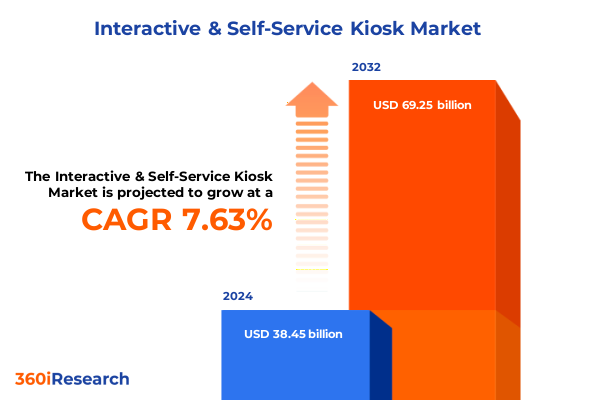

The Interactive & Self-Service Kiosk Market size was estimated at USD 41.27 billion in 2025 and expected to reach USD 44.29 billion in 2026, at a CAGR of 7.67% to reach USD 69.25 billion by 2032.

Exploring the Evolution of Interactive and Self-Service Kiosk Ecosystems Through Market Dynamics and Emerging Technological Frontiers

The interactive and self-service kiosk sector has evolved into a critical interface between organizations and their end users, driven by demand for convenience, personalization, and seamless digital interactions. The proliferation of touch-enabled surfaces, integrated payment modules, and intuitive user interfaces has empowered businesses across banking, retail, transportation, and healthcare to deliver efficient services at scale.

This executive summary provides a concise yet comprehensive overview of the foundational trends, competitive dynamics, regulatory considerations, and technological innovations shaping kiosk deployments. By examining transformative shifts and delineating the impact of recent policy measures, it aims to equip decision-makers and technology strategists with actionable insights that will inform strategic planning, vendor selection, and investment prioritization in the interactive and self-service kiosk domain.

As regulatory frameworks adapt to global supply chain pressures and enterprises accelerate self-service initiatives to optimize operational efficiency, stakeholders must navigate a landscape marked by accelerating innovation cycles, changing consumer expectations, and evolving security requirements. This summary distills the most critical elements of these dynamics, setting the stage for a deeper exploration of segmentation, regional variations, leading technology providers, and strategic recommendations tailored to forward-looking industry leaders.

Unveiling the Key Disruptors Shaping the Interactive and Self-Service Kiosk Landscape Across Digital Transformation and User Experience Evolutions

Rapid advancements in digital transformation have redefined customer engagement paradigms, positioning interactive and self-service kiosks at the forefront of omnichannel strategies. The integration of artificial intelligence and machine learning into user interfaces enables real-time personalization, predictive assistance, and streamlined navigation, transforming standalone terminals into intelligent service nodes. In parallel, the rise of contactless technologies and advanced biometric authentication is elevating security standards while catering to heightened hygienic expectations.

Cloud computing and edge processing innovations are further accelerating kiosk capabilities, allowing for scalable software updates, centralized management, and sophisticated analytics. This shift toward decentralized architectures not only enhances performance in remote or high-traffic locations but also reduces latency for critical transactions. Moreover, the convergence of Internet of Things connectivity with kiosks is fostering ecosystem-driven experiences, where devices communicate seamlessly with back-end systems to deliver contextual content and proactive maintenance alerts.

Environmental sustainability has emerged as another pivotal catalyst, with energy-efficient hardware designs and recyclable components gaining prominence. Stakeholders are increasingly assessing lifecycle impacts and adopting circular economy principles to align kiosk deployments with broader corporate responsibility goals. Consequently, the interactive and self-service kiosk landscape is undergoing a transformative shift, where technological innovation, security imperatives, and environmental stewardship intersect to redefine user experiences and operational efficiency.

Analyzing the Ripple Effects of 2025 United States Tariff Measures on Interactive and Self-Service Kiosk Manufacturing and Deployment

Policy shifts in 2025 have intensified the cumulative impact of United States tariff measures on electronic components and finished kiosk hardware. Increased import duties on touchscreen displays, embedded processors, and specialized peripherals have elevated procurement costs for original equipment manufacturers and system integrators. These financial pressures are prompting many stakeholders to reassess their supply chain strategies, exploring opportunities for onshore assembly or alternative sourcing partnerships to mitigate exposure to cross-border trade volatility.

Beyond direct hardware implications, tariffs have generated secondary effects on service and maintenance agreements. Providers face higher costs for replacement parts and tighter margins on support contracts, compelling them to renegotiate service-level commitments or introduce tiered offerings that balance affordability with reliability. In response, some operators are extending device lifecycles through proactive firmware updates and remote diagnostics, thereby maximizing return on investment despite an increasingly complex trade environment.

