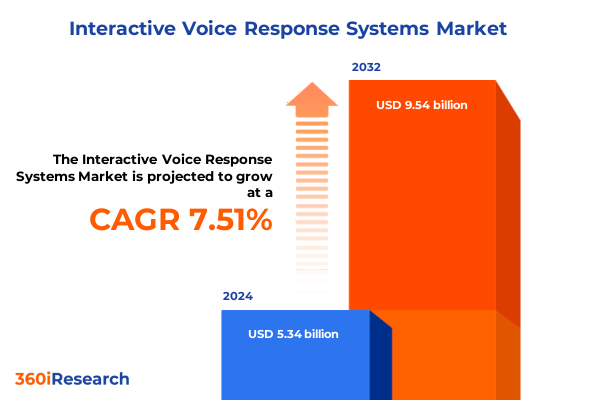

The Interactive Voice Response Systems Market size was estimated at USD 5.67 billion in 2025 and expected to reach USD 6.02 billion in 2026, at a CAGR of 7.71% to reach USD 9.54 billion by 2032.

Envisioning the Next Generation of Interactive Voice Response Systems in an Era Defined by AI Advancements and Unprecedented Customer Expectations

Envisioning the Next Generation of Interactive Voice Response Systems in an Era Defined by AI Advancements and Unprecedented Customer Expectations

Interactive Voice Response systems have evolved from simple digit‐driven menus to sophisticated conversational AI platforms, serving as a critical touchpoint between enterprises and their customers. As organizations strive to deliver seamless digital experiences, the IVR landscape is reshaping itself around advancements in natural language processing, cloud computing, and omnichannel integration. This introduction explores how these technologies converge to redefine IVR not merely as a cost‐saving measure but as a strategic asset for customer engagement and brand differentiation.

The maturation of AI‐powered speech recognition and sentiment analysis tools enables interactive systems to handle increasingly complex customer inquiries with human‐like accuracy. With predictive analytics, system architects can now anticipate user needs, routing calls proactively and minimizing friction. Moreover, the proliferation of cloud and hybrid deployment models has broken down traditional barriers to adoption, allowing even resource‐constrained enterprises to leverage enterprise‐grade capabilities. In this context, the following sections will delve into the transformative market dynamics, regulatory influences, and strategic imperatives shaping the future of IVR solutions.

Navigating the Transformative Shifts Reshaping How Organizations Deploy and Manage Interactive Voice Response Technologies Globally

Navigating the Transformative Shifts Reshaping How Organizations Deploy and Manage Interactive Voice Response Technologies Globally

In recent years, the IVR ecosystem has witnessed seismic shifts driven by customer experience priorities and rapid technological innovation. Where once menu trees and touch‐tone navigation dominated, today’s IVR platforms harness AI‐driven virtual agents capable of understanding context and executing complex transactions. These intelligent assistants not only reduce the average handle time but also elevate first‐contact resolution rates, fostering deeper brand loyalty.

Concurrently, cloud migration has emerged as a pivotal trend, offering scalability and agility that on‐premise solutions cannot match. Cloud and public cloud models now coexist with private and dedicated private cloud offerings, enabling organizations to balance cost, performance, and security needs. Hybrid approaches further extend this flexibility, allowing businesses to optimize workflows across diverse IT infrastructures. These deployment innovations, paired with enhanced reporting and call control modules, are empowering enterprises to tailor IVR experiences in real time, driving continuous improvement and aligning strategic goals with operational metrics.

Understanding How 2025 United States Tariff Policies Have Cumulatively Influenced Costs Supply Chains and Strategic Sourcing Decisions in IVR Solutions

Understanding How 2025 United States Tariff Policies Have Cumulatively Influenced Costs Supply Chains and Strategic Sourcing Decisions in IVR Solutions

The imposition of incremental tariffs on imported telecommunications hardware and related components has markedly influenced total cost of ownership considerations for IVR deployments. Cumulative duties on core hardware modules such as telephony cards, servers, and networking gear have increased procurement costs by an estimated mid‐teens percentage range since 2018. These cost pressures have prompted many service providers and end users to reassess their sourcing strategies and accelerate shifts toward software‐centric, cloud‐based offerings.

These tariffs have had a ripple effect across the supply chain, influencing vendor partnerships and encouraging localized manufacturing initiatives. As a result, organizations are increasingly negotiating multi‐year agreements with regional providers to lock in pricing and avoid exposure to future duty escalations. Simultaneously, the cost sensitivity induced by tariffs has spurred innovation in software licensing models, with pay-as-you‐go and consumption-based pricing gaining traction. Overall, the tariff environment has catalyzed a strategic pivot toward modular, software-first architectures that can mitigate hardware cost volatility and streamline total operating expenses.

Unveiling Detailed Insights into Interactive Voice Response System Market Segments Based on Component Application Deployment Modes and Organizational Profiles

Unveiling Detailed Insights into Interactive Voice Response System Market Segments Based on Component Application Deployment Modes and Organizational Profiles

The Interactive Voice Response market can be dissected through multiple lenses, each providing a unique perspective on technology adoption and value creation. By component, hardware segments remain essential for on-premise environments, while software modules such as call control, in-depth reporting, and advanced speech recognition drive differentiation and support evolving customer demands. As enterprises evaluate their IVR roadmaps, they assess the trade-offs between hardware-intensive deployments and the flexibility inherent in software-focused ecosystems.

