, product, and operations teams. The result is a practitioner-focused methodology designed to surface actionable insights while acknowledging real-world constraints around sourcing, regulatory compliance, and deployment scale.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Interactive Kiosk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Interactive Kiosk Market, by Kiosk Type

- Interactive Kiosk Market, by Deployment Location

- Interactive Kiosk Market, by Mounting Type

- Interactive Kiosk Market, by End User Industry

- Interactive Kiosk Market, by Region

- Interactive Kiosk Market, by Group

- Interactive Kiosk Market, by Country

- United States Interactive Kiosk Market

- China Interactive Kiosk Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding synthesis emphasizing the essential role of adaptable design, secure architecture, and supply-chain foresight in successful kiosk programs

In conclusion, interactive kiosks remain a pivotal channel for enterprises seeking to optimize physical-digital interactions, but success increasingly depends on adaptable design, secure payments architecture, and supply-chain foresight. The twin pressures of rising customer expectations for speed and personalization, together with policy-driven procurement complexity, mean that organizations must balance aggressive innovation with pragmatic lifecycle and sourcing strategies. By adopting modular hardware approaches, embedding telemetry and predictive operations, and negotiating supplier terms that anticipate tariff volatility, operators can preserve deployment momentum and protect total cost of ownership.

Ultimately, the most successful kiosk programs will be those that treat kiosks not as isolated devices but as integral service nodes within a broader customer experience ecosystem. When companies align product, procurement, and operations around these principles, kiosks deliver both immediate service improvements and durable data flows that inform continuous improvement.

Purchase and licensing options for the full market research report with tailored briefings and addenda coordinated by the Associate Director, Sales & Marketing

To secure a copy of the detailed market research report and gain immediate access to strategic findings, bespoke data tables, and deployment-ready insights tailored for procurement and commercial teams, please contact Ketan Rohom, Associate Director, Sales & Marketing. His team will confirm the report scope, provide licensing options, and arrange a briefing call to walk through the most relevant chapters for your business needs. For organizations seeking customized addenda - such as supplier risk matrices, tariff-sensitivity analyses, or rapid-deployment checklists - Ketan can coordinate a bundled research package and a short consulting session with the analysts who prepared the study.

- How big is the Interactive Kiosk Market?

- What is the Interactive Kiosk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?