As enterprises adapt to these headwinds, a growing emphasis on design-for-manufacture principles is emerging, where modular architectures and standardized interfaces facilitate rapid component swaps and regional assembly. This approach not only reduces the logistical burden associated with customs clearances but also enables greater agility in responding to evolving regulatory frameworks. Ultimately, the interplay between tariff constraints and innovation-driven optimization is reshaping the economics of kiosk deployment and service delivery.

Uncovering Essential Segmentation Dynamics Across Hardware Services Software Application Verticals End Users Deployment Modes and Kiosk Types

A nuanced understanding of product segmentation reveals that hardware variations-spanning printers, scanners, and touchscreen-enabled terminals-each deliver distinct value propositions, while services such as consulting, system integration, and ongoing maintenance drive post-deployment performance lifecycles. Application-oriented software, whether delivered through middleware platforms or specialized interfaces, orchestrates user journeys across payment processing, information dissemination, and ticket printing workflows.

Diverse end-user segments are coalescing around tailored kiosk implementations. Banking halls incorporate secure deposit modules and context-aware navigation aids, whereas healthcare facilities leverage touchless check-in and patient triage systems to expedite workflows. In retail environments, kiosks blend wayfinding assistance with promotional displays, and transportation hubs rely on dynamic ticketing stations to optimize traveler throughput. Each deployment mode-whether cloud-hosted or on-premise-underscores the balance between centralized oversight and localized control.

The dichotomy between interactive touchpoints and self-service stations further shapes adoption trajectories, with interactive units fostering guided user experiences and self-service terminals prioritizing autonomy and speed. Recognizing these distinctions is essential for vendors and end users alike, as the intersection of product form factors, application requirements, and deployment preferences dictates both user satisfaction and operational viability.

This comprehensive research report categorizes the Interactive & Self-Service Kiosk market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Kiosk Type

- Application

- End User

- Deployment Mode

Mapping Strategic Opportunities and Adoption Patterns Across Americas Europe Middle East Africa and Asia-Pacific for Interactive and Self-Service Kiosks

In the Americas, rapid urbanization and robust retail expansion continue to fuel demand for self-service kiosks, particularly within the banking and quick-service restaurant sectors. Government initiatives promoting digital inclusion have accelerated public adoption of interactive terminals in service centers, and ongoing infrastructure investments are driving kiosk integration within transportation networks. Meanwhile, cross-border trade considerations and regional free trade agreements influence procurement sourcing strategies, encouraging localized assembly where feasible.

Europe, the Middle East, and Africa exhibit a mosaic of adoption patterns, shaped by regulatory diversity and varying levels of digital infrastructure maturity. Western European nations emphasize advanced functionalities such as biometrics and multi-language support, while emerging Middle Eastern and African economies favor cost-effective units tailored to core transactional needs. Sustainability mandates in several countries are also incentivizing energy-efficient hardware solutions, fostering innovation in recyclable materials and low-power computing platforms.

Asia-Pacific remains a dynamic growth engine for kiosks, propelled by large-scale smart city initiatives and a digitally engaged consumer base. Urban transit projects across major metropolitan areas increasingly incorporate wayfinding and information kiosks, and hospitality venues are deploying multilingual self-service check-in systems to cater to international travelers. Government-driven contactless commerce programs continue to expand the role of interactive terminals in public services, underscoring the region’s emphasis on scalable, cloud-enabled deployments.

This comprehensive research report examines key regions that drive the evolution of the Interactive & Self-Service Kiosk market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Dynamics and Strategic Focus of Leading Technology Integrators Manufacturers and Software Innovators in the Kiosk Industry

The competitive landscape features established systems integrators and hardware manufacturers refining their portfolios through targeted acquisitions and strategic partnerships. Leading global technology providers are investing in modular kiosk platforms that support rapid customization for vertical-specific use cases, while specialized software houses are developing advanced analytics and remote management tools to differentiate their offerings.

Key industry participants are distinguishing themselves through expanded service networks and strategic alliances with telecommunications operators, ensuring reliable connectivity for decentralized deployments. Several vendors have introduced subscription-based models for software licensing and hardware-as-a-service arrangements, aligning cost structures with operational budgets and reducing upfront capital expenditure. This shift towards outcome-oriented engagements underscores a broader trend of risk-sharing between solution providers and enterprise clients.

Innovation-focused challengers are carving out niches in areas such as cash automation, biometric authentication, and interactive advertising displays, compelling incumbents to accelerate their product roadmaps. Strategic investment in end-to-end security frameworks and compliance certifications has become a prerequisite for market leadership, given rising concerns over data privacy and system integrity. Consequently, the interplay between technological innovation, service excellence, and regulatory adherence is defining competitive advantage across the kiosk ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Interactive & Self-Service Kiosk market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Azkoyen, S.A.

- Bolloré SE

- Crane Co.

- Diebold Nixdorf, Incorporated

- Fujitsu Limited

- Glory Global Solutions Inc.

- GRG Banking Equipment Co., Ltd.

- KIOSK Information Systems, LLC

- Meridian Kiosks

- NCR Corporation

- Olea Kiosks, Inc.