From an application standpoint, scenarios range from call routing and customer care to order processing, surveys, and telecom billing, each demanding specialized functionalities and integration capabilities. Deployment mode further distinguishes the market, encompassing cloud Native public or private environments as well as hybrid and on-premise architectures, with private cloud sub-categories including dedicated and managed offerings. Organization size also plays a critical role; while large enterprises demand highly customized solutions with robust security protocols, micro enterprises and SMEs favor turnkey, cost-effective models that ensure rapid time to value.

End user verticals exhibit diverse adoption trajectories. Banking, capital markets, and insurance within BFSI leverage IVR for secure transactions and self-service, while government agencies employ it for citizen engagement and public safety notifications. In healthcare, clinics and hospitals utilize IVR to manage appointment scheduling and patient outreach, whereas retail and telecom sectors rely on sophisticated call trees and real-time analytics to drive sales and reduce operational friction.

This comprehensive research report categorizes the Interactive Voice Response Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Application

- End User

Examining Distinct Regional Dynamics and Growth Drivers Shaping the Adoption and Evolution of Interactive Voice Response Platforms Across Global Markets

Examining Distinct Regional Dynamics and Growth Drivers Shaping the Adoption and Evolution of Interactive Voice Response Platforms Across Global Markets

Regional landscapes reveal contrasting drivers and barriers for IVR adoption. In the Americas, modernization initiatives and digital transformation agendas within banking and retail have spurred demand for cloud-native IVR services. North American enterprises are particularly focused on integrating voice channels with digital touchpoints to deliver seamless omnichannel experiences, while Latin American markets are embracing cost-competitive hosted models to overcome infrastructure challenges.

Europe, the Middle East, and Africa represent a heterogeneous market wherein data privacy regulations and varied telecommunications frameworks influence IVR strategies. In Western Europe, stringent GDPR requirements have accelerated the deployment of on-premise and private cloud solutions featuring enhanced encryption and data residency controls. Meanwhile, the Middle East is witnessing strong government investment in smart city initiatives that incorporate voice automation for citizen services, and Africa is fueling growth through mobile-first IVR applications that extend service delivery to underserved regions.

Asia-Pacific stands as a high-growth region, with countries such as India and China driving large-scale IVR rollouts in telecom and e-commerce. Public cloud adoption is particularly robust, supported by major hyperscale providers offering localized compliance and multi-language capabilities. Additionally, regional players are customizing solutions to accommodate local dialects and complex script recognition, unlocking new opportunities in customer engagement and enterprise automation.

This comprehensive research report examines key regions that drive the evolution of the Interactive Voice Response Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Driving Innovation Strategic Partnerships and Competitive Landscapes Within the Interactive Voice Response Ecosystem

Highlighting Key Industry Players Driving Innovation Strategic Partnerships and Competitive Landscapes Within the Interactive Voice Response Ecosystem

The IVR ecosystem is characterized by a mix of established technology vendors, emerging startups, and specialized service providers. Leading global technology providers offer end-to-end platforms that combine advanced speech analytics, omnichannel orchestration, and AI-powered virtual assistants. These companies maintain extensive partner networks to deliver integrated solutions spanning hardware, software, and managed services.

A cadre of mid-tier vendors focuses on niche capabilities such as predictive routing, sentiment analysis, and deep integration with CRM and contact center platforms. These specialists often collaborate with telecommunications carriers and cloud operators to deliver bundled offerings to enterprises seeking rapid deployment and low initial investment. Meanwhile, innovative startups are pushing the boundaries of natural language understanding and embedding conversational AI within messaging apps and IoT devices, creating new touchpoints for customer engagement.

Competitive dynamics are further shaped by strategic alliances between platform providers and consulting firms, which guide large-scale digital transformation initiatives. These partnerships drive the evolution of IVR from a standalone voice channel into a component of integrated, AI-driven engagement hubs. As a result, stakeholders are continually reevaluating their go-to-market strategies to capture emerging opportunities in voice commerce, virtual agents, and self-service automation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Interactive Voice Response Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AT&T Inc.

- Atos SE

- Avaya LLC

- Cisco Systems, Inc.

- Concentrix Corporation

- Dialogic Corporation by Enghouse Systems Limited

- Five9, Inc.

- Genesys Cloud Services, Inc.

- IVR Lab by A Stormfire Group Company

- Mitel Networks Corporation

- NEC Corporation

- NICE Ltd.

- Nuance Communications, Inc. by Microsoft Corporation

- Oracle Corporation

- RingCentral, Inc.

- True Image Interactive, Inc.

- Verizon Communications Inc.