- Posiflex Technology Inc.

- Pyramid Computer GmbH

- Samsung Electronics Co., Ltd.

- SITA

- Thales Group

- Toshiba Global Commerce Solutions Holdings Corporation

- Zebra Technologies Corporation

- ZIVELO, LLC

Driving Sustainable Growth Through Collaborative Ecosystems Data-Driven Innovation and Strategic Partnerships in Interactive and Self-Service Kiosk Deployments

Vendors and integrators should prioritize the development of open, modular architectures that facilitate rapid customization and adaptation to emerging application scenarios. By embracing standardized interfaces and interoperability protocols, solution providers can reduce integration complexity and accelerate time to value for their clients. Additionally, embedding artificial intelligence capabilities for proactive diagnostics and personalized user interactions will serve as a differentiator in an increasingly crowded market.

End users and service operators must invest in robust cybersecurity frameworks, extending from endpoint protection to secure cloud orchestration. Establishing clear governance models and adhering to data privacy regulations will be essential for maintaining user trust and mitigating potential risks. Moreover, structuring flexible service agreements with performance-based metrics can align incentives between operators and technology partners, ensuring ongoing reliability and continuous improvement.

Sustainability should be integrated into product design and deployment strategies, with an emphasis on energy-efficient components, recyclable materials, and circular economy principles. Collaborative initiatives across the value chain can drive greater resource utilization and reduce environmental impact. By concertedly addressing technological innovation, operational resilience, and ecological responsibility, industry leaders will position themselves to capture new growth opportunities while enhancing stakeholder confidence.

Outlining Rigorous Research Approach Integrating Qualitative Insights Quantitative Assessment and Primary Secondary Data Collection for Market Validation

Primary research activities centered on in-depth interviews with technology integrators, hardware manufacturers, and end-user organizations provided qualitative insights into current adoption drivers and barriers. These discussions informed the identification of high-impact use cases and the assessment of strategic priorities across diverse verticals, ranging from commercial banking to public transportation.

Secondary research encompassed a rigorous review of industry publications, regulatory frameworks, and financial disclosures to validate key market trends and emerging legislative influences. This phase leveraged a broad set of reputable sources, including trade journals, government reports, and independent analyst briefings, ensuring a balanced and accurate representation of competitive and policy landscapes.

A structured analysis framework synthesized both primary and secondary findings through triangulation techniques, confirming data integrity and reducing potential bias. Segmentation analyses were conducted by mapping product capabilities, application domains, end-user requirements, deployment modalities, and kiosk typologies. This multi-dimensional approach underpins the clarity and relevance of strategic insights presented in this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Interactive & Self-Service Kiosk market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Interactive & Self-Service Kiosk Market, by Product Type

- Interactive & Self-Service Kiosk Market, by Kiosk Type

- Interactive & Self-Service Kiosk Market, by Application

- Interactive & Self-Service Kiosk Market, by End User

- Interactive & Self-Service Kiosk Market, by Deployment Mode

- Interactive & Self-Service Kiosk Market, by Region

- Interactive & Self-Service Kiosk Market, by Group

- Interactive & Self-Service Kiosk Market, by Country

- United States Interactive & Self-Service Kiosk Market

- China Interactive & Self-Service Kiosk Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Learnings and Strategic Imperatives to Navigate the Ongoing Evolution of Interactive and Self-Service Kiosk Technologies and Ecosystem Dynamics

The convergence of digital transformation imperatives, supply chain realignments, and evolving consumer behaviors has accelerated the strategic importance of interactive and self-service kiosks across multiple verticals. Organizations that harness integrated analytics, secure connectivity, and user-centric design will unlock new efficiencies while delivering enhanced customer experiences.

Key imperatives for industry stakeholders include adopting flexible modular architectures, strengthening cybersecurity postures, and embedding sustainability considerations into product lifecycles. By aligning innovation roadmaps with operational realities and regulatory requirements, market participants can navigate the complexities of trade policy and technological disruption. The insights and recommendations distilled in this summary offer a strategic foundation for informed decision-making and targeted investments in kiosk solutions.

Securing Exclusive Insights and Consultation Opportunities with Ketan Rohom to Empower Your Organization through Customized Interactive and Self-Service Kiosk

To explore how tailored insights and strategic guidance can accelerate your organization’s adoption of interactive and self-service kiosks, engage with Ketan Rohom, an experienced associate director overseeing sales and marketing. His expertise in aligning technological capabilities with business objectives ensures a personalized consultation that addresses your unique challenges and growth opportunities.

By partnering with Ketan Rohom, you will gain access to exclusive research findings, in-depth competitive intelligence, and targeted recommendations designed to optimize your kiosk deployments. Reach out today to secure a comprehensive briefing and begin leveraging data-driven strategies that will elevate customer interactions, streamline operations, and drive long-term value.

- How big is the Interactive & Self-Service Kiosk Market?

- What is the Interactive & Self-Service Kiosk Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?