Providing Actionable Recommendations for Industry Leaders to Leverage Technological Advances and Optimize Interactive Voice Response Strategies for Enhanced Customer Engagement

Providing Actionable Recommendations for Industry Leaders to Leverage Technological Advances and Optimize Interactive Voice Response Strategies for Enhanced Customer Engagement

To capitalize on the shifting dynamics of the IVR market, industry leaders should prioritize the integration of AI-driven speech recognition and sentiment analysis capabilities. By embedding natural language processing modules directly into self-service workflows, organizations can reduce dependency on touch-tone navigation and foster more intuitive customer interactions. Additionally, adopting consumption-based pricing models enables flexibility during peak demand periods, aligning costs with usage patterns and preserving budgetary agility.

Leaders must also evaluate their deployment strategies through the lens of data sovereignty and performance requirements. Hybrid architectures that position sensitive workloads on private clouds while leveraging public clouds for elastic scalability strike an optimal balance between control and cost efficiency. Furthermore, stakeholder alignment is crucial; cross-functional teams spanning IT, customer experience, and compliance should collaborate on roadmap development to ensure holistic adoption and measurable ROI. Finally, fostering an ecosystem approach by engaging technology partners, consulting firms, and service integrators will accelerate innovation cycles and expand service portfolios.

Detailing Rigorous Research Methodologies Employed to Analyze Market Trends Competitive Forces and Technological Innovations in Interactive Voice Response Systems

Detailing Rigorous Research Methodologies Employed to Analyze Market Trends Competitive Forces and Technological Innovations in Interactive Voice Response Systems

This analysis is grounded in a multi-faceted research framework combining both secondary and primary research approaches. Secondary research included an exhaustive review of industry publications, regulatory filings, technology whitepapers, and credible news sources to establish a comprehensive baseline of market dynamics. These inputs were corroborated by examining corporate websites, product brochures, and case studies to validate solution capabilities and deployment patterns.

Primary research comprised structured interviews with key industry stakeholders, including platform vendors, channel partners, system integrators, and end users across multiple sectors. These interviews provided qualitative insights into decision-making criteria, challenges faced during implementation, and emerging use cases. Data triangulation techniques were employed to reconcile discrepancies between secondary findings and primary feedback, ensuring robust, data-driven conclusions. In addition, expert panels contributed quantitative assessments of market segmentation, competitive intensity, and technology adoption rates, further reinforcing the validity of the study’s outcomes.

The combination of rigorous data collection, stakeholder engagement, and analytical frameworks supports the credibility of the insights presented. This methodological rigor enables decision-makers to navigate the IVR landscape with confidence and to make informed strategic investments in customer engagement technologies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Interactive Voice Response Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Interactive Voice Response Systems Market, by Component

- Interactive Voice Response Systems Market, by Deployment Mode

- Interactive Voice Response Systems Market, by Application

- Interactive Voice Response Systems Market, by End User

- Interactive Voice Response Systems Market, by Region

- Interactive Voice Response Systems Market, by Group

- Interactive Voice Response Systems Market, by Country

- United States Interactive Voice Response Systems Market

- China Interactive Voice Response Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Implications for Stakeholders in the Interactive Voice Response Market to Navigate Future Opportunities

Synthesizing Core Findings and Strategic Implications for Stakeholders in the Interactive Voice Response Market to Navigate Future Opportunities

The evolution of Interactive Voice Response systems is being propelled by AI and cloud technologies, reshaping the way organizations engage with customers and manage operational workflows. The migration toward software-centric solutions, combined with flexible deployment models, is democratizing access to advanced IVR capabilities. Simultaneously, external factors such as tariff policies and regional regulatory regimes continue to influence cost structures and deployment strategies, underscoring the need for adaptable sourcing frameworks.

Segmentation insights reveal that organizations across components, applications, deployment modes, and enterprise sizes are customizing IVR strategies to align with specific business objectives. Regional analyses indicate differentiated growth trajectories driven by digital transformation initiatives, regulatory landscapes, and infrastructure maturity. Competitive landscapes highlight a dynamic interplay between established vendors, specialized mid-tier players, and agile startups, tied together through strategic alliances and partner ecosystems.

Collectively, these findings point to a market at an inflection point, where technological innovation and strategic alignment will determine winners and laggards. Stakeholders equipped with detailed segmentation knowledge, regional context, and competitive intelligence are best positioned to harness future opportunities and drive sustained customer engagement.

Driving Strategic Decision Making: Engage with Our Associate Director to Acquire In-Depth Market Research on Interactive Voice Response Systems for Competitive Advantage

Ready to empower your organization with comprehensive insights and strategic guidance on Interactive Voice Response systems? Connect today with our Associate Director of Sales & Marketing, Ketan Rohom, to explore customized solutions and secure your copy of the definitive market research report. By partnering directly with Ketan, you will gain exclusive access to tailored briefings, in-depth data visualizations, and expert analysis that address your organization’s unique challenges and objectives. Whether you are seeking to optimize deployment strategies, assess competitive positioning, or identify untapped growth opportunities, this is your opportunity to leverage a premium research offering designed to drive measurable business impact. Reach out now and take the first step toward informed decision-making and sustained competitive advantage in the evolving landscape of customer engagement technologies.

- How big is the Interactive Voice Response Systems Market?

- What is the Interactive Voice Response Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?